Summary:

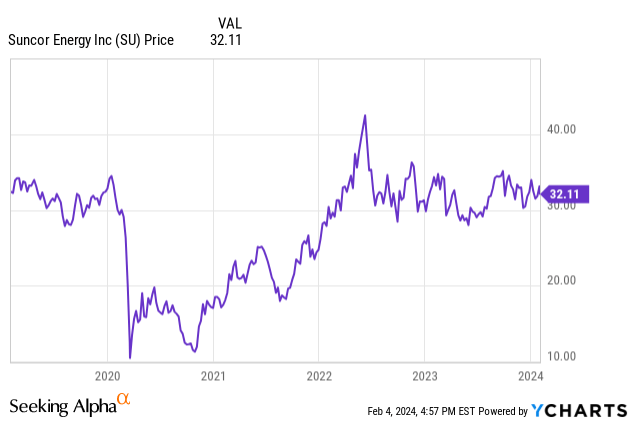

- Suncor Energy’s share price has fallen 3% in the past 5 years despite demand for oil only growing.

- Suncor Energy has significant reserves and falling net debt and is committed to shareholder returns via buybacks.

- It trades at a discount to peers that I believe is unwarranted and has a potential upside of 42% to reach fair value.

MARK RALSTON/AFP via Getty Images

Introduction

Suncor Energy (NYSE:SU) is one of the largest integrated oil sand producers in Canada. Over the past five years, the shares have fallen over 3%, significantly lagging the S&P 500 as well as the Energy ETF (XLE). However, with demand for energy continuing to grow, Suncor looks in increasingly good shape with the opening of the Trans Mountain Pipeline, vast oil reserves, and an improving balance sheet. Combined with a solid plan on what to do with excess free cash flow, this means Suncor is set to boost returns to shareholders whilst setting the company on solid future footing. Let me explain why Suncor Energy is a buy.

Company Overview

Suncor Energy is a leading integrated energy company with a significant presence in the Canadian oil sands. Founded in 1979 and headquartered in Calgary, Alberta, Suncor has grown to become a prominent player in the North American energy sector. The company’s operations span the entire energy value chain, encompassing extraction, transportation, refining, and marketing.

Suncor energy’s main focus is in the Canadian oil sands, one of the world’s most substantial reserves of bitumen, a heavy and viscous form of crude oil. The company’s extensive oil sands operations are primarily located around Fort McMurray, Alberta. Oil sands extraction is characterized by high upfront capital expenditures and fixed operating costs. However, it offers the unique advantage of having relatively low variable costs once operations are established. This cost structure and the nature of oil sands result in a relatively low decline rate, providing stability in production levels over time. This cost structure means that oil sand producers will continue to produce even if there is a short-term dip in the oil price whereas non-oil sand producers will generally stop or slow new production.

Suncor also boasts substantial refining capabilities, with around 0.5 million barrels per day of refining capacity, smaller offshore extraction capacity, and ownership of the Petro-Canada gas station chain. With approximately 7 billion barrels of oil equivalent of 2P reserves, this represents around 26 years of production.

Trans Mountain Pipeline

Later this year, the much-delayed Trans Mountain pipeline expansion is set to come online, resulting in the capacity of the pipeline increasing from 300,000 barrels per day to 890,000 barrels per day enabling increased export of oil from the oil sands in Alberta from the Canadian west coast. So why is this a big deal for Suncor? Given the current lack of export pipeline capacity, this expansion will enable Canadian oil to reach global markets and not be entirely reliant on exports to the United States.

With the current reliance on exports to the United States, Canadian oil sands have typically sold at a significant discount to the benchmark West Texas Intermediate, in some cases trading more than $50 below the price of WTI. With the introduction of this expanded pipeline, Canadian West Coast oil will be able to reach the West Coast where it can be shipped to Asia or Californian refineries enabling higher price realization. Following the announcement that the Trans Mountain Pipeline will begin filling ready for first loadings later this year, Canadian oil sands prices increased to the narrowest differential to West Texas Intermediate since August 2023, representing a current discount of only $16 a barrel. This development means that in the longer term, Suncor should be able to achieve higher prices for each barrel it produces, helping to boost revenues and profits in the future.

Although the Trans Mountain pipeline has recently faced another delay, this setback is likely to be temporary. Trans Mountain pipeline reiterated its commitment to achieving an in-service date in Q2 of this year despite the delay. I anticipate that this delay will be brief and will not diminish the case for Suncor Energy, as the pipeline’s completion promises a substantial increase in cash flow due to higher oil sale prices.

Q3 Results

Suncor Energy released its Q3 results on the 8th of November, reporting a decrease in profit, compared to the previous year. The company’s Q3 adjusted operating earnings amounted to C$2 billion (~US$1.49 billion), equivalent to earnings per share of C$1.52 compared to C$1.88 per share a year earlier, largely due to the lower price of oil.

Despite the challenging market conditions, Suncor saw only a small year-on-year decrease in its total upstream production, with production at 690.5 thousand barrels of oil equivalent per day (boe/d), against 724.1 thousand boe/d in the previous year. Refinery utilization was strong with an average utilisation of 99% during the quarter.

Although the company reported a reduction in net debt of C$1.399 billion to C$12.995 billion during the quarter, it was noted that the net debt balance is set to increase following the acquisition of TotalEnergies (TTE) stake in Fort Hills. However, it was highlighted that the company remains on track to achieve its C$12 billion net debt target by the end of 2024.

In response to this solid set of results, Suncor raised their dividend by 4.8% to C$0.545 per share.

Q4 Outlook

Suncor Energy will report its results for Q4 2023 later this month. Current expectations are for revenue of $9.48 billion, a fall of 8.73% compared to the equivalent quarter in the previous year. Earnings per share are set to contract by 40% to $0.81.

This comes despite upstream production reaching 808K boe/d, the second-highest quarterly production in the company’s history, with December output being its best ever. Average refining utilization was 97%. The reason for lower revenues compared to last year, despite increased production, is largely due to the lower price of oil. Overall, the trend for the company looks positive, with a focus on cost reduction and growing output.

Valuation

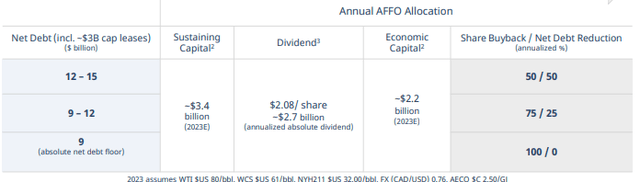

Suncor Q3 Earnings Presentation

In recent years Suncor has had a clear strategy of shareholder returns based on its level of net debt, with increased returns primarily coming from buybacks. This has resulted in its share count falling from 1526.8 million shares at the end of Q4 2019 to 1295 million shares at the end of Q3 2023. Additionally, the company also returns money to shareholders through a dividend with a dividend yield of 4.74%. I expect steady growth in the value of the dividend in the coming years, with buybacks increasing as net debt reduces.

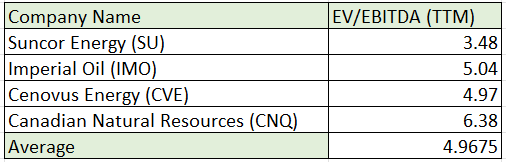

Given the volatile nature of earnings for Suncor due to its dependence on the volatile price of oil, I believe the fairest way to value the company is to compare it to its peers. Given the large differences in debt and cash levels among energy companies, a simple comparison of earnings multiples will not suffice, and I therefore use an enterprise value to EBITDA multiple.

Table of Valuation comparisons with data from Seeking Alpha

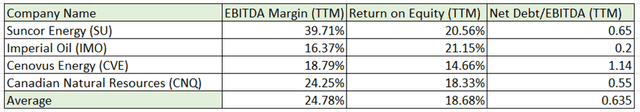

When compared to Imperial Oil (IMO), Cenovus Energy (CVE), and Canadian Natural Resources (CNQ), Suncor Energy’s EV/EBITDA multiple of 3.48 suggests an undervaluation compared to the average multiple of 4.97 for its peers. If Suncor were to trade in line with its peers and considering that many of its key metrics align with or outperform those of its peers (as shown in the table below), I believe it should, this would imply a share price of $45.84, an upside of 42% from the current share price.

Table of key metric comparisons created by the author with data from Seeking Alpha

Risks

When investing in Suncor Energy, I have three main risks I believe it is important to consider.

Firstly, the oil price. Suncor Energy is significantly exposed to the volatility of oil prices. Fluctuations in the oil price, driven by factors such as geopolitical events, global economic conditions, and demand-supply imbalances, have a profound impact on the company’s revenue and profitability. A prolonged period of low oil prices could lead to reduced capital spending, cash flow challenges, and reduced shareholder returns.

Secondly, Suncor faces environmental risks related to its operations. Oil spills, leaks, and other incidents can occur which can cause significant harm to the environment and local communities. These incidents could potentially lead to substantial fines and cleanup costs for Suncor if one were to occur. For instance, Suncor recently faced repercussions, paying a $10.5 million fine for air pollution violations at its Colorado refinery. Although the small fine required is almost immaterial given the size of the company, this highlights the stringent regulatory environment in which the industry operates. Larger environmental breaches can incur much higher costs, as evidenced by the Deepwater Horizon accident that cost BP (BP) over $60 billion pre-tax.

Finally, Suncor operates in a heavily regulated industry, subject to various government policies, including environmental standards, emissions reduction goals, and tax laws. Changes in government regulation could significantly impact Suncor’s operations and hence its profitability. Additionally, governments could introduce windfall profit taxes during periods of high oil prices as we have seen in the UK, reducing the company’s earnings and financial stability. Suncor is arguably more at risk given its reliance on a single jurisdiction (Canada) as opposed to more diversified oil majors such as Shell (SHEL).

Conclusion

In conclusion, Suncor Energy offers a compelling investment opportunity within the energy sector. With a clear strategy for managing free cash flow, Suncor Energy is well-positioned for increased shareholder returns in the future. Suncor Energy appears to be undervalued relative to its peers and could yield a 42% increase in share price if traded at the same valuation as peers. Given these factors, I believe Suncor Energy is a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SHEL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.