Summary:

- Sterling Infrastructure stock has outperformed the market significantly in the past year.

- Sterling has capitalized on the AI data center build out, and it can still expand further into other growth verticals.

- Its combined backlog provides significant potential revenue visibility, lowering execution risks.

- I explain why STRL is no longer undervalued. However, there are no sell signals.

- With STRL possibly bottoming after a steep pullback, get ready to ride its next potential rally.

J Studios

Sterling Infrastructure Stock’s Massive Gains

Sterling Infrastructure, Inc. (NASDAQ:STRL) investors have much to celebrate over the past year as STRL stock outperformed the market significantly. Accordingly, STRL delivered a total return of almost 126% over the past year, lifting its market cap to a high of $3.63B.

Notwithstanding its outperformance, STRL is still valued reasonably, although the valuation bifurcation against its robust growth grade has narrowed considerably. In other words, I believe it might be a tough call for investors to continue expecting Sterling Infrastructure to deliver such substantial returns unless management can upgrade its forward outlook considerably.

Sterling Capitalizes On The AI Hype

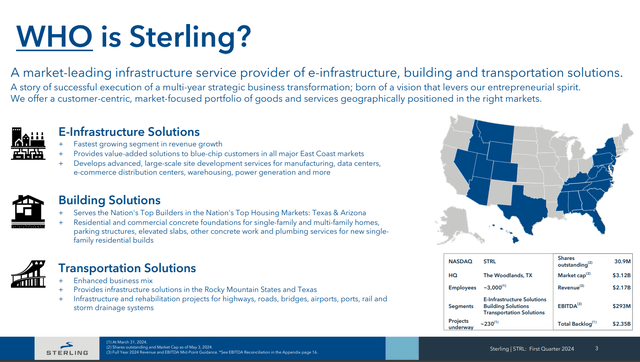

Sterling Infrastructure corporate profile (Sterling Infrastructure filings)

For investors less familiar with STRL’s thesis, it’s essential to understand that Sterling is an infrastructure company within the industrial sector (XLI). It has transformed its business over the past five years as it focuses on growing its E-Infrastructure solutions segment. As a result, the segment has risen markedly to become Sterling’s most significant revenue and profit driver, demonstrating its execution prowess.

As seen above, Sterling’s E-Infrastructure business exposes it to a myriad of opportunities. Sterling can capitalize on the secular growth potential of “manufacturing, data centers, e-commerce distribution centers, warehousing, power generation, and more.” Notably, its ability to grow its footprint for its data center customers has likely contributed to the surge in investor sentiment attributed to the AI upcycle. Moreover, the nascent buildout of AI data centers across the US could continue to drive a multi-year roadmap for Sterling’s E-Infra business, providing significant forward visibility moving ahead.

Furthermore, Sterling management underscored the possibilities of expanding into new verticals to expand its opportunities further in E-Infra. Sterling highlighted that the “flexibility of its site development business” positions Sterling well to enter “verticals like semiconductors, pharmaceuticals, and food and beverage.” Accordingly, Sterling attributed the “growing demand for high-quality service providers to the ramp-up of data centers and onshoring of manufacturing.” Therefore, Sterling Infrastructure remains well-primed to benefit from a resilient US economy and a rapidly evolving AI data center market.

Moreover, the robust backlog across Sterling’s Building and Transporation solutions helps to diversify its concentration risks in the E-Infra business. Investors should note that Sterling’s E-Infra business suffered from seasonal and weather-related challenges in Q1, leading to a revenue decline of 10% YoY. Despite that, Sterling expects growth to resume throughout the year, aiming for a “high single to low double-digit revenue growth” for FY2024, which is Sterling’s most critical revenue and profit driver.

Bolstered by its combined backlog reaching $2.4B (representing about 16 months of backlog revenues), I assess substantial visibility into Sterling’s performance. Therefore, investor sentiment should remain resilient unless management guides to a much slower book-to-burn ratio over the rest of the FY.

STRL Stock No Longer Undervalued

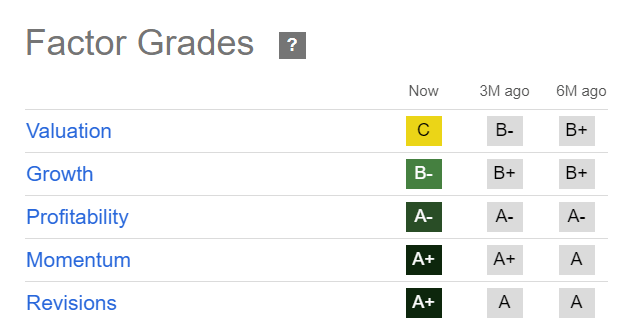

STRL Quant Grades (Seeking Alpha)

STRL’s valuation remains reasonable with a “C” valuation grade. Digging deeper would unveil a forward GAAP P/E of 22.2x, nearly 20% over its sector median.

Sterling Infrastructure’s growth is expected to slow further in FY2025 to 9.2% from this year’s estimated 12.3% growth cadence. Therefore, I assess it more challenging for STRL to replicate its massive outperformance.

Notwithstanding my caution, STRL has demonstrated its ability to execute its 5Y transformation through its E-Infrastructure solutions business. Furthermore, with profitability (“A-” grade) expected to remain robust, I glean that STRL might not be expensive after all.

Is STRL Stock A Buy, Sell, Or Hold?

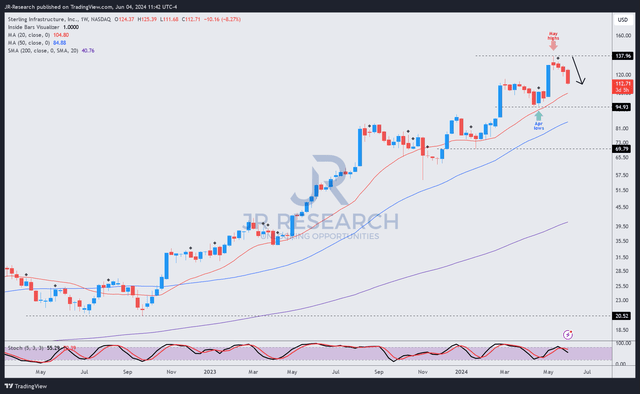

STRL price chart (weekly, medium-term) (TradingView)

STRL’s price action remains highly constructive, with no red flags suggesting the need to cut exposure significantly. It continues to grind out higher-lows and higher-highs over time, remaining supported above its 20-week moving average (red line in the chart).

STRL is undergoing a pretty steep retracement as it fell more than 18% from its May 2024 highs. I haven’t assessed a bullish reversal yet, therefore investors should anticipate potential downside volatility, causing it to drop further to the $95 level if the market selloff intensifies.

Despite that, I see little reason for investors to panic. As highlighted in my discussion earlier, STRL has exposure to several growth vectors within its E-Infra business. Sterling also has a robust combined backlog across its three revenue segments, which is driving significant forward visibility. Coupled with STRL’s still reasonable valuation, investors should consider letting their winners run further.

While near-term downside volatility cannot be ruled out, given the pullback and bearish sentiment, I assess a further selloff as a brilliant opportunity for dip-buyers to add exposure.

Rating: Initiate Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STRL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!