Summary:

- Suncor just reported the highest refining throughput in the company’s history at 488,000 barrels per day, and the upstream segment also reported its best third quarter ever.

- The management change that occurred in 2023 led to a strategic review of the portfolio, and the improvements in operational efficiency are clearly visible by now.

- Suncor’s asset base is characterized by a high level of integration along with a compelling concentration around low-decline oil sand mining assets.

- Using a free cash flow estimate of CAD$6.5 billion in 2024, Suncor is currently trading at a free cash flow yield of around 8.5%.

dan_prat

Summary

Suncor Energy (NYSE:SU) is characterized by a deeply integrated business model focused on key oil sand mining assets. The company’s production decline rate of approximately 5.0% is one of the lowest that I am aware of in the oil and gas industry, and it is an important factor behind the company’s significant free cash flow generation capabilities. Although I am attracted by the high-quality asset base, I am not comfortable buying an oil producer at all-time highs, especially considering the highly cyclical nature of the industry.

Q3-24 Earnings

Suncor released its Q3-24 earnings after the market close on November 12, and the results show once again that the company made significant progress on operational efficiencies since Elliot Investment Management got involved in 2022.

For example, Suncor just reported the highest refining throughput in the company’s history at 488,000 barrels per day with an overall utilization rate of 105%. The same phenomenon is also observable in the upstream segment, as it just reported its best third quarter ever at 829,000 barrels per day. When all the variables are combined, free cash flow generation in the third quarter has been solid at CAD$2.2 billion, and the net debt target of CAD$8.0 has now been achieved.

Description

Suncor is one of the largest oil producers in Canada, with the vast majority of its producing assets located in the Athabasca oil sands. The area is characterized by large deposits of bitumen that form one of the most important sources of unconventional oil in the world. In terms of reserves, only about 20% of Canada’s oil sands are close enough to the surface to be mined, and when they are too deep, an in-situ production method called steam-assisted gravity drainage (SAGD) is used. In terms of production volumes, mining assets represent approximately 50% of the production volumes coming out of the Canadian oil sands, and although there are other important players in the region like Canadian Natural Resources (CNQ) and Imperial Oil (IMO), the depth of Suncor’s vertical integration is unparalleled.

Oil Sand Assets Map (May 2024 Investor Day Presentation)

The cornerstone asset of the company is the Base Plant, which produced 250,000 barrels of bitumen per day in 2023. The asset includes the Millennium and North Steepbank open-pit mines, along with two integrated upgrading facilities. The two other important mining operations consist of Syncrude and Fort Hills, which produced 212,000 and 147,000 barrels of bitumen per day in 2023, respectively.

Oil Sand Assets Overview (May 2024 Investor Day Presentation)

Suncor owns a 58.84% working interest in Syncrude, and the joint venture partners consist of Imperial Oil, Sinopec and CNOOC who own 25.00%, 9.03%, and 7.23%, respectively. The Syncrude joint venture began operations in 1964, and production is expected to continue until the field reaches its economic limit in 2045.

In the early days of 2022, Elliott Investment Management wrote a letter to Suncor’s board of directors calling for an overhaul of the management after highlighting the underperforming safety track record in addition to other operational challenges. Following the death of a contractor at the Base Mine in July 2022, Mark Little announced his resignation from his role as chief executive officer. In February 2023, with the support of the new Elliot’s directors, Suncor named Rich Kruger as the new chief executive officer. From 2013 to 2019, Rich Kruger served as the chief executive officer of Imperial Oil, the second-largest partner in the Syncrude joint venture. In my view, it is not a coincidence that Elliot proposed the appointment of an executive with multiple years of experience at Syncrude, and in a way, it highlights the importance of the asset for Suncor’s shareholders.

After the changes at the executive level, Suncor announced two key transactions. In March 2023, the company announced that it had entered into an agreement with Equinor (EQNR) for the sale of Suncor Energy UK Limited, which included the non-operated offshore interests in the North Sea. The deal was valued at approximately CAD$1.2 billion and it closed at the end of June 2023 after Equinor received the necessary regulatory approvals. From a strategic point of view, Suncor did not have any competitive advantage in owning a 29.9% working interest in the Buzzard field and a 40% working interest in Rosebank.

A few months later, in October 2023, Suncor announced a second important transaction. This time, it was to consolidate the ownership of the Fort Hills joint venture by acquiring the 31.23% working interest owned by TotalEnergies (TTE). With the CAD$1.5 billion transaction, Suncor added approximately 61,000 barrels per day of production in addition to securing additional long-term bitumen supply to feed the two Base Plant upgraders. In November 2022, Suncor also announced the $1.0 billion acquisition of the 21.3% working interest in Fort Hills owned by Teck Resources (TECK).

Fort Hills began the production of bitumen in early 2018, and based on current mine plans, the asset has a life expectancy estimated at approximately 50 years. Nobody can predict the future that far off, but Fort Hills probably has enough resources to produce oil as long as the world economy consumes it. For the full year of 2023, Fort Hills produced just under 150,000 barrels per day. The ultra-long mine life of oil sand mining assets reminds me of my previous research on Altius Minerals.

Any analyst building an NPV model on the Rocanville mine in 1970 when it entered production would have likely missed the target as the mine is not only still producing almost 55 years later, but the mine is actually bigger than ever after an important round of expansion in 2013. In my view, this is where the big money is made in the royalty and streaming business as average deposits are more likely to be correctly valued by DCF and NPV models. In that sense, having a management team and a shareholder base with a long-term time horizon becomes a key competitive advantage. Altius Minerals: Highly Vulnerable To Recession Risks

Competitive Advantages

Decline Rates

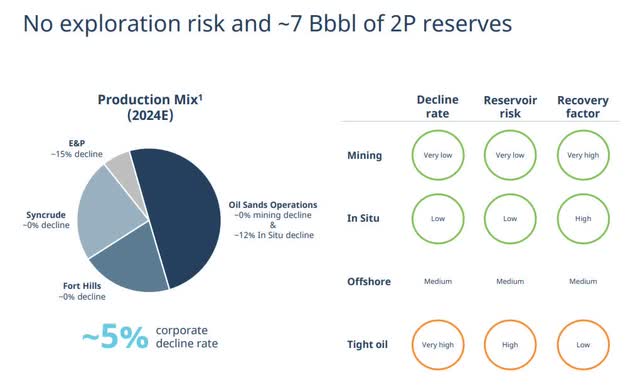

The most important competitive advantage of oil mining assets is their low decline rates, which are close to zero. In other words, the production volumes at Fort Hills and Syncrude are determined by the pace of the mining operations, and there is no need to worry about managing the pressure in the reservoir, for example. In terms of decline rate, if oil mining assets are at one extreme, tight oil wells are at the other extreme. It is nothing exceptional for a shale oil producer to deal with decline rates of 40% or more, and the consequence is that they are on a constant treadmill to drill new wells and replace production.

Competitive Advantages of Oil Sand Mining Assets (May 2024 Investor Day Presentation)

There is a strong link between decline rates and free cash flow generation capabilities, and we simply have to observe how much capital shale oil producers must invest to keep production volumes flat. In addition, most of the economic value of a well with an elevated decline rate is in the first few years of production. If oil prices are weak when the well is put into production, the returns on invested capital may be impaired in a permanent way.

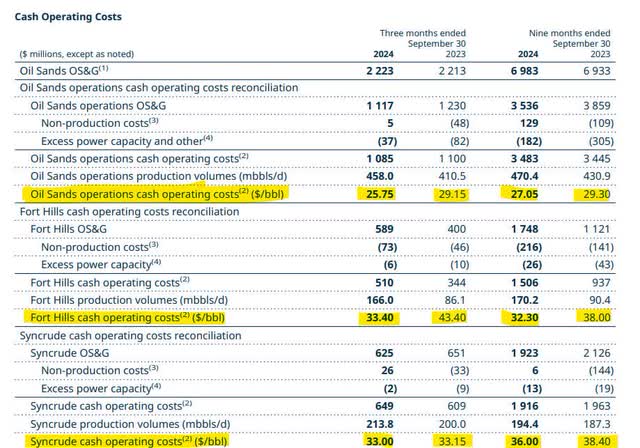

Suncor Cash Operating Costs (Q3-24 Report)

On the other hand, oil sand mining assets have seen and will continue to see many oil price cycles. The capital requirements are still important, but there is a lot more room to breathe. Suncor has a decline rate of approximately 5.0% per year, which is one of the lowest that I am aware of in the industry. Although in-situ assets like Firebag and MacKay River have higher decline rates compared to mining assets, they still remain low compared to tight oil wells, and even relative to offshore assets. For example, Firebag produced its first million barrels of oil in 2004, and it is still producing more than 200,000 barrels per day 20 years later. Firebag is the largest in-situ asset owned by Suncor and approximately 600 wells have been drilled on the property so far. Oil production will always remain a capital-intensive business, but in my view, the free cash flow generation of oil sand assets is unparalleled over a multi-year or even multi-decade time horizon.

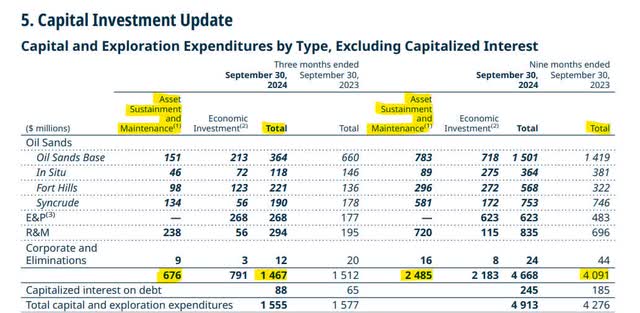

Suncor Capital Expenditures (Q3-24 Report)

Vertical Integration

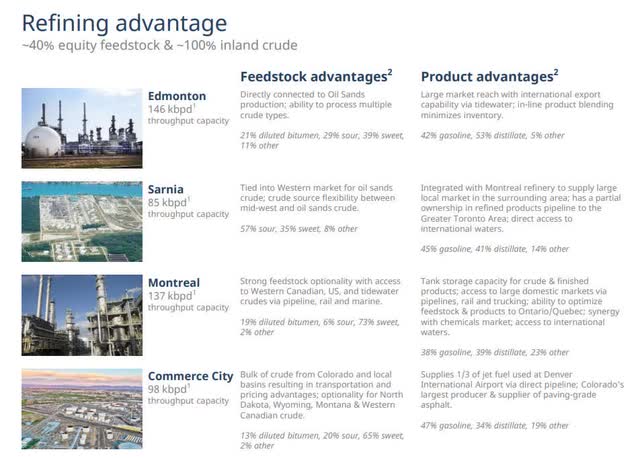

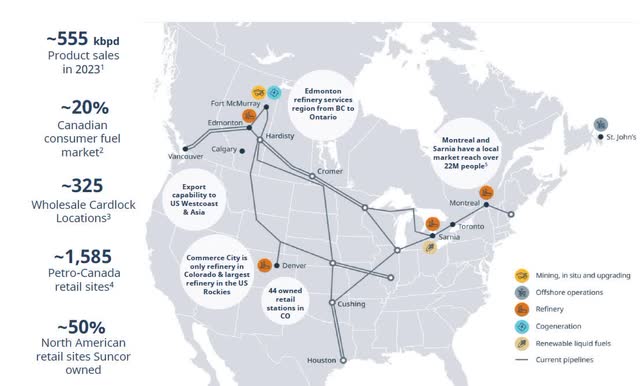

The second important competitive advantage that Suncor has is its high level of vertical integration. The company owns a portfolio of four refining assets with the capacity to process approximately 40% of the upstream production. In addition, the level of integration goes one step further as the company also owns Petro-Canada, which has a network of more than 1,800 retail and wholesale locations across Canada.

Refining Assets Overview (May 2024 Investor Day Presentation)

When the price differential between WTI and Western Canadian Select prices blows out, Suncor’s refineries are well-positioned to capitalize on the opportunity for cheap feedstock. As illustrated in the chart below, all four refineries have the capability to process crude coming from oil sands if it makes economic sense to do so. Given its proximity to the Athabasca Basin, the Edmonton refinery is particularly well-positioned to benefit from dislocations in Western Canadian Select benchmark prices.

Earlier this month, the price discount for Western Canadian Select (WCS) versus WTI at Cushing blew out to more than $30/bbl — 2.5x what’s typical and a signal that something was seriously out of whack. Well, it turns out that several things were — and to some degree still are — off-kilter, combining to drive down the price of Western Canada’s benchmark heavy-oil blend to its lowest levels relative to WTI in four years. Roller Coaster – Another Wild Ride for Western Canadian Select-WTI Differentials

Refined Product Markets (Q3-24 Presentation)

There has been a period of severe dislocation in the first half of 2022 following Russia’s invasion of Ukraine, but the market breakdown in 2019 was also quite something. In those times, small oil sand producers like MEG Energy (MEG:CA) or Athabasca Oil (ATH:CA) are particularly vulnerable, although it is precisely in those times that Suncor’s integrated business model shows its real power.

Valuation & Balance Sheet

Using a share price of CAD$54.00 per share, Suncor is currently trading at a market capitalization of CAD$68.7 billion, and if we include the CAD$8.0 billion of net debt as of the end of September 2024, we are talking about an enterprise value of CAD$76.7 billion.

Based on an average WTI price of $77.55 during the first nine months of 2024, Suncor generated CAD$5.4 billion in free funds flow year-to-date. On an annualized basis, it would represent free funds flows of CAD$7.2 billion, although the actual number is likely to come below that as WTI prices have been trading in the low $70s for a large part of the fourth quarter, so far.

Using free funds flows of CAD$6.5 billion for indicative purposes, Suncor would be trading at a free cash flow yield of around 8.5%. I certainly do not pretend to know what WTI prices will average moving forward, but those estimates provide an order of magnitude. Someone could provide compelling arguments as to why the CAD$6.5 billion figure in free funds flow is too high or too low, but it would not change the fact that, in general terms, Suncor is currently trading at a free cash flow yield between, let’s say, 8.0% and 9.0%.

In my recent article about Talos Energy (TALO), I discussed why I view Ecopetrol (EC) as one of the most compelling opportunities in the oil and gas sector at the moment. Even though I rated Ecopetrol as a hold when I initiated the company in early October 2024, the share price has been under tremendous pressure since, and it is now at a level that is catching my attention.

The reason why I view Ecopetrol as a superior opportunity at the moment is the downside protection provided by the vertically integrated asset base. In addition, the share price has been subject to significant selling pressure over the last few weeks, and it is now deeply in oversold territory. On the other hand, the Colombian government owns 88.5% of the shares outstanding, in addition to operating in a volatile region of the world. Obviously, if everything were perfect, the shares would not be trading where they are right now. Ecopetrol: Downside Protection Provided By Vertical Integration

Although Ecopetrol and Suncor are different in many ways, they also share important similarities. First, both companies operate an integrated business model, and second, they also have similar production volumes, generally between 750,000 and 800,000 barrels per day. Obviously, Ecopetrol operates in a much more challenging operating environment, and the fact that the Colombian government owns 88.5% of the shares outstanding also raises important questions.

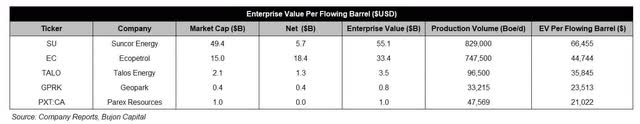

Having said that, I want to point out the valuation gap between the two companies. Ecopetrol is trading at an enterprise value per flowing barrel of approximately $45,000, which is a discount of almost 35% versus Suncor’s enterprise value per flowing barrel of around $66,500. As indicated in the table, there is an important difference in the capital structure, with Ecopetrol having a more leveraged balance sheet. When it comes to smaller producers like Talos Energy, GeoPark (GPRK) and Parex Resources (PXT:CA), they are trading at much lower valuations as they are not integrated and do not have the same access to capital.

Enterprise Value Per Flowing Barrel (Bujon Capital)

A lower multiple per flowing barrel should not be interpreted as an indication of future outperformance, as each company is different and has its own strengths and weaknesses. I am simply sharing the fact that Ecopetrol is catching my attention, given its drastic underperformance over the last few weeks and its deeply integrated asset base.

1-Month Share Price Performance (Bujon Capital)

Conclusion

Suncor is characterized by a high level of integration along with a compelling concentration around low-decline oil sand mining assets. The management change that occurred in early 2023 led to an important strategic review of the portfolio, and the company is now more focused on its core oil sand and refining assets. As demonstrated once again by the Q3-24 results, the company has made important progress in improving operational efficiencies, and it is clearly visible in upstream and downstream production levels.

My hold rating is based on the fact that the shares are currently trading near all-time highs. The oil and gas industry is highly cyclical, and I am simply not comfortable buying an oil producer at all-time highs. I will remain patient for now, and on the look for a compelling point of entry.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article should be seen as part of a personal notebook documenting a personal journey. Please consider that I have been consistently wrong in the past. I am not in a position to give advice to anyone.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.