Summary:

- Suncor Energy Inc. offers appealing shareholder returns that continue to grow.

- Recent business performance shows strong profits and cash flows, with growth capital spending leading to record-high production levels.

- Suncor Energy’s updated shareholder return framework includes an increased buyback pace and massive expected free cash flow per share growth in the coming years.

dan_prat

Article Thesis

Suncor Energy Inc. (NYSE:SU) is a leading Canadian oil sands player that has offered appealing shareholder returns and should deliver even more of the same going forward. While shares have offered compelling returns over the last year, Suncor’s shares are still far from expensive, which is why further upside potential exists.

Past Coverage

I have covered Suncor Energy Inc. in the past here on Seeking Alpha, most recently in May 2023. In that article, I focused on the company’s quarterly earnings results at the time. Since more than a year has passed and since Suncor Energy recently made changes to its shareholder return framework, it is time to take another look at this Canadian energy player.

Suncor Energy: Recent Business Performance

The company’s first-quarter earnings results beat estimates where it counts, as Suncor Energy outperformed the analyst consensus earnings per share estimate, even though the company missed the revenue consensus estimate slightly. In other words, sales were marginally lower than expected, but since costs were lower than expected as well (and by a wider margin), the company nevertheless was more profitable than forecasted.

Along with profits, shareholders also care about cash flows, of course. Cash flows, after all, allow Suncor Energy to reduce its debt pile, to buy back shares, and to offer growing dividends. During the most recent quarter, Suncor Energy’s funds from operations — basically operating cash flows adjusted for working capital movements — came in at CAD$3.2 billion, or almost CAD$13 billion annualized. For a company that is currently being valued at CAD$66 billion, that makes for a very nice cash generation pace, as the cash flow yield is 19.7%.

Not all of that cash is available for shareholder returns and debt reduction, of course, as Suncor Energy also needs to invest in current and future assets. While its oil sands assets are long-lived and do thus not require heavy maintenance capital expenditures, some maintenance capital spending is needed, and Suncor Energy also invests in new assets on top of that. These investments in new assets are partially to grow production in the long run, and partially to replace existing assets’ production eventually since even longer-lived assets will not produce oil forever. Suncor Energy’s growth capital spending (and M&A) in the past has allowed the company to hit a new record-high level when it comes to production, as production averaged 835,000 barrels of oil equivalent per day during the most recent quarter. Not surprisingly, production mostly came from Suncor Energy’s oil sands assets, where a record-high was hit as well, with 785,000 barrels per day.

Suncor Energy’s capital expenditures, including maintenance and growth spending, totaled CAD$1.2 billion during the most recent quarter, which translated into a free funds flow number of almost CAD$2 billion, which would be equal to the company’s free cash flow at unchanged working capital levels. CAD$8 billion annualized in free cash flow would make for a free cash flow yield of close to 12% at the current market capitalization of CAD$68 billion.

Macro Environment

Of course, commodity companies such as Suncor Energy do not generate the same profit and cash flow every quarter. After all, commodity price movements — in this case, the movements in the price of oil — have a significant impact on a quarter-to-quarter basis, even if underlying business growth in terms of production and refining levels is growing reliably.

Looking at oil prices, we see the following:

WTI price per barrel in 2024 (Seeking Alpha)

The price per barrel of WTI has risen nicely so far this year, while the start of the year was not especially strong. In Q1, the average was around $75, while the second quarter average was a little higher — the Q2 high was higher than the Q1 high and the Q2 low was also higher than the Q1 low. The current quarter, Q3, has started nicely as well, with WTI trading close to the 2024 high right now. From an oil price perspective, the second quarter thus was a little better compared to the first quarter, which should be positive for energy companies when they report their Q2 results in the coming month or so.

On top of that, Canadian energy companies also benefitted from another tailwind. The Trans Mountain expansion started moving oil in May, adding transportation capacity to the West Coast and the export terminals located there. This has had a positive impact on the differential between US crude oil and Canadian crude oil, with WTI crude oil rising by 18% so far this year, while Syncrude Sweet Premium has risen by a much stronger 35% so far this year, according to oilprice.com. Other Canadian blends have performed well, too, but since Suncor Energy has the biggest ownership stake in the Syncrude joint venture at around 60%, this blend looks especially meaningful for Suncor.

Suncor Energy refines some of the oil it produces, so it will not capture all of the benefits of improving differentials, but between some differential tailwinds and firming oil markets, Q2 and Q3, so far, look quite good.

Suncor Energy’s Updated Shareholder Return Framework

The COVID crisis with very low oil prices forced many oil companies to add debt, and in the following years, interest rates rose, which made debt more costly. In order to drive down interest expenses and to prepare for potential future crises, Suncor Energy and many other energy companies decided to reduce their debt levels. Suncor Energy installed a capital allocation framework that would dictate how the company would use its available cash, depending on how large its debt position was at any specific time. The plan foresaw rising shareholder returns and a declining focus on reducing debt levels as debt reduction efforts progressed — the higher the debt level, the larger the focus on reducing debt, while low debt levels would mean that more cash would be diverted toward the company’s owners.

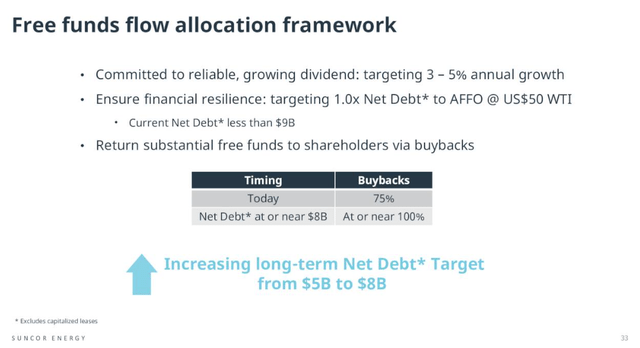

The company recently showed a new capital allocation framework in its 2024 business update:

Suncor Energy capital allocation policy (Seeking Alpha)

While the company previously planned to lower its net debt to $5 billion, the floor has now been lifted to $8 billion. The company will thus begin to return 100% of its excess free funds flow via buybacks sooner than previously thought, as fewer dollars will have to be used for debt reduction purposes.

Right now, Suncor Energy is at the 75% buyback level, which is already an increase compared to the last couple of years, when the company was putting 50% of its excess free funds flow towards buybacks. Investors can thus expect an increased buyback pace going forward, which will mean the share count will decline even faster in the future, all else equal.

Combined with the expected free cash flow growth stemming from cost reduction programs, improving differentials, and production growth from growth investments, should result in highly compelling free cash flow per share growth in the coming years. In its business update presentation, Suncor Energy guides for a free funds flow per share growth rate of 24% in the 2023 to 2026 time frame, which would be excellent, but even if the company missed that goal and would deliver just two-thirds of that, i.e. 16%, that would still be a highly attractive performance considering the energy industry is seen as a low-growth industry by many.

The dividend yields around 4.2% at current prices, which is way above the broad market’s (SPY) 1.3% dividend yield. Suncor Energy guides for dividend growth of 3% to 5% per year, as we can see in the above slide, which would make for a very solid combination. But with free fund flows per share forecasted to grow way faster than that, I wouldn’t be surprised if Suncor eventually decided to up the dividend growth rate. Over the last five years, the dividend was increased by 5.3% per year, and this includes the dividend cut we saw during the initial phase of the pandemic when many oil companies were struggling. If SU was able to grow the dividend by more than 5% per year despite this one-time macro crisis, I believe that there is a solid chance for dividend growth of more than 5% per year in the future, too.

Is Suncor Energy Still Attractive?

Shares have rallied by 18% so far in 2024, so in retrospect, buying half a year ago was better than buying today. But even today, Suncor seems like a pretty appealing pick.

Shares trade for 9x this year’s expected net profits, while the dividend yield is attractive as well, at 4%. As noted above, buybacks are getting even better, and between business growth, macro tailwinds from rising oil prices and the Trans Mountain expansion, and cost-saving programs, Suncor should deliver highly compelling profit and cash flow growth going forward.

While I do not believe that SU is ultra-cheap any longer, I believe that Suncor remains undervalued today. Buying this growing energy company with excellent shareholder returns at a single-digit earnings multiple seems like a good idea for long-term-oriented investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!