Summary:

- StoneCo is a Brazilian fintech company focused on MSMBs, offering financial services and software solutions.

- The company demonstrates consistent growth across all key financial and operating metrics. The management’s long-term outlook is quite optimistic as well.

- My valuation analysis suggests there is a 73% upside potential from the current share price levels.

Jasmina007

Investment thesis

Investors of StoneCo (NASDAQ:STNE) are experiencing pain in 2024, as the stock has lost about a quarter of its value since the beginning of the year. The selloff was mostly caused by the ‘disappointing’ latest earnings release. However, my analysis suggests that STNE’s Q1 performance was robust across all crucial metrics, and adverse movements in foreign exchange rates were the only dragging factor. Despite foreign exchange headwinds, the company’s profitability is expanding rapidly. Moreover, the management has a robust long-term outlook, and I believe this optimism is backed by a few vital fundamental factors. The valuation is very attractive as well. All in all, I assign STNE a “Buy” rating.

Company information

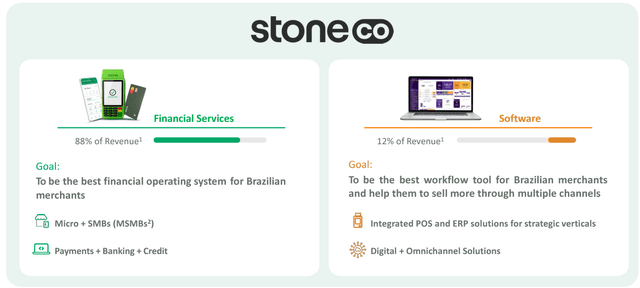

StoneCo is a Brazilian fintech company mostly focusing on micro, small, and medium businesses [MSMBs]. STNE operates via two business segments: Financial Services and Software.

STNE’s latest presentation for institutional

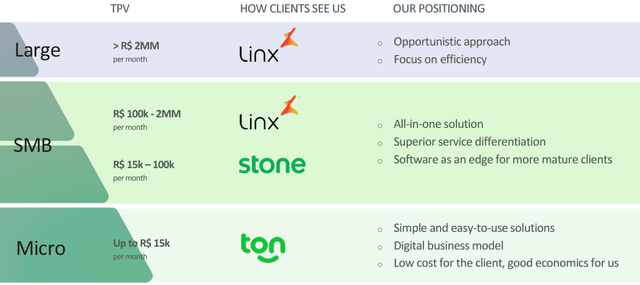

Through the Financial Services segment, STNE offers payments, digital banking, and credit solutions. Through the Software segment, the company sells POS and ERP solutions for different retail and services verticals, Customer Relationship Management [CRM], engagement tools, e-commerce and Order Management System [OMS] solutions, among others, focused on both SMBs and large clients. The company offers its solutions under three different brand names: Linx, Stone and Ton.

STNE’s latest presentation for institutional

Financials

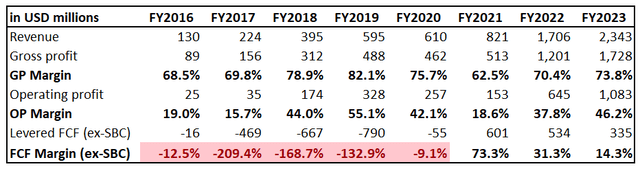

Long-term trends in financial performance are crucial to me as they help in understanding the strength of the business model and consistency in the management’s performance. From this perspective, StoneCo’s business model appears robust and well-executed by the management.

Revenue grew with a 38% CAGR between 2016 and 2023. The gross margin demonstrated consistent expansion as the business scaled up, and the operating margin more than doubled. Free cash flow [FCF] has been consistently positive over the last three years.

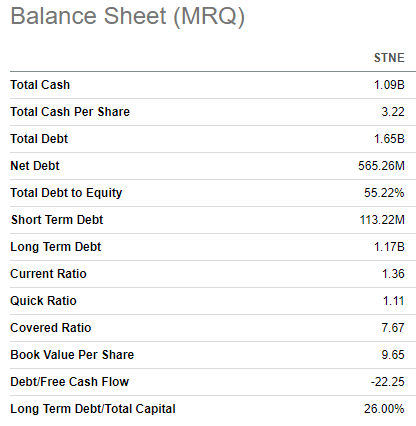

As a result of consistently improving profitability and expanding FCF, StoneCo has a healthy balance sheet with around a billion-dollar outstanding cash position and moderate debt levels. Liquidity ratios are also robust. Overall, the balance sheet is strong enough to position StoneCo well for future growth.

Seeking Alpha

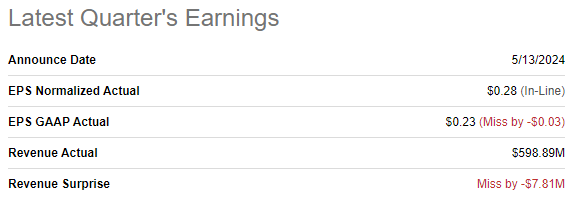

The latest quarterly earnings were released on May 13. The company missed both revenue and EPS estimates. The stock price fell by more than ten percent after the disappointing earnings release. It was the second consecutive quarter where the company missed consensus revenue estimates.

Seeking Alpha

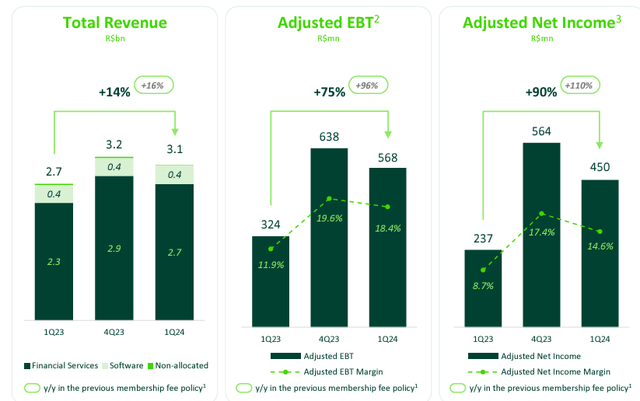

On the other hand, from the point of view of financial performance, the quarter was solid. Revenue grew YoY by 9% and the adjusted EPS expanded from $0.15 to $0.28. The EPS strength was achieved due to the operating leverage, as key profitability metrics improved YoY. In operational currency revenue growth looked much better with a 14% YoY increase.

STNE’s latest earnings presentation

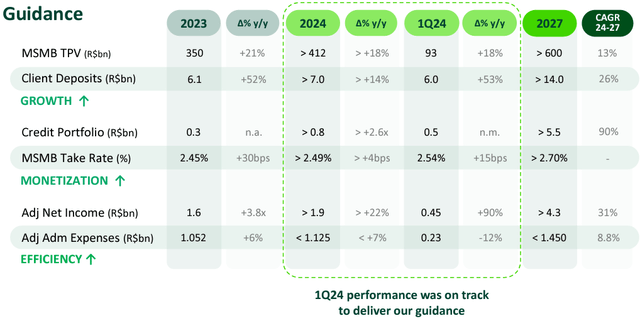

Key operating metrics also demonstrated robust dynamics. The MSMBs payments clients base grew by 33% YoY and the total payment volume [TPV] grew by 24% YoY. The take rate improved by 15 basis points.

From the bigger picture perspective, there are a few strong reasons to be bullish about StoneCo.

As I said before, long-term trends in the company’s financial performance clearly indicate the strength of the business model. The recent, almost 100%, EPS growth indicates massive potential to exercise operating leverage. The management plans to deliver a 31% CAGR for adjusted net income between 2024 and 2027. This will be fueled by robust TPV and client deposit base expansion together with strict financial discipline.

STNE’s latest earnings presentation

The TPV heavily depends on the broader economy’s overall health. According to Statista, the Brazilian economy [real GDP] is expected to grow with around 2% CAGR by 2029. This is a solid factor that will likely support STNE’s TPV growth.

Brazil also demonstrates a clear secular trend of rapid decline in cash usage, which means that the demand for fintech services will highly likely remain robust and as an emerging player in the industry, STNE is poised to benefit.

Last but not least, Brazil’s e-commerce industry is thriving, which is another positive catalyst for digital payments. According to Mordor Intelligence, the country’s e-commerce market will compound with almost 19% CAGR by 2029. This is another robust growth catalyst for STNE.

Valuation analysis

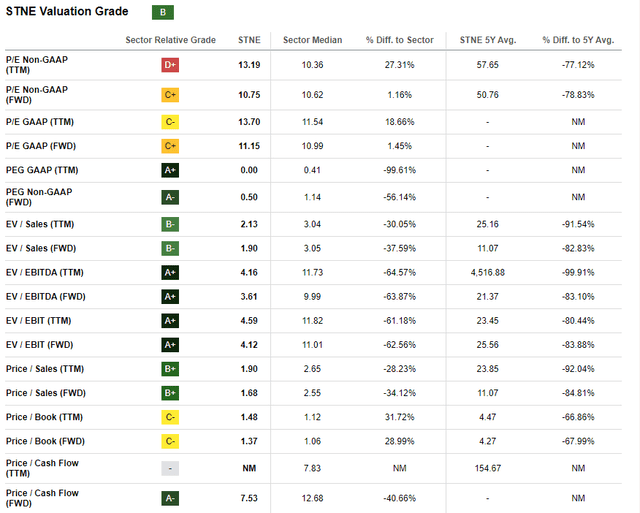

The stock price increased by 13% over the last twelve months, substantially outperforming the iShares MSCI Brazil ETF (EWZ). However, this year is tough for STNE’s investors as the stock lost around 21% of its value YTD. Most of the valuation ratios look low compared to the sector median and historical averages, making a solid “B” valuation grade from Seeking Alpha Quant well-deserved.

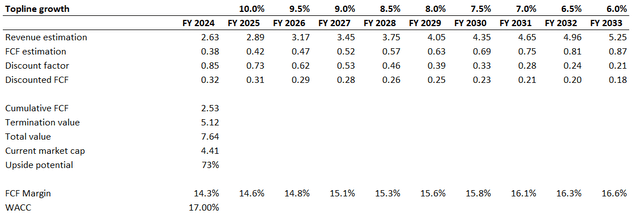

To cross-check what valuation ratios say, I am simulating the discounted cash flow [DCF] model. Due to the risks which I discuss in the next section, I use an elevated 17% WACC recommended by Gurufocus. Consensus revenue estimates project around 9-10% revenue CAGR for the next three years. I take a 10% revenue growth for FY 2025 and project a 50 basis points yearly deceleration as comparative figures grow and the penetration of fintech deepens in Brazil. I use FY 2023’s FCF margin of 14.3% and expect a conservative 25 basis points yearly improvement.

Despite using conservative revenue growth assumptions, STNE’s fair value is 73% higher compared to the current market cap. I consider the upside potential to be compelling.

Risks to consider

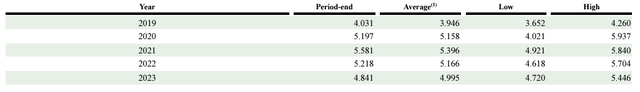

STNE operates in Brazil, which means several significant risks for investors. As an emerging country, Brazil is still developing its political institutions. This may lead to sudden changes in regulations, which could adversely affect STNE’s operations. Brazil is a large exporter of various commodities. Prices for most commodities are volatile, which increases the volatility of the country’s currency, the Brazilian Real.

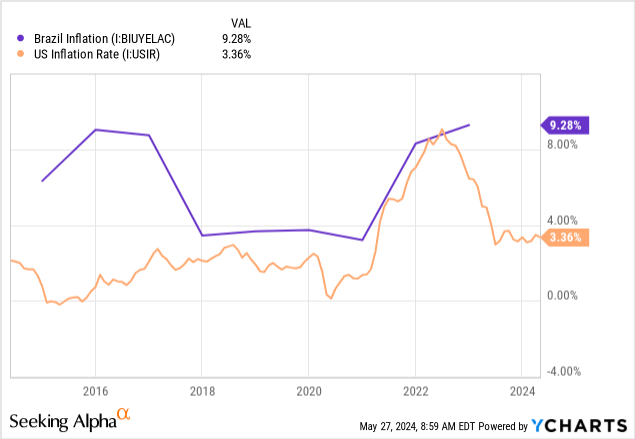

Since inflation in Brazil is generally higher compared to the U.S., the local currency loses its value faster than USD over time. Since STNE operates in Brazilian Real, long-term trends in foreign exchange rates are likely to be adverse for the company.

Investors’ sentiment around STNE is much weaker compared to MELI. While MELI already almost fully recovered towards 2021 highs, STNE is nowhere near its peak levels of 2021. Therefore, investors seeking for exposure to emerging Brazilian fintech might continue betting on MELI instead of STNE. This might also be a solid headwind for the share price growth.

Bottom line

To conclude, STNE is a “Buy”. The valuation is very attractive and outweighs all the risks and uncertainties in my view. The company demonstrates impressive profitability expansion and growth across all key business metrics, which will likely help in sustaining consistent revenue growth for longer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.