Summary:

- Super Micro Computer offers a compelling risk-reward opportunity, driven by strong growth, discounted valuation, and potential regulatory resolution despite recent volatility.

- Key catalysts include the compliance plan submitted to Nasdaq, a Special Committee’s findings of no fraud, and solid partnerships, particularly with Nvidia.

- SMCI’s robust growth trajectory, highlighted by an 181% YoY revenue increase and pioneering direct liquid cooling technology, positions it well for future gains.

- Despite regulatory and margin pressures, my target price is at $48 per share, contingent on the company resolving current challenges and maintaining growth.

CasarsaGuru

Written by Robert Clark

Super Micro Computer (NASDAQ:SMCI), I believe, presents a compelling risk-reward opportunity for investors willing to stomach near-term volatility. The stock has experienced a dramatic decline of nearly 85% from its March 2024 peak of $118.81 due to a short seller’s report in August, primarily driven by concerns stemming from delayed financial filings and the resignation of its auditor Ernst & Young. While regulatory concerns and accounting issues have battered the stock down from its March 2024 high, I now see multiple catalysts that could drive a significant recovery:

First and foremost:

Super Micro Computer (SMCI) stock surged over 17% in extended trading on Monday after the company said it has engaged an independent auditor and submitted a compliance plan to Nasdaq. The company said it has engaged accounting firm BDO USA as its auditor, effective immediately.

The timing of this announcement is particularly significant as it came ahead of the November 18 Nasdaq deadline. According to Nasdaq listing rules, SMCI had 60 days from the September 17 notification letter to either file its Form 10-K or submit a plan to regain compliance. What’s crucial to understand is that if this plan is accepted, SMCI could be granted up to 180 days from the original 10-K due date to achieve full compliance. This extended timeline would provide the company with the necessary breathing room to address its audit requirements thoroughly.

More importantly, the recent conclusion of the Special Committee’s investigation, which has delivered several crucial findings. After a three-month investigation led by an Independent Counsel, the Committee explicitly stated that “the Audit Committee has acted independently and that there is no evidence of fraud or misconduct on the part of management or the Board of Directors.” This finding directly contradicts the serious allegations raised in Hindenburg Research’s August report.

Furthermore, the company’s relationship with key partners remains solid. Particularly noteworthy is SMCI’s continued strong partnership with Nvidia, which was confirmed during their recent earnings call. Michael Staiger, Senior Vice President of Corporate Development, explicitly stated that they’ve spoken with Nvidia (NVDA), who confirmed there have been no changes to allocations and that they maintain a strong relationship. This is crucial given the speculation about Nvidia potentially redirecting orders to other vendors.

The company’s fundamental growth trajectory remains intact, with preliminary Q1 FY2025 results showing revenue between $5.9 billion and $6.0 billion, representing an extraordinary 181% YoY growth. This growth isn’t just a one-time phenomenon, SMCI has demonstrated consistent revenue expansion with a three year CAGR of 61.35%. The growth is primarily driven by surging demand for AI infrastructure, evidenced by the company’s ability to ship over 100,000 GPUs per quarter and its successful deployment of the world’s largest direct liquid cooled (DLC) AI supercluster.

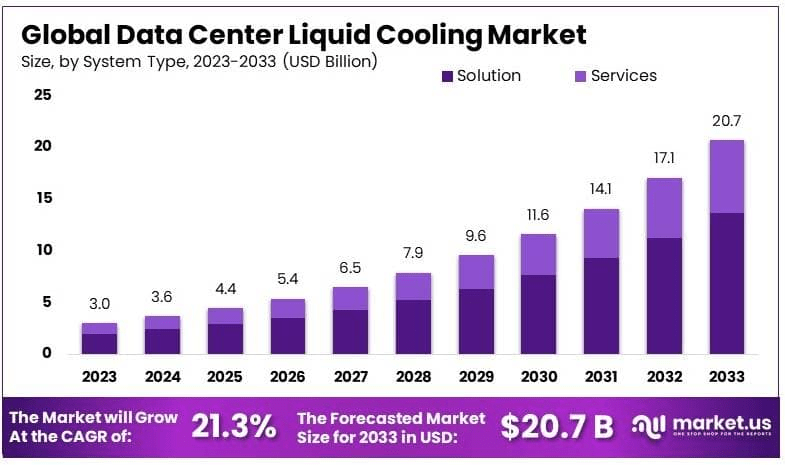

Additionally, the expected rapid adoption of liquid cooling technology in data centers, with SMCI projecting 25-30% adoption in new data centers over the next 12 months, positions the company to capture a growing share of this high-value market segment.

The combination of these developments, the Special Committee’s findings, the compliance plan submission and maintaining strong partnerships creates what, I believe, is a strong foundation for SMCI to move past its current challenges. I believe the risk-reward profile at current valuations is highly attractive for investors who can maintain appropriate position sizing and risk management strategies. The combination of strong fundamental growth, technological leadership and deeply discounted valuation metrics creates a compelling case for investment at current levels.

Discounted Valuation Metrics With Robust Growth Profile

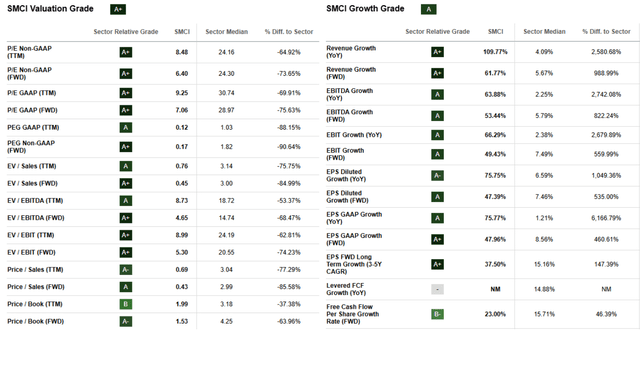

The main reason why I am willing to take risk at the current price point is that I think that the current valuation presents an exceptionally compelling opportunity, particularly when viewed alongside the company’s robust growth trajectory. Looking at key valuation metrics, SMCI currently trades at a forward P/E multiple of 6.4x, a striking 73.54% discount to the sector median of 24.2x. The P/S ratio tells a similar story, with SMCI’s 0.69x (TTM) multiple sitting 77% below the sector median of 3.0x.

These valuation metrics become particularly compelling when compared to direct competitors in the Technology Hardware, Storage and Peripherals industry. For instance, Dell (DELL) trades at a forward P/E of 16.73x and Hewlett Packard Enterprise (HPE) at 10.74x while both command significantly higher EV/Sales multiples of 1.23x and 1.25x respectively. Even accounting for the current regulatory uncertainty, I believe this magnitude of discount is excessive and fails to reflect SMCI’s market position and growth potential.

The growth profile of SMCI is what truly sets it apart from peers. The company has demonstrated exceptional revenue growth with a YoY increase of 109.77% compared to the sector median of just 4.02% representing an outperformance of over 2,600%. This growth isn’t a short-term anomaly; SMCI has maintained a remarkable three-year revenue CAGR of 61.35% demonstrating consistent execution and market share gains.

The company’s preliminary results for Q1 FY2025 further reinforce this growth narrative, with revenues between $5.9-6.0 billion marking a stunning 181% YoY increase. While this fell slightly short of the initial $6.0-$7.0 billion guidance, management attributed this primarily to timing issues around new GPU availability rather than any fundamental demand weakness. The sustained strength in AI-driven demand is evident in the fact that AI contributed over 70% of revenues across enterprise and cloud service provider markets during the quarter.

The combination of these deeply discounted valuation multiples alongside exceptional growth rates and solid profitability creates a favorable risk-reward opportunity. While the market has severely punished the stock for its regulatory challenges, the underlying business fundamentals remain remarkably strong. The current valuation implies that either the growth will dramatically slow or that regulatory issues will significantly impair the business scenarios, that, I believe, are overly pessimistic given the company’s market position and the continuing strength of AI infrastructure demand.

Supermicro’s Cooling Technology A Growth Catalyst For 2025

My prediction for 2025 is that Supermicro’s growth will largely hinge on its ability to capitalize on its direct liquid cooling (DLC) technology, a niche it has pioneered in the AI server market. As AI applications become more advanced, the need for efficient cooling solutions is paramount. GPUs are the core components that power these systems and generate a tremendous amount of heat. If not properly managed, this heat can lead to system failures and energy inefficiencies.

Market.US

Super Micro’s direct liquid cooling system claims to provide up to 40% energy savings and 80% space savings compared to traditional air cooling methods. This system is designed to handle the intense power demands of AI workloads, capable of cooling racks that exceed 100kW.

The ultra-dense servers can quadruple computing density within a 4U space, allowing for larger AI models to be run in a smaller footprint. This is particularly beneficial for data centers looking to maximize their space and efficiency. The package includes components like cold plates, Coolant Distribution Units (CDUs), and management software facilitating rapid deployment, often within weeks, of large-scale AI infrastructure.

What sets Supermicro apart from its competitors is its first mover advantage in deploying DLC at scale. While other companies like Dell are only now ramping up their efforts in this space, Supermicro has already been selling these systems for several quarters. The company announced in October that it’s shipping over 100,000 GPUs per quarter, many of them equipped with DLC technology for large data centers focused on AI workloads. This figure is impressive and underscores the high demand for its products.

Why DLC Could Drive 2025 Revenue Surge

The significance of this technology can’t be overstated. In my opinion, Supermicro’s early adoption of DLC gives it a crucial edge in the AI infrastructure market, which is growing at an unprecedented pace. AI data centers are looking for ways to optimize both performance and cost, and liquid cooling offers a solution to both challenges. It prevents overheating while also reducing energy consumption, which is a key concern for data center operators.

What’s particularly interesting here is that Supermicro isn’t charging a premium for its DLC systems, it’s offering them at the same price as its air-cooled systems. So, Instead of buying traditional GPU accelerated Air Cooled Systems, Data Centers can afford new advanced more energy efficient DLC Systems at the same price. This pricing strategy not only makes DLC more accessible to a wider range of customers but also helps drive adoption of the technology.

That said, it’s important to remember that while DLC is driving growth in terms of units shipped, it’s not doing much for the company’s gross margins. This is largely due to the fact that Supermicro isn’t making significant profits on the GPUs themselves. Instead, it’s generating revenue by integrating these GPUs into its custom-built servers and offering them at competitive prices. This is a classic low margin, high-volume strategy, and it can work well in a fast-growing market like AI.

Risk Factors

While I maintain a bullish outlook on Super Micro Computer. I believe it’s crucial to acknowledge the significant risks facing the company. The most immediate concern is the ongoing regulatory uncertainty surrounding SMCI’s delayed financial filings. The company’s inability to file its 10-K for fiscal year 2024 and the subsequent resignation of Ernst & Young as its auditor in October 2024 have created significant market anxiety.

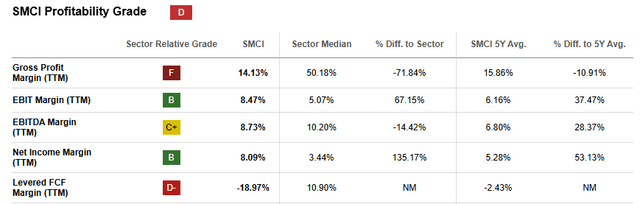

Margin pressure represents another significant challenge that requires careful consideration. SMCI’s current gross profit margin(TTM) of 13.3% stands dramatically below the sector median of 50.18% representing a concerning gap of 71.84%. This margin compression is partly attributable to the company’s competitive pricing strategy particularly in its direct liquid cooling (DLC) systems, which are being offered at the same price as air cooled systems to drive adoption. The preliminary Q1 FY2025 results showed some improvement, with non-GAAP gross margins increasing from 11.3% in the previous quarter to 13.3%, driven by better product mix and lower costs. However, management’s guidance for Q2 suggests margins will decline by approximately 100 basis points due to customer and product mix changes.

While management noted during their earnings call that their relationship with Nvidia remains strong, with no changes to chip allocations, there’s potential for enterprise customers to delay or reduce orders until there’s greater clarity on the accounting situation. This risk is particularly acute given that AI contributed over 70% of revenues in the latest quarter, making any hesitation from major customers potentially impactful.

Established players like Dell Technologies and HPE are rapidly expanding their presence in the AI server market. Dell, in particular, could benefit from improving AI order momentum and competitive intensity in the quarters ahead, as noted by Citi analysts. These competitors bring significant resources and established enterprise relationships to the market. Dell’s gross margin of 22.54% and HPE’s 33.88% demonstrate their ability to command premium pricing, which could put further pressure on SMCI’s margins as competition intensifies.

My Price Target and Final Thoughts

I’ve conducted a detailed valuation framework that points to a target price of $48 per share. This target is based on both discounted cash flow analysis and comparative valuation metrics, incorporating conservative assumptions.

My DCF model assumes a forward revenue growth rate starting at the 61.77% for FY2025, gradually declining to align with the broader GPU market’s projected CAGR of 27% from 2024 to 2032, as forecast by Global Market Insights. I’ve also factored in a more conservative growth rate of 15% from FY2030 to FY2032, followed by a 10% growth rate from FY2033 onward due to market maturation. For margins, I’ve modeled a gradual expansion of 10 basis points annually, supported by operational efficiencies from the scaling of production and improved manufacturing processes.

The model incorporates a cost of equity of 16.2%, calculated using a risk-free rate of 3.6%, a beta of 1.8 and an equity risk premium of 7%. This relatively high cost of equity is because of the current regulatory uncertainty and operational risks. I’ve also included $20 million in legal and litigation costs for both FY2025 and FY2026 to account for potential expenses related to the current regulatory situation.

Even with these conservative assumptions, the model indicates significant 2x upside potential from current levels. The $48 price target represents a forward P/E multiple of approximately 12x, but still well below the sector median of 24.2x, and there is room for further upside if the company successfully addresses its regulatory challenges and continues executing on its growth strategy.

The company maintains a relatively strong balance sheet with $2.1 billion in cash against $2.3 billion in total debt, resulting in a manageable net debt position of $200 million. The recent improvement in operating cash flow, which reached $407 million in Q1 FY2025 (a $1 billion improvement QoQ), demonstrates the company’s ability to generate significant cash flow despite current challenges.

However, I must emphasize that this investment thesis requires a strong stomach for volatility and careful position sizing. The stock could face continued pressure until regulatory issues are fully resolved and competition from established players like Dell and HPE remains intense.

SMCI presents elevated risks that need careful consideration, I believe the current valuation offers a balanced risk-reward opportunity for investors who can maintain appropriate position sizing and tolerate near-term volatility.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long SMCI with a 6.5% portfolio allocation. This article represents my personal opinion and analysis. Investors should conduct their own due diligence and consider their risk tolerance before making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.