Summary:

- Sterling Infrastructure stock has rallied 47% since October 2023, outperforming the market since my initial thesis went live.

- Recent developments show strong revenue growth, operating margin expansion, and raised guidance for FY 2024, indicating bullish signs for investors.

- Valuation update suggests massive undervaluation with a vast upside potential.

Pgiam/iStock via Getty Images

Investment thesis

My initial bullish thesis about Sterling Infrastructure (NASDAQ:STRL) aged well as the stock delivered a 47% rally since October 2023, substantially outperforming the broader U.S. market. The stock still has a high Seeking Alpha Quant rating, and I think it will be interesting for readers if I share my insights about recent developments and update my valuation analysis.

I remain optimistic, as I believe that both recent developments and secular trends are quite bullish for STRL investors. The valuation is still extremely attractive, with a massive upside potential. All in all, I reiterate a “Strong Buy” rating for STRL.

Recent developments

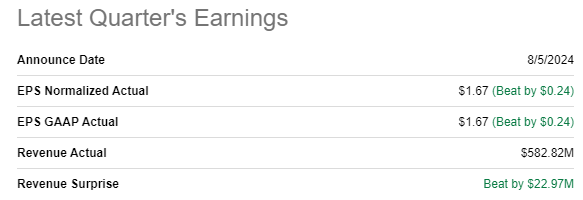

Sterling Infrastructure released its Q2 quarterly earnings on August 5, surpassing consensus estimates. Revenue growth accelerated to double digits with an 11.6% YoY growth. The adjusted EPS grew YoY from $1.27 to $1.67.

Seeking Alpha

I always look at the quality of the EPS improvement because it is common when the metric expands due to the change in outstanding shares count. Fortunately, it is not STRL’s case, since the operating margin expanded by a solid 95 basis points YoY. Strong operating leverage is a certain bullish sign for investors.

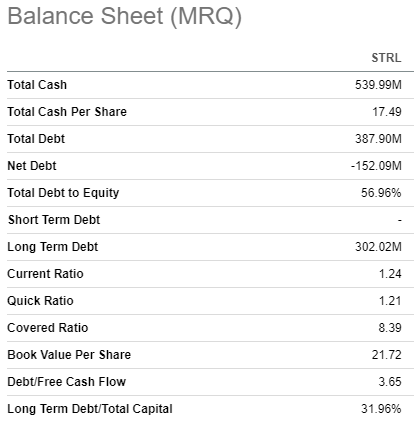

The company generated $70 million in free cash flow [FCF] during Q2, which helped in fortifying STRL’s balance sheet. The company had ample liquidity as of the latest reporting date, with total cash notably higher than total debt. A strong balance sheet is another bullish sign as it provides the company with more financial flexibility to deliver more value for shareholders.

Seeking Alpha

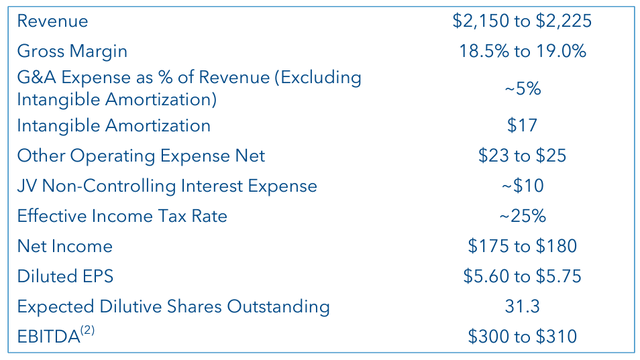

Another bullish sign is that the management raised guidance for the full fiscal year during the earnings call. FY 2024 revenue is expected to be around $2.19 billion, which is the midpoint of the provided range. This will be around 12% higher compared to FY 2023, which is a strong growth in the current environment of high interest rates. EBITDA growth is also expected to be solid between 2023 and 2024, from $264 million to around $305 million.

STRL’s latest earnings presentation

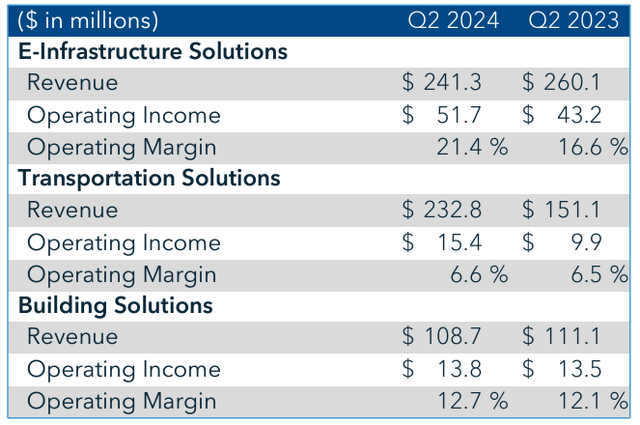

That said, we can expect more revenue growth and operating leverage from Sterling Infrastructure. During the earnings call, the management reiterated its commitment to increase efficiency to maximize returns on investments. The management’s focus on driving profitability expansion is evident when we look at the breakdown by segments. The operating margin grew across all segments despite only one of them delivering revenue growth in Q2, which is solid evidence of the management’s efficiency.

STRL”s latest earnings presentation

I do not think that revenue pullbacks in E-Infrastructure and Building segments to be secular. I think so because the backlog in E-Infrastructure is growing, which was 7% higher at the end of Q2 compared to the beginning of the year. A Q2 revenue pullback in Building Solutions is mainly explained by unfavorable weather conditions and not any adverse secular trends.

Sterling is poised to benefit from secular trends. For example, the company’s data center revenue is rapidly growing as technological hyper-scalers are in the fierce AI battle, which has led to a spike in data center investments. Building Solutions segment is also in a good secular position, especially considering the massive shortage of homes after underinvestment in the industry since the Great Recession.

To wrap up, I remain quite bullish from the fundamental perspective. Revenue is growing with impressive pace, operating leverage is robust, the management’s outlook is positive, and secular trends are favorable. This blend looks very strong, in my opinion.

Valuation update

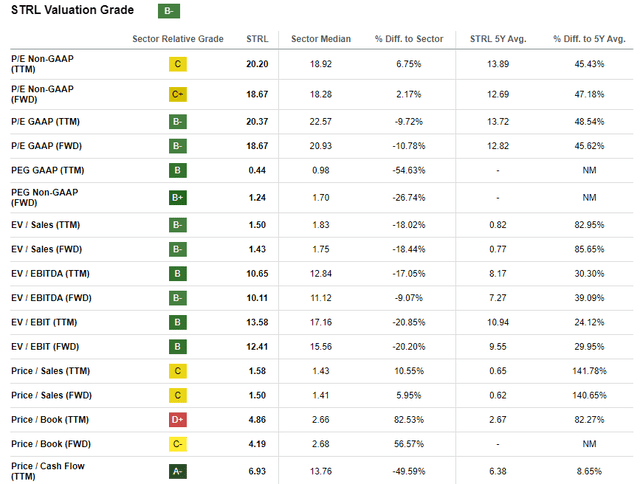

The stock has notably outperformed the broader U.S. market over the last twelve months, with a 35.5% rally since last August. Seeking Alpha Quant assigns the stock a decent “B-” valuation grade. Current multiples are mostly lower than the sector median, which is likely to indicate undervaluation. On the other hand, a comparison with historical averages says that the current multiples are substantially higher. Multiple expansions might have happened due to a solid profitability improvement compared to a few years ago.

Seeking Alpha

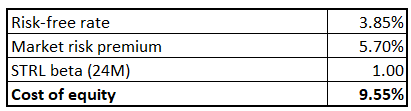

Multiples analysis outcomes are mixed and insufficient to give me a high level of conviction. Therefore, I want to run a discounted cash flow [DCF] simulation. I use cost of equity as a discount rate for STRL, which is 9.55%. Cost of equity is calculated below using the CAPM approach, all variables are easily available on the Internet.

Author’s calculations

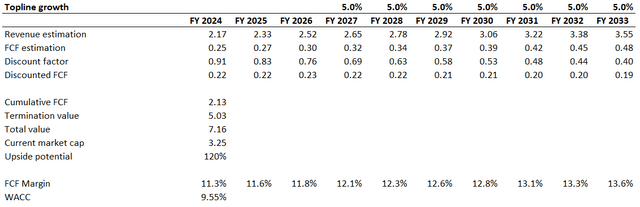

I have consensus estimates for revenue for the next three fiscal years, and I incorporate a very conservative 5% CAGR for the years beyond in my first scenario. I use the TTM 11.3% FCF margin ex-SBC for my base year and expect a 25 basis points expansion per year.

Author’s calculations

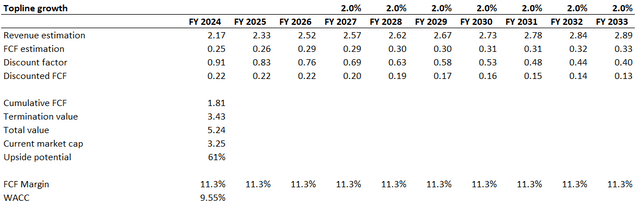

According to my base-case DCF simulation, the business’s fair value is above $7 billion, which indicates massive undervaluation. The upside potential is around 120%. To understand how significantly STRL is undervalued, I want to simulate a much more conservative scenario below. I use a 2% revenue CAGR after FY 2026 and no FCF margin expansion for the second scenario.

Author’s calculations

The second scenario suggests that even with very conservative revenue and FCF margin assumptions, the stock is still around 61% undervalued. That said, the margin of safety is huge.

Risks update

The current uncertain macro environment with tight credit conditions and Federal funds rates at their highest since the beginning of the century also does not add tactical optimism. High interest rates might weigh on plans around significant construction and infrastructure projects. They can be postponed, downscaled, or canceled due to the unfavorable monetary environment. Considering Sterling’s notable customer concentration, even if one of the projects is downsized, this will likely adversely affect the company’s financial performance over the short term. On the other hand, STRL’s balance sheet is robust enough to weather the storm.

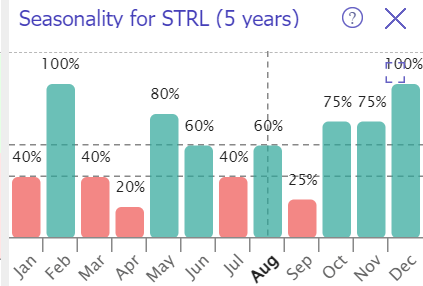

TrendSpider

If we look at STRL’s seasonality trends over the last five years, the picture does not look good. The above bar chart suggests that September is rarely green for STRL investors, meaning that there might be a pullback next month. On the other hand, seasonality trends suggest that the last quarter of a year is mostly robust. I am not trying to time the market, but it is better to keep in mind seasonality trends.

Bottom line

To conclude, STRL is still a “Strong Buy”. The valuation is still compelling and there are multiple bullish signs that back up my positive opinion about the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.