Summary:

- Super Micro faces potential delisting should a Nasdaq plan to remain listed not be approved.

- Despite a promising 32% growth forecast for 2025-2026, competition and potential restatements of revenue and earnings pose significant risks.

- The company’s products are also becoming more commoditized and remain far lower gross margin products than others in the “AI” space.

- All being said, there could be massive reward for investors should the company both remain listed and future earnings trajectories remain unchanged.

Thomas Barwick

Can Super Micro make a comeback?

I have been tempted for some time to take a closer look at Super Micro Computer, Inc. (NASDAQ:SMCI) but never pulled the trigger. With the latest news that Super Micro has submitted a plan to the Nasdaq to remain listed after delaying their 10-K filing, I decided to finally take a look.

Interestingly, enough if delisted, this would be the second go around with the last one occurring in 2018. Will this time around be different? Is Super Micro really so undervalued right now that if they can remain on the Nasdaq the stock would skyrocket? Let’s examine.

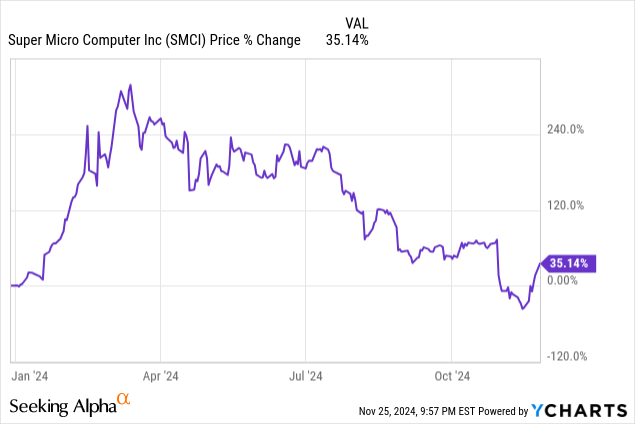

Year-to-date performance

Year-to-date the company is not a poor performer. This still beats most stocks in the S&P500 from a year-to-date price return perspective.

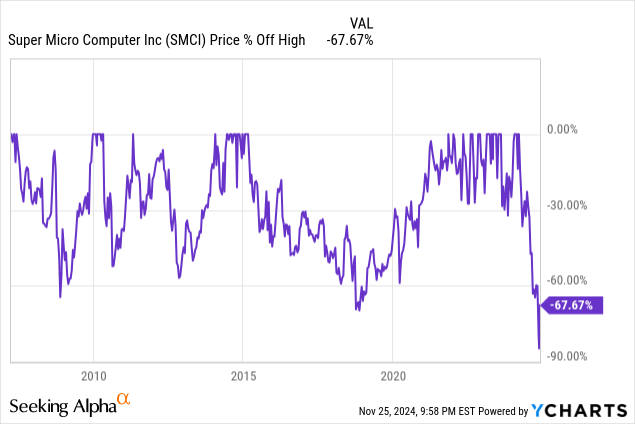

Off from all-time high

But from an all-time high perspective, this stock has been crushed. Down nearly -67% with the possible prospect of a delisting should the NASDAQ not accept their plan to remain in compliance with accounting regulations. It may still be an opportunity for the bold.

This time Super Micro seems more nimble and has a new auditor working on getting the necessary filings up to snuff after the previous one left the job. While the company may survive with a revised accounting plan, it may result in downward analyst revisions for 2025 and 2026 earnings. Those analyst growth expectations are the entire enchilada of what makes Super Micro “cheap”.

Let’s look at the fundamental case.

The fundamental case

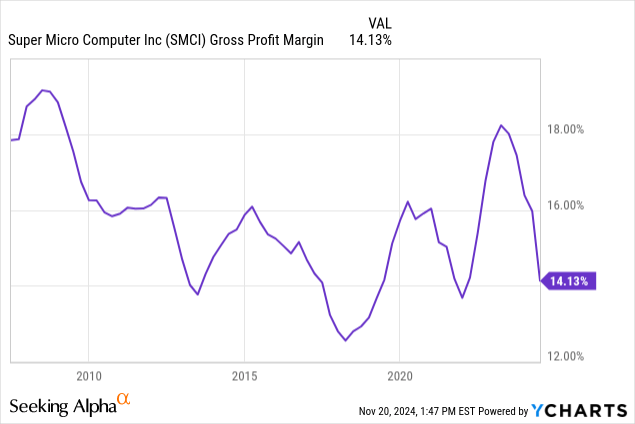

First and foremost, although Super Micro is in the “AI” space, this is not a big gross margin industry. We can observe from the above that cyclical server rack margins are somewhere in the neighborhood of 14-16% and are pretty typical for this business.

Secondly, there is coming competition in the server rack space. Both Dell Technologies Inc. (DELL) and Foxconn expect to be competitors from here on out along with others like Hewlett Packard Enterprise Company (HPE). As we see gross margins collapsing a bit in the above chart, this could be due to added competition.

It’s not as cheap as you think

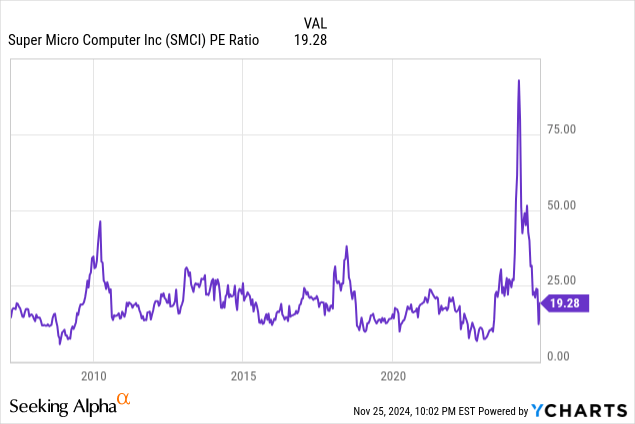

At 19.28 X GAAP earnings, we can observe that this is a bit higher than the long-term average. Even though the company booked a lot more orders which led to the market lumping this in with the likes of NVIDIA Corporation (NVDA) and others in the AI space, this is still a low-margin business that used to trade as such. In my opinion, the price it’s at now is settling right back where it belongs from a long-term multiple perspective.

Is there growth in the tank?

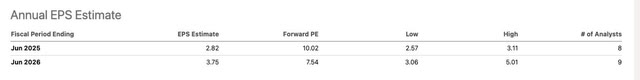

Analysts expect a 32% growth rate in GAAP earnings between FY 2025 and FY 2026. If this is the case, and it turns out to be true, then yes, the company would be very undervalued in a GARP scenario looking at a fair PEG ratio valuation.

I’ve noted before that when I draw up PEG ratio models, I always put a cap of 25% growth on my expectations. This was advice from Peter Lynch that I consistently tout. With that being said, 32% breaks the 25% threshold so it would be reasonable to use 25 as our max multiplier here.

Again, a fair value PEG ratio price target is simply the P/E divided by the growth rate [less the percent sign]. A ratio of 1 or less is a good deal and using the growth rate times the EPS will get you the PEG 1 value.

In this case, we would have:

- 25 multiplier.

- $3.75 2026 EPS.

- 25 X $3.75 = $93.75 fair price.

- Current price: $38.3.

- Selling at 40.5% of fair value.

Will the numbers change?

We don’t know exactly what is in this submission to the Nasdaq to remain listed. It could contain several provisions where they have to restate revenue and possibly earnings that could throw all the analyst models out of whack. If there are lots of downward revisions to where the implied FWD growth rate drops to 10% or less, then I think the stock is not a great value regardless of remaining listed.

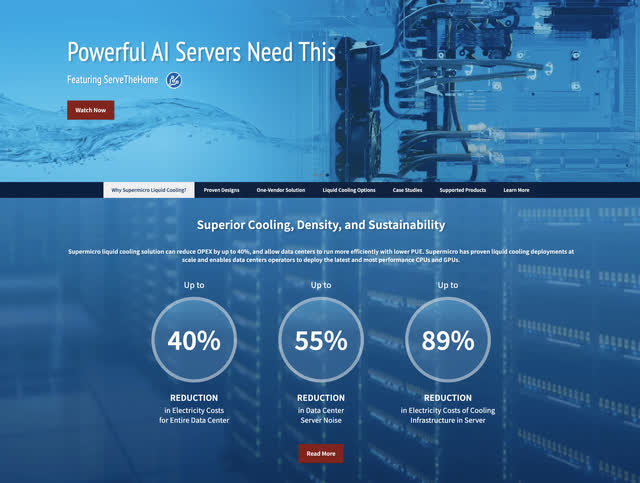

Cooling systems

Another bullish point about the company and the server rack space, in general, is all the new cooling tech coming online with the need to cool GPUs running LLMs [large language models]. The numbers Super Micro advertises are attractive, the question is if they can still be a cost leader while incorporating these more technologically advanced components that may hurt margins even further while competition is coming online.

Balance sheet

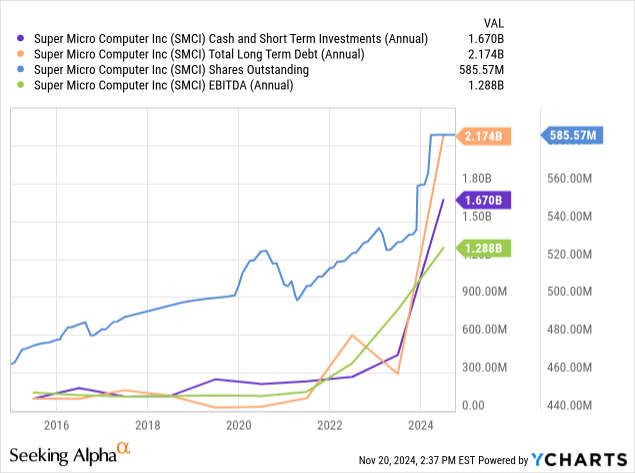

One important thing that Super Micro did was beef up its balance sheet at the expense of investors. When the price shoots sky-high, it’s not a terrible idea to dilute. The consistent practice does, however, make it more and more difficult to meet analyst per-share expectations.

With long-term debt only at 1.3 X cash and short-term investments and about 1.7X EBITDA, the balance sheet is healthy. All looks good on this front.

Risks and summary

I, personally, feel there is still too much risk involved in making a purchase. The value thesis is clear, 32% implied forward growth selling at only 11 X forward earnings, this would be a killer deal if true. The counterarguments are also just too great to ignore in my opinion. This is becoming a more and more commoditized product with not much product differentiation and I wouldn’t expect growth rates over 25% to happen for very much longer, making long-term growth models difficult to ascertain.

Competition from Dell and Foxconn in an environment where Super Micro may only turn out to be a cost leader rather than a quality leader will quickly erode margins in my opinion. If the company is approved to stay on the Nasdaq and there are no significant enough changes to expect less than 20-25% growth from 2025 to 2026, then this is very undervalued.

This still sells at 3.5X book value, so the only reason I, personally, would be inclined to stick around with a delisting risk still hanging in the balance is if the market priced this for bankruptcy well under asset value net of long-term debt. The potential to buy a $90+ stock selling at $38, is an enormous potential ROI should everything go swimmingly. Remember you need two things to hit:

- Stay on the NASDAQ.

- Growth rate expectations remain largely unchanged.

You have to weigh that risk-reward benefit for yourself and the potential makes this at least a hold rather than a sell. It’s just not my personal cup of tea.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.