Summary:

- StoneCo Ltd. investors have endured a disappointing bear market decline.

- StoneCo’s Q1 earnings miss has intensified execution risks for STNE to meet its full-year guidance.

- Potential political interference by the Lula administration has weakened investor confidence in the independence of Brazil’s central bank.

- STNE is valued at a forward adjusted PEG ratio of 0.46, well below its sector median.

- I argue why STNE is well-primed for a recovery if investors can overcome their fears and capitalize on its weakness.

Buda Mendes/Getty Images News

StoneCo Ltd. (NASDAQ:STNE) investors have endured a hammering since my previous article in April 2024. In my bullish STNE article, I highlighted StoneCo’s increased focus on the MSMB segment in lifting its value proposition. In addition, I also assessed that STNE’s valuation seemed attractive, suggesting the market has yet to appreciate its go-to-market strategy fully.

However, the bear market decline over the past two months suggests that my thesis has not panned out. Stone’s Q1 earnings release in May 2024 was below Wall Street’s estimates. In addition, the Brazilian fintech company’s decision to maintain StoneCo’s full-year guidance likely intensified execution risks over the rest of 2024.

Moreover, investor sentiments have worsened, as the market is growing wary about Brazil’s central bank’s independence against possible political interference by President Lula’s administration. As a result, I assessed that as a fintech company focusing on MSMB customers, StoneCo could be hit harder by heightened macroeconomic risks. Coupled with the impending June 19 policy rate decision meeting, investors have likely taken substantial risks off the table. Accordingly, the “upcoming meeting is seen as the most consequential in recent memory, with significant implications for market confidence and economic stability.”

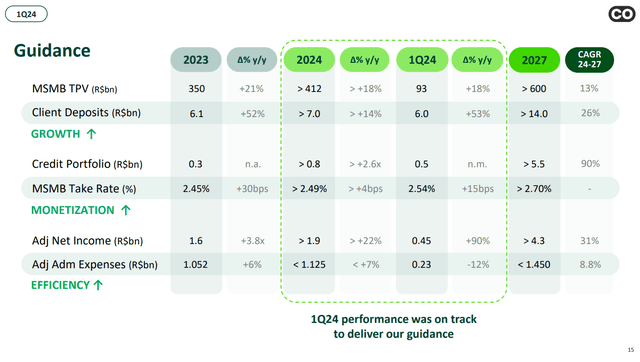

StoneCo guidance (StoneCo filings)

As a result, the market could also be pricing in the possibility of StoneCo lowering its guidance subsequently. Despite that, StoneCo still anticipates a continued expansion across several critical growth metrics, enabling the company to cross-sell its software solutions. StoneCo has also expanded its focus on selling its software to focused vertical customers. Accordingly, StoneCo delivered a 12% YoY increase in the retail and gas station vertical.

In addition, StoneCo believes it can continue refining its GTM approach to improve its take rates through bundled offerings to its customer base. Consequently, it should help StoneCo improve its engagement metrics, leading to a potential improvement in profitability.

Notwithstanding management’s optimism, StoneCo’s focus on the MSMBs segment exposes it to potentially more adverse macroeconomic risks. As a result, investors are likely increasingly concerned about its credit portfolio, as it’s considered a key growth driver. StoneCo has provisioned about 20% of its loan book to incorporate credit risks. However, I assess that the market remains concerned over a possible surge in NPL in vulnerable MSMB customers.

Therefore, I urge investors to closely monitor StoneCo’s NPL metrics over the next few quarters. Management indicated that the current NPL performance is “above expectations.” Accordingly, StoneCo indicated “NPLs between 50 and 90 days of 2.2% and NPLs over 90 days of 1.5%.” Therefore, a potential worsening of macroeconomic conditions could further impact StoneCo’s NPL, hurting StoneCo’s profitability.

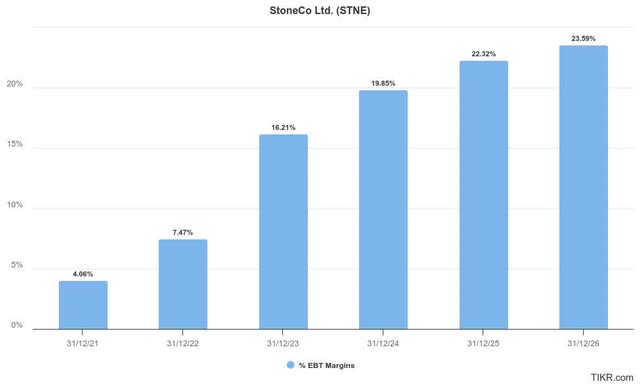

StoneCo adjusted EBT margins estimates % (TIKR)

However, StoneCo is still expected to post solid profitability over the next two years. The optimism is in line with StoneCo’s near- and medium-term guidance, although STNE’s recent battering likely reflected significant caution.

Wall Street analysts have also upgraded StoneCo’s earnings estimates, suggesting the market could be overly pessimistic. STNE’s forward adjusted PEG ratio of 0.46 is almost 60% below its financial sector median.

I believe investors should be cautious about Brazil’s political climate. The implication of possible political interference (even if implied) could weaken Brazil’s central bank’s credibility. In addition, it could worsen the effectiveness of Brazil’s monetary policy in controlling inflation, potentially hurting StoneCo’s MSMB customer base.

Despite that, STNE’s significantly discounted valuation suggests the market could have taken the caution too far. However, have we observed buyers returning to defend the slide in STNE yet?

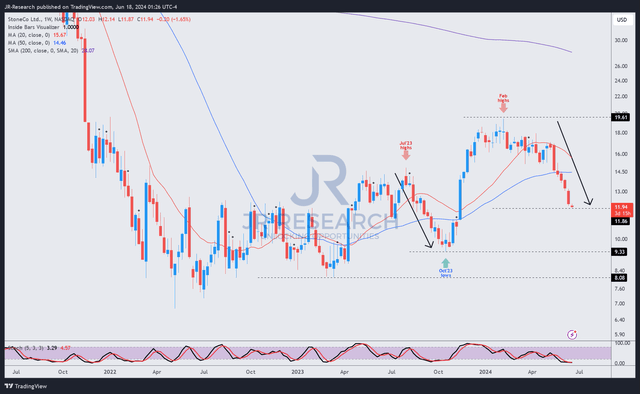

STNE price chart (weekly, medium-term) (TradingView)

Unfortunately, I have not observed a bullish reversal price action in STNE stock. Therefore, the bear market decline from STNE’s February 2024 highs could continue. However, STNE has experienced significant volatility in the past. Therefore, long-term STNE investors shouldn’t be surprised at the downside over the past four months.

However, STNE’s momentum has weakened significantly, corroborated by Seeking Alpha Quant’s “D” momentum grade. STNE has also fallen well below its 50-week moving average (blue line). Therefore, momentum buyers aren’t expected to support the stock until they observe a more robust consolidation zone.

Based on my assessment of STNE’s fundamental thesis and price action, I believe a Strong Buy rating is no longer appropriate. However, STNE’s highly attractive valuation still favors a bullish bias. In addition, STNE’s downside seems to have subsided this week, suggesting a potential turnaround could be in the works.

Consequently, I assess that the risk/reward in STNE is still skewed toward the upside from the current levels.

Rating: Downgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STNE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!