Summary:

- StoneCo is a Brazilian fintech company providing payment, software, and banking solutions for MSMBs.

- Despite recent volatility, StoneCo has undergone structural renewal and is projected to have over 30% CAGR in adjusted net income until 2027.

- StoneCo’s business includes payments, software, and banking segments which create a strong ecosystem around the business services.

Lyndon Stratford

Investment Thesis:

StoneCo (NASDAQ:STNE) is a Brazilian fintech company which provides solutions for MSMB’s through the form of payments, software, and banking solutions. Stone has had a volatile few years with a meteoric rise after covid to a high of $90 a share, which was then met with a sharp collapse to a low of $9 a share after the mishandling of their credit segment and major losses with their investment in BancoIntern. As a result of the stock’s collapse, the company underwent a complete structural renewal since then, which resulted in a new CEO being brought in and a re-launch of their credit segment. Looking forward, Stone has a phenomenal business model that is sticky among the businesses they work with as they can vertically integrate their payment solutions with the software and banking services they provide, which allows them to heavily monetize the customers they have and ensure it is extremely difficult for them to stop using their services. In addition, they are rapidly growing their business through expansions into new product segments and disrupting the traditional players in the sector, leading to management projecting an over 30% CAGR for their adjusted net income until 2027.

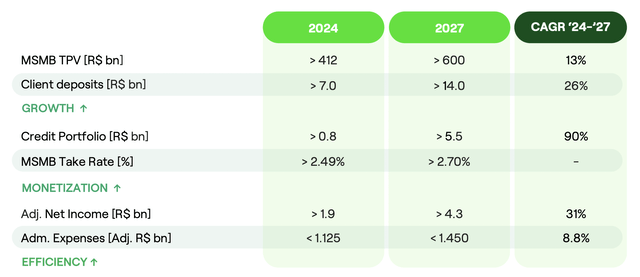

StoneCo long term projections investor day (StoneCo investor day presentation / investor relations)

The above figures are in Brazilian Reais, which is equivalent to roughly $0.18 USD. When adjusting the figures to USD, Stone is projecting themselves to do over USD $774 million in adjusted net income. Currently, they are guiding for USD $342 million in adjusted net income for 2024, which means they trade at just 10.5x their 2024 earnings, which is an outstanding figure considering the tremendous growth they are poised for. Even with conservative assumptions, StoneCo appears very undervalued and looks poised to deliver market-beating returns over the next few years.

Business Breakdown:

Although StoneCo themselves classify their business into the segments of just financial services and software, to better understand the business I have segmented out their payments, software, and banking segments to ensure that everyone can properly understand their business and the beauty of it.

Payments:

The payments segment of StoneCo is the backbone of the business. Essentially, StoneCo allows merchants to accept electronic and alternative payments through their standard payment terminals which can accept credit cards, the TapTon solution which allows merchants to sell via their phones, and Pix which is a QR code form of payments. Essentially, StoneCo provides a variety of solutions which allows merchants to accept virtually all forms of payments from their consumers, while StoneCo takes a small percentage of each transaction. This segment is a great business as once the solutions are deployed, it is an extremely high margin business to simply take a percentage of each transaction. For 2024, StoneCo is guiding towards USD $74.16 billion in TPV with a 2.49% take rate, which would result in USD $1.846 billion in revenue for the payments segment. It is also important to note that management is guiding the business to reach USD $108 billion in TPV in 2027 with a 2.7% take rate, which would result in $2.916 billion in revenue for the segment and an over 13% CAGR. A downside of the payments segment itself is that on its own, it is hard to establish a competitive advantage and moat around your business, although, when paired with the other segments of StoneCo’s business, the payments segment serves as an introduction into their other services which ultimately creates the StoneCo ecosystem.

Software:

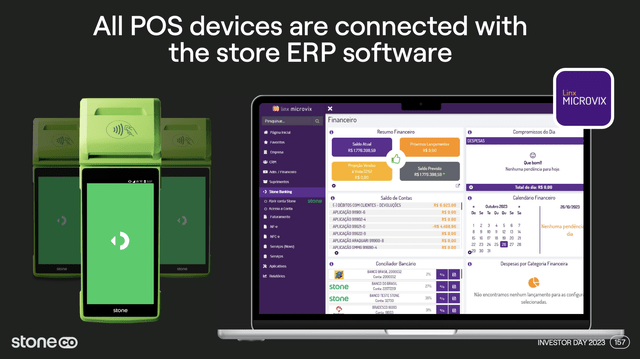

The software segment, although not a core focus of StoneCo’s growth plan and overall business, serves as an essential component of reinforcing Stoneco’s ecosystem of products. The primary software solutions they employ are POS/ERP solutions for clients in retail, gas stations, food, and drugstores on top of electronic transfer of funds and CRM.

StoneCo investor day software segment presentation (StoneCo investor relations)

The integration of ERP software with StoneCo’s payments solutions allows for merchants to seamlessly run their businesses using StoneCo’s suite of products. As a result of the seamless integration of products, it is very difficult for merchants to pivot away from the StoneCo ecosystem once it is integrated, as it will be incorporated into all components of their business.

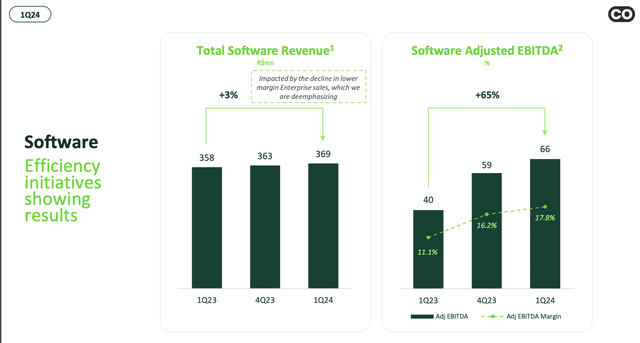

STNE Q1 2024 presentation (STNE investor relations)

Delving into more figures about the software space, in the first quarter of 2024 total software revenues grew only 3% YoY while adjusted EBITDA grew at a significantly faster pace at 65%. I do not view the slow growth in the software segment as a concern due to the segment not being emphasized by the management in terms of future growth prospects. Overall, I view the software component of the business as a great compliment to the payments and banking segments that further reinforces the ecosystem and stickiness of StoneCo’s suite of products.

Banking:

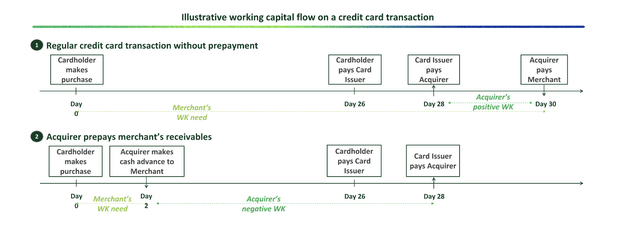

The banking segment of StoneCo’s business is the newest and fastest growing component, which represents the largest growth prospects over the next few years. The main components of the banking segment are their working capital/pre-payment solutions, credit solutions, and digital banking solutions. StoneCo’s pre-payment solutions essentially meet their merchant’s working capital needs in the time between the merchant sells a good/service and when they get paid by the card issuer. StoneCo gives their merchants a prepayment on their receivables and charges a fee in return, resulting in StoneCo themselves becoming the ultimate recipient of the merchant’s receivables from the card issuer.

Furthermore, StoneCo has begun re-introducing their credit solution in a conservative manner. Similar to their pre-payment solutions, when Stone offers loans/lines of credits to their merchants, the merchants are able to pay off their debts in line with their TPV. The beauty of Stone’s suite of services is displayed in the banking portion as they assume significantly less risk relative to traditional banks in their credit segment as a result of the integration of their payments segment, which helps merchants pay off their credit in an easier manner and allows Stone to better understand the MSMB’s they are lending to. Although StoneCo is still in the early days of their credit segment, their non-performing loans (NPL’s) are quite low at 1.5% for 90+ days and 2.2% for 15–90 days, which is extremely low relative to their credit provisions of 20%. Although management does believe NPL’s will grow to 10% over time, this will occur as a result of a greater expansion of the credit segment, which will still lead to a net positive on the top and bottom line for Stone’s overall business.

STNE NPL’s (STNE q1 2024 presentation)

Lastly, StoneCo’s digital banking solutions are also integrated into their POS allowing merchants to issue and receive payments, issue payment slips, make transfers, and do much more, yet another instance of the seamless integration of the different elements of StoneCo’s business to grow the ecosystem.

Key Financial Metrics:

StoneCo’s financials are complicated to analyze, especially from a balance sheet perspective, due to the banking component of their business. The most important components to note about the business is that in the TTM, Stone had USD $2.345 billion in revenue representing a P/S of just 1.54 which appears low when taking their outstanding 73.88% gross margin into consideration. I will not highlight Stone’s operating income, as it is skewed higher as a result of the classification of their financial expenses (Stone had USD $1 billion in GAAP operating income). In the TTM, they had net income of USD $346.7 million, which represents a 14.7% net margin and a 10.4 P/E for the TTM. Regarding the businesses balance sheet, the important highlights are that they have USD $1.087 billion in cash & cash equivalents yet USD $1.5 billion in total debt, not including capital leases. It is important to note their debt is financed at extremely high rates due to Brazil’s high-interest rates, although their debt is financed at both fixed and variable rates. Therefore, they will be a beneficiary of interest rate cuts. Lastly, looking at the businesses shares outstanding, I always love to see businesses I believe to be undervalued buying back their shares, therefore the slight decline in shares outstanding of 312.6 million to 308.9 million from 2022 to their last report is beneficial. In addition, StoneCo has a USD $250 million share buyback program in place which represents 7% of their market cap, although management has been slow to continue buying back shares as a result of their capital needs in the banking business. Overall, StoneCo has strong margins, a great share buyback program in place, and they are well capitalized to continue expanding their business.

Valuation:

Although StoneCo appears clearly undervalued as a result of the cheap multiples they trade at, high quality of the business, and tremendous growth prospects, I utilized a simple DCF model with extremely conservative assumptions to further reinforce how undervalued it is. I inputted the businesses TTM of net income, net debt, and very conservative growth assumptions which are far under management’s guidance. For instance, the assumption of 23% growth rates for the first 3 years results in cash flow projections of USD $585.3 million in year 4 (2027) while management expects close to $774 million in 2027. It is also important to note that management has continuously reinforced their 2024 and long-term projections in their most recent quarters. Moving on, the 12.5% and 5% growth assumptions for the following years represent Stone’s continued growth momentum, which I believe they can maintain over the next 10 years as they continue to take market share from traditional players and Brazil’s economy grows.

STNE DCF Model (Rasoli Research – Seeking Alpha Financials)

As we can see, assuming a discount rate of 13% which is above the market average of 10% over long periods of time, at today’s prices StoneCo appears to have a massive 86% margin of safety to their intrinsic value even with the extremely conservative assumptions. Overall, the undervalued nature of StoneCo appears to be reinforced even in scenarios where they fall short of growth expectations.

Risk Factors:

StoneCo appears tremendously undervalued, yet, there are still significant risks that must be considered, primarily due to their operations in Brazil and the volatile political and macroeconomic environment.

Macroeconomic Landscape:

The macroeconomic landscape is Brazil has been difficult over the past few years. Brazil experienced periods of large inflation in 2022 which led to the central bank rapidly raising interest rates to over 13% at its peak. Since then, inflation has fallen to just under 4% with the central banks target being 3%. Recently, there has been some conflict in the central bank as they slowed down their rate cuts to just 25 bps last month and completely paused them this month, which opposed the left-leaning president’s philosophy where he believes that rates should be continuously cut. The drama between the left-leaning Brazilian president, Luiz Silva, and the right-leaning head of the central bank, Roberto Neto, is likely the reason for the recent decline in StoneCo’s stock price. Interest rates in both Brazil and the US are extremely important in regard to StoneCo’s performance. First, a reduction in US interest rates is crucial as it would weaken the dollar relative to the Real, thus strengthening StoneCo’s earnings when translated to USD. Furthermore, due to the debt-load that Stone-Co carries, of which is partially variable, a reduction in Brazilian interest rates will bring down the interest payments for their debt while also simulating overall economic activity which will further boost StoneCo’s business. The major risks to StoneCo are that if US interest rates remain elevated, the dollar will remain strong against the Real, thus harming Stone’s earnings when translated to USD. Furthermore, persistent high Brazilian interest rates keep their cost of capital very high and may stunt economic growth, of which their business is heavily reliant upon.

Final Thoughts:

StoneCo is a high-quality Brazilian fintech business which offers payments, software, and banking solutions for MSMB’s that are integrated into their merchant’s everyday operations, allowing them to heavily monetize their clients and ensure there is low attrition of their services. StoneCo’s management has guided for extremely large growth over the upcoming years, while the equity trades at low multiples. Even when leveraging conservative growth assumptions, it appears the equity can yield market-beating returns, although the looming macroeconomic and political risks associated with Brazil are present and could jeopardize the investment thesis.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STNE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.