Summary:

- StoneCo’s acquisitions of Linx and Banco Inter have been financially disappointing, leading to significant losses and potential future impairments.

- StoneCo’s current strategy involves potentially selling Linx, which may result in a leaner focus on core activities but with limited differentiation.

- Despite trading at a discount, StoneCo’s stock lacks investor confidence due to profitability challenges and intense competition in the Brazilian market.

- A prudent investment approach would be to wait for clearer signs of improved profitability before considering buying StoneCo’s stock.

Klaus Vedfelt/DigitalVision via Getty Images

Investment overview:

StoneCo (NASDAQ:STNE) is a Brazilian financial technology provider specializing in payments acquiring, banking and management software. I have been following StoneCo since 2020, when the company caught my attention for the first time. In my last article about this company, I believed that it was slowly turning around its business after a significant setback in its credit business in 2021. With the benefit of hindsight, I must admit that my initial thesis seemed overly optimistic.

Due to intense competition in the Brazilian payments processing industry, for the past few years, companies operating in this subsegment have focused on acquiring companies from the field of banking and software to create a more integrated solution for their users. StoneCo has not been an exception. In 2020, the company acquired Linx, a leading management software provider in Brazil. In 2021, it made a further acquisition in Banco Inter. Both acquisitions turned out to be major disappointments, both from the operational and financial perspectives. While a 5% stake in Banco Inter was sold at a significant loss during 2022, current market rumors suggest that StoneCo is considering selling Linx.

In the following analysis, I will discuss the implications for StoneCo if it decides to sell Linx and what this suggests about the company’s ability to profitably grow in the coming years.

StoneCo as a capital allocator

In 2021, the company faced a crisis in its credit offering business. Problems with a registry of receivables forced the company to stop providing any credit until it could claim the collateral behind the offered loans. In the first quarter of 2021, StoneCo acquired a 4.99% stake in online bank, Banco Inter for BRL2,500 million, equivalent to USD460 million. The partnership was expected to enhance StoneCo’s ability to leverage credit products and payment technology. Additionally, Banco Inter was anticipated to help StoneCo improve efficiency in its working capital offerings. The acquisition was approved by then-CEO, Thiago Santos Piau, but it turned out to be a costly mistake. StoneCo eventually sold its entire stake in Banco Inter in 2022, booking a loss of BRL1,300 million, or approximately USD230 million.

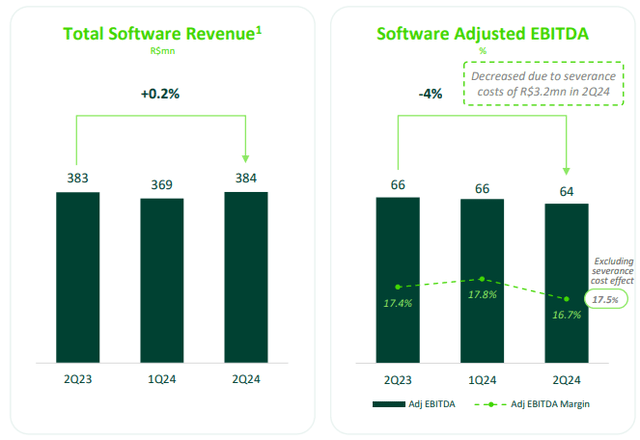

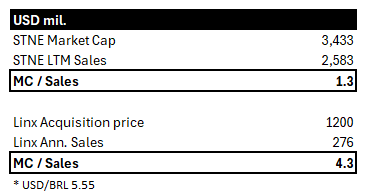

The acquisition of Linx in 2020 was based on the premise of expanding its services into management services and creating integrated offerings for users across various business verticals. At the time of the acquisition, Linx was one of the leading software companies in Brazil, focusing on retail management. The integration of Linx’s software within StoneCo’s financial solutions was expected to be a key differentiating factor from its main competitors – PagSeguro, MercadoLibre, Rede, and Cielo SA. StoneCo acquired Linx for BRL6,700 million (USD1,200 million). When comparing this price to StoneCo’s current market cap of USD3,500 million, the company paid almost 34% of its current market cap for an acquisition that, in the second quarter, generated revenues of BRL384 million and adjusted EBITDA of BRL64 million. Even worse, Linx’s performance is stagnating, and no significant changes are expected in the following quarters.

It is evident that StoneCo significantly overpaid for this acquisition, in my opinion, as the price was 30% above Linx’s then-current share price. I believe the acquisition has proven neither transformative nor differentiating. For a more direct comparison, StoneCo currently trades at a market cap to sales multiple of 1.52x, while Linx’s acquisition price represents a multiple of 4.3x its annualized sales. Although this was done under the previous CEO, Thiago Piau, current shareholders are still paying the price for these ill-fated decisions.

Market data, Own Work

Linx as an acquisition target

Recently, a well-recognized Brazilian business magazine reported that StoneCo had approached Morgan Stanley and JP Morgan to find a buyer for Linx. This is not a surprising development. During the second quarter earnings call, CEO Pedro Zinner, explicitly stated that StoneCo was not selling the asset, but the company is evaluating all options to maximize the value of its assets. Given Linx’s lackluster results and its narrow focus on verticals – retail, pharmaceuticals, food, and gas stations – it is hard to imagine StoneCo significantly improving the performance of its software division in the near future.

More than four years after acquiring Linx, StoneCo has still not been able to monetize its full potential. During the last earnings call, Chief Strategy & Marketing Officer – Lia Machado de Matos confirmed that the company is still learning how to sell its financial services through its software bundles.

If StoneCo manages to sell Linx, it will likely be at a significant discount to the initial acquisition price, resulting in future impairments and pressure on earnings. On one hand, StoneCo would become a leaner company with a sharper focus on its core activities of payments acquiring and banking, but on the other hand, it would offer only commodity-like services, with little opportunity to differentiate from its competitors. At the Capital Markets Day, StoneCo outlined its strategy to expand into banking by building a proprietary banking platform. In banking, StoneCo would face direct competition from giants such as MercadoLibre, Nu Holdings, Itau Unibanco or Banco Bradesco. Given StoneCo’s size, I believe this will be a challenging task.

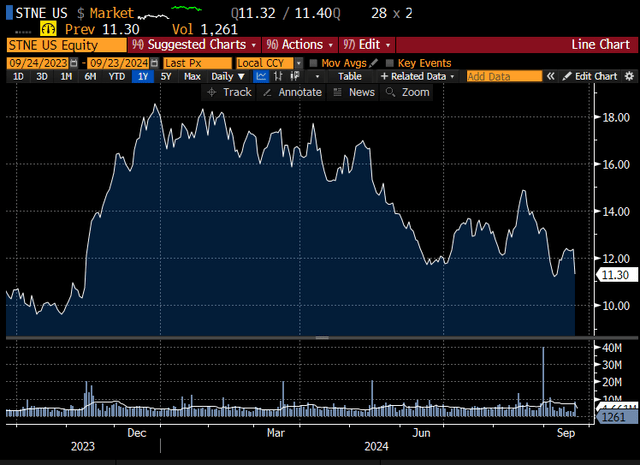

Cheap valuation is not enough for share repricing

StoneCo currently trades at a multiple of 9.8 times its LTM earnings, a significant discount to its historic average multiple of 14.3 times. Despite relative cheapness, it appears investors aren’t eager to buy its stock. StoneCo’s largest competitor, PagSeguro Digital, also trades at a similar multiple. The biggest difference between the two companies is that PagSeguro is further along in the development of its banking business, while StoneCo is still in the building phase. Although both stocks appear relatively cheap, investors are valuing them similarly to Brazilian banks, which trade at comparable earnings multiples.

Market Data, Own Work

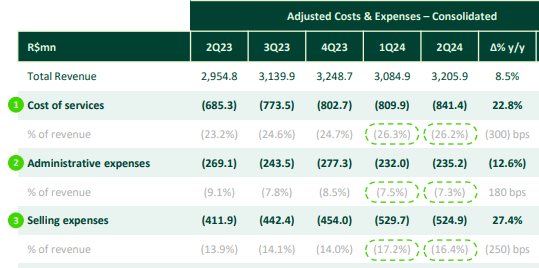

For StoneCo’s stock to see significant repricing, investors would need to see either increased profitability or higher revenue growth, so the company can defend its growth stock status. Both StoneCo and PagSeguro are disproportionately increasing their sales and marketing expenses to defend market share in the extremely competitive market.

2Q 2024 Presentation

Analysts following the industry consider higher growth of selling expenses in relation to growth of revenues as a clear indicator of future margin pressure. Thus, for StoneCo, it will be very hard to improve its profitability in the near term. For investors considering buying StoneCo at current levels, I believe a superior risk management strategy would be to remain on the sidelines until there is better visibility regarding future profitability. This strategy is safer than guessing where the bottom is for the falling stock price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STNE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.