Summary:

- Despite Super Micro Computer’s heavy dip, in my opinion, the current negative market sentiment seems exaggerated, as most of the negative developments are probably already priced in.

- Super Micro generated preliminary fiscal Q1 net revenues between $5.9 billion and $6 billion, an 181% increase over the previous quarter. It missed the management’s guidance.

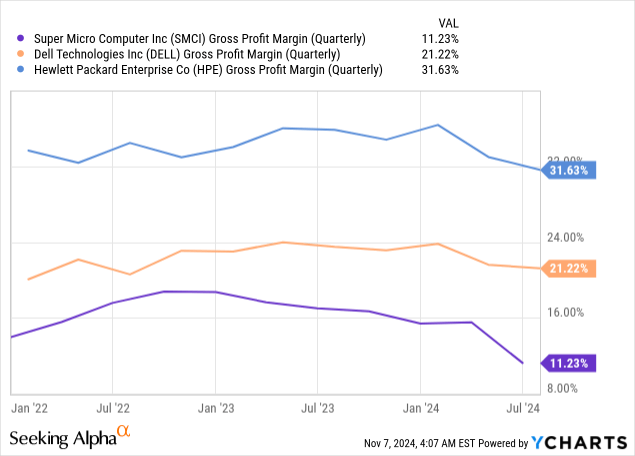

- The market clearly didn’t like the QoQ dynamics and guidance. SMCI kept facing severe headwinds in its margins, especially in comparison to Dell Technologies and Hewlett Packard Enterprise.

- If we assume that SMCI will miss its current FY2026 EPS consensus by 10% and the stock continues to trade at the current low P/E ratio of 7.5x, this should theoretically lead to a fair price of $26.2.

- Since I believe that SMCI’s business will eventually find a way out of the current deplorable situation, I think to average down my position at the current price level.

MicroStockHub

My Thesis Update

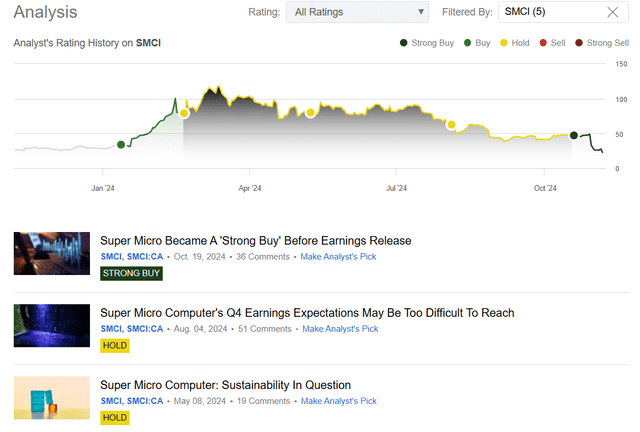

I initiated my coverage of Super Micro Computer (NASDAQ:SMCI) stock in mid-January 2024 with a “Buy” rating, stating that the stock was undervalued. After the SMCI stock price rose from $34.55/sh. to about $79 per share, I downgraded my rating to “Hold” and advised investors to trim their positions, as I believed the stock had become too expensive.

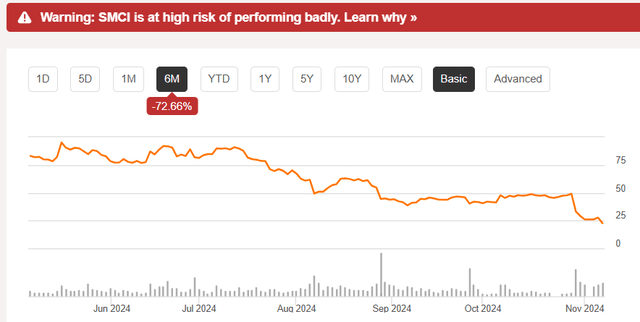

Once SMCI hit $47.3/share and there were 2 weeks before the firm’s fiscal Q1 FY2025 results release, I upgraded it to “Strong Buy”, anticipating that it would exceed analysts’ consensus forecasts, potentially restoring confidence among investors who had been disappointed for many weeks. Unfortunately for my thesis, SMCI didn’t beat the consensus for Q1. In fact, we heard the news that its auditor – Ernst & Young – resigned a few days before the report release, so the stock’s price action became “ugly” as traders say quite long in advance:

Seeking Alpha, Oakoff’s SMCI coverage

However, I’d like to point out that we are seeing a number of positive moments in Q1 FY2025 Super Micro that few people are talking about due to the mostly negative agenda. In my opinion, the current negative market sentiment seems exaggerated, as most of the negative developments are probably already priced in, assuming Super Micro isn’t a reincarnation of the Enron story. So, since I believe that SMCI’s business will eventually find a way out of the current deplorable situation, I think to average down my position at the current price level (although it’s far from being a meaningful position – yet).

My Reasoning

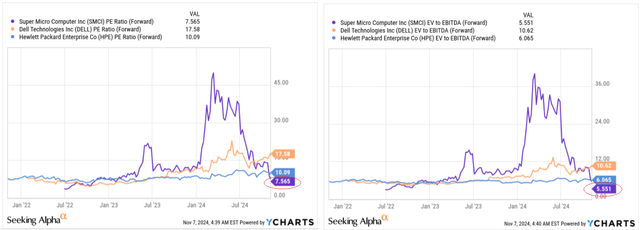

Super Micro generated preliminary fiscal Q1 net revenues between $5.9 billion and $6 billion, an 181% increase over the previous quarter. These increases are largely attributed to the rising adoption of AI technologies and the use of Direct liquid-cooled (DLC) AI superclusters. That significant rise was roughly in line with the consensus estimate but missed the management’s guidance of $6-7 billion. With the company investing heavily in AI infrastructure, such as providing 100,000 NVIDIA GPUs, its efforts at leveraging the AI revolution remain an obvious goal. This attention has driven both revenue and margins, with non-GAAP gross margin improving to approximately 13.3% vs. 11.3% last quarter, and operating margin improving to 9.9% vs. 7.8%. But the market clearly didn’t like the QoQ dynamics – SMCI kept facing severe headwinds in its margins, especially in comparison to Dell Technologies (DELL) and Hewlett Packard Enterprise (HPE):

In addition to this stagnation, Super Micro has significant operational issues. The allegations made by the short-seller Hindenburg led to an investigation by the US Department of Justice (DoJ). The resignation of its auditing firm and the DoJ probe have clouded the firm’s financial reporting, adding more fuel to the fire initially caused by the delay in SMCI’s 10-K for fiscal year 2024. This has undoubtedly put many investors off, as reflected by the 72% drop in the stock price for the past 6 months.

In my opinion, both the DoJ probe and Hindenburg’s accusations highlight possible holes in the company’s internal controls and governance – even the slow financial reporting and the hiring of a new auditor are signs of a struggle to be transparent and build investor confidence. These could negatively affect the company’s chances to win new customers and stay on track.

Why do I consider buying more SMCI then?

I think SMCI’s stock price action has already absorbed most of the risks that everyone is talking about today – from lower margins to a “possible Enron-like bankruptcy”. Honestly, I don’t think Super Micro’s existence is in question at the moment. The company’s strengths are in its robust AI growth and innovative products: SMCI’s Datacenter Building Block Solutions (DCBBS) and the innovative DLC solution are key selling points in the market today – still. These solutions not only improve the overall performance and effectiveness of data centers, but also drastically reduce customers’ operating costs. The speed at which the company delivers large-scale AI infrastructures (including a new delivery record for NVIDIA GPUs) speaks to its technical and logistical capabilities – just take a look at the YoY dynamics of the firm’s top line. Furthermore, with its investments in additional factories in Malaysia and additional manufacturing capacity in Silicon Valley, the company should be strategically positioned to meet growing demand.

At the same time, the management remains positive about the company’s future. We may look at their projection with great skepticism, but they estimate net sales in Q2 2025 at $5.5 billion to $6.1 billion, while gross margins should indeed decrease slightly “due to a shift in customer and product mix.” That looked quite disappointing, adding to the stock’s fall yesterday. However, the company is also looking to grow its share of the DLC market as 15%-30% of new data centers will use liquid-cooled infrastructure over the next 12 months (this growth is driven by the maturation of its DLC offerings and rapid expansion of AI applications). So as far as I understand it, SMCI’s growth initiatives are not going anywhere, despite all the headwinds it faced recently.

In terms of the balance sheet, Super Micro’s closing cash balance was $2.1 billion and total debt was $2.3 billion, leaving the company with a net cash position of approximately negative $0.2 billion, which is quite solid, in my opinion. The company’s operating cash flow slowed down substantially, and FCF for the quarter was positive at $365 million.

Due to the high level of uncertainty, SMCI’s valuation has deflated as quickly as the stock has fallen. Right now, the stock is trading at just 7.5x forward P/E, which is about 36% lower than the peer average. The EV/EBITDA ratio is lagging behind by ~25%, according to YCharts data:

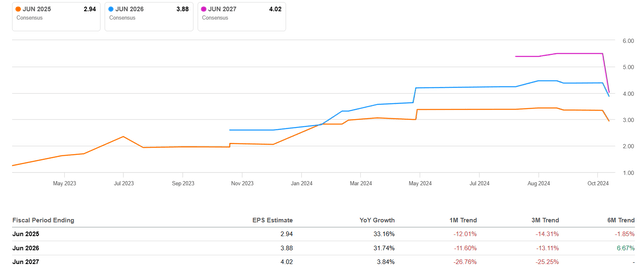

Although Wall Street analysts have clearly reacted negatively to the recent events surrounding SMCI and have lowered their investment ratings, their consensus estimates still assume continued EPS growth over the next few years (albeit at a much more modest pace than previously assumed):

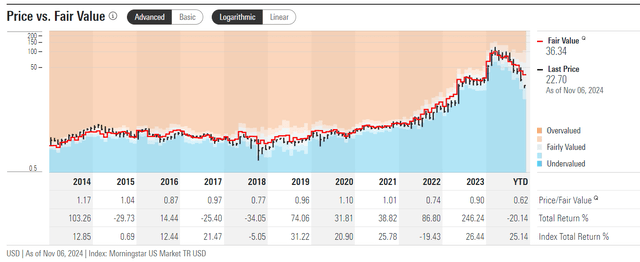

If we assume that SMCI will miss its current FY2026 EPS consensus by 10% and the stock continues to trade at the current low P/E ratio of 7.5x, this should theoretically lead to a fair price of $26.2, which is 15.7% above today’s price. In reality, I expect we will see a much stronger relief rally once the company finds a new auditor and finally publishes its 10-K report for the last fiscal year.

Morningstar Premium (proprietary source)

In other words, once a strong bullish catalyst emerges, I think the current valuation discount should narrow.

Given all that, I’m thinking of buying the dip in SMCI shortly – wish me luck.

Risks To Consider

The company’s high adoption rate in the AI market is a good sign, but the governance and DoJ probe is also troubling. Whether or not the company will be able to resolve these issues and regain investor confidence will decide whether or not it will survive in the long run. The opportunity for more competition in the AI infrastructure space, particularly when new technologies such as NVIDIA’s Blackwell chips are coming along, is another issue. As a Citi analyst reported recently, “Dell, and to a lesser extent HPE, will likely benefit from improving AI order momentum and competitive intensity in the quarters ahead”. So who knows – maybe the struggles are just getting started for Super Micro.

Also, a significant risk in my thesis today is my optimistic outlook on how the company’s growth initiatives will perform in the coming periods. Last time I expected that Super Micro would have improved its margins soon, as management anticipated – that didn’t happen, and the stock continued to decline. So if the current expectations don’t materialize as well, we’re unlikely to see anything good in terms of SMCI’s momentum.

So the above considerations also influence my conclusions regarding the undervaluation of the company. If it turns out that EPS remains under pressure due to lower margins, the supposed undervaluation could actually become an overvaluation.

Your Takeaway

Despite the clear risks most investors are already aware of, I believe SMCI’s strong performance in the AI space and its product portfolio should provide the company with a solid starting point for growth in the future. However, governance challenges and the DoJ investigation posed serious risks to its ability to maintain this expansion. Whether management can resolve these issues and win back investors will determine how successful the company is in the coming quarters. I believe the firm isn’t going out of business, while its solutions seem to have a good market standing. As the company resolves the above concerns, it’ll continue to have a strong opportunity to capitalize on the emerging need for AI infrastructure. The current discount to SMCI’s valuation seems to be too large, even if it seems fair right now.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.