Summary:

- As a long-term-oriented investor with an extensive investment time horizon, I am attracted to companies with room to grow. A cheap valuation could sweeten the deal.

- I have been bullish on StoneCo for quite some time and I have remained invested through ups and downs.

- My bullish stance on StoneCo stems from recent shifts in Brazil’s payment landscape, the product expansion strategy of the company, and prudent strategic investments.

Maskot

When I invest in a company with a long-term view, I often look for companies that enjoy a long runway to grow. An attractive valuation certainly makes things very interesting, but I am comfortable investing in small, high-growth companies that are expensively valued. Occasionally, I come across businesses that are valued attractively despite enjoying a lot of room to grow. StoneCo Ltd. (NASDAQ:STNE) is one.

I have been bullish on STNE for quite some time. In April 2023, I thought the positively trending earnings revisions would take the stock higher. The stock is up 18% since then, but down more than 22% since I reiterated my bullish stance last March before the release of Q4 2023 earnings.

I believe StoneCo remains well-positioned to grow for a few reasons. In this article, I will highlight some of the main factors that point to sustainable growth in the foreseeable future.

The Favorable Shift In Payments

According to Statista, nearly 10% of Brazil’s population is unbanked. This is no longer a new piece of information and I believe the market has already factored this into the valuation of Brazilian fintech companies, so I am not going to discuss this here.

A key trend that supports my bullish case for StoneCo is the gradual shift from cash to digital payments in Brazil. The launch of Pix in late 2020 has played a key role in enabling this transition. As of 2019, a staggering 77% of retail transactions in Brazil were completed with cash. Today, Pix is used by approximately 80% of adults in Brazil and 13 million businesses. This wide adoption of Pix has revolutionized the payment landscape in the country. Even on a global scale, Pix offers best-in-class instant payment settlement services.

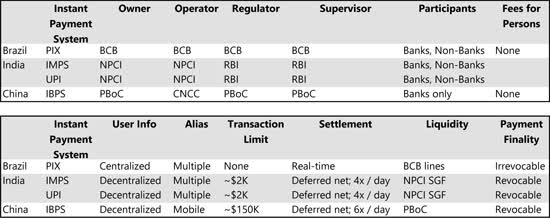

Exhibit 1: Comparison of instant payment systems in Brazil, India, and China

IMF

With digital payments now becoming the leading mode of payment in the country, StoneCo, as an established fintech that connects small businesses to consumers while expanding into banking services, seems well-positioned to grow its customer base. The Q1 performance of StoneCo confirms this. The MSMB client base grew 33% YoY to 3.67 million, MSMB total payment volume grew 24% YoY to R$102 billion, active banking clients almost doubled to 2.38 million, and client deposits increased 53% YoY to R$6 billion.

The relationships StoneCo has built with millions of small businesses by helping them be a part of the digital payment revolution in the country will be a growth catalyst in the future when these business owners embrace other financial solutions offered by StoneCo.

Now that the majority of Brazilians have access to digital payments and banking facilities, the winners of this sector will be determined by the speed, security, and convenience added by fintech companies. StoneCo, in my opinion, is strongly positioned to emerge as a big winner given its focus on these aspects.

Product Expansion Will Drive Growth

StoneCo is aggressively diversifying its revenue through product expansion. This is an encouraging sign at a time when digital payments are growing in popularity in the Latin American region. The company’s strategic decision to bundle banking and payment solutions together and the introduction of instant payments in TON during Q1 are examples of some of the recent efforts by StoneCo to keep customers engaged and satisfied while targeting new businesses.

The financial services business, which brought in R$2.7 billion in revenue in Q1, has a lot of room for expansion. Offering credit solutions to large clients will form the backbone for long-lasting relationships with these key clients through increased customer stickiness.

The software business holds great potential too. StoneCo is now focused on its vertical software business where it develops tailor-made solutions to cater to the unique needs of different business sectors. As highlighted during the Q1 earnings call, the company will be focused on the retail and gas station business verticals this year. From the perspective of a business owner, these software solutions offer a seamless way to take their business online as StoneCo offers a hassle-free integration of the software with its payment solutions. In the long run, this strategy will expand the company’s footprint across Brazil. In the best-case scenario, the vertical software business will help the company enjoy competitive advantages resulting from switching costs.

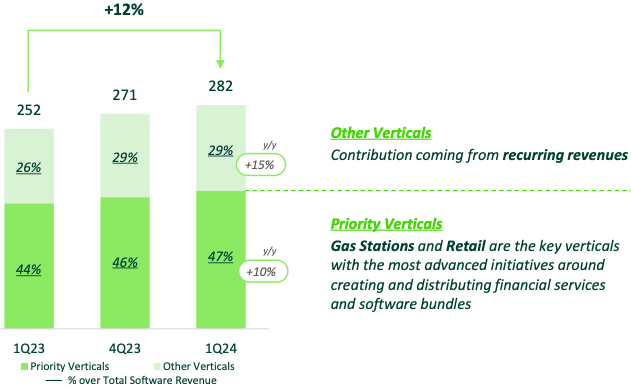

Exhibit 2: Verticals software revenue

Q1 presentation

Strategic Investments That Address The Market Needs

As I highlighted earlier, the next big winners in Brazil’s fintech sector will be determined by the convenience, speed, and security brought to the table by a fintech company. Identifying this, StoneCo has pledged to invest in improving its payment processing capabilities to support faster and more reliable transactions. This strategic focus suggests the company has identified the market needs and where the industry is headed in the future. These product investments are likely to yield better results in the next few years compared to a geographic expansion.

Investing in industry-specific software solutions, enabling seamless integration between software solutions and payment processors, upgrading the data analytics capabilities offered to clients, using AI for threat detection, investing in scalable cloud infrastructure, and developing user-friendly interfaces are some of the areas StoneCo is currently focused on, based on the data shared on recent earnings calls.

Patience Will Be Tested

StoneCo, as some SA analysts have recently highlighted, is cheaply valued in the market at a forward P/E of around 11. Remember, this is a company that has seen double-digit revenue growth in each of the last five quarters. STNE has declined more than 25% this year despite the numbers heading in the right direction. The uncertain economic conditions in Brazil, the increasing competition in Brazil’s fintech sector, and Warren Buffett’s divestment of STNE while building a stake in Nu Holdings Ltd. (NU) are some of the reasons that have deteriorated investor sentiment this year. To make matters worse, earnings revisions – which I believe play a major role in stock price movements in the short run – have been trending lower mostly in recent times.

The aforementioned factors have masked the long-term earnings growth potential of the company, creating a compelling entry point for investors. That said, it may take some time for the investor sentiment to improve. The Q2 earnings report, scheduled to be released on August 14, will have to show above-average growth to change the current sentiment toward the stock. I don’t see this happening either, but since I am in for the long haul, I would not be bothered by short-term stock price declines resulting from short-term negative developments that do not threaten the fundamentals of the company.

Takeaway

StoneCo is my favorite fintech company. I believe there is a lot of room to grow, and more importantly, the company is making the right strategic moves to cater to the changing market needs. Although short-term gains are likely, I am convinced that STNE is poised to deliver lucrative investment returns in the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STNE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.