Summary:

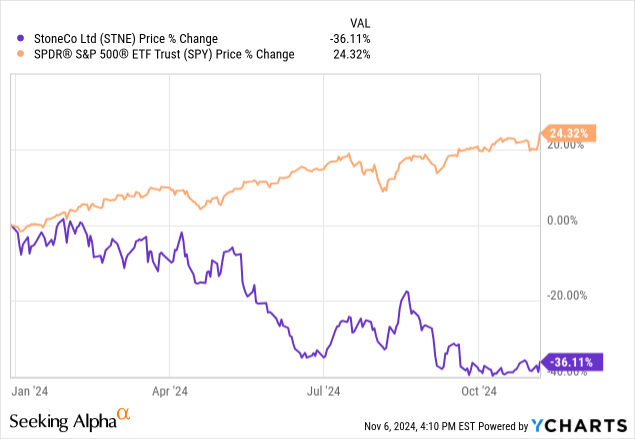

- StoneCo’s stock is down nearly 40% year-to-date, with recent underperformance largely due to macroeconomic challenges in Brazil.

- Interest rate hikes in Brazil have posed challenges, affecting expenses and profitability, especially for small business clients.

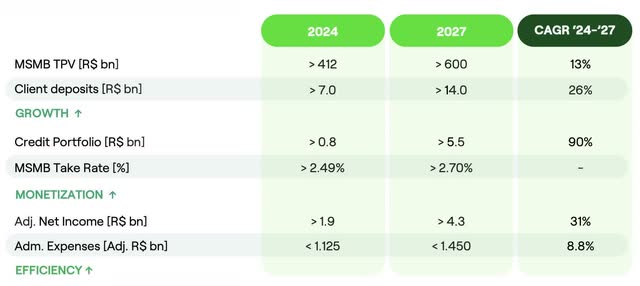

- STNE’s long-term guidance remains strong, with an expected 31% CAGR in net income from 2024 to 2027, despite near-term hurdles.

- The Company’s valuation is highly attractive, trading at low multiples compared to international peers, signaling a potential upside.

- Q3 earnings will be crucial, with a focus on TPV growth and expense management amidst Brazil’s rising interest rates.

ZeynepKaya/E+ via Getty Images

As I’ve been a long-term StoneCo (NASDAQ:STNE) bull since I wrote my previous article covering the stock in November 2023, it’s already down more than 21% since then, as the stock has already fallen almost 40% over the year.

Seeking Alpha

At the time, a large part of my bullish investment thesis on StoneCo rested on the fact that the company was pursuing a “robust expansion in Total Payment Volume (TPV) and a credit portfolio growing at annual double digits for the next four years, while possible, will likely face challenges in execution amid macroeconomic hurdles.” This was in a scenario where there was an ongoing credit recovery and persistently high interest rates in Brazil despite a downward trend.

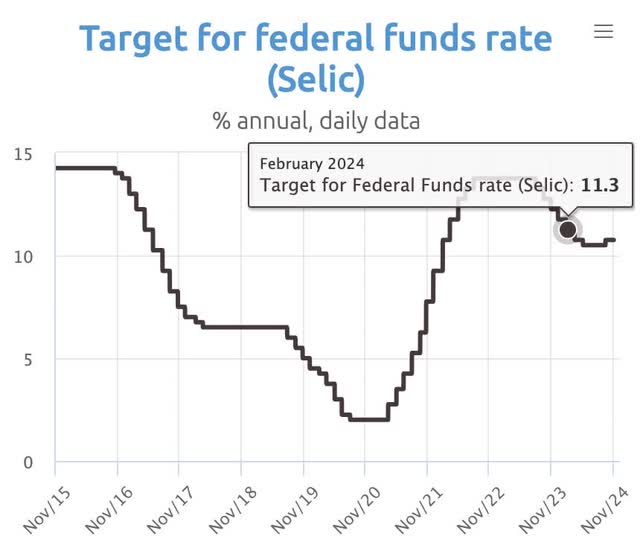

It turns out that this scenario proved to be more complicated than anticipated. This started with inflation in Brazil (StoneCo’s primary market), which rose again this year. Brazil’s 12-month accumulated inflation rose from 3.8% in May to 4.2% in August. As a result, the country’s Central Bank interrupted a sequence of interest rate cuts, which went from 13.75% in August 2023 to 10.5% by September 2024 and a further 0.50 points in November, reaching 11.25%-back to the same level as in February. It’s worth remembering that expectations at the start of 2024 pointed to figures below two digits.

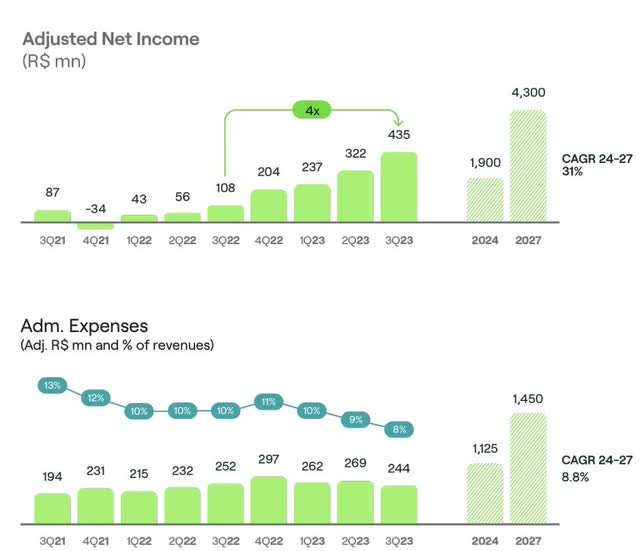

This shift in the interest rate scenario is bad news for StoneCo, as we can see from the total costs and expenses reported in Q2, where it totaled R$1.9 billion, growing below revenues by 2% year-over-year, signaling a gain in profitability. This was mainly thanks to a 20% reduction in financial expenses due to a lower interest rate at the time and the increased financing of the operation with its own cash rather than debt.

Not only that, but the competitive environment for payment processing companies in Brazil has been very intense, with StoneCo investing in sales and scaling specialist distribution as the company continues to move up to onboard larger small-business clients. Thus, expenses as a percentage of revenues have increased in the last two quarters compared to the last five, with operating income growth decelerating sharply year-over-year.

Moreover, as the management team highlighted in the most recent earnings call, StoneCo expects that the key challenge for H2 2024 will be focused on controlling expenses.

I think the place where it’s going to become more challenging the second half is probably going to be financial expenses, simply given the fact that interest rates are expected to increase in the second half versus decreasing the first half, and we also did a sizeable buyback, which is creative when we look at EPS over time, but has a short-term negative impact to the P&L. So those are pretty much the main movements that we see going ahead.”

The Targets StoneCo Needs to Hit

Even with an adverse macroeconomic scenario, StoneCo made it very clear last quarter that there is a high chance that the company will exceed its customer deposit and credit portfolio guidance.

With regard to the adjusted net income guidance, which points to a profit of over R$1.9 billion, so far in the first half of 2024, the company delivered R$948 million, which is apparently on track.

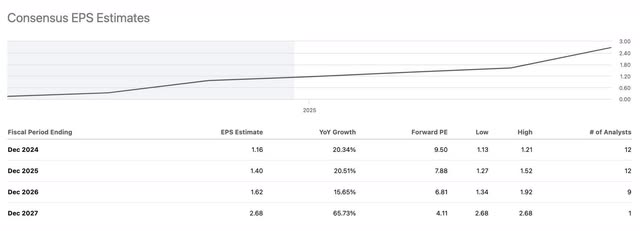

StoneCo is forecasting net income to grow at a CAGR of 31% from 2024 to 2027. In comparison, market estimates for EPS growth over the same period are 32.2%, suggesting higher expectations, possibly due to StoneCo providing conservative guidance.

What is striking is that EPS is projected to grow by 20% between 2024 and 2025, 15% in 2026, and 65.7% to close with the company’s guidance. This needs to be achieved in a scenario with well-managed NPLs and expense control, in which StoneCo forecasts to grow at a CAGR of 8.8% between 2024 and 2027.

Based on a single analyst’s projection of revenues reaching US$3.66 billion (or R$20.86 billion), this would imply that total expenses as a percentage of revenue will be approximately 6.95% in 2027. This is quite challenging, as the macroeconomic scenario in Brazil, marked by historically high inflation and often very high interest rates, could disrupt this trajectory.

StoneCo’s Valuation Remains Highly Attractive

With StoneCo’s recent underperformance throughout the year, valuations are more attractive than ever, especially when compared to its international peers. However, it seems to me that this sharp drop is already pricing in potential hurdles for the company in the face of an unfavorable macro scenario.

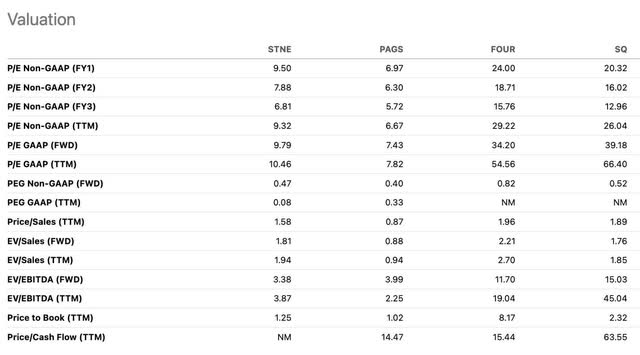

StoneCo trades at a 2024 estimated P/E of 9.5x. When we adjust this multiple for growth, considering an EPS CAGR according to the company’s adjusted net income guidance of 31% between 2024 and 2027, it will result in a PEG of 0.32x, signaling a strong undervaluation.

The situation becomes even more critical when we compare StoneCo’s forward EV/EBITDA at 3.4x versus 11.7x and 15x for peers such as Shift4 Payments (FOUR) and Block, Inc. (SQ), respectively, and even lower than domestic peers with lower growth potential, such as PagSeguro (PAGS) trading at 4x.

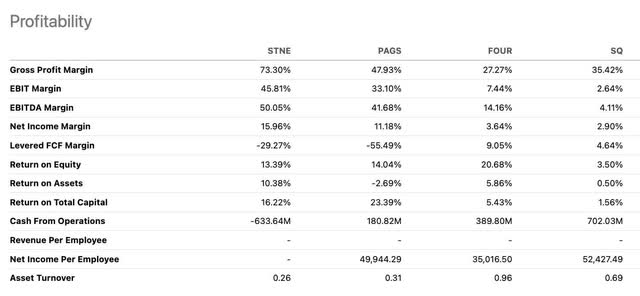

What also strikes me is that if we compare StoneCo’s profitability with these other payment companies. StoneCo has gross profit margins of 73.3% and an EBITDA margin of 50%, well ahead of all of its main peers. I see this in large part due to how well StoneCo has maintained its operational efficiency, mainly by controlling costs and managing SG&A expenses. On the other hand, perhaps the most deficient point of StoneCo’s profitability is its lower return on equity (ROE) than some of its main peers at 13.4x.

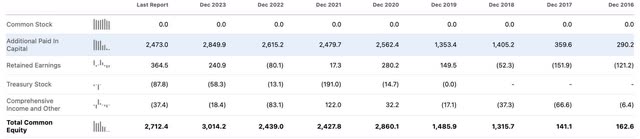

However, the lower ROE may be an indication that the company is still at a stage where it is prioritizing growth and reinvestment, which is not yet well reflected in higher equity returns. This is also clear from the high equity base compared to its current profitability. StoneCo had $2.9 billion in additional paid-in capital in 2023 alone, adding up to more than $3 billion in total common equity-a consequence of follow-ons in 2020 and 2021 after its IPO in 2018.

A Word Ahead of Earnings

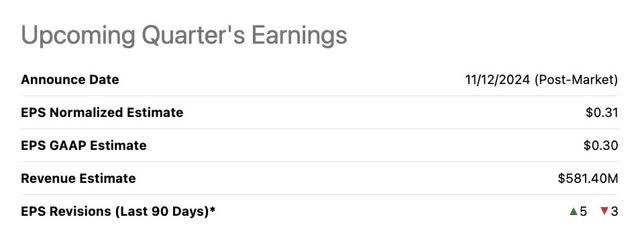

StoneCo’s Q3 earnings are scheduled to be released on November 12th after the closing bell, where the market anticipates the company reporting EPS of $0.31 and revenues of $581.40 million (approximately R$3.13 billion), which would imply annual growth of 14% and an annual decline of 9%, respectively.

In the last three months, however, analysts’ revisions have been quite negative, falling 2.9% and around 12% in the last six months, a factor I attribute to the scenario of rising interest rates in Brazil at a time when the U.S. has been lowering interest rates. This tends to put pressure on the local economy, especially SMB’s, and so can cause an oscillation in the growth trend in TPV. Thus, StoneCo’s resilience in TPV growth will be one of the main parameters, in my view, for Q3 to be perceived as a success or not.

The other crucial point will be the evolution in expenses, which, as StoneCo’s management team has revealed, is the main point of attention for the company in H2 with the adverse interest rate scenario.

Less optimistic indications are also seen on Wall Street, especially with the news of Morgan Stanley’s recent downgrade for StoneCo and PagSeguro, based on an expectation that 2024 will be the peak in profitability in the payments sector in Brazil, attributing a “saturated market,” with the need to leverage the banking business as quickly as possible.

Therefore, client deposits and the evolution of the credit portfolio that are aligned with the trend of the company delivering a value above R$7 billion and R$800 million by Q4, respectively, could also be determinants of investors’ immediate reaction.

Having said that, I don’t believe the upcoming earnings will create a short-term bullish or bearish opportunity for StoneCo. I lean toward the view that long-term investors, who take advantage of buying STNE at its current valuation-despite the macroeconomic turbulence the company has faced-should focus on the company’s strong profitability and growth potential, rather than being swayed by its volatility.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STNE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.