Summary:

- StoneCo’s stock price has fallen significantly and underperformed the market since the last analysis.

- Despite slowing revenue growth, StoneCo’s current valuation reflects a significant discount, making the stock attractive.

- Analysts predict strong EPS growth for StoneCo, making it a potentially lucrative investment opportunity.

- I believe that the current dip in the StoneCo stock is not accompanied by a corresponding deterioration in the company’s fundamentals.

PM Images

Intro & Thesis

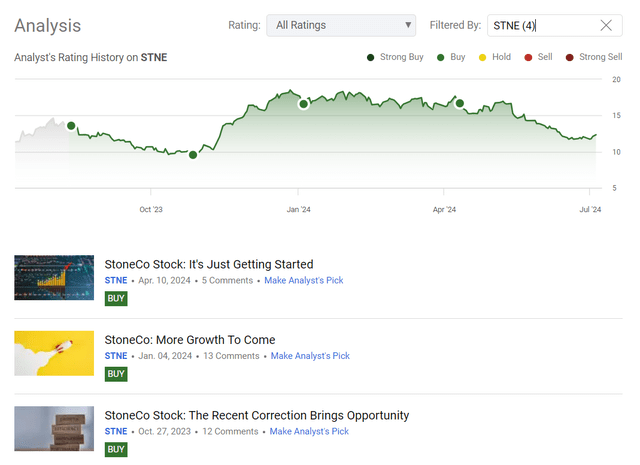

I initiated coverage of StoneCo Ltd. (NASDAQ:STNE) on August 12, 2023, when the stock was trading at $13.52. Since then, STNE has moved in a wide trading range, occasionally trying to move higher but encountering strong resistance. In my last article, I argued that the company’s improving margins and the stock’s lack of movement, due to some misunderstanding, made STNE’s valuation more attractive. Since then, however, STNE’s stock price has fallen significantly and has underperformed the broader market.

Seeking Alpha, my coverage of STNE stock

After reviewing the recent financials, it’s clear to me that StoneCo’s revenue expansion has slowed down indeed, but its current valuation multiples reflect a significant discount. I anticipate that as management’s initiatives take effect, the company’s margins will expand, enabling it to surpass current EPS estimates, which already indicate rapid growth in the coming years. A multiple expansion may follow suit. So based on today’s analysis, the current dip in STNE’s stock price appears quite attractive to me. I reiterate my previous “Buy” rating.

Why Do I Think So?

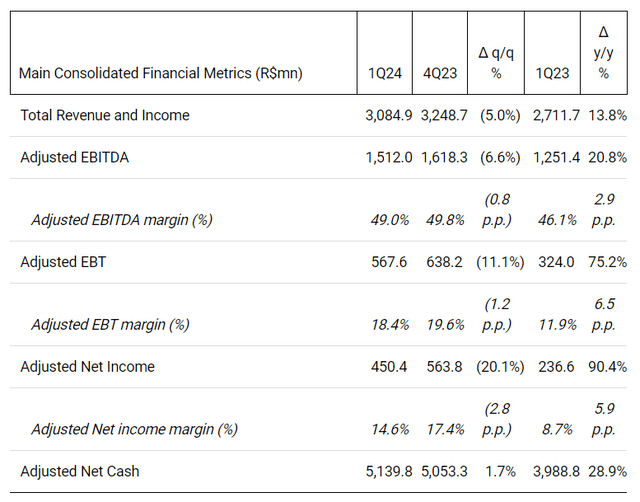

I suggest starting with an analysis of the latest quarterly results, as 3 months have already passed since the publication of my last article. StoneCo’s total revenue and income for Q1 FY2024 reached R$3,084.9 million, an increase of 13.8% compared to the previous year. This growth is primarily due to a 16.0% increase in financial services revenue, driven by a growing active customer base and higher monetization from customers in the MSMB segment. According to the press release, payment services saw robust TPV growth, including PIX, and the highlight of the quarter was the launch of instant settlement for Ton customers, which meets the needs of micro merchants. In banking, the company made great progress in onboarding new and existing customers to its bundled banking and payments solution – 80% of active payments customers now use this offering. The credit solution also continued to grow according to management’s plans, which took a conservative approach while exploring different customer profiles. STNE’s adjusted EBITDA amounted to R$1,512.0 million, an increase of 20.8% year-on-year but a decrease of 6.6% quarter-on-quarter. The adjusted EBITDA margin decreased from 49.8% to 49.0% compared to the previous quarter, mainly due to “lower seasonal sales, changes in the internal accounting method for membership fees, and higher selling expenses as a percentage of sales”. However, this was partially offset by lower other operating and administrative expenses as a percentage of sales. Unfortunately, this didn’t save STNE from QoQ net income margin contraction (from 17.4% to 14.6%).

STNE’s Q1 FY2024 press release

What I liked about StoneCo’s performance during Q1 was that its software business made some progress, with revenue growth being driven by a double-digit increase in vertical software revenues, completely organic (although the enterprise software wasn’t). I see continuing efforts to improve profitability in this segment through efficiency. According to the commentary on the earnings call, the strategic focus remains on cross-selling financial solutions to customers in priority verticals and developing bundled financial services and software offerings. The expansion of credit solutions with a focus on larger customers will also play an important role in STNE’s future development, as will further progress on the bundled banking and payment solution and the pilot launch of credit cards for Stone clients.

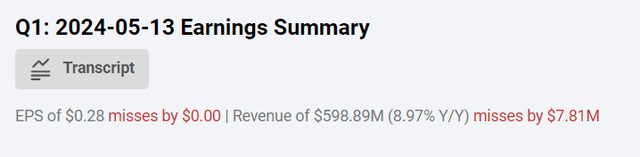

Despite a 20% drop in its stock since mid-May due to Q1 earnings that included several one-off items, J.P. Morgan analyst Yuri Fernandes noted in early June that STNE’s results were generally in line with expectations – which is true when we look at the consensus surprises:

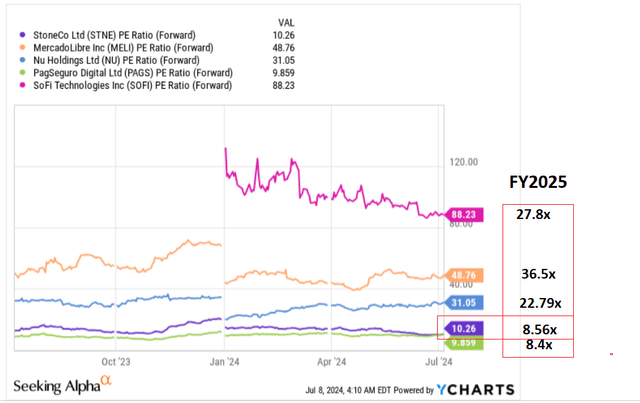

Yuri Fernandes emphasized that StoneCo’s re-rating would depend more on its banking sector performance, particularly deposits and healthy credit growth, rather than the broader macro environment. So being positive on STNE in this regard, he expects the company to compound EPS at a CAGR of around 20% from 2023-2027, so given its “attractive valuation at 9x the estimated 2025 price-to-earnings ratio”, JPM issued an “Overweight” rating at the time. However, since then, STNE’s next-year P/E has dropped from 9x to 8.5x, making the stock even cheaper than J.P. Morgan initially indicated.

I generally agree with J.P. Morgan’s assessment of the company’s growth potential, and would like to offer my perspective on why StoneCo’s stock dropped so sharply after the Q1 report. It appears that the market focused on quarter-to-quarter dynamics, where revenue and other key financials posted a decline. In addition, the company’s NPL continued to grow, which is generally not a good sign. Nevertheless, I believe the market has overreacted. Looking at year-on-year results, which smooth out seasonal fluctuations, we’re still seeing growth, albeit at a slower pace. Also, while the NPL has increased slightly, it’s still at a low 2.2%, so I don’t believe that the company’s operating and credit risks have increased significantly enough to justify the recent stock price dip.

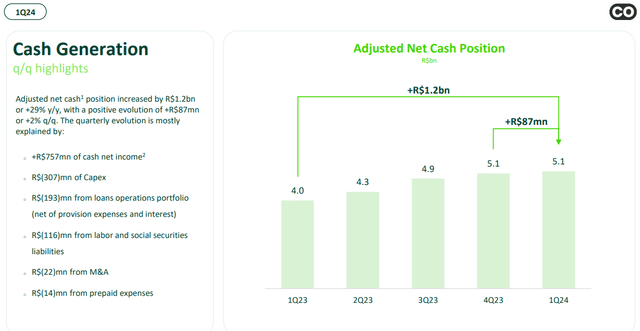

What I definitely liked about the Q1 results is the company’s ability to continue to generate strong operating cash flow. We see that the cash balance has increased to R$2.1 billion, which is 29% more than last year, while this was achieved without any significant one-off variances, underlining the company’s robust cash generation capability, in my opinion.

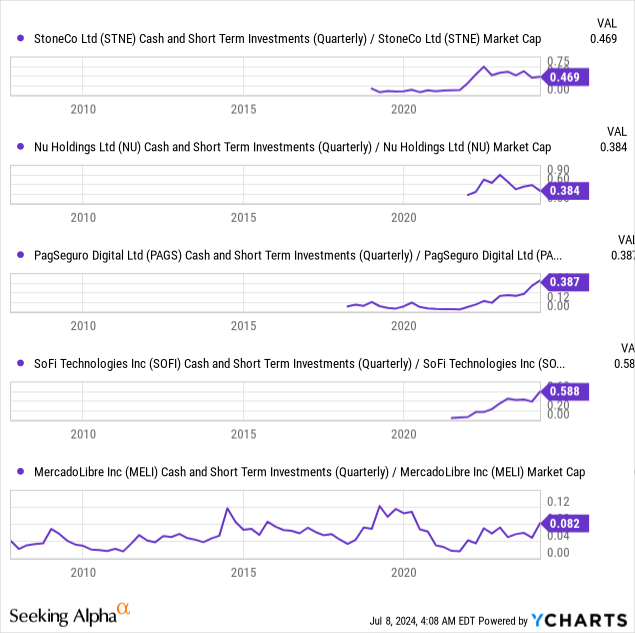

Taking into account the growth in the cash position on the company’s balance sheet, approximately 46.9% of StoneCo’s market cap is represented in cash. This makes STNE not only relatively inexpensive in absolute terms, but also when compared to its peers.

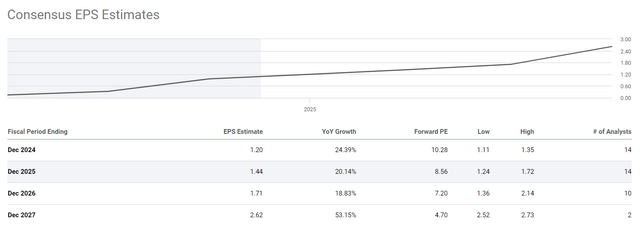

The market predicts that over the next 4 years, StoneCo will increase its EPS at an impressive CAGR of 21.56%. So I think that even if the actual growth rates are slightly lower than that, it still positions the company as a highly attractive investment in the medium term. As we saw previously, by the end of 2025 the stock is projected to trade at just 8.5 times earnings, which is remarkably cheap for such strong growth potential. In addition, StoneCo’s stock appears to be among the cheapest (among its peers) looking out over the next two years:

YCharts, Seeking Alpha’s data, the author’s notes added

Let’s assume that in FY2025, the company’s EPS grows not by 20% as the market expects today, but by 18% – this would result in earnings per share of $1.42 instead of $1.44. If we also assume the price-to-earnings ratio increases to at least 10x, which looks realistic, and assumes STNE remains at its current valuation multiple, the fair value per share would be $14.16, representing a 15% increase from the current price. This is my bear-case scenario, as I believe the management’s initiatives aimed at growth and improving margins should lead to stronger EPS growth. In my base case, I assume the current consensus underestimates the real growth prospects: I expect StoneCo’s EPS to grow by at least 22% instead of 20%, resulting in an EPS of $1.46. At the current multiple, this would yield a share price of almost $15, which is about 21% higher than the current price. This is my base scenario 12-month target price for StoneCo.

Given the undervaluation and solid expansion opportunities, I think STNE’s current dip looks too tempting to pass up.

Where Can I Be Wrong?

I believe the biggest risk today in maintaining my buy rating for StoneCo’s stock is the high level of competition. Latin America is a rapidly growing addressable market for the fintech industry, attracting many companies aiming to capitalize on this potential. StoneCo is not the only company with high-growth potential, and not all can be winners. StoneCo risks losing its current position to competitors such as Nu Holdings (NU) or PagSeguro Digital (PAGS).

So today’s EPS forecasts and my reflections may be too optimistic. If I’m indeed overestimating StoneCo’s capabilities, then its current valuation multiples could end up being even lower as margins continue to suffer, and growth rates will likely slow down.

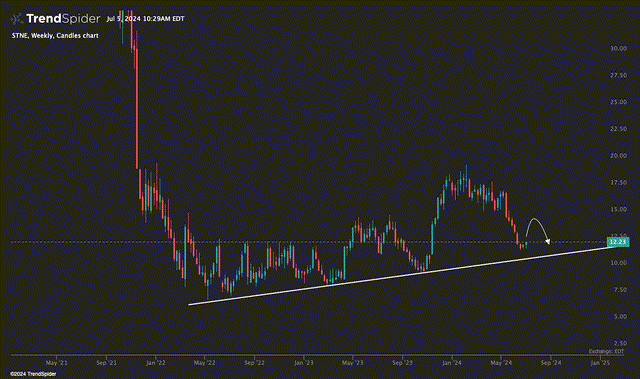

In the short term, my technical analysis paints risks that the current decline may not yet be over. There is a very strong demand zone just a couple of dollars below the current level. Therefore, after this possibly short-term recovery, the stock could continue to fall until it reaches its demand zone and the long-term support of the weekly trend.

TrendSpider Software, STNE, notes added

The Verdict

Even considering the high level of competition in the industry and possibly overly optimistic forecasts regarding the company’s margins, I still see great growth potential in the STNE stock. I believe that the current dip in the stock is not accompanied by a corresponding deterioration in the company’s fundamentals. Even if STNE potentially falls further in the short term, it’s already trading at a deep valuation discount. This undervaluation is unlikely to be sustainable unless we see a significant decline in net income over the next two quarters which justifies it. But if StoneCo continues to report EPS and sales in line with the current consensus (or even beating it), a recovery seems inevitable to me. Therefore, the current stock price dip appears very attractive for medium to long-term investments, in my opinion.

Hence, my “Buy” rating reiteration today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in STNE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!