Summary:

- Suncor’s stock price is currently range-bound, in correlation with the oil market, trading at $30-$40/share, as oil trades in the $60-$90/barrel range.

- In the shorter term there is a great deal of global oil supply/demand balance uncertainty, which could cause the market to sink, or break past the upside of the range.

- For the longer term, Suncor is a must-own for me, due to its ample upstream reserves, and production increase potential, within a world that is seeing dwindling oil exploration results.

- I plan to hold within the current range of $30-$40/share, sell incrementally once the price rises above $40/share, and buy in case it drops below $30/share while maintaining a significant position in Suncor stock for the foreseeable future.

dan_prat

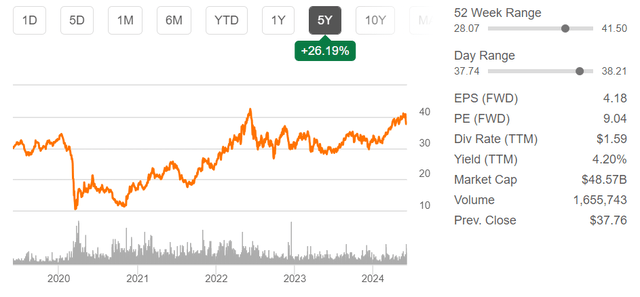

Investment thesis: Suncor’s (NYSE:SU) stock price seems range-bound in the shorter term, in the $30-$40/share range for the past two years, and it correlates with oil prices hovering in the $60-$90/barrel price range for the same period. I expect this correlation to last longer for a while, so I currently see this stock as a hold. For the longer term, I see Suncor’s stock as a good buy-and-hold due to its ample reserves and ability to increase production, even as its main industry peers mostly struggle to do the same. Given recent global oil discovery trends that fall far short of achieving reserve replacement, Suncor’s valuation versus its peers should see an improvement, as the market will eventually re-evaluate upstream production growth potential and ample reserves. While we wait for that to happen, Suncor is rewarding long-term shareholders with a generous dividend and stock buybacks.

Suncor’s recent financial results at a glance.

Suncor’s earnings before income taxes came in at $2.2 billion for the first quarter of this year. It is down significantly from the same quarter of last year when earnings before taxes were $2.7 billion. The drop in earnings comes despite a healthy pace of upstream production growth of about 15% for the same period. The decline is not attributable to oil market fluctuations, since oil prices were more or less comparable for the quarters in question. It seems that Suncor’s operations were just less profitable. Capital expenditures increased by $200 million compared with the same quarter from a year earlier, which is explained by a path of rising production that can hurt profit margins.

Suncor’s total debt increased from $15.41 billion at the end of last year to $15.95 billion at the end of the first quarter. Given the current high-interest rate environment, it is a significant leap at a bad time. With interest rates rising, increasing debt levels can lead to interest expenses spiraling out of control, eating into Suncor’s profit margins. The situation is not currently critical, with net interest expenses in 2023 coming in at $543 million, about 15% less than its net interest expense in 2022. Given that gross revenues came in at $52 billion in 2023, its interest to revenues ratio is about 1% which is very manageable, as of last year. I tend to worry once interest costs rise to about 5% of revenues on a sustained basis because it eats into profits and internal financial resource generation.

Ample reserves provide the basis for long-term production growth

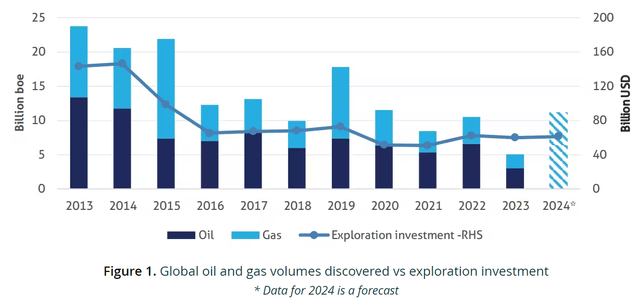

Last year, global conventional oil discoveries amounted to about 3 billion barrels.

For reference, Suncor has about twice as much in total oil reserve volumes. At the end of the first quarter of this year, it reported 26 years of reserves at current production rates. As I pointed out in previous articles, I find Suncor’s relatively superior reserves situation, about 7 billion barrels last year, to be its most attractive feature, contrary to the emerging dominant hypothesis, namely that oil reserves might soon become stranded assets. The world is currently producing about 30 billion barrels of crude oil per year, therefore conventional reserve replacement amounted to about 10% of that volume.

According to even the most pessimistic major institutional forecasters, global demand is still forecast to increase, as I pointed out in a recent article, while major oil companies that are still able to increase production are becoming scarce.

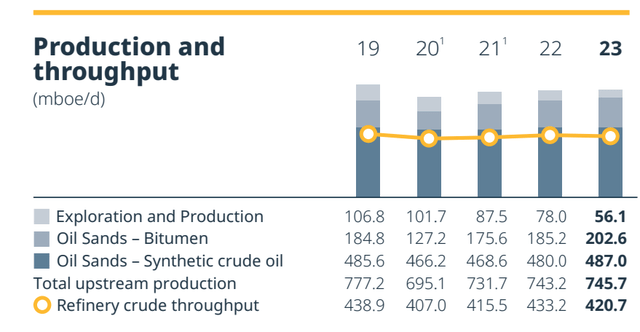

This year’s upstream production is estimated to be 6% higher compared with 2023, which could be an all-time high for Suncor if it comes in on the higher end of the estimate. In 2023 Suncor’s total upstream production was still 4% below 2019 levels as the chart shows.

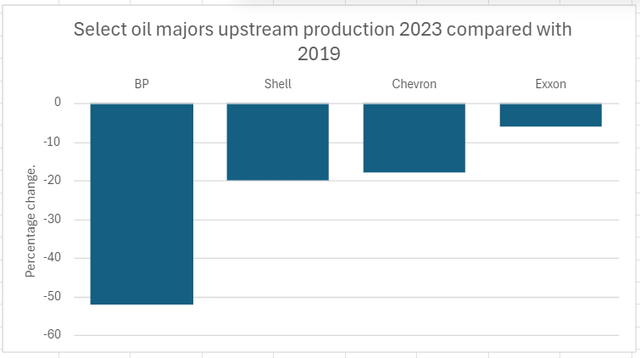

By comparison, many of its oil major peers are seeing a decline in upstream production compared with the end of last decade. In the case of some oil majors, the decline in production has been spectacular, but it should be noted that the loss of their shares in Russian projects had a significant role to play.

Data sourced from multiple sources.

If one believes in the peak oil demand theory, it can be argued that Suncor’s ability to reach new all-time highs in upstream production, as it is forecast to do this year, should not lead to higher valuations relative to its peers. The market seems to agree with the hypothesis, given that Suncor’s forward P/E ratio of just under 9 is mostly in the middle of the crowd compared with the above-mentioned peers. Shell (SHEL) has a forward P/E ratio of 8.5, whereas Exxon (XOM), the only company that almost matches Suncor in upstream production growth, has a higher P/E ratio of just under 12. Chevron (CVX) has a forward P/E ratio of just under 12, whereas BP (BP) has the lowest P/E ratio among this group at about 7.7.

My take on this aspect of market valuation of oil companies is that companies with better upstream production prospects should be evaluated higher relative to peers. This should become ever more obvious as certain factors, such as the global EV market stalling out recently might suggest that it will not have the expected detrimental impact on oil demand that the market expects. The only factor that I see as able to stem global oil demand growth at this point is a sustained downshift in global economic growth to an average of less than 2% per year from the recent average in the 3% range.

Within the context of dwindling global oil discoveries, and continued demand growth, companies with higher viable oil reserves should arguably benefit from a higher level of valuation. Compared with Suncor’s 26 years’ worth of reserves, Shell has about a decade, while BP has about nine years in total upstream reserves. Exxon has almost 17 billion barrels in oil equivalent in reserves, which is enough to last it for about 13 years at a rate of 3.74 mb/d. Chevron is currently producing 3.1 mb/d in oil equivalent and it has 11.1 billion barrels in upstream reserves, which amounts to about a decade’s worth of reserves. It should be noted that both American companies have better reserve replacement prospects compared with their European peers, thanks to their growing shale portfolios, where new acquisitions as well as upgrading of already existing resources to proven reserves can potentially help them to maintain the current status quo in terms of reserves & production, and perhaps even grow production going forward.

There are other considerations aside from the upstream segment of the business when it comes to evaluating integrated oil majors. There are also non-hydrocarbon-related factors such as Shell’s ambition to become Europe’s largest green hydrogen supplier, which should arguably be factored into one’s comparative analysis of valuations. At the same time, the continued dilution of the magnitude of the upstream segment of the business relative to other segments that we see with companies like Shell puts into question the continued correlation of their stock price movements with oil price movements. As a long-term bet on higher oil prices, Suncor as well as other oil sands peers such as CNQ (CNQ) that I also have in my portfolio, both offer prospects of rising production, which can amplify the impact of higher oil prices.

Recent global oil market developments.

As things stand right now, OPEC + seems determined to maintain its current rate of production, which in theory should be positive for oil prices. On the other hand, economic indicators, ranging from downward GDP revisions in the US to the recent weekly EIA reports that show a trend of building crude and product inventories, suggest that as of right now there is enough slack in the global oil markets

If the US & the global economy continue to show signs of weakness in the coming months, we could see further inventory builds that have the potential to push the market to temporarily dip below the $60/barrel level. I need to emphasize the very temporary nature of any such dip in prices, because based on recent history, oil prices below the $60/barrel level tend to trigger supply destruction, especially in North America, where the upstream segment of the industry is dominated by unconventional shale and oil sands.

OPEC continues to be bullish on oil consumption growth for the third and fourth quarters of this year, despite ample signs that suggest that there might be some demand weakness. On the supply side, EIA data suggests that since last fall, US production has been stagnant. This is important because most major institutions are forecasting continued robust production growth in the US shale patch. The US shale industry added more to global supply capacity in the past decade than all other sources of global oil supply combined. If it turns out that US shale supply growth is stagnated, the global oil markets may experience tightness, despite global demand slowing.

Investment implications.

- Suncor stock is a long-term buy, but in the shorter term, its stock is a hold as it is range-bound in the $30-$40/share range, in correlation with oil prices being stuck in the $60-$90/barrel range.

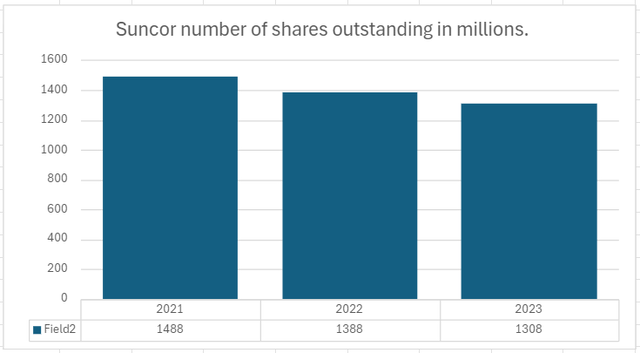

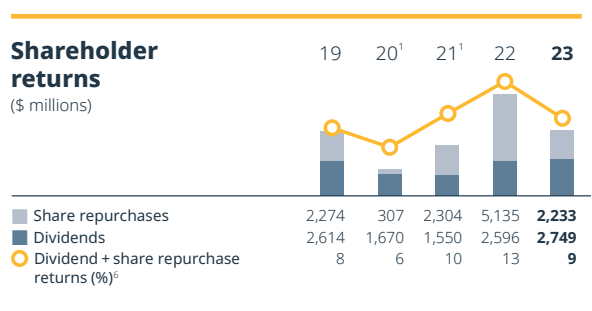

In a best-case scenario for Suncor’s long-term prospects, higher oil prices will accompany higher production, which can positively impact financial results going forward. Earnings per share should improve to a greater extent than overall company results, given Suncor’s efforts to reduce the number of shares outstanding.

Aside from stock repurchase efforts that provide investors with extra value on their long-term stock position in Suncor, the dividend currently yields over 4.2%, generating extra long-term benefits to one’s investment position in this stock.

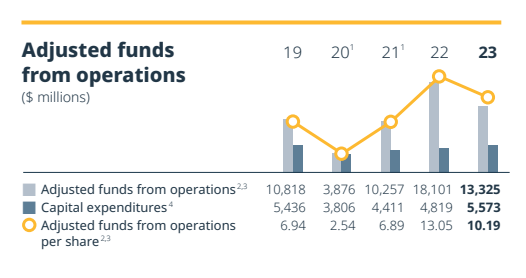

For a glance at whether the dividend and stock buybacks are sustainable, we can consider Suncor’s Adjusted Funds from Operations, versus the costs of the dividends & stock buybacks for 2023.

Suncor

2023 should be a good representative year in this regard because the oil market, being range-bound for the past few years with WTI trading mostly in the $60-$90/barrel range seems to indicate that it is the current price range that we should expect when the supply/demand situation is more or less balanced.

Suncor

Looking at the Adjusted Funds from Operations, which takes into account what is left over after capital expenditures as well as maintenance costs, it is more than adequate in covering the costs of the shareholder returns for the year. I like this measure because it also involves an inclusion of capital expenditures in the mix. This shows that Suncor can meet shareholder return costs as well as capital expenditure needs meant to keep Suncor on track for production growth in what we might reasonably consider to be a typical or average year in terms of oil prices going forward.

I held Suncor stock continuously since 2015. I bought some along the way and sold some, but it is my longest continuous position in a stock and is by far my largest current stock position. My lowest purchase price was $16/share, and my highest was $31/share. I recently sold a small amount of Suncor’s stock as the price went over $40/share, mostly focusing on reducing my position in the shares I bought at a higher price.

Suncor stock price & other metrics (Seeking Alpha) WTI oil price (Seeking Alpha)

If one looks at Suncor’s stock price evolution so far this decade, its price surpassed $30/share in early March 2022, just as the price of oil was starting to establish a solid foothold above $60/barrel. More recently, as the price of oil surpassed $85/barrel, so did Suncor’s stock move above $40/share. Oil prices have been range-bound around the $60-$90/barrel range for over two years now, and Suncor’s stock price has been range-bound in the $30-$40/share range in correlation with the oil markets. As long as the current market conditions persist, I see Suncor as a short-term hold, keeping a lookout for any dips below $30/share as a buying opportunity, and a move above $40/share as an opportunity to take some profits. It is a change from my last article, where I had Suncor as a buy in the low $30s/share range because I believe that there is a very real chance that we will remain range-bound for a while longer.

- Risks to my thesis.

One of the main reasons why BP saw its upstream production slashed in half this decade is because of its Russia exposure. Other oil majors were less impacted, as they had less exposure to Russia. Suncor did not have any Russia-related exposure, so it was spared. Suncor does not carry significant geopolitical risk, unlike most of its oil major peers, since it is mostly operating in Canada. The ongoing issue to watch as a risk factor for Suncor has to do with domestic politics, as well as internal pressures to reduce pollution from its operations.

A potentially new emerging political risk that I do not believe is on the market’s radar is Canada’s worsening economic & fiscal situation. Given increasingly hard choices, I do believe that a politically convenient answer might be to raid the country’s mining sector for more revenues, which can change the outlook for Suncor’s future financial results. The recent decision to increase capital gains taxes may be an early indication of an emerging political environment that may not be beneficial to most mining as well as non-mining companies in Canada.

There are other potential risks, both external as well as internal that one could argue to be of relevance. For instance, my thesis of a price spike being temporary might end up being wrong, if the increase ends up taking on a more permanent shape, in which case, the current holding pattern for Suncor’s stock price in the $30-$40/share range will prove to be a buying opportunity missed.

Impediments to continued production growth, ranging from higher costs of production due to factors such as declining resource quality, or rising costs of environmental measures can also be considered a potential long-term risk. In its 2023 annual report, for instance, Suncor highlighted its efforts to use cogeneration for energy needed to produce steam needed for in-situ extraction, while for the longer term, it intends to invest in carbon capture facilities to work toward a net zero emissions goal by 2050. It remains to be seen how much these efforts will cost.

If I were not already heavily invested in Suncor and more broadly in oil sands, I would probably be a buyer at the current stock price levels in the upper $30s/share. My long-term thesis for Suncor assumes that its potential for higher production volumes, while many of its peers are struggling to maintain production will eventually be recognized by the market as an advantage over other oil majors and it will reward it accordingly. In conjunction with my positive long-term outlook for oil prices, Suncor’s stock price should see significantly higher levels from here. At the same time, I also see a decent chance in the shorter term of revisiting the $30/share level or lower periodically, for relatively short durations, in correlation with significant dips in oil prices. As someone who is already heavily invested in this stock, I can afford to wait for a better buying opportunity, without worrying much about potentially missing out.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SU, CNQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.