Summary:

- Sterling Infrastructure has generated exceptional alpha over the past year, outperforming its small-cap peers as well as the S&P500 by 5-9x.

- STRL offers diversified access across the infra-services spectrum, but we are most enthused about its prospects in the high-margin data center construction space.

- STRL maintains a strong balance sheet and is well placed to use some of its excess cash which now accounts for the largest chunk of total assets.

- For the degree of medium-term EBITDA growth on offer, the stock looks very expensive, and the charts also suggest a fresh long position now wouldn’t be too rewarding.

Kyryl Gorlov

Introduction

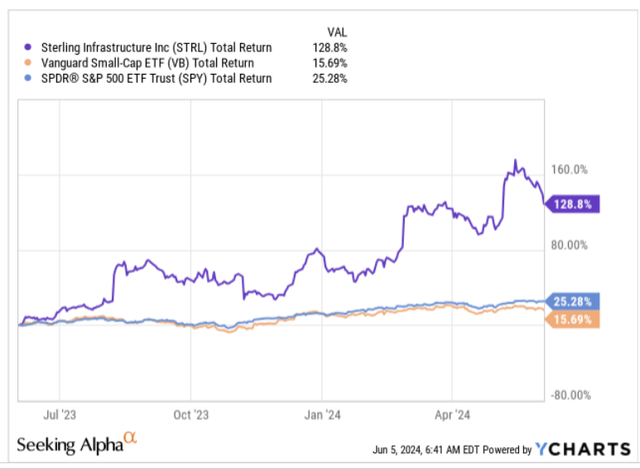

The stock of Sterling Infrastructure, Inc. (NASDAQ:STRL), a small-cap proxy on diversified infrastructure services in the US has proven to be a stellar source of alpha generation in recent periods. Over the past year, whilst its peers have generated returns within the mid-teens threshold, and the prime benchmark has generated returns of 25%, our focus stock STRL has surged by a whopping ~129%!

YCharts

An Attractive Business

Firstly, note that STRL offers a degree of diversification across the infrastructure spectrum that one would normally associate with a large-cap firm and not a small-cap like STRL. Through STRL one gets to participate in infrastructure narratives linked to data centers, e-commerce warehouses & distribution centers, power generation, highways, bridges, airports, port construction, and even single-family and multi-family homes.

STRL is able to get their foot in the door across all these different avenues, as it mainly operates in the mid-level markets, which tend to be too small for multinational construction firms and too big for small local contractors.

Amongst all these end markets, we believe STRL’s prospects are most dazzling in data-center construction, as it looks like the sky is the limit here. The exponential growth of AI, digital services, and cloud services have already seen data center construction capacity in North America hit record highs of 3078MW last year; what’s key to note is that 83% of this capacity was already pre-leased even before these projects were completed. It is now believed that the pipeline of new data center projects in the US stands at a whopping $160bn, with around 20% of those projects based in Virginia alone, where STRL has a useful presence, besides some of the other mid-Atlantic regions.

These data-center projects typically come in at high margins, and were instrumental in abetting the Q1 operational performance of STRL’s largest division: e-infrastructure solutions (48% of group revenue), even though revenue saw a 10% hit, mainly on account of weather-related issues (the revenue outlook for the rest of the year is still resplendent with management guiding to high single-digit to low double-digit growth for the rest of the year, based on the backlog as of Q1).

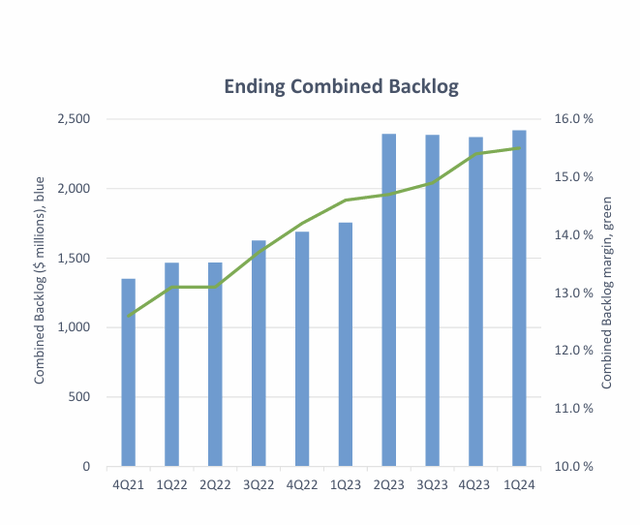

On a sequential basis, STRL’s backlog is growing at a sturdy pace of 13% and recently came in at 2.35bn (STRL’s backlog typically takes 16 months to convert to revenue). What’s key is not just the healthy pace of growth of the backlog, but also the quality of the backlog. Around 3 years back, STRL was signing contracts with a gross margin profile of around 13%, now it is inching closer to the 16% mark.

Stifel Presentation

Besides the pivot towards the center, it also helps that within STRL’s traditional business – transportation solutions (32% of group revenue) – they are now not focussing too much on low-bid heavy highway projects, but more on alternate delivery and higher margin work such as airport development, commercial work, shoring, etc.

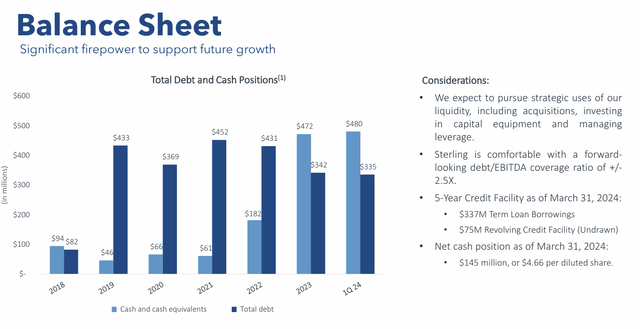

In a capital-intensive business such as this, it also helps that STRL now maintains a pristine balance sheet. In the four years, prior to FY23, it carried more debt than cash on its books, but this has been completely reversed over the last couple of quarters with STRL now maintaining a net cash position. With record cash of nearly half a billion now (this makes cash account for the largest share of STRL’s asset base at 26%), STRL has ample elbow room to engage in M&A or buy back more stock.

Stifel Presentation

In fact, towards the end of last year, the company announced a $200m buyback plan (this represents over 5.5% of the current market cap), which it intends to wrap up within a duration of just 2 years (most companies don’t set a time period on their buyback programs, and this reflects well on STRL’s commitment to the cause). The improving cash-generating profile is also, in some parts, down to the company’s greater focus on e-infra services and data-center construction, where the timing of cash payments is more beneficial from a working capital angle.

Closing Thoughts – Why STRL Stock Isn’t A Good Buy Now

Despite some of the favorable narratives associated with the Sterling Infra business, we don’t believe investors should just buy the stock at any price. Currently, we believe valuations look stretched and some of the bullish momentum appears to be fading.

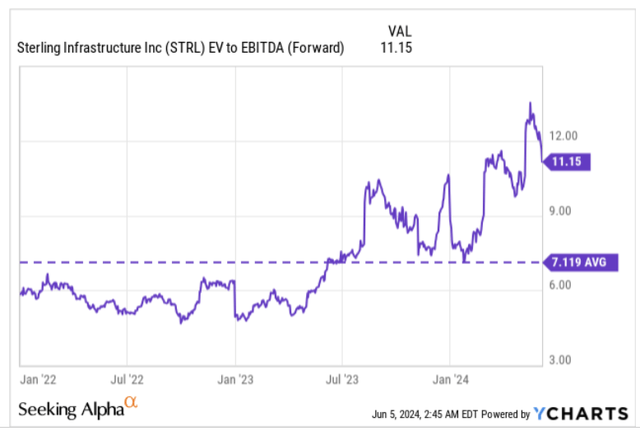

Starting with valuations, note that STRL is now priced at an exceptionally high forward EV/EBITDA of over 11x, which translates to a premium of 57% over its long-term rolling average.

YCharts

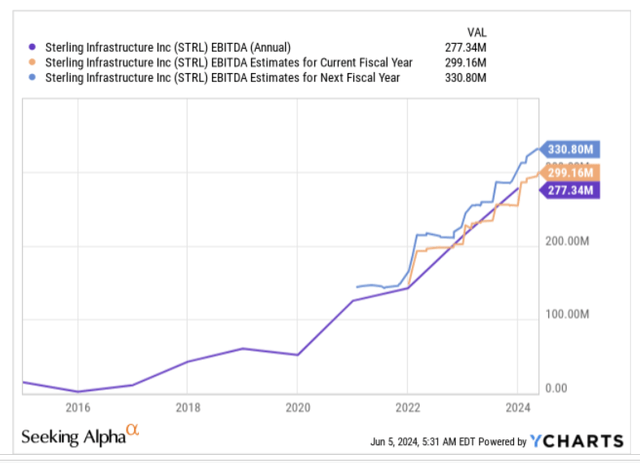

For that sort of multiple, you’d want to see extremely robust medium-term EBITDA growth, or at least EBITDA growth that is in line with the multiple on offer, but consensus estimates over the next two years point to EBITDA CAGR of only 6% through FY25.

YCharts

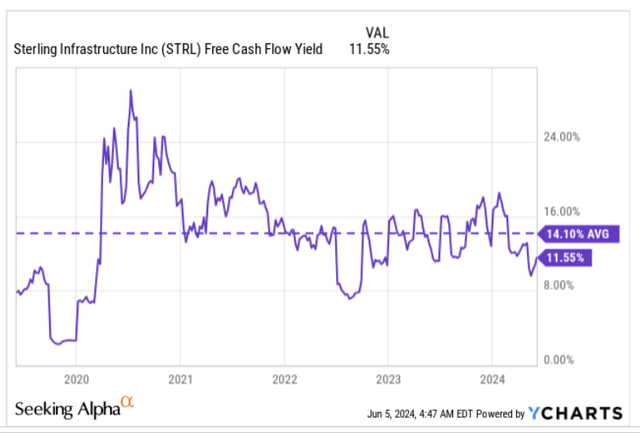

Then as noted earlier, STRL has a solid enough cash position and manages to generate very healthy FCF over time, but do consider that at current price levels, the FCF yield you’re getting (11.55%) is over 250bps lower than what the stock normally yields (14.1%), thus reducing the incentive to go long here.

YCharts

Then, investors looking for suitable infrastructure-oriented US stocks that could benefit from mean-reversion momentum, are unlikely to take a fancy to STRL at this juncture, given how steep its strength looks now relative to its peers from the infra space. For context, the current relative strength ratio is around 3x higher than its long-term average of 0.85x and in fact, makes STRL quite vulnerable to some mean reversion on the downside.

YCharts

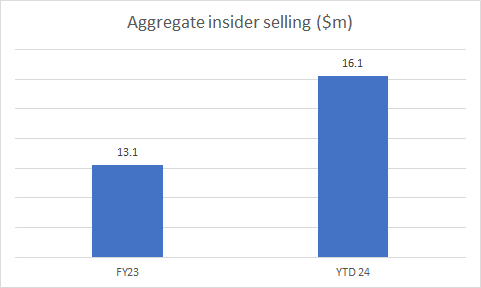

In fact, investors may want to consider that notable insiders including the CEO and the CFO have used the rally this year to sell large portions of their stake. For context, across the whole of last year, aggregate insider sales totaled over $13m; this year we haven’t even crossed half the year, and we’ve already seen $16.1m worth of insider selling.

Barcharts

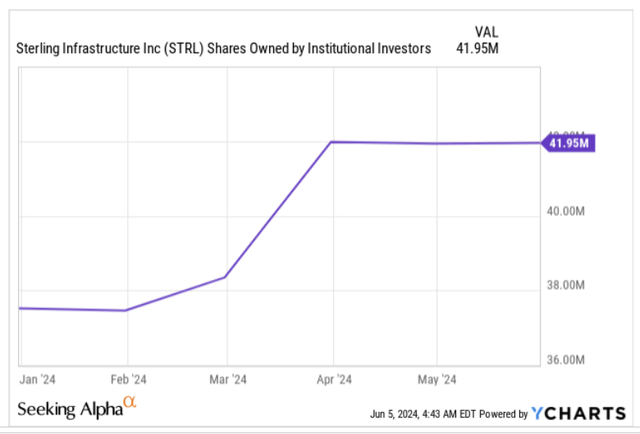

Investors may also want to pay some consideration to the manner in which the smart money is positioned. On a YTD basis, they’ve no doubt been bullish on the STRL stock, increasing their stake by 12%, but do consider that they haven’t added to their positions over the last couple of months.

YCharts

The lack of ample institutional interest is mirrored in the dynamics on the monthly chart, where it appears that we are seeing a bit of buying fatigue at these elevated levels, and the stock may be due for some consolidation.

Note that for close to 2 years the stock has trended up within a certain ascending channel (marked by the two black lines). Last month, it looked like the price was going to surge past the upper boundary, but that didn’t come to pass, with the presence of a long wick outside the channel boundary. It’s early days in June, but so far, the price action does not look great. Either way, since the stock is still quite some way from the lower boundary of the channel, we don’t believe a new long position here should be considered. STRL is a HOLD.

Investing

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.