Summary:

- This article upgrades my rating on Super Micro Computer, Inc. stock to BUY from my earlier HOLD rating.

- The top factors that catalyzed this rating upgrade are margin recovery potential, the clarity provided by this internal audit, and the bullish technical patterns.

- The factors create a good set up for SMCI swing trades in the next 2~3 months until the 2025 FY Q1 earnings release.

Pla2na

SMCI stock: latest developments set up a swing trade

My last piece on Super Micro Computer, Inc. (NASDAQ:SMCI) was published on November 3, 2024, shortly before the release of its 2024 FY Q4 earning report (“ER”). That article was entitled “Super Micro Computer: Time To Consider Options As A Hedge” and rated the stock as a HOLD. As the title hinted, the goal of that article was to suggest actionable ideas – especially via the use of options — that can hedge expected uncertainties in the upcoming ER. To be more explicit, I argued that:

SMCI Investors are faced with major uncertainties, both positive and negative, in the upcoming ER. The top positives are the strong earnings reported by Taiwan Semi recently, attractive valuation, and the promise of its liquid cooling racks. But the resignation of a reputable auditor like Ernst & Young LLP is a key concern. With such uncertainties, we suggest the consideration of options to manage risks and minimize capital exposure.

The FY Q4 ER, released on November 5, 2024, indeed painted a mixed picture (more on this in a minute) and was followed by a large price correction (from about $27 per share to as low as $18 in a few trading days). Along with the ER, a few other important catalysts have also been evolving around the stock. In this article, I will argue why these new developments call for a reexamination of the stock and why this reexamination has led me to upgrade my rating on the stock to BUY from my earlier HOLD rating. In a nutshell, I see an excellent setup for a swing trade between now and the release of its next ER (i.e., for FY1 2025) scheduled in February 2025.

For the remainder of this article, I will detail that top 3 catalysts in my assessment that support this swing trade: the margin expansion potential implied in its 2025 Q1 earnings forecast, the latest developments with its internal audit review, and also the recent technical trading pattern.

SMCI stock: Margin recovery potential

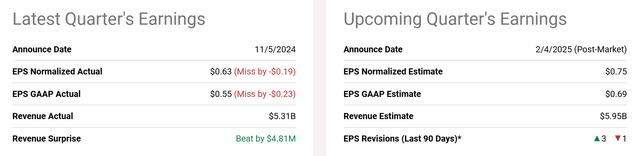

Let me start with the margin expansion potential. As just mentioned, its FY Q4 reported mixed numbers in my view. To wit, the company missed analysts’ expectations for both normalized and GAAP EPS to a substantial degree. Normalized EPS came in at $0.63, missing the estimate by $0.19, while GAAP EPS was $0.55, falling short of the $0.23 estimate. On the brighter side, SMCI did beat revenue expectations – although very slightly. It reported $5.31 billion in revenue, $4.81 million higher than the forecast (i.e., by less than 0.1%).

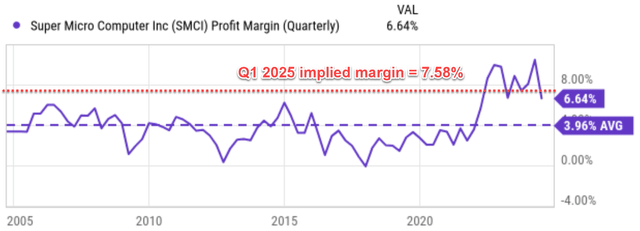

What is more concerning is its profit margins. As you can see from the following chart, SMCI has experienced a fluctuating profit margin over the years, as seen in the chart above. But since the company has become stably profitable (from around 2020), its margins have been on an upward trend and have been hovering around an average of 8% in the past 2~3 years. However, based on the financials reported in its recent ER, its profit margin dropped to 6.64% only. Additionally, given the resignation of its auditors at that time, I was not certain if its margins were even 6.64% as reported.

The latest developments since my last writing have dispelled my above concern. Following the resignation of Ernst & Young, the company formed an independent audit committee and conducted an internal review. Details are quoted below:

Seeking Alpha News (Dec. 2, 2024): SMCI extended intraday gains to ~31% on Monday after an independent special committee found no evidence of misconduct by the board of directors or audit committee. The investigation took over three months and did find some lapses in processes. As part of the investigating committee’s recommendations, SMCI will appoint a new chief financial officer, chief compliance officer and general counsel…

With confidence in its reported financials, now I see margin recovery potential ahead. My optimism came from the company’s underlying fundamentals. I expect strong demand for SMCI’s products to continue driven both by its strategic position, products lineup (especially the liquid cooling racks as detailed in my earlier article), and also the rapid growth of the artificial intelligence server market. In the Tier 2 cloud markets that prioritize speed and performance, I see clear differentiations from SMCI compared to other competing solutions.

As a reflection of my above optimism, consensus estimates also imply a much better margin for the upcoming quarter. If you recall from the first chart above, SMCI is scheduled to report its next quarterly earnings on February 4, 2025 (for FY 2025 Q1). The consensus estimates for this upcoming quarter are a normalized EPS of $0.75 and a total revenue of $5.95 billion. Assuming its share counts remain constant (at the current level of about 602 million shares), these estimates imply a profit margin of 7.58%, which would be back to the ~8% range it has been enjoying recently.

SMCI stock: technical analysis

In addition to the above fundamental catalysts, I am also seeing strong technical indicators that suggest a potential upward price movement in the near term.

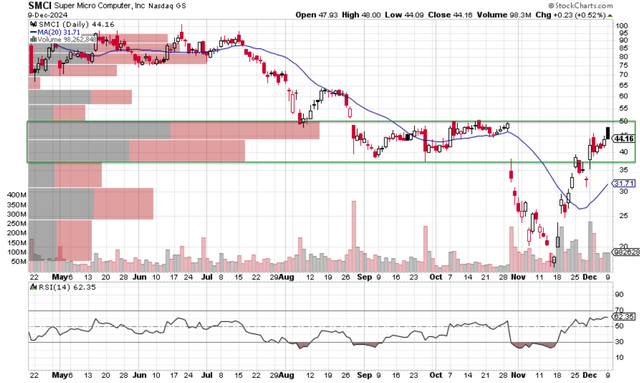

As aforementioned, shortly after the release of Q4 ER, SMCI suffered a large price correction and bottomed out near $18 as you can see from the following chart. The trading patterns after the bottom are a strong bullish reversal pattern. The pattern is characterized by a V-shaped recovery accompanied by robust trading volumes. The recovery easily overtook the 20-day moving average (currently at $31.71) and stayed well above it.

The Relative Strength Index (“RSI”) also shows strong momentum. Readings above 70 are considered overbought, readings below 30 are considered oversold, and an RSI reading between 50 and 70 suggests buying pressure. As seen, SMCI’s RSI recovery from the oversold regime since November 18 and has been improving steadily to the current level of around 62.35, comfortably above 50 and indicating a bullish momentum.

Finally, I want to highlight the price-volume range highlighted by the green rectangle. The green rectangle highlights the price range that has witnessed the highest trading volumes in the past 6 months since its stock price last peaked (at around $100). Due to the large cumulative shares exchanged hands in these price ranges, I consider them crucial support and resistance levels in the near term. As seen, SMCI’s current price of $44.16 has broken the resistant level of around $40. The next resistance level (i.e., the upper bound of the green rectangle) is $50. It is not far from the current price, and I see good odds for SMCI to break it too given the fundamentals analyzed above.

SMCI stock: Other risks and final thoughts

In terms of downside risks, the company is yet to file its Annual Report on Form 10-K for the fiscal year ended June 30, 2024. The filing was delayed due to the accounting issues mentioned above, and the company has received Nasdaq’s approval for an extension. Based on the results of its internal auditing, I expect the annual report to be filed before the extended deadline and do not expect too many surprises in the report.

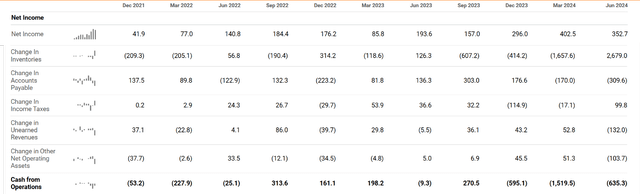

The company’s recent organic cash flow and inventory are also worth monitoring. For the latest quarter, SMCI reported a negative operating cash flow of $635 million, as you can see from its cash flow statement below. The negative number is of course concerning, but what is more concerning to me is how the negative number is derived. As seen, the cash flow statement started with a net income of positive $352.7 million. Many changes turned the positive net income to a negative cash flow, and one of the key changes is inventory. As seen, inventory changed by a positive $2679 million in the last quarter, compared to a negative change of $1,657 million. Such a sharp increase in inventory not only ties up cash but also creates balance sheet risks and could indicate competition pressure.

All told, my overall assessment is that the upside risks outweigh the downside risks for Super Micro Computer, Inc. stock, and I see a good set up for swing investors. To recap, the top catalysts on my list are margin recovery/expansion potential, the clarity provided by its internal audit, and bullish technical trading patterns. Finally, as a swing trade idea, let me emphasize that the targeted timeframe is for the next 2~3 months until its next quarterly earnings are filed.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea competition investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.