Summary:

- Suncor Energy showcases operational efficiency, impressive cost controls, and strong shareholder returns, making it a standout in the energy sector with significant upside potential.

- The company boasts record-breaking refining throughput, a 26-year reserve profile, and mostly zero decline rates, providing stability and growth potential.

- Suncor’s strategy of combining dividend growth with substantial buybacks enhances per-share value while maintaining financial flexibility.

- Despite oil price challenges, Suncor’s attractive valuation and efficient operations make it a compelling investment, warranting a Strong Buy rating.

ImagineGolf

Introduction

A few months ago, The Wall Street Journal wrote an article titled “Forget Shale: Canada’s Oil Sands Are Having Their Moment.” As some of my readers may recall, this is a topic I have discussed in many articles as well, as it is very critical to understand the increasing importance of Canada’s oil and gas resources in an environment where the U.S. shale revolution is running out of steam.

Essentially, there are a few things to keep in mind when it comes to the difference between Canadian oil sand operations and American onshore shale oil.

- Oil sands are a mixture of sand, clay, water, and bitumen, which is a thick, heavy oil that needs to be processed before it can be used.

- Shale oil is crude oil trapped in shale rock formations. It’s extracted using hydraulic fracturing (fracking).

Oil sands are mining operations that require big trucks to haul sand to processing facilities. Besides the oil quality, the biggest difference is that these mining operations require billions in upfront spending. This includes extensive infrastructure, mining trucks, and everything that comes with building large-scale mining operations.

Chevron Corporation

While these operations may come with more upfront costs, they also have major benefits. One of the biggest benefits is longevity. Canada is home to some of the world’s largest oil and gas reserves in its Western Canadian Sedimentary Basin. I added emphasis to the quote below:

With estimated reserves of about 164 billion barrels, the Canadian oil sands are among the largest oil deposits on the planet. They are so large that Canada ranks third behind Venezuela and Saudi Arabia in terms of oil reserves. The oil sands are a significant part of Canada’s oil production. – CAPP

Additionally, once these mines are operational, upkeep costs are rather low, supported by zero decline rates. For example, in U.S. shale operations, wells quickly lose pressure, which requires new wells to be drilled. It is much easier to maintain mining operations, which often comes with very favorable breakeven costs for operators.

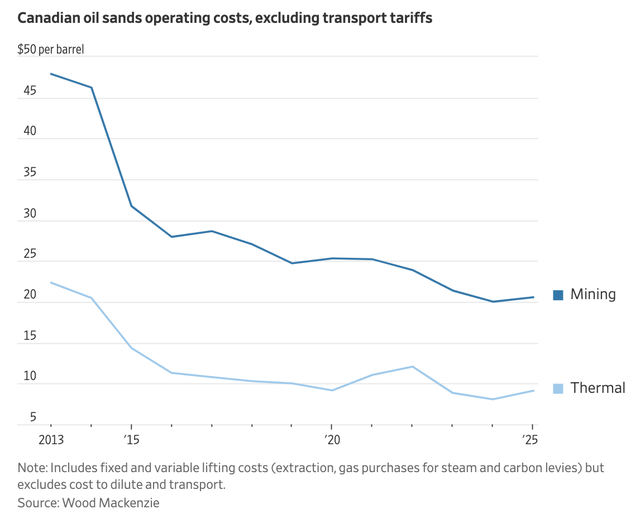

The aforementioned Wall Street Journal article noted that operating costs per barrel have declined by roughly 19% over the past five years. Since 2013, mining costs have declined from almost $50 to roughly $20 per barrel. Thermal oil sand operations are even cheaper. These are operations where steam is used to extract oil in places that are hard to reach.

It also helps that exports get more support from pipelines like the Trans Mountain Pipeline, which improves Canada’s access to export markets and reduces the discount of Canadian oil compared to other benchmark prices.

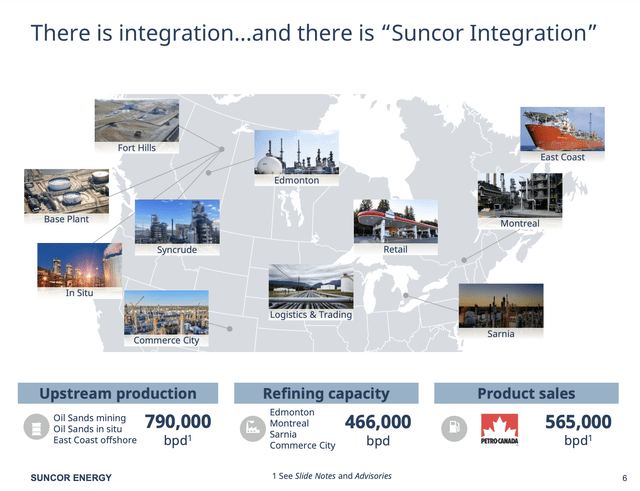

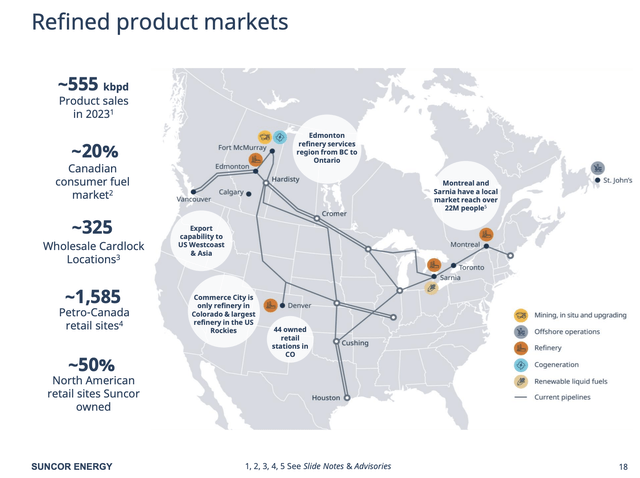

With that said, Suncor Energy (NYSE:SU) is one of the nation’s largest oil producers. The company has upstream (production) capabilities of roughly 790 thousand barrels per day, refining capacities (downstream) of 470 thousand barrels per day, and commercial operations that operate under the Petro-Canada brand, selling up to 565 thousand barrels per day.

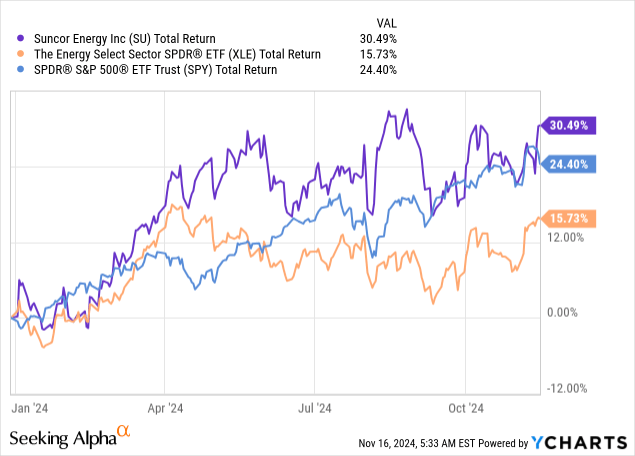

My most recent article was written on September 12, when I called it “A High-Yield Oil Play Too Good To Ignore.” Since then, shares are up 11%, beating the energy ETF and the S&P 500 – despite oil price weakness.

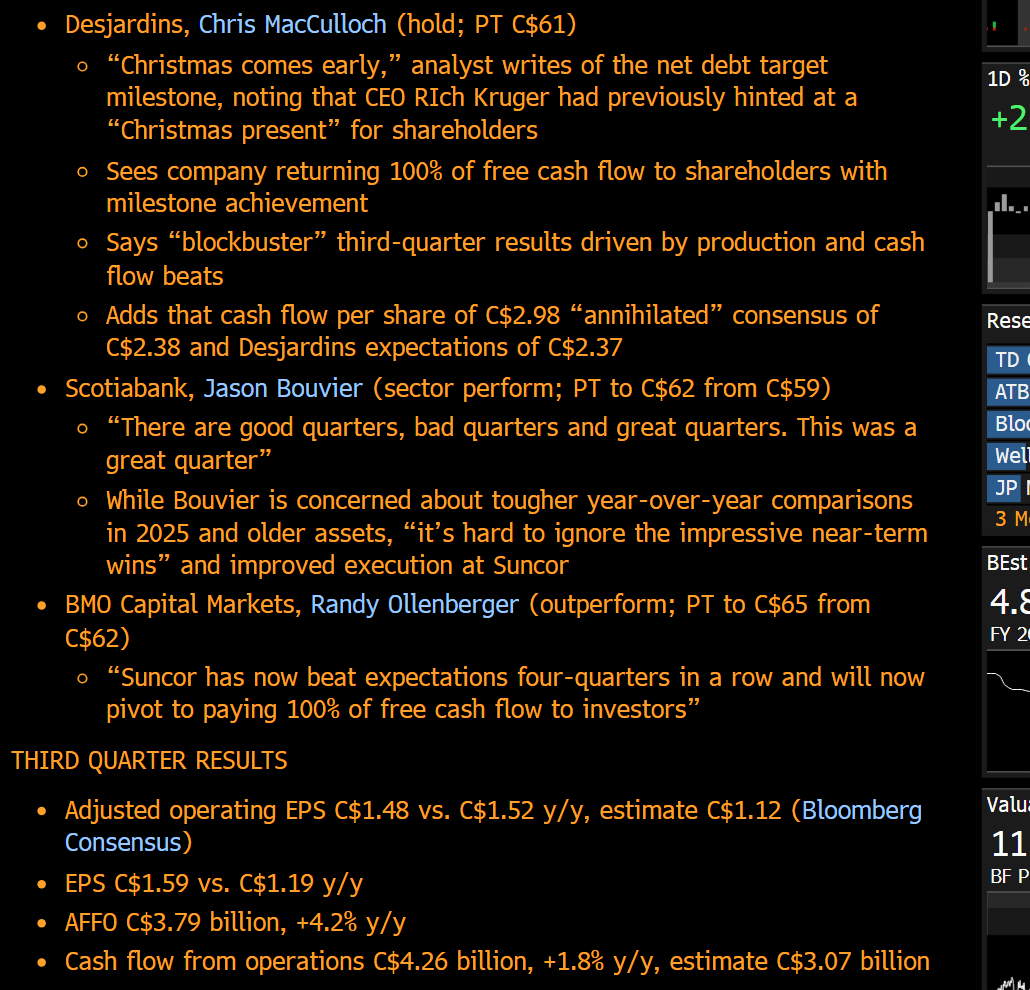

Since then, the company has reported its 3Q24 earnings. These were nothing short of fantastic, as it improved its operations, reduced its debt, and hinted at extremely favorable shareholder returns. This also caused analysts to become very upbeat.

In this article, I’ll update my thesis and explain why Suncor remains one of my best ideas in the energy industry.

So, let’s get to it!

Suncor Is Firing On All Cylinders

The only reason I do not own Suncor is because I own its bigger peer, Canadian Natural Resources (CNQ). When I bought CNQ, I preferred it over SU because I already had refining exposure back then.

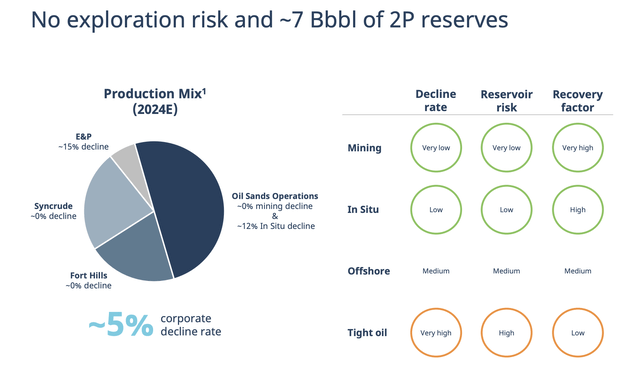

That said, just like Canadian Natural, Suncor has fantastic operations. As we can see below, it has a corporate decline rate of just 5%, as the vast majority of its operations have zero decline rates. It also has no exploration risks and seven billion of 2P (proven + probable) reserves. Based on its current output this gives it a reserve profile of 26 years without any new discoveries.

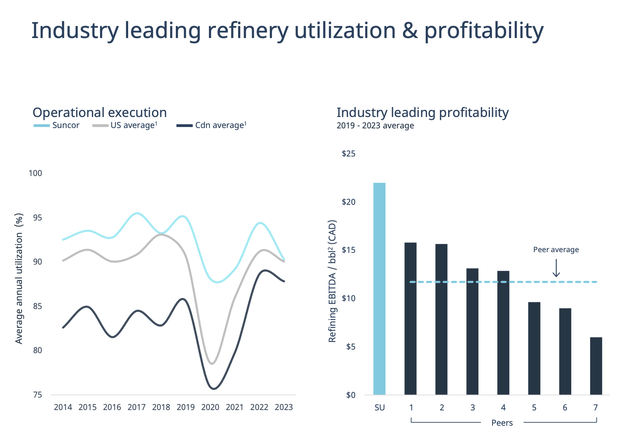

The best thing is that these operations are very efficient. For example, in its refining operations, 3Q24 throughput reached 488 thousand barrels per day, the highest in the company’s history and 5% higher compared to 3Q23. It also achieved the best utilization rates ever, with an average of 105%.

Needless to say, this is a fantastic result, as the year-to-date number remains close to 100% as well. The company has clearly proven it was able to turn around its refining assets. As one can imagine, this improves the company’s ability to effectively sell its refined oil products.

Year-to-date utilization is 98% compared to 88% at the same time last year. We’re on pace to blow away our previous high. High reliability and resulting throughput enable us to confidently and aggressively market and sell. The result refined product sales of 612,000 barrels a day in the third quarter, the highest quarterly sales in our history in our first quarter ever with sales above 600,000 barrels a day. For those that are keeping track, this is now back to back to back record quarterly — our quarterly records. – SU 3Q24 Earnings Call (emphasis added)

Suncor has built a leading refinery portfolio, including peer-beating margins and elevated utilization rates.

These assets also have a great footprint in high-demand markets, including the U.S. West Coast and Asia through maritime exports, the U.S. Rockies, and the Midwest/NorthEast.

In its upstream operations, the company boosted 3Q24 output by 20% to 829 thousand barrels per day. That’s a new record and comes with a C$340 million year-to-date decline in operating, selling, and general costs.

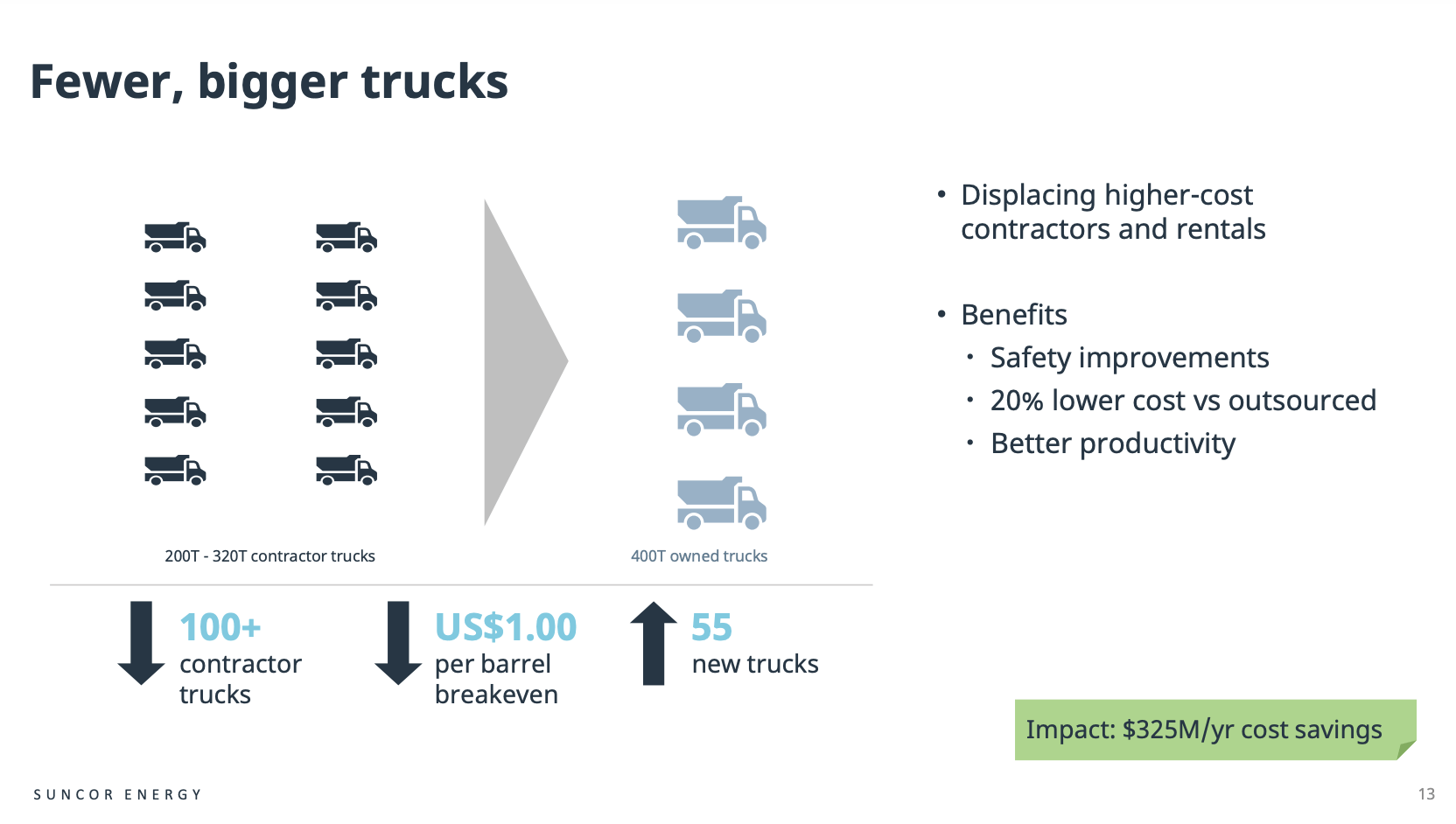

On top of that, total maintenance turnaround spending is expected to be 20% below its five-year average, another sign that Suncor has been in control of its operating profile. To maintain high operating efficiency, it introduced 55 of the new 400-ton autonomous trucks that are expected to reduce annual operating costs by more than C$300 million. This translates to roughly $1 per barrel, which is a big deal.

Suncor Energy

All of this bodes well for shareholders.

Shareholders Remain In A Great Spot

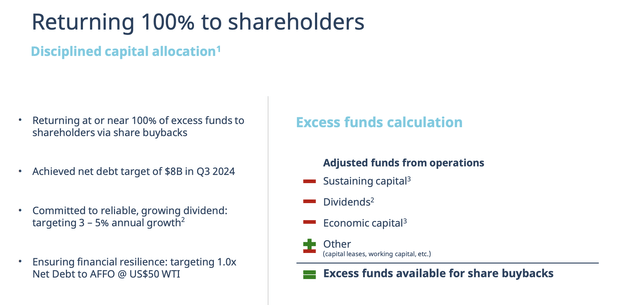

One of the most important things to mention is that Suncor achieved its C$8 billion net debt target ahead of schedule.

Hence, starting in 4Q24, the company will return 100% of its excess free cash flow to shareholders. That’s up from 50% at the start of 2024 and 75% after its Investor Day in May of this year.

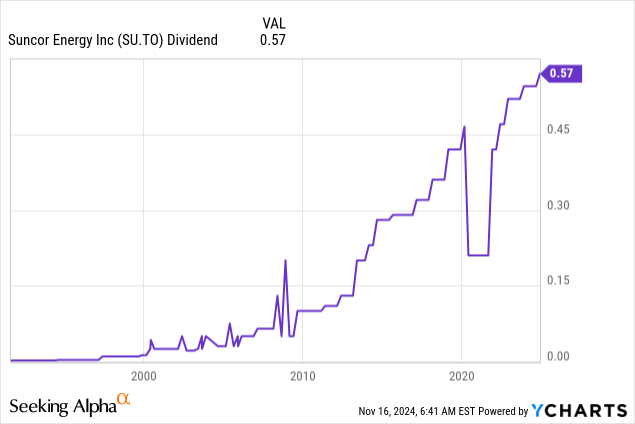

With regard to its base dividend, the company does not aim for the highest yield but prefers gradual dividend growth and stability. Essentially, the company integrates share buybacks as a complementary strategy to its dividend.

The dividend yield is 4.0% and is expected to grow by 3-5%.

During its 3Q24 earnings call, the company explained that by repurchasing shares at a rate equal to or exceeding the dividend growth rate, the company effectively strengthens its financial position.

This method reduces the number of shares and improves per-share dividend payouts while keeping the absolute dividend obligations manageable.

I believe this makes sense, as buybacks reduce the number of shares that require quarterly dividend payments. That way, the company can use buybacks to offset dividend growth, which is a very smart strategy that improves the per-share value of the business and leaves a lot of room for future dividend growth.

Moreover, after the company cut its dividend during the pandemic, I do not expect future cuts, even during recessions.

We look at the dividend as a commitment, an obligation. It’s in our breakeven. So in any business environment, we want to be that reliable and growing the mantra. So the dividend is extremely important to us. – SU 3Q24 Earnings Call

It also helps that SU equity is very cheap.

Valuation

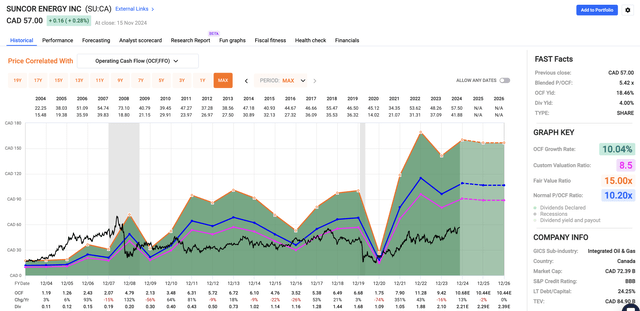

For 2025 and 2026, analysts expect Suncor to generate close to C$6.5 billion in annual free cash flow. That is roughly 9% of its current market cap. That’s a fantastic number in light of current oil price challenges.

These numbers also show how much buyback and dividend growth potential the company has, as its expected dividend payout ratio is below 50%.

Even better, using the data in the chart below, the company trades at a blended P/OCF (operating cash flow) of 5.4x. Even though analysts expect no per-share OCF growth through at least 2026 (this is ONLY based on the fact that analysts do not incorporate rising oil prices in their theses), the company is way too cheap compared to the 8.5x multiple I applied in prior articles. Most high-quality oil and gas stocks trade close to 9-10x OCF, which is a target I expect to apply to SU in the years ahead as well.

Hence, I give SU a price target of C$88, 54% above its current price.

The same applies to New York-listed shares, with the exception that these come with currency risks.

I also have to mention that I’m not the only one upbeat about Suncor, as analysts are extremely bullish, as we can see below:

Bloomberg (Via X @thecashman22)

Needless to say, I stick to a Strong Buy rating and believe this stock has a lot of room in the years ahead. While the current environment is tough, I like to buy high-quality value in energy, as long as the sector is unloved.

Takeaway

Suncor Energy remains a standout in the energy sector, showing operational efficiency, impressive cost control, and a strong commitment to shareholder returns.

It also has very deep reserves and extremely low decline rates.

Even better, its strategy of combining dividend growth with substantial buybacks improves the per-share value while maintaining financial flexibility.

Despite current oil price challenges, Suncor’s attractive valuation, efficient operations, and focus on long-term value creation make it a compelling investment.

That’s why I maintain a Strong Buy rating, believing Suncor has significant upside potential and remains one of the best opportunities in the energy sector for long-term investors.

Pros & Cons

Pros:

- Operational Efficiency: Record-breaking refining throughput and low-cost operations support Suncor’s industry-leading position.

- Longevity and Stability: A 26-year reserve profile and mostly zero decline rates provide reliability.

- Shareholder Focus: A 4% dividend yield, buybacks, and a commitment to return 100% of excess free cash flow bode well for the total return picture.

- Valuation: Trading at just 5.4x P/OCF, I believe Suncor is significantly undervalued.

Cons:

- Oil Price Dependency: Its performance is tied to oil prices, which remain unpredictable in the current macro environment – and volatile in general.

- Currency Risks: Non-Canadian investors face potential volatility from fluctuations in the Canadian dollar.

- Environmental Concerns: Oil sands operations are rather “dirty,” which could come with regulatory and reputational risks – although I expect no major headwinds as Canadian oil production is too critical.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CNQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.