Summary:

- Sterling Infrastructure (STRL) capitalizes on strong secular trends in North America’s growing infrastructure construction market, driven by increased government spending and private sector investment.

- STRL’s E-Infrastructure Solutions segment, focusing on data centers and advanced manufacturing, has become its largest revenue stream, significantly boosting operating margins.

- The company’s strategic execution and strong balance sheet support its growth initiatives, with a 21% revenue CAGR and improved profitability in recent years.

- Despite potential risks from economic cycles, supply chain issues, and regulatory hurdles, STRL’s intrinsic value is estimated at $292.43 per share, indicating significant undervaluation.

quantic69

My thesis

Sterling Infrastructure (NASDAQ:STRL) offers investors a unique combination of growth potential and financial stability. I think so because the company capitalizes on positive trends both in mature and emerging industries. STRL benefits from the increased governmental infrastructure spending in the U.S., which is a mature industry. The emerging industry where STRL has exposure is data centers. With E-Infrastructure business’s customers including some of the Magnificent 7 companies, I think that STRL is positioned well to capitalize on the data center spending spree from tech giants. STRL’s around 50% potential upside makes it a Strong Buy.

STRL stock analysis

Sterling Infrastructure capitalizes on solid secular trends. The company is a leading provider of infrastructure services headquartered in Texas. STRL operates across key U.S. regions including the Southern, Northeastern, Mid-Atlantic, Rocky Mountain areas, and the Pacific Islands.

I say that STRL capitalizes on solid secular trends because North America’s infrastructure construction market is growing significantly faster compared to inflation. For example, globaldata.com forecasts the industry to deliver a 6.9% CAGR by 2026. The industry experiences growth driven by increased government spending and private sector investment. For example, the Infrastructure Investment and Jobs Act (IIJA) allocates around $643 billion for transportation program.

Seeking Alpha

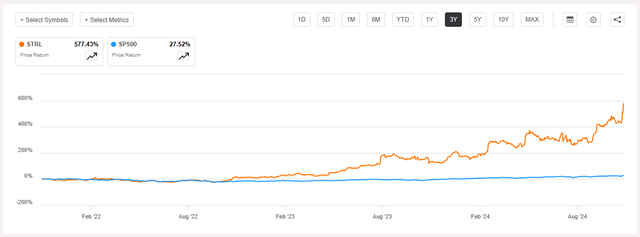

Governmental spending for transportation program is a solid tailwind for the company as Transportation Solutions is one of STRL’s segments that accounted for 38% of the total revenue in Q3 2024. However, we see above that the stock started soaring compared to S&P 500 index in 2023. When I see such a dynamic, the first thing that comes to my mind is that the company has a solid AI or data center exposure.

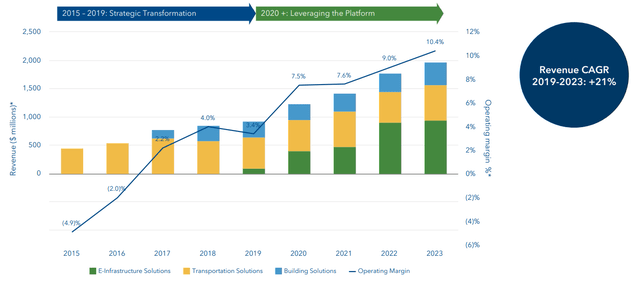

STRL’s Q3 earnings slides

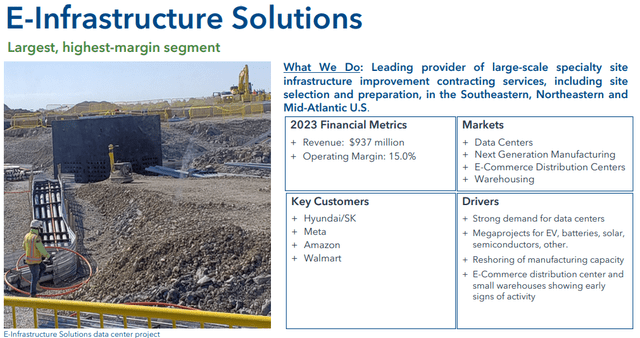

And STRL indeed has such an exposure via its E-Infrastructure Solutions segment. This business line originated only five years ago, but it is already the company’s largest revenue stream with a 45% share. Furthermore, the above chart indicates that STRL’s operating margin started improving notably after the segment’s origination. The business provides large-scale site development services for data centers, advanced manufacturing, and e-commerce distribution centers.

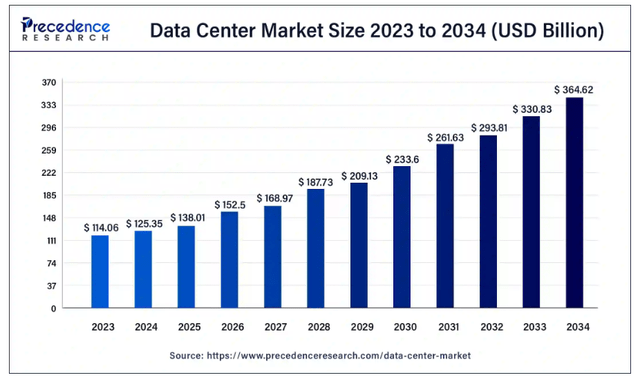

Precedence Research

The data center market experiences robust momentum, which is another solid tailwind for STRL. According to Precedence Research, the industry is expected to deliver an 11.4% CAGR by 2034. Sterling Infrastructure is poised to capitalize on positive trends in the data center industry as its key customers include giants like Amazon (AMZN), Meta (META), and the South Korean giant Hyundai (OTCPK:HYMTF). According to one of the company’s latest presentations, investing in developing the Infrastructure Solutions segment will be prioritized among the management’s capital allocation priorities.

Prioritizing the segment’s needs looks like a sound business move due to the expected longevity of data center tailwinds. For example, Amazon plans to invest $150 billion in data centers during the next 15 years. STRL’s other major tech customer, Meta, is also likely to aggressively invest in data centers over the next several years as it develops its own large-language model (LLM) Llama.

STRL’s presentation of September 19, 2024

The management’s track record of strategic execution and capital allocation is strong. We have already seen that STRL delivered a 21% revenue CAGR over the last few years and solid operating margin expansion. I would also like to add that Sterling is financially flexible to pursue new growth opportunities thanks to its healthy balance sheet. The company closed Q3 2024 with $648 million outstanding cash and $296 million in long-term debt. As we see, the net cash position is strong, and it is a solid foundation to support the management’s strategic initiatives (outlined below).

STRL’s presentation as of June 4, 2024

The management’s strategic priorities were reiterated during the Q3 earnings call that took place on November 7. The company’s Q3 performance was solid with a 6% YoY revenue growth and notably improved profitability. The gross margin expanded from 16.4% to 21.9% on a YoY basis. The operating margin improvement was also notable on a YoY basis, from 10.2% to 14.8%. The share price grew by 11% since the earning release, marking the market’s positive reaction to the Q3 financial performance.

Intrinsic value calculation

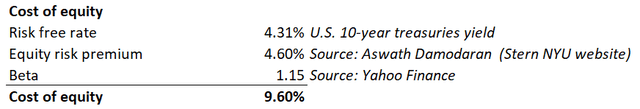

The reliance on debt is relatively low, which makes cost of equity a good choice as a discount rate for the discounted cash flow (DCF) model. STRL’s cost of equity is 9.6%, and the calculation is outlined in the below working.

DT Invest

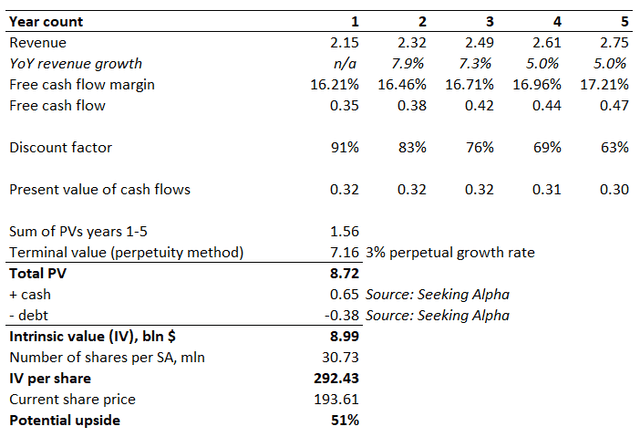

The DCF relies on consensus revenue projections for FY2024-2026, which are years 1-3 in my DCF. For years 4-5, a slower 5% revenue growth rate is incorporated. Due to STRL’s data center exposure, I use a 3% perpetual growth rate. The TTM levered FCF margin is 16.21%, my year 1 assumption. Due to solid trends in STRL’s profitability expansion demonstrated over the last few years, I believe that the metric deserves at least a 25-bps yearly expansion forecast.

The stock’s intrinsic value per share is $292.43. This is 51% higher than the last close.

DT Invest

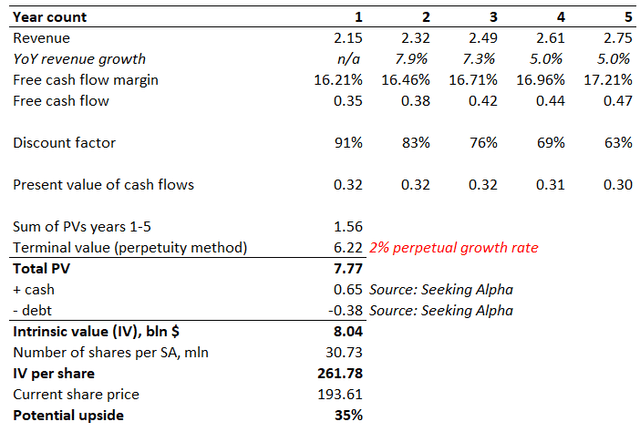

My DCF model’s sensitivity analysis demonstrates that the stock is significantly undervalued even with a 2% perpetual growth rate. In this case, the potential upside is 35%.

DT Invest

What can go wrong with my thesis?

Sterling Infrastructure operates in very cyclical industries. Demand for construction and infrastructure services can also vary wildly with the overall economy. In recessions or extreme cycles, less public and private infrastructure spending can be generated to impact Sterling’s revenue streams directly. The company’s dependence on federal, state and municipal funding for its Transportation Solutions division also places it at risk for government budget shifts and priorities. A weaker economic environment may cause project cancellations, delays, or dilution of margins, which could impact Sterling’s bottom line.

Construction sector faces inherent risks of supply chain interruptions and cost hikes. Sterling Infrastructure is not immune from such problems, and hence the expense of steel, cement, and other building materials can be increased. It is up to the company how it handles these costs because price spikes can cause margin erosion. And supply chain disruption can also adversely affect project delivery, costing penalties and client confidence.

Sterling Infrastructure is an industry that is heavily regulated and must meet all federal, state, and local environmental laws and regulations. In case of a violation, they can get penalized, or the project delayed, or contract cancelled. The building and infrastructure industries are also highly regulated in terms of emissions, waste management and water quality. There is also the issue of navigating the issues of securing the permits and authorizations that can take time and be politically and publicly scrutinized by the company. If these regulatory hurdles are not dealt with properly, it may negatively impact Sterling’s standing, performance and future projects.

Summary

It appears that STRL’s high overall SA Quant rating is well-deserved. The management’s capital allocation priorities will likely help STRL to capitalize on growing demand for data centers and increased infrastructure spending in the U.S.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STRL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.