Summary:

- Upgraded SMCI to Strong Buy due to cleared regulatory uncertainties, compelling valuation metrics, and strong technical setup, creating an exceptional risk-reward opportunity.

- Super Micro Computer’s recent NASDAQ extension and new auditor appointment address delisting concerns, validating its impressive 181% YoY revenue growth and compliance with export regulations.

- Nvidia’s explosive demand for Blackwell GPUs positions SMCI for significant revenue growth, leveraging its leadership in liquid-cooled server technologies and deep partnership with Nvidia.

- Despite risks like financial filing deadlines and margin pressure, the Company’s strong fundamentals, attractive valuation, and improving technical setup offer a compelling investment opportunity.

Just_Super

On November 20, 2024, I published my initial analysis of Super Micro Computer (NASDAQ:SMCI). In that article, I highlighted the stock’s deeply discounted valuation, its strong growth trajectory, and the potential catalysts that could drive a recovery despite the ongoing regulatory uncertainties at the time. Since then, SMCI’s stock has risen by an impressive 47%, confirming my initial thesis.

Based on Super Micro Computer’s recent developments and financial metrics, I am upgrading my rating to Strong Buy. The clearing of regulatory uncertainty, combined with compelling valuation metrics and strong technical setup, creates an exceptional risk-reward opportunity.

The company’s recent announcement of NASDAQ’s extension through February 25, 2025, for its financial filings marks a crucial turning point. This extension and the appointment of BDO USA as the new auditor effectively addresses the immediate delisting concerns that drove the stock down to its November 15th low of $17.25.

The investigation’s scope was remarkably comprehensive, addressing four critical areas that had raised investor concerns: the rehiring of certain employees who resigned in 2018, current sales and revenue recognition practices, export control matters, and related party disclosures. What stands out to me is the committee’s finding that Ernst & Young’s resignation and the conclusions stated in their resignation letter were not supported by the facts examined in the review.

The Special Committee’s review of 52 sales transactions from April 1, 2023, to June 30, 2024, found no disagreement with the company’s revenue recognition conclusions. This validation is crucial given SMCI’s preliminary Q1 FY2025 revenue of $5.9 to 6.0 billion, representing an extraordinary 181%YoY growth.

Moreover, the committee’s examination of export control matters, reviewing 11 specific transactions noted by EY and addressing allegations in the August 27, 2024, short-seller report, found no evidence of circumvention of export control regulations or awareness of product diversion to prohibited end users or locations. This finding is particularly relevant given the current geopolitical climate and increased scrutiny of technology exports.

These developments, when viewed collectively, present a transformed risk profile for SMCI. The thorough investigation, coupled with concrete steps to enhance corporate governance, effectively addresses the key concerns that have weighed on the stock. With the regulatory overhang largely resolved and strong fundamental growth intact, I believe SMCI offers an exceptional risk-reward opportunity at current levels.

Blackwell Demand Will Boost Revenue

The explosive demand for Nvidia’s (NVDA) next-generation Blackwell GPUs is poised to be a transformative catalyst for Super Micro Computer. According to Morgan Stanley’s recent analysis, Blackwell chips are already fully sold out for the next 12 months even before volume production begins. Nvidia expects to generate “several billion dollars” in Blackwell revenue in Q4 FY2025 alone, underscoring the scale and speed of the anticipated production ramp.

Blackwell’s availability in both air cooled, and liquid cooled configurations aligns perfectly with SMCI’s leadership in liquid-cooled server technologies. This is exemplified by XAI’s unveiling of the world’s most powerful supercomputer cluster, the Colossus, which integrates 100,000 Nvidia GPUs using SMCI’s advanced liquid cooled systems.

SMCI’s deep partnership with Nvidia places it at the epicenter of this generational hardware upgrade cycle. Nvidia’s GB200 NVL72 system, capable of linking up to 72 GPUs into a single unit with an aggregate bandwidth of 259 terabytes per second, is optimized for power constrained environments through liquid cooling, a field where SMCI excels. With tech giants such as Microsoft (MSFT), Google (GOOGL), Meta (META), and CoreWeave deploying Blackwell systems at scale, SMCI is uniquely positioned to capture significant revenue growth as it continues to deliver its liquid cooling solutions for these demanding AI infrastructure needs.

In particular, SMCI’s collaboration on the XAI Colossus cluster demonstrates its ability to execute at scale. SMCI has enabled the deployment of over 100,000 GPUs in an energy-efficient and high density configuration, setting a new benchmark for AI compute power. This deployment not only showcases SMCI’s technical prowess but also solidifies its role as a critical partner in the AI ecosystem during a period of unprecedented growth for Nvidia.

Given Nvidia’s visibility into robust demand for Blackwell GPUs through FY2026, SMCI stands to benefit significantly from continued hardware deployments and infrastructure expansions.

SMCI Is Still Severely Undervalued

The company’s current market valuation significantly undervalued both its existing business fundamentals and future growth potential, creating an exceptional investment opportunity.

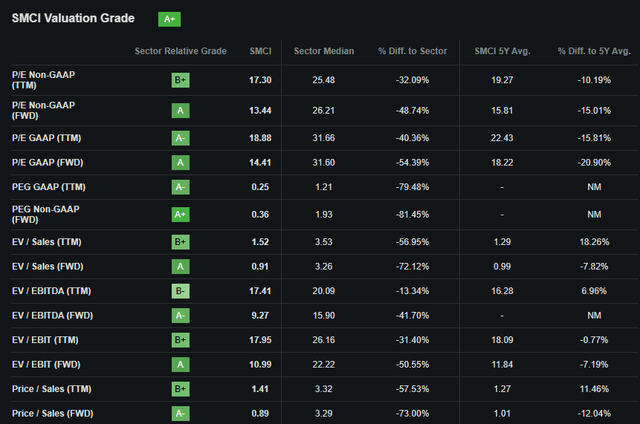

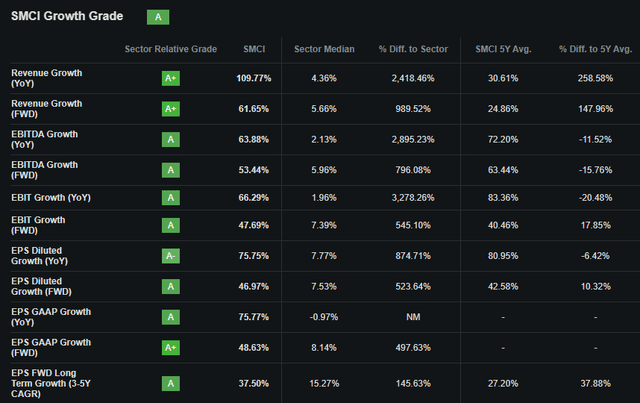

SMCI forward P/E multiple of 13.4x, which represents a 48% discount to the sector median of 26.2x. This valuation gap becomes even more pronounced when considering the company’s extraordinary growth trajectory. While the sector shows median revenue growth of just 4.3%, SMCI has delivered remarkable YoY revenue growth of 109.77%, outperforming the sector by an astounding 2,418%. This growth isn’t a one-time phenomenon; the company has maintained a three-year revenue CAGR of 61.35% demonstrating consistent execution and market share gains.

The valuation disconnect becomes particularly evident when you look at SMCI’s enterprise value metrics. The company’s forward EV/EBITDA ratio of 9.27x sits 41.7% below the sector median of 15.9x, while its EV/Sales multiple of 0.91x represents an 72% discount to sector peers. These metrics are especially noteworthy given SMCI’s EBITDA growth of 63.88%YoY, compared to the sector median of just 2.22%. The company’s ability to grow its EBITDA at nearly 29 times the sector rate while trading at a fraction of the sector’s valuation multiples suggests a significant market mispricing.

Looking at asset efficiency metrics, SMCI’s asset turnover ratio of 2.19x represents a 256.55% premium to the sector median of 0.62x, indicating highly efficient use of capital in generating revenue. The operational efficiency and the company’s strong growth profile suggests potential for significant margin expansion as the business scales, particularly in the new high margin AI infrastructure segment.

This leads me to conclude that SMCI’s current market price reflects lingering concerns about regulatory issues rather than the company’s fundamental value and growth potential. With these regulatory concerns now largely addressed through the Special Committee’s findings and NASDAQ’s filing extension, I believe the stage is set for a significant valuation re-rating.

What Could Go Wrong?

The most critical risk factor remains the February 2025 filing deadline. While the appointment of BDO USA as auditor and the Special Committee’s findings reduce this risk, missing this deadline would likely trigger significant selling pressure and most likely delisting from Nasdaq. I don’t consider that to be a likely scenario, but it is possible and represents a worst-case scenario.

There are some other short-term headwinds like Super Micro Computer will be removed from the Nasdaq-100 Index. This temporary headwind caused the stock price to plummet more than 6%, but I consider this a solid dip buy opportunity.

Margin pressure presents another significant risk factor that requires monitoring. The current gross margin of 14.13% stands significantly below the sector median of 50.27%. While this is partly SMCI’s strategic pricing decisions to capture more market share in the AI infrastructure market, any further margin compression could impact investor sentiment negatively.

The competitive landscape in the AI server market is intensifying, with established players like Dell Technologies (DELL) and HPE expanding their presence. Dell’s improving AI order momentum and competitive positioning, as noted by Citi analysts, could pressure SMCI’s market share and margins.

The combination of strong technical structure, clear catalysts and defined risk parameters creates what, I believe, is a compelling trading opportunity. While volatility should be expected, the risk-reward profile strongly favors a bullish positioning with clearly defined exit points and profit targets.

In Conclusion

While risks remain, particularly around financial filing deadlines and margin pressure, I believe the current risk to reward profile heavily favors a bullish positioning. The convergence of strong fundamentals, attractive valuation and improving technical setup supported by multiple near-term catalysts creates what I consider to be a compelling investment opportunity at current levels.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.