Summary:

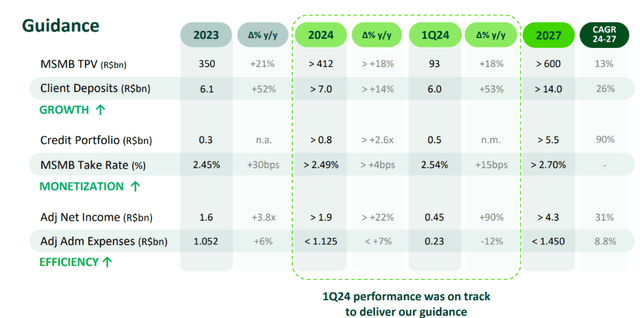

- Brazilian FinTech StoneCo’s stock dropped 10% after reporting lower-than-expected revenue and EBIT, but the company remains on track to exceed its guidance for the year.

- StoneCo’s customer base growth rate is slowing down, with only 200k new customers registering last quarter.

- Costs have gone up because of one-off marketing expenses.

- StoneCo’s credit division is performing exceptionally well. Increasing borrowers and volume will drive future profits. Even more so when the loan loss provision rate will be adjusted downwards.

- At the current price, you get this credit division for free.

Maskot/DigitalVision via Getty Images

Brazilian FinTech StoneCo (NASDAQ:STNE) has dropped 10% since it reported a top- and bottom-line that were both lower than expected. Is this dip a buy opportunity, or does it foreshadow further pain? Let’s investigate.

I’ll first discuss the results and compare them to the expectations and the guidance. Then, I’ll give an update with regards to StoneCo’s three segments: Payments, Banking, and Credit. Finally, I’ll discuss some other trends that I picked up and find important, before concluding this analysis.

The results

In summary, revenue came in 1% below analysts’ expectations, while EBIT came in as much as 12% below expectations. EPS also missed expectations, but only by 1%. As such, the drop in the share price seems warranted.

However, if we zoom out just a little bit and take a full-year perspective, it gets clear that one should not worry all that much. StoneCo remains perfectly on track to exceed its own guidance this year. Results in the first quarter exceeded the guidance for the whole of 2024, although Q1 2023 was admittedly an easier comp.

Payments

The revenue that StoneCo makes in its payments division follows the following formula: #customers * payment volume per customer * take-rate. Let’s discuss each of these three components.

Number of customers

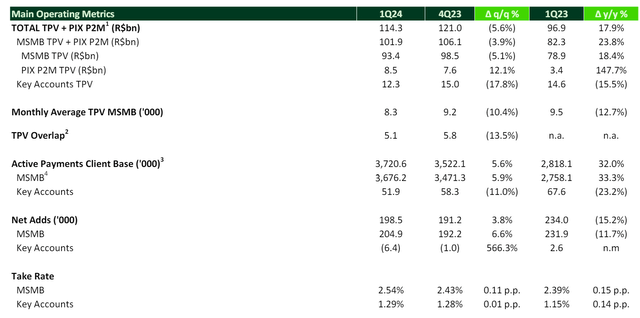

Long the growth driver of the business, it seems like the growth is slowing down. At least in terms of the number of customers, as of last quarter, “only” 200k new customers were registered. This will be the going rate from now on:

We expect going forward, in terms of net adds, levels will be more or less in line with what we saw this quarter. – Lia de Matos, Marketing Officer

To compare: in 2023, 940k net adds were registered, while in 2022, 818 were registered. As such, only registering 200k net adds per quarter in 2024, would not only be a reduction in absolute growth, but also quite significantly in relative terms, as StoneCo now has a larger total number of active customers than it did last year and the year before. Still, an increase of 800,0000 customers, would constitute a growth of 23%.

Payment per customer

Monthly average payment volume dropped to 8,300 reais, 13% lower than last year, and 10% lower sequentially. This is mainly because of the greater proportion of micro-merchants as customers. Note that inflation will make this number go up over time, which is a very attractive component of this business.

Combine the increase of 32% in the number of customers, with 13% fewer average payment volume per customer, and you get 18% higher total payment volume. Not bad, but lower than it used to be, which is mainly because of the drop in average payment volume.

Take rate

I have read in several commentaries some fear for the commoditization of StoneCo’s business. If that was true, prices would be falling. No such trend is discernible, on the contrary:

The take rate is 14 bps higher than last year and also increased over the last quarter.

StoneCo is attracting more customers while increasing its prices… does this sound like commoditization to you, dear reader?

Banking

Number of banking customers increased sequentially by 14% and 90% year-over-year. There still is some room for further growth, as StoneCo has 3.7 million active payments customers, and only 2.4 million banking customers. Converting all of its current payments customers to its banking product, would entail a further increase of 50%.

The deposits, however, decreased by 2.2% sequentially. The reason is the same as this is a pity, as StoneCo does not pay any interest on its deposits. It will convert these deposits to remunerated deposits at a later stage so that StoneCo can use them to extend trade credit. This has greater potential, if StoneCo has actually more deposits on its books.

Credit

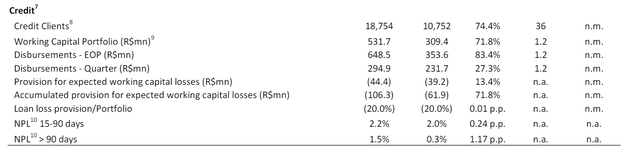

This is going absolutely fantastic and above expectations.

StoneCo now has more than 18 thousand borrowers, compared to 10 thousand last quarter. It has lent out almost 300 million reais in working capital, compared to 230 million last quarter (+27%). This brings the total loan book to almost 650 million reais.

StoneCo still uses an incredibly conservative loan loss provision percentage of 20%. Last quarter, this scared investors. However, as I explained back then, it is very likely that this percentage was to come down in the coming year. And indeed, StoneCo’s CFO now admitted that they will do so this year:

In 2024, we will converge to risk-based approach. It’s probably going to start either in the second Q or third Q but towards the end of the year, we should have the provision conversion to our models.

So, what should the new loan provision rate be? Well, let’s calculate it ourselves. Around half the loans have only been extended in this quarter. They have, thus, not even been extended more than 90 days ago, and are impossible to be non-performing beyond 90 days.

Overall, 1.5% of total loans extended are non-performing beyond 90 days. Given the preceding, among the loans that have been extended more than 90 days ago, around 3% should be non-performing. We can take a further margin of safety into account, which would bring us to 4-5% non-performing loans after 90 days.

StoneCo, however, will still remain far more conservative:

In terms of expected losses, our models are pointing towards the 10% threshold… slightly below that… it shouldn’t stay at 1.5% or 2%.

10%! That’s more than double the “fair” provision. I expect the final NPL in the coming years to be closer to 5 than 10%.

This would be an immensely profitable product. StoneCo charges 3 to 5% per month for its working capital loans. On an annual basis, that’s an interest rate of over 50% (considering the compounding effect).

If 5%, or even 10%, of loans default (and 0% can be recovered), that’s still a net interest of 40-45%… While StoneCo only pays 7-8% for its own funding!

One “kicker”

The profits of this product could be even higher.

StoneCo currently has almost 6B reais in deposits. It does not lend these deposits out, although it has a banking license and could, thus, do so. Why not? Because it would need to pay interest on its deposits, which it currently does not. As the credit portfolio currently is less than 10% of the deposit base, having to pay interest on all deposits to lend 10% or so of them out… is just way too expensive. Or, as CFO Mateus Schwening states:

We want to make sure that we don’t cannibalize our current deposit base for which we don’t renumerate anything.

As the credit book grows, StoneCo will start using its deposits. On the one hand, this will force StoneCo to pay interest on these deposits… but on the other hand, it will free up billions of reais in capital (which is now – also costly – provided for by debt financing). This is not for 2024, however:

We’re testing the waters in terms of retail funding, and that’s pretty much the mode of the year. I would not expect any big movements on the balance sheet in 2024.

When StoneCo decides to use these deposits as a source of funding for its working capital product, it will free up to 6 billion reais in capital. That’s 25% of the company’s market cap.

Other important notes

Besides the updates from the three divisions, I picked up some other important decisions and trends. In particular, there were 2 management decisions that I did not appreciate.

First, the management’s decision to not yet use its buyback program – for which it has gotten an authorization of up to 1 billion reais (around 7% of the market cap!). When asked about the utilization of the program, management stated that it was in no particular hurry to use it.

Second, management’s decision to spend heavily on marketing. In particular, marketing expenses increased sequentially by 17% (and 36% year-over-year), almost entirely driven by advertising “Big Brother Brazil”. It remains to be seen whether this was a wise decision… But I think not. At least, it is difficult to rhyme with the focus on increasing efficiency.

On the other hand, the focus on increasing efficiency seems to be working well. StoneCo reduced its administrative expenses sequentially by 17% and year-over-year by 14%. This is an impressive feat and shows that the current management is, indeed, disciplined. (It further makes me wonder why they paid so much to market a television show?)

Another positive note is that PIX is gaining traction. Contrary to popular belief, this is a good thing for StoneCo! Not only does StoneCo charge PIX payments at the same rate as payment by card, but the merchant does not need to pay an additional fee to the card issuer – as PIX is operated by the Central Bank of Brazil and is free. As such, the total cost of the payment transaction is lower for the merchant… potentially giving StoneCo more room to raise its prices.

Finally, Brazil has been hit with floods. The management noted that it had extended a 90-day grace period on merchants from the hit regions and reduced its prices. This will reduce profits in the coming quarter, but not to the extent that it will impact full-year guidance.

Conclusion

To conclude, I think that the sell-off was warranted as StoneCo missed the market’s expectations. However, the medium- and long-term prospects have not been hurt. Instead, the credit business is firing on all cylinders, and will be the profit driver for the years to come.

Current market expectations are for StoneCo to earn $1.28 EPS GAAP this fiscal year. Given the current stock price of $15.10, StoneCo is valued at less than 12x forward P/E.

Yes, the banking division should be valued lower than the payments division. However, currently, nearly all profits are coming from the payments division. And in my opinion, that deserves a higher multiple than 12x earnings, even in Brazil.

As such, in my opinion, if you buy StoneCo, you get an undervalued payment processing business, and its promising credit division for free!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of STNE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.