Summary:

- Despite underperformance, StoneCo’s stock is undervalued with promising unit economics and expected EPS growth, justifying a bullish rating.

- Q2 2024 results showed strong performance in payments, banking, and credit segments, with significant revenue and EPS growth.

- Management’s efficient capital deployment and ambitious growth targets suggest potential for substantial profitability and market penetration.

- Despite competition and macroeconomic headwinds, StoneCo’s stock is poised for a 20.8% upside, trading at a discount to its fair value.

- I’m reiterating my “Buy” rating for the STNE today.

Adam Gault

Intro & Thesis

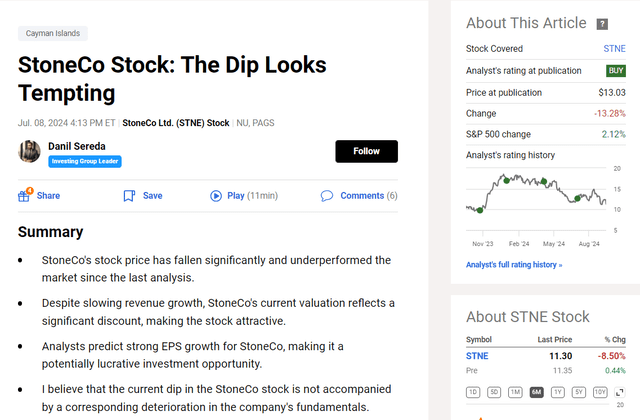

I initiated coverage of StoneCo Ltd. (NASDAQ:STNE) on August 12, 2023, when the stock was trading at $13.52 and since then, STNE has moved in a wide trading range, occasionally trying to move higher but encountering strong resistance, so the stock actually underperformed the S&P index (SPY) (SP500) quite significantly. In my last article (July 2024), I argued that the STNE’s dip looked tempting because I expected strong EPS growth, which should have made the stock a potentially lucrative investment opportunity given its valuation discount. Unfortunately for my thesis, STNE’s stock price has kept falling significantly and, as I said, has underperformed the broader market.

Seeking Alpha, my previous article on STNE

Despite this underperformance, I believe STNE became even cheaper while the business growth hasn’t gone anywhere. Yes, it’s decelerating, but unit economics ratios still shine, promising strong margins going forward. As before, I anticipate that as management’s initiatives take effect, the company’s margins will expand, enabling it to surpass current EPS estimates, which already indicate rapid growth in the coming years. A multiple expansion may follow suit. Hence my bullish rating reiteration.

Why Do I Think So?

As I usually do, let’s start with a quick financial review of the recent quarter results.

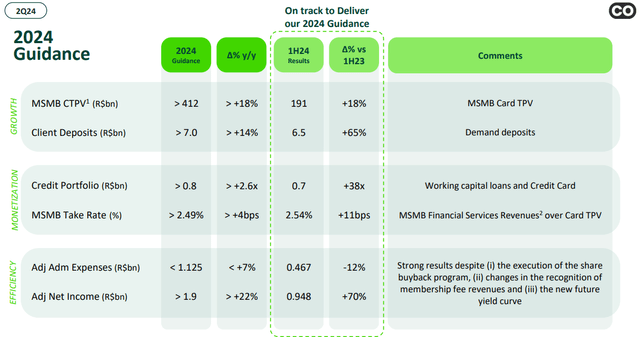

STNE recorded solid results in Q2 2024 (released on August 14, 2024), especially in the payments, banking and credit segments. In Payments, the MSMB client base grew by 30% YoY with Total Payment Volume (TPV) gaining 25%; the MSMB take rate improved by 7 b.p. to 2.54%, reflecting the adoption of successful pricing and bundling strategies [Source: IR presentation].

In Banking, the client base was up 62% year-over-year, and deposits were up 65% YoY to R$6.5 billion. The total credit portfolio was up 32% QoQ to R$712 million, working capital portfolio went up by 28%. The non-performing Loans ((NPLs)) rate remained at 2.6%, which is explained by the portfolio maturation process and actually doesn’t look too high to me.

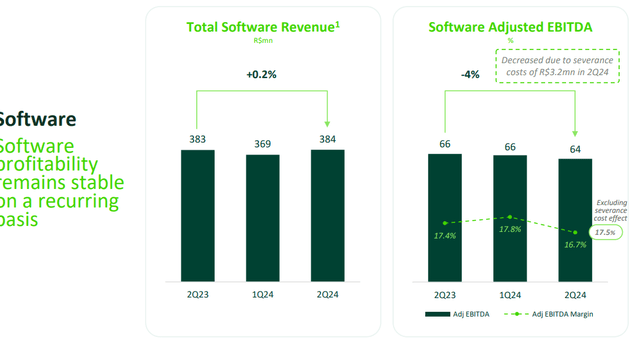

What I assumed kind of scared investors and Wall Street analysts in Q2 data was the software dynamics: sales here grew by only 0.2% YoY, while due to severance costs of R$3.2 million for the quarter, we saw a decline of 4% in adjusted EBITDA.

STNE’s IR materials

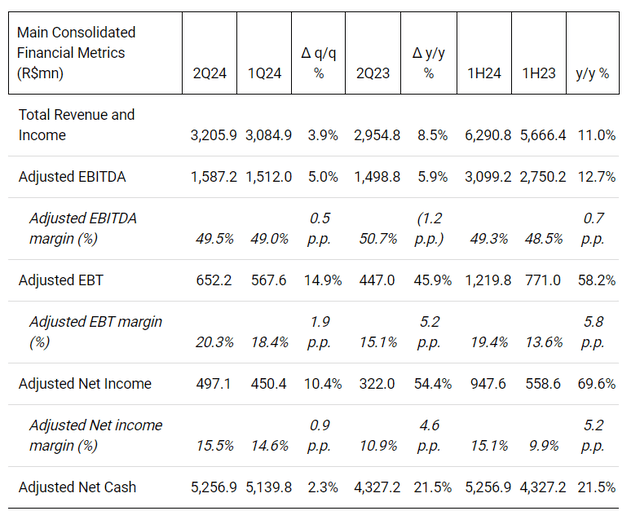

As a result of the segments’ performance for the quarter, we saw an 8% year-over-year increase in StoneCo’s consolidated revenues, consistent mid-teens TPV growth, and improved client monetization (revenue per TPV up by 34% year-over-year). Thanks to limited growth in OPEX and some cost cuts (for instance, the administrative costs decreased by 12.6% YoY), the adjusted EBT was up 46% and adjusted net income up 54%, both reflecting benefits of topline growth and expense efficiencies.

STNE’s press release for Q2 FY2024

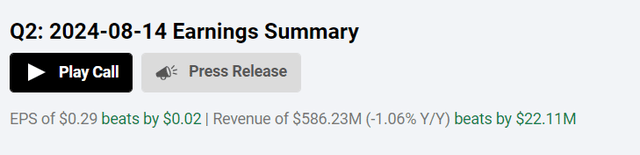

So the efficiency and capital deployment drove a 57% year-over-year increase in adjusted basic EPS to R$1.61 ($0.29 in US dollars), leading to a double-beat of consensus expectations for the quarter:

Seeking Alpha, STNE

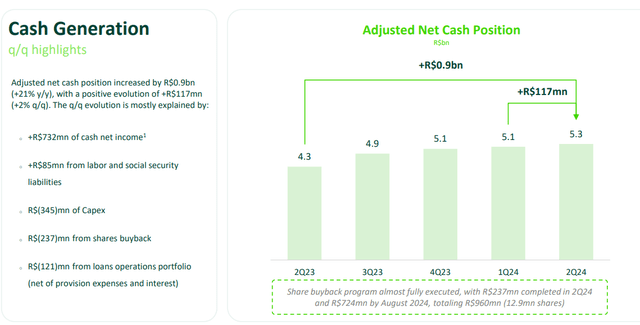

STNE held a strong cash position of R$5.3 billion adjusted net cash, though it was down significantly compared to 2023 in US dollar terms [Seeking Alpha data]. However, the firm’s cash generation capacity has only improved in Q2 FY2024:

STNE’s IR materials

StoneCo’s management tried to wisely deploy capital for investments in share repurchases (diluted share count fell 0.41% QoQ) and a tender offer for 2028 bonds to optimize capital structure and funding spread, according to the earnings commentary.

Operationally, I believe the company made substantial gains in both the MSMB and banking segments, both confirming strong market penetration and cross-selling initiatives (the unit economics metrics dynamics look promising to me). I think the very strong TPV growth and enhanced take rates in the payments business reveal that the company’s merchandising pricing and bundling strategies are working well, while the strong growth of the credit portfolio and stable NPL rates (though growing slightly) show good credit quality and strong credit risk management. The software business shows modest growth but is generating more and more recurring revenue through vertical expansion, with particularly noteworthy cross-selling initiatives in the gas station and retail verticals, so it may be just the beginning for StoneCo in terms of how much growth it may drive in the future.

STNE’s management also set some ambitious goals calling for the MSMB TPV to top R$412 billion (+18% over 2023 levels), and client deposits to eclipse R$7 billion with banking showing signs for strong growth. From here, the company is well-prepared to achieve its 2024 targets, in my opinion.

STNE’s IR materials

In the face of all the positive developments I mentioned above, STNE listed other headwinds, including R$120 million lost in revenues due to a cut in “the recognition of membership fee revenues”, along with a higher yield curve leading to a very turbulent macroeconomic environment. However, I believe that these challenges are only a temporary setback for the company. Looking ahead to the next few years, the company’s efforts to expand its product offering and increase its total payment volume should allow it to recover quickly and eventually improve its profitability.

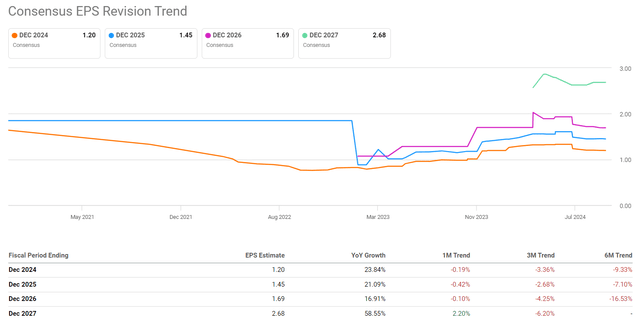

Although analysts are divided on StoneCo’s performance next year and some have lowered their forecasts for FY2025, there’s little doubt that the company’s EPS will increase significantly. The current consensus is for a compound annual growth rate of ~22.25% for EPS for the next 4 years.

Seeking Alpha, STNE

Again: This consensus comes after a series of estimate reductions in recent quarters. As the company’s profitability may exceed expectations, there could be a reverse market reaction, causing the same analysts to revise their forecasts upwards. In such a scenario, today’s consensus could prove to be too conservative in hindsight.

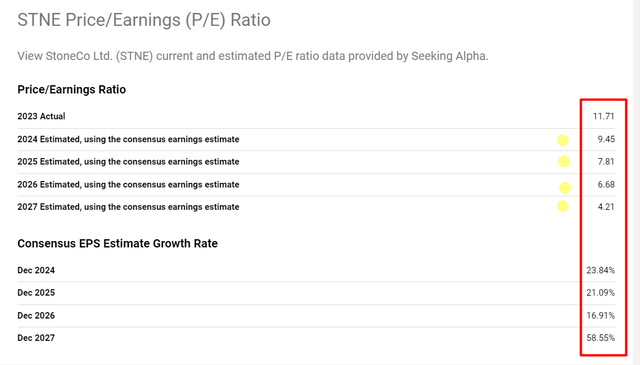

If the current consensus forecast proves accurate, StoneCo stock will be trading at just 7.8 times next year’s earnings, representing a very modest valuation multiple given the strong pace of operational growth the company has demonstrated in recent quarters (and still expected to demonstrate in the next few years). The market’s bullish forecast for EPS expansion suggests that assuming a stagnation in the stock price, it could eventually result in the valuation multiple dropping by half from the forecast FY2024 to that of FY2027. To me, this seems illogical, given the expected growth and expansion.

Seeking Alpha, STNE, notes added

Assuming the forecasted EPS levels for FY2025 are close to reality, I think it’s fair to assume that the stock should be fairly valued at 10 times earnings (implied PEG of ~0.47x, a bit higher compared to today’s FWD metric of 0.45x). All that would suggest the STNE stock should trade at $14.50 apiece by the end of FY2025 – that is 28% higher than the current stock price. Given its quite comfortable upside potential that I anticipate over the next 12 months, STNE remains a “Buy” to me today.

Where Can I Be Wrong?

As I mentioned in my previous article back in July, I believe the biggest risk today in maintaining my buy rating for StoneCo’s stock is the high level of competition. As you may know, Latin America is a rapidly growing addressable market for the fintech industry, attracting many companies aiming to capitalize on this potential. StoneCo is not the only company with high-growth potential, and not all can be winners. StoneCo risks losing its current position to competitors such as Nu Holdings (NU) or PagSeguro Digital (PAGS).

So today’s EPS forecasts and my reflections may be too optimistic. If I’m indeed overestimating StoneCo’s capabilities, then its current valuation multiples could end up being even lower as margins continue to suffer, and growth rates will likely slow down.

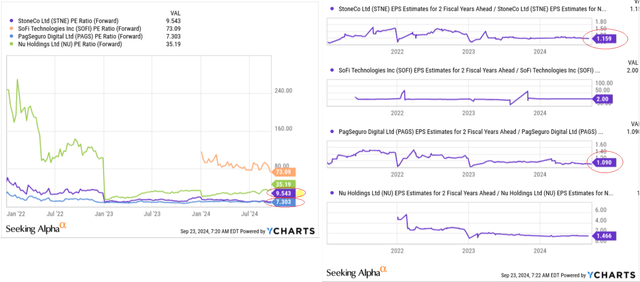

When considering my “fair” assessment of STNE valuation at 10x P/E in FY2026, you should keep in mind that I might be mistaken here, as the discount I perceive may not actually exist. I mean, if we compare StoneCo to its closest peers in terms of business processes, we find that the current low multiples are actually justified by the lack of future earnings growth. For instance, compared to companies like Nu Holdings and SoFi Technologies (SOFI), StoneCo appears relatively inexpensive. However – unlike StoneCo – Nu Holdings and SoFi are projected to grow their EPS by 46.6% and 100% in calendar 2026, respectively; in comparison to PagSeguro, StoneCo seems fairly valued:

YCharts, notes added by the author

The Bottom Line

Despite the risks mentioned and the negative sentiment from some investment banks recently, I believe the current pessimism in STNE stock is exaggerated. In general, I appreciate the way management is maximizing efficiency within its business units. Furthermore, I’m encouraged by the growth and earnings beat in the last quarter – the company continues to outperform consensus forecasts, which were trending downwards in the past few months. Despite the macro risks and a logical slowdown in sales growth, I believe StoneCo has significant opportunities to increase its profitability, particularly through new projects and cross-selling initiatives. I expect the company to keep exceeding the increasingly pessimistic forecasts going forward. It seems that the entire market for fintech companies in Latin America is trading at a discount, and StoneCo is no exception here. The stock is currently trading at just 7.8x FY2025 earnings, while I believe the multiple should be closer to 10 times. Therefore, I see a potential upside of around 20.8% from the current share price, given the current consensus is correct (which, again, is likely to be beaten in reality). In view of all these factors, I’m reiterating my “Buy” rating for the STNE today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in STNE, over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!