Summary:

- Super Micro Computer has surged 70% since my ‘Buy’ rating in November 2024; I maintain a one-year price target of $80 per share.

- The Special Committee’s investigation found no material accounting issues but recommended leadership changes and internal control improvements.

- Nasdaq granted an extension to file the 10-K by February 25, 2025; successful implementation of recommendations is crucial.

- Super Micro Computer is well-positioned for growth, supplying GPUs to xAI and capitalizing on Nvidia’s Blackwell GPUs, projecting 30% revenue growth from FY26 to FY28.

sankai

Since I reiterated a ‘Buy’ rating on Super Micro Computer (NASDAQ:SMCI) in November 2024, the stock price has surged by more than 70%. The Special Committee completed its investigation and made several recommendations to the Board on December 2nd. Super Micro Computer is actively executing these recommendations. On December 6th, the Nasdaq Stock Market granted the company an exception to file its 10-K by February 25th, 2025. I think Super Micro Computer is making concrete progress in addressing its accounting standards. I reiterate a ‘Buy’ rating with a one-year price target of $80 per share.

The Special Committee’s Conclusions

On December 2nd, 2024, the Special Committee completed its investigation and made several recommendations to the Board, including recruiting a new CFO and appointing a Chief Accounting Officer, as disclosed in the SEC filing.

As a result, Super Micro Computer’s current CFO, David Weigand, will leave once his successor has been appointed. In addition, the company appointed Kenneth Cheung as the Chief Accounting Officer, effective as of November 27, 2024. Mr. Kenneth Cheung has been with Super Micro Computer as Corporate Controller since January 2018. I think Super Micro Computer is actively following the Special Committee’s recommendations and strengthening its accounting standards.

The Key findings of the Special Committee can be summarized as follows:

- The Special Committee reviewed the rehiring of nine individuals and concluded that the company generally had appropriate processes for rehiring these individuals. However, it identified inconsistencies in documentation, tracking, training, and instructions regarding appropriate guardrails during the rehiring process, and the current CFO should be responsible for this issue.

- The committee reviewed 52 sales transactions from April 1, 2023, to June 30, 2024, and determined that their revenue recognition practices complied with the accounting standards. They haven’t found any evidence of a pattern or practice of the company shipping incomplete products at or near quarter ends to recognize revenue. I think the revenue recognition is the most critical component of the accounting review, as any improper methodology could lead to material consequences. As such, I find the Special Committee’s conclusion quite reassuring.

- The committee reviewed 11 specific export transactions flagged by the previous auditor, and found no evidence of attempts to circumvent export control restrictions. Most importantly, there was no evidence suggesting exports to Russia.

- Lastly, the committee also concluded that the related party transactions are fully disclosed, and disagreed with the claims made in the Hindenburg Research short report.

Overall, I think Super Micro Computer doesn’t have any material accounting issues, although they probably need to improve their internal control and documentation practices. As a result, the company will replace the current CFO, and hire several new roles including, Chief Accounting Officer, Chief Compliance Officer and General Counsel. They will improve trainings and internal monitoring going forward. In short, I think the company is on the right track to address their accounting, internal control and legal risks.

Nasdaq Listing

On December 6, 2024, Super Micro Computer received a letter from Nasdaq granting the company to file its 10K by February 25, 2025, as disclosed in the SEC filing.

I think the most critical priority for Super Micro Computer is to implement changes recommended by their Special Committee. If they can successfully enhance their internal control and make changes to key leadership roles, I do not anticipate any issues with the current 10-K filing. In addition, I believe the company has sufficient time to complete its annual report by February 25th, 2025.

Outlook and Valuation

On December 5th, Super Micro Computer’s CEO, Charles Liang, announced that the company supplied more than 1 million GPUs to xAI’s supercomputer. In June 2024, Elon Musk confirmed that Super Micro Computer and Dell (DELL) would provide servers for the supercomputer that xAI is building. This reinforces my view that Super Micro Computer’s business has not been significantly impacted by its current accounting challenges.

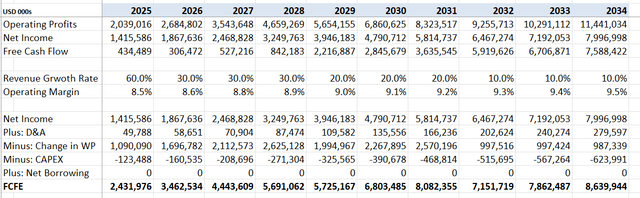

As discussed in previous reports, Super Micro Computer is well positioned to capitalize on the rapid growth of Nvidia’s (NVDA) Blackwell GPUs, which could contribute significant growth for the company. I project the company will deliver 30% revenue growth from FY26 to FY28, aligned with the overall GPU market growth. As AI training demands will mature, I forecast the company will deliver 20% revenue growth from FY29 to FY31, driven by growth in AI inference among enterprise customers. From FY32, I assume the growth rate will decelerate to 10% as the overall AI market matures.

I continue to project 10bps annual margin expansion driven primarily by reduction in SG&A and operating leverage. I calculate the total operating expense’s growth rate will be 1% lower than the topline growth, leading to an operating margin of 9.5% by FY34. I maintain the cost of equity to be 16.3% assuming: risk free rate 3.6%; beta 1.8; equity risk premium 7%.

With these assumptions, I calculate the free cash flow from equity (FCFE) as follows:

I discount all the future FCFE to the end of FY25 to estimate the company’s one-year target price. The one-year target price is calculated to be $80 per share, according to my model.

Key Risk

The next critical deadline is February 25th, 2025, and the clock is clicking. If Super Micro Computer fails to file its 10-K by this date, the company might get delisted from the Nasdaq market. In that case, investors will suffer significant loss.

In addition, the Special Committee is comprised of Susie Giordano who serves on the company’s board from August 2024. While she is an independent board member, she joined the board not a long ago. On the positive side, the committee is supported by outside counsel Cooley LLP and forensic accounting firm Secretariat Advisors, which lends credibility and independence to their findings and recommendations.

Conclusion

I believe Super Micro Computer is taking the right steps to address its current challenges. It is encouraging to see the company implementing the Special Committee’s recommendations and making necessary changes. I reiterate a ‘Buy’ rating with a one-year price target of $80 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.