Summary:

- StoneCo stock has shown significant underperformance over the past quarters despite overall market strength.

- As I see it, StoneCo’s Q2 results show impressive MSMB client growth, improved cost management, and potential for further buybacks to enhance shareholder value.

- I see that a recovery trend may have already started in July 2022. The nearest resistance target is now ~28% above the current price.

- Despite risks and market uncertainty, StoneCo remains a strong “Buy” with growth potential and attractive valuation compared to peers in the fintech market.

PM Images

My Thesis

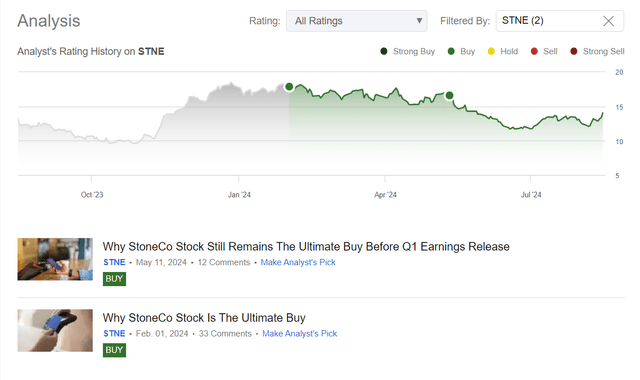

I began covering StoneCo Ltd. (NASDAQ:STNE) stock on Seeking Alpha on February 1, 2024, and have reiterated my “Buy” rating only once since then, on May 11, 2024. Unfortunately, despite the overall market’s strength, STNE has declined, showing significant underperformance recently:

Seeking Alpha, Oakoff’s Coverage of STNE

Despite its recent underperformance, I still believe that StoneCo stock is a compelling buy based on the latest data (Q2 2024 results the firm reported just a couple of days ago) and its fundamental strengths. So today might be an opportune time to either add to an existing position or start a new one at current prices.

My Reasoning

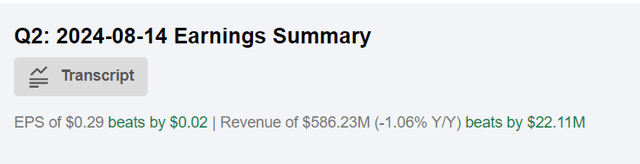

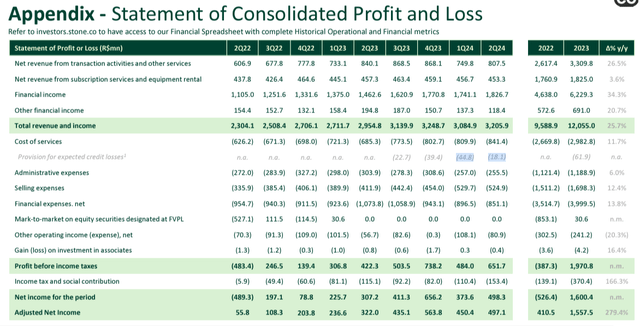

First off, let’s begin with the Q2 FY2024, for which StoneCo reported on August 14, 2024, and what hasn’t been analyzed yet by other analysts here on Seeking Alpha (as of the time of this writing). The company showed impressive MSMB clientele growth, adding ~185,000 new MSMB clients during the quarter, bringing the total active client base to ~3.9 million (+30% YoY), bolstered by StoneCo’s focus on “bundling payments and banking services, which improved client monetization and TPV growth,” according to the management’s notes. So as a result, the top line declined not as much as the market initially expected (considering the accounting change – StoneCo now defers its membership fees over the expected life of a merchant rather than recognizing it at the time of acquisition).

Furthermore, as I see, the cost of services as a percentage of revenues decreased by 10 basis points QoQ, primarily due to reduced loss provisions. Administrative expenses also declined as a percentage of revenues, benefiting from “efficiency gains and the divestment of non-core segments.” Financial expenses decreased by 4.5% QoQ, driven by lower average CDI rates and optimized funding strategies. Overall, such an improvement in cost management helped STNE to increase its net income by 34% YoY to R$498 million, which amid continued buybacks led to an EPS beat for the quarter:

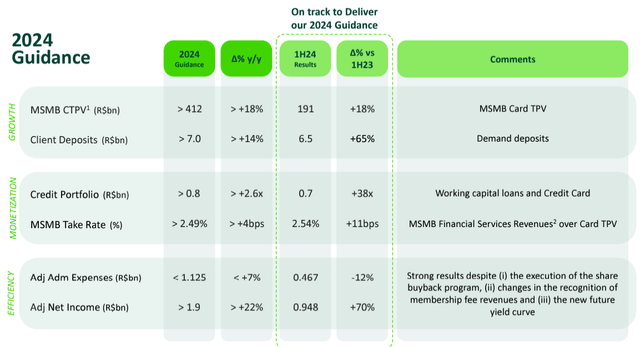

Noteworthy, as STNE focused more on higher-margin products and expanding its financial services, particularly within the MSMB, the firm’s credit portfolio grew to R$712 million by the end of Q2. The working capital portfolio alone increased by 28% sequentially, reaching R$682 million – this expansion clearly outpaced expectations. Although the NPLs saw a slight increase (15 and 90 days reaching 2.9% and >90 days at 2.6%), the provision for expected losses decreased significantly quarter-over-quarter, reflecting the maturation of the credit portfolio.

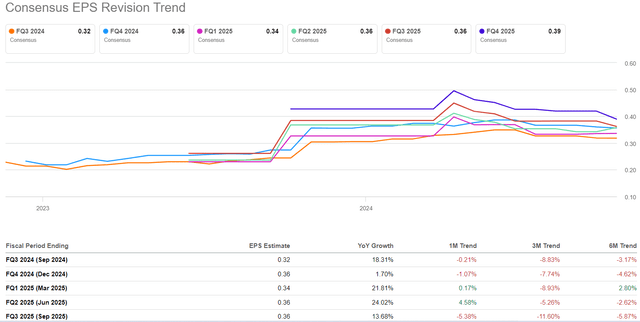

Compared to Q2 2023 data, StoneCo’s diluted share count outstanding is down ~7.9%. Even allowing for the need for cash for further R&D and innovation spending in the coming periods, something tells me that with the stock price remaining as low as it is today, there is the possibility of further buybacks. I believe these could further enhance shareholder value and increase the likelihood of STNE beating EPS consensus estimates again in Q3 and Q4.

Management was quite confident during the Q2 earnings call and predicted further relatively strong growth both in terms of expanding MSMB’s CTPV and in terms of monetizing the loan portfolio and improving cost management ratios.

Nevertheless, in my opinion, the stock has not yet reacted as it should. I attribute this mainly to the fact that STNE is far from being one of the most talked about stocks among Wall Street analysts, as evidenced by the modest number of sell-side reports following the Q2 release. According to TrendSpider (proprietary source, August 2024), there was only one “Hold” rated report from John Coffey 15 days ago.

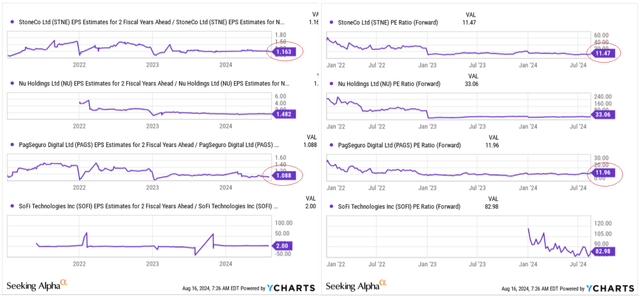

Furthermore, the rather modest growth against the backdrop of strong earnings can be partly explained by the meager earnings revisions, which mostly paint a gloomy picture for STNE in the medium term.

It’s clear that the market StoneCo is targeting is highly competitive and that the major players are also looking to expand and secure their positions. However, I don’t believe that the situation is as dire as it might seem based on recent changes in STNE’s estimated earnings (the consensus figures). In my opinion, the data from the second quarter suggests otherwise. The company continues to grow, improve its internal cost control processes, and focus on higher-margin products. This strategy should theoretically lead to faster earnings per share growth because it creates operating leverage. I don’t believe that this potential is fully reflected in current Wall Street EPS forecasts, which provide StoneCo a margin of safety for the next few quarters.

Assuming from technical analysis that the current market reaction to the relatively strong Q2 report appears to be delayed, we may infer that as investment banks begin to update their models, we could see the emergence of a recovery. The stock price is trying to stabilize above its 52-week moving average, fluctuating both above and below it; however, we see that a recovery trend has formed since July 2022. The nearest resistance target is now ~28% above the current price.

TrendSpider Software, STNE Weekly, Oakoff’s Notes (Weekly Chart – 52MA Weekly Added)![TrendSpider Software, STNE weekly, Oakoff's notes [weekly chart - 52MA weekly added]](https://static.seekingalpha.com/uploads/2024/8/16/53838465-17237978416992254.png)

In my opinion, the current discount in the company valuation is not justified. If we compare projected EPS growth indicators, which I consider to be modest for STNE, with those of similar companies, the picture becomes clearer. The company’s EPS is expected to rise by around 16.3% in 2026, YoY. Meanwhile, the forwarding price-to-earnings ratio is around 11.5x as of today. A comparable company, PagSeguro Digital (PAGS), is expected to grow only half as fast as StoneCo in 2026 but has a similar valuation multiple. So this suggests that StoneCo stock may be undervalued compared to its peers – this undervaluation supports my earlier thoughts on the company’s future growth potential.

So that’s why I’m reiterating my “Buy” call today.

Risks To My Thesis

As I noted in my previous article, my bullish thesis on StoneCo has plenty of risks for investors’ consideration.

The stock price consolidation phase we saw for the past several months reflects the market’s uncertainty about the company’s medium-term prospects. If the next report (for Q3) falls short of expectations and/or the earnings commentary is pessimistic, it’s very likely that the stock may open with a significant downside gap despite the undervaluation I mentioned above.

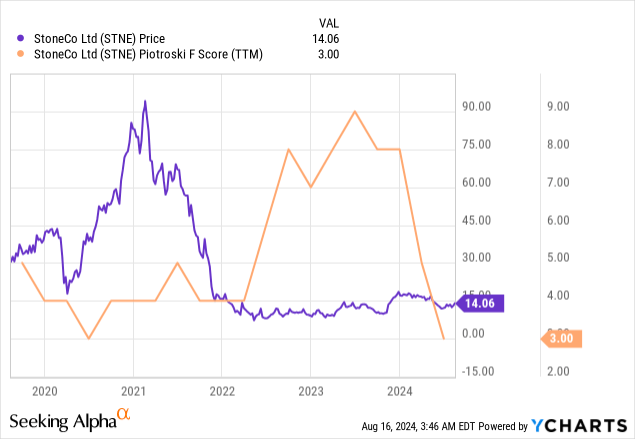

In my last article, I referred to the Piotroski F-Score and noted that the company had scored 8 out of 9, which was pretty good. However, after the last reporting period, this score has dropped to 3. Although this method can be controversial, especially for financial companies, it’s still a factor to consider. Therefore, it’s important to mention this in the risks section.

Furthermore, my conclusions regarding the undervaluation of the company should be taken with a grain of salt. As you have probably noticed, STNE is not the most expensive stock, but neither is it the cheapest among its direct competitors in the region. Therefore, we can’t claim that the company is cheap enough to prevent further declines. In the medium term, the margin of safety might actually be lower than I’m assuming in my base-case scenario.

Your Takeaway

Despite the risks mentioned above, I continue to view StoneCo stock as a strong “Buy” and one of the most attractive options in the fintech market today.

The company’s development keeps going well, as evidenced by its rapid and qualitative growth across various key business metrics. I see further opportunities for StoneCo Ltd. to improve its margins, and I’m encouraged by the current state of the company’s credit portfolio. If management continues its earlier initiatives, it’s likely that we’ll see revised earnings expectations from Wall Street. While the second quarter report triggered a positive market reaction, it may not have fully reflected the company’s fundamental strengths. Moreover, I think the undervaluation identified should allow StoneCo Ltd. to continue its growth trajectory.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in STNE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.