Summary:

- Suncor Energy is a high-quality Canadian oil company with strong results, a nice starting yield, and an undemanding valuation.

- Despite macroeconomic uncertainties, Suncor’s operational performance is robust, with increasing production and significant cash flow generation.

- Suncor is reducing its debt and plans to enhance shareholder returns through dividends and aggressive buybacks.

- Suncor’s low valuation and strong free cash flow yield make it an attractive investment for those seeking energy exposure and solid shareholder returns.

Marvin Samuel Tolentino Pineda

Article Thesis

Suncor Energy Inc. (NYSE:SU) is a high-quality Canadian oil company that generates strong results and that should be able to increase its shareholder returns substantially in the foreseeable future as its debt levels decline. A nice starting yield and an undemanding valuation round out the positive picture.

Past Coverage

I have written about Suncor Energy Inc. a couple of times here on Seeking Alpha, most recently in July, a little more than four months ago. I gave the company a “Buy” rating back then, with Suncor Energy returning around 3% since then. With the company releasing its most recent earnings results since my last article, and with some important macro developments since then, it is time for an update.

Oil Price Macro: Opportunities And Threats

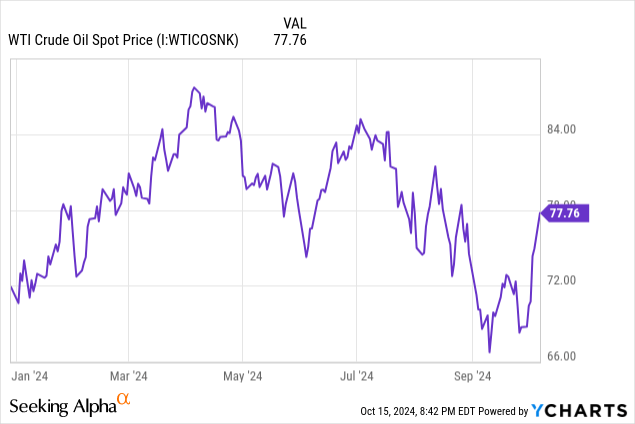

So far this year, oil prices have been volatile, seeing some ups and downs, as we can see in the following chart:

Oil prices are currently higher than they were at the beginning of the year, and oil prices are substantially higher compared to early September, but oil nevertheless trades below the highs seen in spring. A couple of macro developments are noteworthy:

– China’s economic growth remains unappealing for now, as the country continues to struggle with a real estate downturn. Overall consumption in China is rather weak as consumers are conservative with their cash due to uncertainties, which also impacts oil demand. The IEA states that oil consumption in China is down. On the other hand, China has recently indicated that there will be increased economic stimulus in the foreseeable future, which may result in improving oil demand in the coming quarters. So while China’s rather weak economic growth today (relative to the country’s growth in the past) is a drag on oil prices, there is potential for improvement with increased stimulus spending.

– Conflict in the Middle East has escalated recently, with Iran attacking Israel with around 200 missiles. Israel will very likely strike back in some way, possibly attacking Iran’s oil infrastructure. This could result in lower supply from Iran in the future, which is why oil prices firmed as tensions in the Middle East rose.

– Electric vehicle enthusiasm seems to wane in some countries, especially in Europe, where EV sales have declined in the recent past. It looks like some projections about the growth of electric vehicles were overly optimistic. This means that more ICE vehicles will be sold, compared to a scenario of fast EV growth, which should result in higher oil consumption down the road. This does not have an immediate effect, but if consumers are less likely to switch to EVs going forward, that should be a positive for oil demand in the long run.

– There is a risk of an economic downturn and recession in the US. While this is far from guaranteed, Goldman Sachs (GS) sees a 20% recession probability over the next year, for example. If a recession were to happen, consumers would likely travel less, and economic activity would decline, which would result in lower oil demand, thereby likely causing a decline in oil prices.

Overall, there are thus macro factors that could result in higher oil prices going forward, but there are also potential “threats” for oil prices to keep an eye on. I am relatively neutral on oil markets right now and believe that Suncor Energy is relatively well positioned, no matter what due to being a low-cost producer — after all, the company even generated positive operating cash flows in the ultra-weak oil price environment in 2020 when the world ground to a halt.

Suncor: Operationally Strong, Deleveraging At A Nice Pace

The macro picture can be important, but so is a company’s operational performance. In the most recent quarter, Suncor Energy did pretty well: The company beat estimates on both lines, as analysts once again underestimated the Canadian energy giant.

Delving into the details, we see that Suncor Energy’s production averaged 771,000 barrels per day in Q2, which was up nicely versus the previous year’s quarter, during which Suncor had produced around 742,000 barrels daily. This makes for a growth rate of 4%, which is a compelling result. Production levels were down slightly compared to the first quarter of the current year, but this was to be expected due to turnaround activity at Suncor Energy’s Oil Sands Base bitumen asset. Meanwhile, production of synthetic crude oil was down slightly as well, with planned maintenance being the key factor. With these headwinds having passed now, Suncor Energy is positioned to deliver even better production numbers during the second half of the year. Production should be up nicely thanks to the company’s increased interest in the Fort Hills oil sands asset and due to strong production levels at Firebag. Overall, Suncor Energy plans to grow production by around 100,000 barrels per day between 2023 and 2026 — this would be quite attractive, and yet, at the same time, the goal seems achievable, considering SU’s solid performance so far this year.

Despite turnaround activity, Suncor Energy generated highly appealing cash flows during the most recent quarter. Operating cash flow stood at CAD$3.83 billion, which was up by more than CAD$1.0 billion on a year-over-year basis. While Suncor Energy reinvests some of that cash in its business, in order to maintain existing assets and to hit its production growth goals, there is ample cash left over for other purposes. After accounting for capital expenditures of CAD$2.05 billion, Suncor Energy had around CAD$1.8 billion of free cash flow left over to pay for shareholder returns and to reduce debt levels.

During the most recent quarter, Suncor Energy used CAD$1.5 billion of its free cash flow for shareholder distributions, with a little more than half of that going to dividends, while a little less than half of that (CAD$700 million) was paid out via dividends. At current prices, this makes for a dividend yield of around 4.2%, while the buyback yield is around 5% per year. Reducing the share count by 5% per year will result in a huge boost to per-share metrics such as earnings per share and cash flow per share. For perspective, Apple’s (AAPL) famed buybacks are currently running at a pace of around 3% per year, meaning Suncor Energy’s buybacks are way more effective.

So far this year, Suncor Energy has reduced its net debt by CAD$800 million, bringing the net debt level to CAD$9.05 billion as of the end of the second quarter. Suncor’s goal is to reduce net debt to CAD$8.0 billion. Based on the H1 net debt reduction pace, Suncor Energy could hit this goal in the first quarter of 2025, but we might even see the goal being hit during the current quarter, Q4, thanks to higher production in H2, which should be positive for cash flows. But even in a scenario where it takes a little longer, Suncor Energy will hit its net debt target in the foreseeable future. At that point, the company will not reduce its net debt further, and will instead amp up its shareholder returns further (now at 75% of free cash flow). This will most likely happen via more buybacks, especially at the current undemanding valuation. Investors got a nice shareholder yield from Suncor Energy in H1, but things will improve further — from a shareholder payout perspective, the best is thus yet to come.

Is Suncor Energy A Good Investment?

Like all other energy companies, Suncor Energy is dependent on oil prices to some degree. While the company generated positive cash flows even in 2020, cash flows were much lower back then — if oil prices were to crash, Suncor Energy’s results would be weaker than today. Lower oil prices are thus a risk, and with a slowdown in China and a potential recession in the US, there are macro issues that might cause lower oil prices in the future. That being said, there are also factors that could result in higher oil prices, and even if oil prices were to pull back, I do not believe that we would see COVID-level oil prices. After all, that was much more than a normal recession due to lockdowns, broad travel restrictions, and so on.

SU is not risk-free, but there are many things to like here: Production is growing nicely, debt is being paid down, shareholder returns are strong and will improve further, and Suncor Energy also is quite inexpensive: Based on current forecasts, the company trades at an enterprise value to EBITDA ratio of just 4.8, which is very undemanding.

Likewise, the free cash flow multiple is pretty low as well — Suncor trades at CAD$67 billion right now, while free cash flows over the last four quarters totaled around CAD$8.5 billion, which makes for an excellent free cash flow yield of 13%.

Overall, I think that Suncor Energy is thus a very attractive pick at current prices for those who want energy exposure and/or a pick with great shareholder returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!