Summary:

- Suncor Energy’s Q3 2024 results exceeded expectations with net earnings of CAD 2.02 billion, reflecting strong operational efficiency and stable oil prices.

- The company increased its quarterly dividend to CAD 0.57 per share, demonstrating a commitment to shareholder value and financial health.

- Suncor remains undervalued with improved valuation ratios, making it an attractive investment in the energy sector with a strong dividend yield.

- Despite inherent risks, Suncor’s diversified portfolio and strategic investments in sustainability position it well for future growth and stability.

dan_prat

Introduction

In my last article, I discussed the incredible performance of Suncor Energy (NYSE:SU) (TSX:SU:CA) in Q2 2024. Its Q2 performance was good, and its valuation ratios showed significant undervaluation. But now, the numbers show a better picture than before.

Since then, Suncor has kept streaking, posting strong third-quarter results and increasing its dividend. The company’s resilience and its continuing commitment to generating value for its shareholders are among these developments. The company is still undervalued with better performance reflecting a perfect time in my opinion. Now, let’s look into SU’s latest performance and what that means for investors. Suncor Energy is a huge company in the oil and gas sector, hanging between operational resiliency and strategic investments in sustainability.

Q3 Highlights

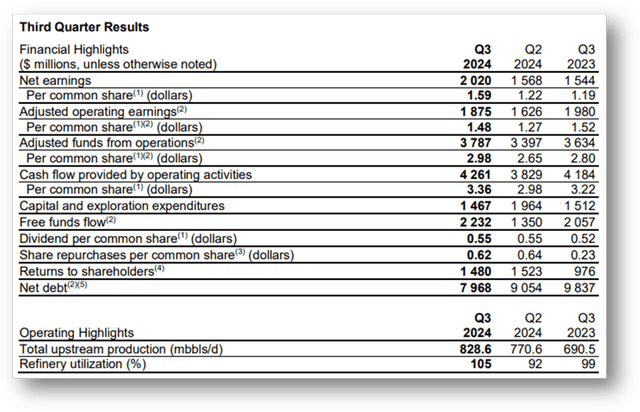

Suncor’s results for Q3 2024 were significantly positive and beat expectations thanks to the company’s ability to ride out market volatility while maintaining huge operational efficiency. According to the company, net earnings were CAD 2.02 billion, up from CAD 1.57 billion in the second quarter of 2024. Oil prices are stable and production volumes and sales are strong, driving this growth, as are Suncor’s revenue streams. Suncor has maintained high refinery utilization rates operationally at 105% versus 92% in the previous quarter. This increase indicates that the company can continue to maintain steady downstream operations while optimizing its abilities. In addition, Suncor’s free cash flow climbed to CAD 2.32 billion in Q3 and is ample to invest more and pay for shareholder returns.

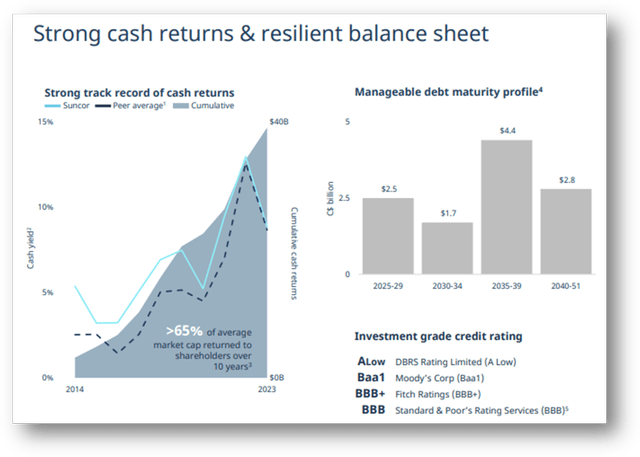

The continued enhancement of cash yield reflects Suncor’s focused efforts on cash returns. This indicates that the company is keen on its capital return plan; in the previous ten years, it has paid out more than 65% of its market capitalization in dividends to shareholders. The company’s strong trust-worthiness with investors is due to its steady dividend payout (CAD 0.55/share), along with the substantial buybacks.

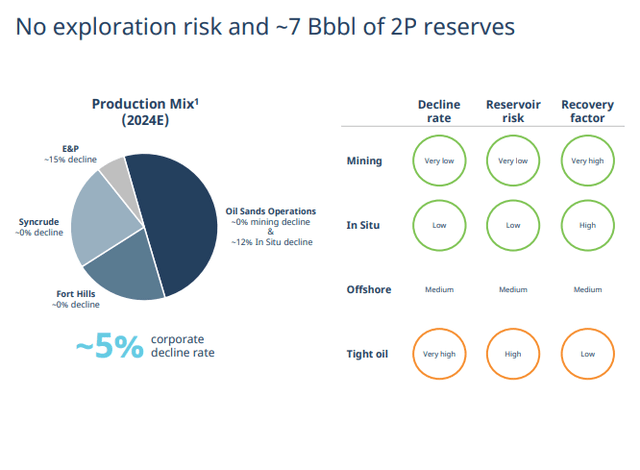

SU’s production portfolio is very stable and reliable with a low corporate decline rate of 5% for 2024. In Situ Operations, with a 12% decline that is modest enough for efficient and steady operations, are possible even in these conditions. Inside E&P, the decline was higher at 15%, but the company’s continued focus on its strong oil sands business is driving consistent and predictable production and returns. That balance is comforting for investors who need stability and value in the energy market and makes Suncor a place to hide among the energy stocks.

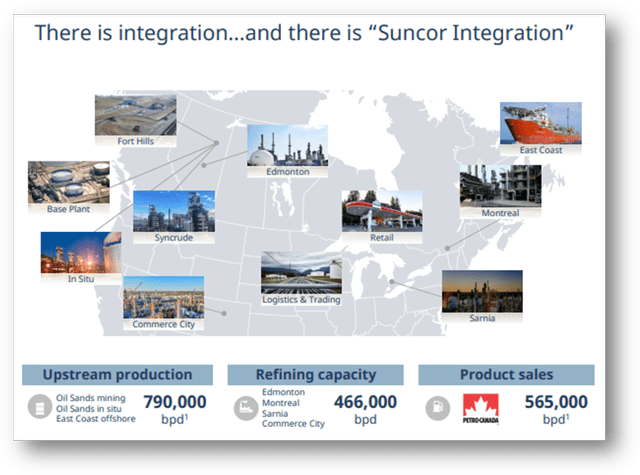

Achieving a critical strategic edge in a market that sees considerable energy price fluctuations is made possible by Suncor’s integrated vertical model. This integration also helps Suncor have a stable margin since it can profit from differences in crude oil prices and refined products. A varied series of assets reflects the successful transportation and marketing system of the company, pointing out the efficient delivery and marketing of the products while lessening risks in certain sectors or businesses.

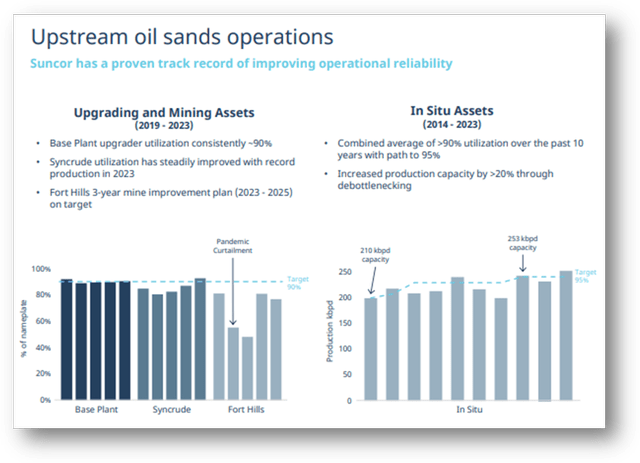

For upgrading and mining, Suncor demonstrates robust performance, with its base plant showing a steady 90% utilization and Syncrude achieving record production in 2023, which has improved from past years. After achieving >90% usage throughout the previous decade, Suncor plans to accomplish a 95% objective throughout Situ Asset. The improved production capabilities of the enterprise show how well it supervises its operations. The improved production capabilities of the enterprise show how well it supervises its operations.

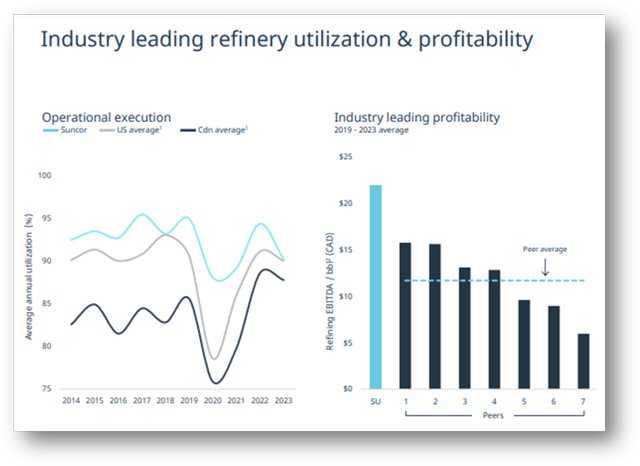

Suncor has retained an operational edge, typically exceeding the averages for the U.S. and Canada in refinery utilization, particularly during periods of volatility (such as the pandemic). The profit chart unambiguously shows that Suncor’s power lies in its accrual of EBITDA, consolidating its position as a leader in the market. A strong profitability relative to other businesses introduces a durable competitive advantage, resulting in significant shareholder profits and safeguarding of stock value.

Valuation

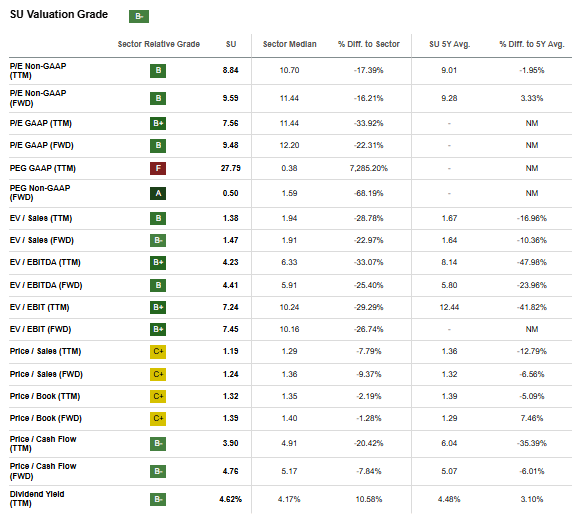

Last time when I wrote about Suncor, the company was trading at a sizeable discount to the sector with a trailing P/E GAAP of 8.74 (sector median 11.40) and a forward P/E GAAP of 9.96 (sector median 12.44). As of now, Suncor valuation ratios are more favorable and its trailing P/E GAAP is 7.56 (sector median 11.44) and forward P/E GAAP is 9.48 (sector median 12.20). I think this shows that the company is now trading at a more favorable trailing P/E ratio showing the investors trust in the company thanks to the oil price stability and increase in the sales.

Seeking Alpha

Its EV/EBITDA ratio has also shown significant improvement. The last time I wrote about this company, its trailing EV/EBITDA ratio was 4.74 (sector median 6.24) and forward EV/EBITDA ratio was 4.74 (sector median 5.93). But now these numbers have improved. Its current trailing EV/EBITDA ratio is 4.23 (sector median 6.33) and the forward EV/EBITDA ratio is 4.41 (sector median 5.91) showing a discount of 33% and 25%, respectively. This is due to the fact that the company has been successful in increasing its sales resulting in strong performance in the third quarter, thus improving its valuation.

Dividend yield has also improved since the last time when I wrote about it, it was 4.31% with the sector median of 3.64%. As of now, its dividend yield is 4.62% with sector median at 4.17%. Suncor has recently announced to increase their dividend by 5%. This shows their commitment to delivering value to their shareholders when the company’s performance is strong. All these numbers show that the company is undervalued than before and its income statement shows a strong performance reflecting a strong bullish case.

Another Dividend Increase

Suncor announced an increase to its dividend in a move which has delighted shareholders. On 12th November, the company raised its quarterly dividend to CAD 0.57 per share. Suncor’s strong cash flow and pledge to return value to its investors is why this hike reflects it. The decision hews to the past few years of Suncor management’s strategy of getting dividends and buybacks right while staying financially conservative and providing rewards to shareholders. As a result, Suncor is now a reliable and attractive energy sector investment with a recent dividend boost and continued buyback program. Suncor’s buyback program tells the market that the stock is cheap, which would increase investor confidence and, hence, raise the stock price. Especially at times of high oil prices, this approach appeals to a wide spectrum of investors by complementing Suncor’s already high dividend yield and offering consistent income and capital appreciation, thus improving general shareholder returns.

Future Outlook and Corporate Guidance

Suncor released its corporate guidance for 2025 which outlines a strategic path to future growth and sustainability. Accordingly, the company aims to produce between 810,000 and 840,000 bbls/d of oil annually. Suncor also says it will increase annual refining utilization from 93% to 97%, thanks to stronger asset performance and a strengthened market position. Captured in their disciplined capital program are high-quality strategic investments: the Upgrader 1 coke drum replacement at Base Plant and the Mildred Lake West Mine Extension and West White Rose projects. Suncor aims to spend a lot on renewable energy projects, a trend followed by the world in its desire for cleaner ways of energy.

Risks

Suncor has done well, but it comes with inherent risks. Because the company is so dependent on its oil sands operations for growth, it has become vulnerable to environmental regulations and carbon costs. Also, geopolitics that affects transportation infrastructure, for example pipelines, could affect Suncor’s ability to get products to market. Of course, market volatility and rising and falling oil prices present major risks as well. Suncor’s resilience has obviously shown itself, but a sharp dive in commodity prices could affect profitability and cash flow, which might affect dividends and the ability of shares to perform.

Conclusion

Flowing well, Suncor Energy is providing strong operational performance and shareholder value. Its impressive Q3 results, coupled with the increased dividend, show it has robust financial health and growth strategy. I believe that the risks of the oil and gas industry are there, but Suncor is responding with measures in place and a diversified portfolio. The latest performance of Suncor Energy will be encouraging for investors seeking a balanced investment in the energy sector. However, the company’s ability (or rather the likelihood) to deliver consistent earnings, grow dividends and maintain high operational efficiency, proves the company’s mettle as the leader of the industry. That’s why I maintain my “Strong Buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.