Summary:

- Sterling Infrastructure stock is cheap again after the recent pullback.

- Sterling Infrastructure is well-positioned to benefit from the AI gold rush.

- Its E-infra solutions business accounts for over 70% of its operating income, underpinned by its data center focus.

- STRL’s profitability growth inflection is expected to be sustainable, justifying the market optimism. I will explain why.

- I argue why the stock is now a bargain as the AI spending boom could drive a multi-year profitability growth inflection.

J Studios

Sterling Infrastructure, Inc. (NASDAQ:STRL) is one of the leading companies ranked within the Construction and Engineering industry, part of the Industrials sector (XLI). I’ve covered the company in a previous article, expounding on STRL’s bullish proposition. Readers are encouraged to refer to that article as a primer into why I believe Sterling Infrastructure is well-positioned to benefit from the AI gold rush.

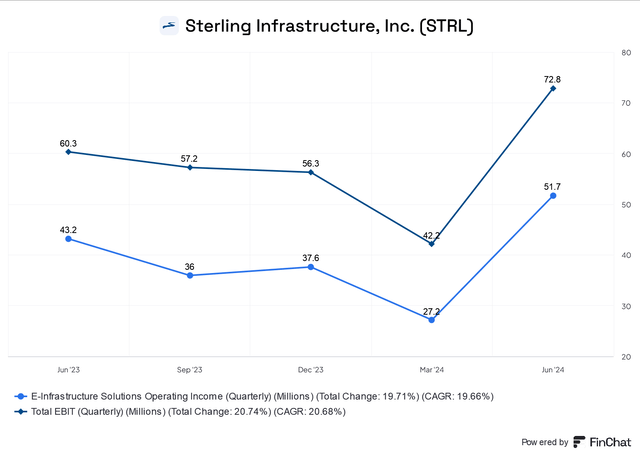

Sterling Infrastructure (E-Infra segment profitability metrics) (FinChat)

As part of its business transformation, the company has increased its allocation, investments, and exposure to benefit from the burgeoning data center market. Sterling Infrastructure’s business is underpinned by three critical segments (E-infrastructure, transportation, building). However, the key profitability driver is its E-infrastructure solutions business, undergirding investor optimism and buying sentiment in STRL. Consequently, I assess that paying close attention to the growth dynamics of its E-infra business is vital to understanding STRL’s bullish thesis.

As seen above, E-infra solutions accounted for more than 70% of its operating income (less corporate-level adjustments). The company’s ability to develop “large-scale site development services” is fundamental to the segment’s growth prospects. Accordingly, the segment’s operating profit increased by 20% YoY, just under its corporate average increase of 20.7%. Notably, its operating margin has also improved to 21.4%, well above STRL’s corporate average of 12.5%. Consequently, investors should be able to appreciate the criticality of the E-infra’s profitability growth inflection to drive operating leverage further for the company.

STRL’s growing footprint and focus on “larger, mission-critical projects, particularly in data centers and manufacturing,” is fundamental to the segment’s growth opportunities. Accordingly, these larger-scale projects are expected to afford higher profitability than “small commercial and warehouse projects.” Therefore, we can expect a profitability pivot for STRL, even as its topline growth momentum could normalize over the next two years. Sterling Infrastructure experienced that slowdown in Q2, as total revenue for E-Infrastructure declined by 7% YoY due to the transition. However, data center revenue surged by more than 100%. In addition, data center revenue also accounts for over 40% of its E-infra backlog, contributing to significant higher-margin revenue visibility for the company.

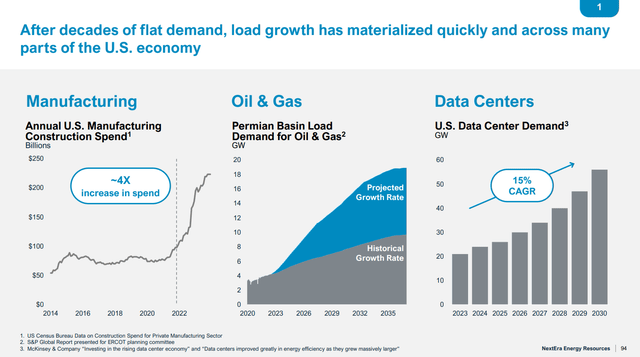

Key electricity demand drivers (NextEra Energy filings)

Furthermore, manufacturing projects and the onshoring initiative have also gained further traction. As the Fed inches closer to its first interest rate cut in September 2024, it should improve the funding landscape for STRL’s customers. Therefore, I assess the tailwinds underpinning the return of “mid to large-sized onshoring-related projects in the manufacturing sector through 2024 and 2025.” The “holy grail” could arrive in 2026/27 as semiconductor foundries are expected to ramp up their capacity. My bullish conviction is supported by projections from the world’s leading renewable energy player: NextEra Energy, Inc. (NEE). In a recent presentation, NEE underscores the significant opportunities from manufacturing (4x spending surge) and the secular growth prospects on electricity demand from US data centers. Therefore, its growing E-infra business justifies Sterling Infrastructure’s increasingly bullish thesis.

Sterling Infrastructure estimates (TIKR)

As seen above, STRL’s adjusted operating margins are estimated to continue rising through 2025 as the company transitions toward larger-scale projects. Fundamental to its growth prospects is whether the onshoring initiatives and the AI gold rush are sustainable. With geopolitical tensions not abating and the need to ensure domestic production sovereignty, I believe the “deglobalization” drive for critical industries isn’t likely to reverse. In addition, STRL’s focus on “mission-critical” industries like semiconductor manufacturing lends further credence to that thesis.

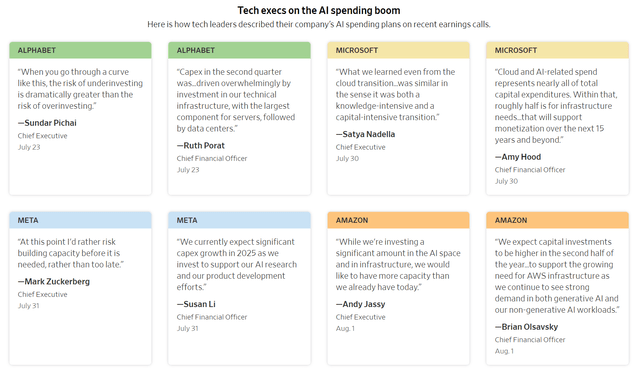

AI investment commentary by hyperscalers (WSJ)

As seen above, big tech companies are ramping up their AI investments to stretch their dominance and market leadership in Generative AI. The AI spending boom could reach $1T, and it’s likely still in the early stages. Recent worries about the slowdown in Nvidia’s launch cadence (due to the anticipated Blackwell architecture delay) haven’t led to a further plunge in NVDA. Therefore, the market seems confident that increased orders and long-term revenue visibility when Blackwell launches are still on track.

That bodes well for Sterling Infrastructure, as it scales up its capabilities in handling large-scale projects. As a result, I assess the company’s profitability growth inflection is anticipated to be sustainable. Wall Street’s earnings estimates on STRL have also been upgraded, undergirding my optimism. Management indicated its belief that the “existing capacity is insufficient to meet the increased needs of AI and other emerging technologies.” Based on the commentary highlighted by the hyperscalers, I assess the company’s optimism isn’t misplaced.

Moreover, the urgency to lift such data spending may not have fully been captured in the current estimates, as they are still evolving. If the downstream GenAI adoption is more robust than anticipated, longer-term growth estimates will likely be revised higher. Based on the significantly increased electricity demand projections, we are likely still in the early stages of a multi-year infrastructure spending ramp, anticipated to boost infrastructure players like STRL.

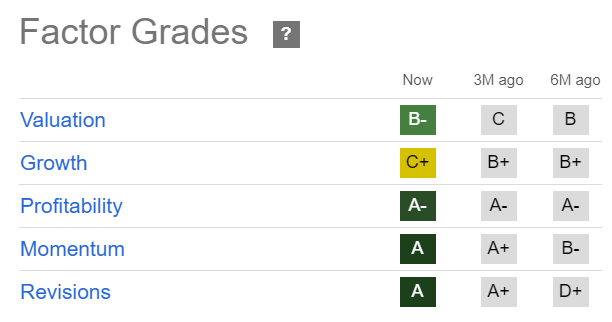

STRL Quant Grades (Seeking Alpha)

Consequently, I assessed that STRL’s “A” range grades justify its medium- and long-term proposition. Its ability to pivot to higher-margin projects is fundamental to justifying its competitive advantages in the critical E-infra business.

Moreover, STRL’s “B-” valuation grade has improved from the “C” grade assigned three months ago. Its forward-adjusted PEG ratio of 1.28 is nearly 30% below its sector median. Hence, I assess that its risk/reward profile seems attractive, notwithstanding its recent pullback.

Key Risk Factors To Consider For STRL Stock

Note that as the company shifts increasingly to the AI data center build-out, a slower-than-expected adoption could impact buying sentiment. There are valid concerns about whether the downstream adoption could broaden out sufficiently to absorb the increased data center capacity. As the hyperscalers focus on ramping up their capacity to drive their GenAI investments, it has also intensified potential overcapacity risks. Big tech’s assertion that they would rather invest ahead of the curve than risk falling behind has also lifted such worries.

In addition, the US economic slowdown could hit investing spending if the Fed is unable to lower interest rates fast enough to guide the economy to a soft landing. As a result, it could slow down the pace of infrastructure investments, which is crucial to justify STRL’s valuation multiples. An unanticipated reduction in its forward growth rates could hit the stock, as it currently trades well above its 5Y averages. Therefore, a growth de-rating could occur, as the market adjusts its optimism on the growth in infrastructure spending.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STRL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!