Summary:

- Nike’s revenue has increased by 10% in the full year YoY and 16% on a currency-neutral basis, indicating stronger demand for its products.

- However, the company’s margins have contracted due to higher input costs and elevated freight costs, leading to declining profitability.

- Nike’s stock is trading at a significant premium to its peers, making its valuation unjustified, in our view.

- For these reasons, we maintain our “hold” rating.

hapabapa

NIKE, Inc., (NYSE:NKE) together with its subsidiaries, designs, develops, markets, and sells athletic footwear, apparel, equipment, accessories, and services worldwide.

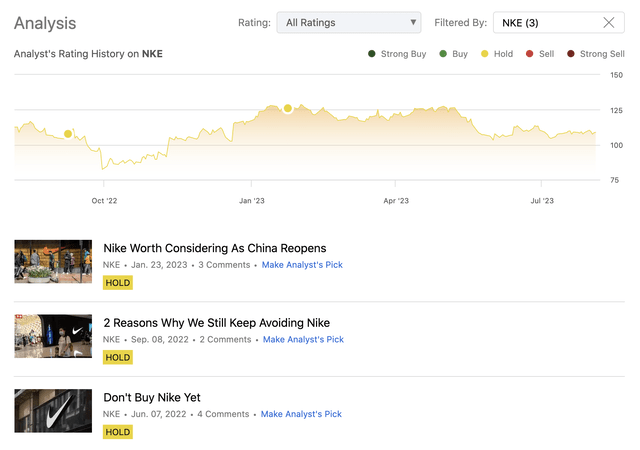

We have initiated coverage on the firm in June 2022 with a neutral rating. Since then, we have published two other articles, one in September 2022 and one in January 2023, maintaining our “hold” rating on the firm each time.

When assigning a neutral rating to Nike, our discussions have been revolving around several pros and cons:

Pros:

- Less significant FX headwinds in 2023 than in 2022

- Reopening of China and the improvement of the macroeconomic situation overall may lead to stronger demand

Cons:

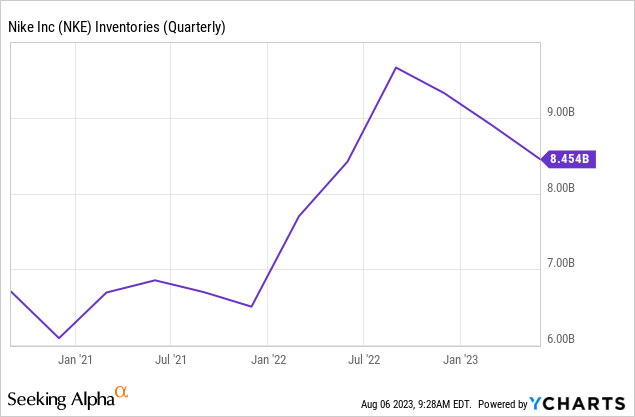

- Elevated inventory and accounts receivable levels

- Overvaluation

In today’s article, we will be looking at both the macro-and microeconomic factors that have been and are likely to keep affecting Nike’s financial performance in the coming quarters. Our aim is to provide an updated outlook incorporating the newest available data.

Macroeconomic environment

Over the past months the macroeconomic environment in the United States has been gradually improving. Inflation rates have come significantly down from the 2022 highs, and consumer confidence has bounced up substantially from its lows. Energy prices have also moderated with oil and gas prices significantly down from their peaks, reached in the previous year.

These are crucial factors when we want to determine Nike’s financial performance in the near term. Let us see why.

1.) Significant improvement in reported revenue

First of all, in Nike’ latest reported financial results, it is already visible that the demand for the firm’s products has picked up.

- Full year reported revenues were $51.2 billion, up 10 percent compared to prior year and up 16 percent on a currency-neutral basis*.

- Fourth quarter reported revenues were $12.8 billion, up 5 percent compared to prior year and up 8 percent on a currency-neutral basis.

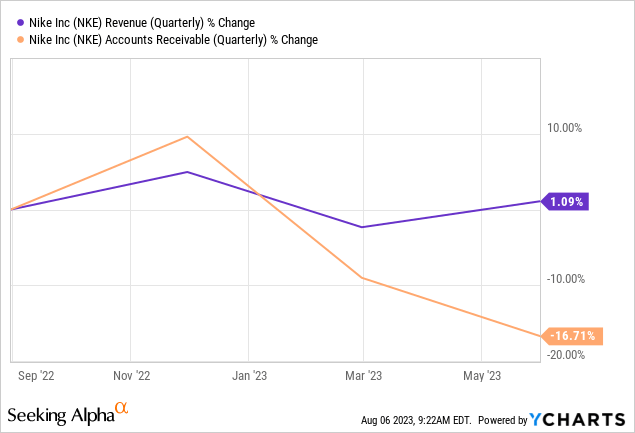

Also good to see that accounts receivable have fallen in the quarter, making us slightly more certain that the improved sales figures are not a result of manipulation, by pulling demand forward from future periods.

In our opinion, with the latest macroeconomic developments this trend is likely to be sustainable.

2.) Margin contractions and declining EPS

While we have seen a meaningful positive development in terms of revenues, margins have, on the other hand, contracted. The gross margin contraction has been mainly driven by the higher input costs, elevated freight costs and higher markdowns.

Gross margin decreased 140 basis points to 43.6 percent, primarily due to higher product input costs and elevated freight and logistics costs, higher markdowns and continued unfavorable changes in net foreign currency exchange rates — partially offset by strategic pricing actions and lapping higher inventory obsolescence reserves in Greater China in the prior period.

In our previous article we have highlighted the importance of inventory levels and have raised our concern that excess/obsolete inventory may result in significant discounting, hurting the firm’s bottom line. This is in fact happening now. Looking forward, we believe that the numbers need to further come down, creating continued downward pressure on the gross margin. In the latest quarter inventories have been flat YoY, but have declined QoQ.

In terms of input costs we are somewhat more optimistic. With falling energy prices and moderating inflation readings, we believe that Nike’s business is likely to be positively impacted in the coming quarters.

Further, the macroeconomic environment does not only impact the cost of goods sold, but also impacts SG&A expenses.

Selling and administrative expense increased 8 percent to $4.4 billion.

- Demand creation expense was $1.1 billion, up 3 percent, primarily due to sports marketing, and advertising and marketing expense.

- Operating overhead expense increased 10 percent to $3.3 billion, primarily due to wage-related expenses and NIKE Direct variable costs.

From these figures, it is clearly visible that Nike’s revenue growth has required additional resources for marketing. In our opinion, these expenses will likely gradually fall as consumer confidence improves further, but in the coming months they are likely to remain elevated.

All in all, we believe that in the coming quarters Nike’s business will benefit from the current macroeconomic developments. This however does not mean that we are clearly turning bullish on the firm. We would like to see improving profitability (margin expansion) and maintained strong demand for the products before we would consider upgrading to a “buy” rating.

China

In our previous writing we have been elaborating on how the reopening of China could benefit Nike. In fact, the Greater China segment has exhibited the fastest growth in the previous quarter:

Revenue increased 16% in Greater China to $1.81B to top the consensus expectation of $1.64B and outpace the revenue growth recorded in Asia Pacific & Latin America (+5%), North America (+5%) and Europe, Middle East, & Africa (+3%).

While this is definitely a good sign and is an indication that the consumer is also picking up in China, the outlook remains uncertain. With limited and often unreliable data economic data coming out from China, we are not comfortable with forecasting the development of the spending behaviour of the consumer in the country in the near future.

Valuation

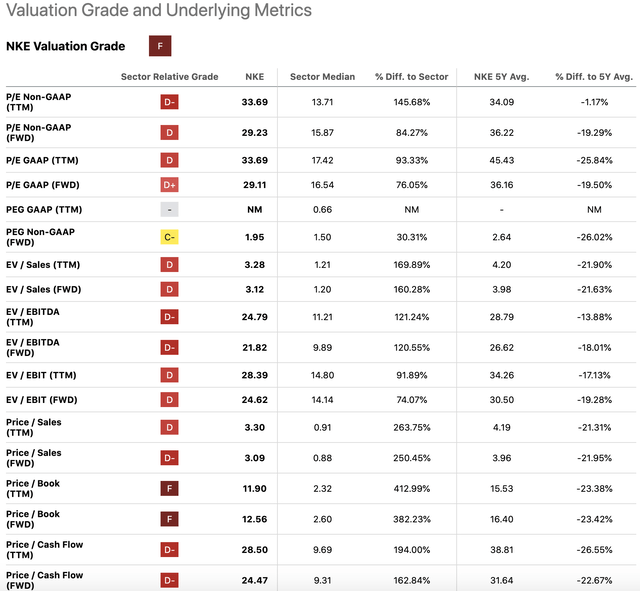

In all of our previous writings we have been using a set of traditional price multiples to assess Nike’s valuation. And each time we have concluded that Nike’s stock is too expensive.

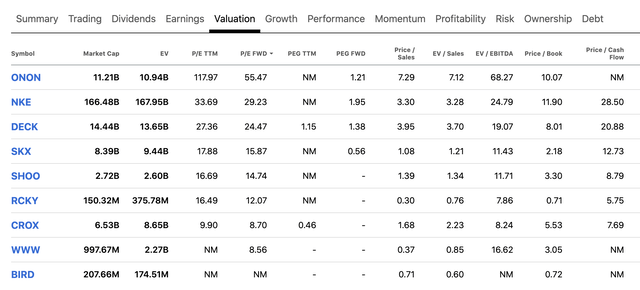

And once again we draw the same conclusion. Nike’s stock is trading at a significant premium to the consumer discretionary sector median. Even if we create a much narrower peer group containing only firms from the footwear industry, according to most metrics Nike is the most expensive stock.

In our opinion these multiples remain unjustified. We understand that Nike is one of the most well-known brands in the world, but as long as the fundamental numbers do not reflect this, we cannot recommend buying the stock at these price levels.

Conclusions

Nike has achieved impressive revenue growth in the past quarter and has also managed to reduce its inventory levels QoQ. This is likely to be the result of the improving macroeconomic environment overall, and Nike’s pricing strategy. The revenue increase has been the highest in the Greater China region.

At the same time the firm’s bottom line results have deteriorated substantially. Profitability has decreased as a result of higher input costs and higher SG&A expenses. In our view, these costs may start normalizing in the coming quarters as energy prices have decreased and the inflation rate has moderated compared to the prior year.

In our view, the valuation of the firm remains unjustified.

For these reasons, we maintain our “hold” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.