Summary:

- I reiterate a ‘Buy’ rating on Super Micro Computer, citing undervaluation and a one-year price target of $60 per share despite near-term pressures.

- Preliminary Q1 results show revenue between $5.9 billion and $6 billion, missing guidance due to new GPU chip availability and 10-K filing delay.

- The independent Special Committee found no fraud or misconduct, and the company is seeking a new auditor, with liquid cooling infrastructure driving future growth.

- Super Micro Computer’s Q2 revenue guidance is $5.5 billion to $6.1 billion, with strong AI computing demand and Blackwell GPU ramp-up expected to boost revenue.

Thomas Barwick

I reiterated a ‘Buy’ rating on Super Micro Computer, Inc. (NASDAQ:SMCI) in October 2024, discussing the short report and 10-K filing delay. The company released its preliminary Q1 result and provided an update from the independent Special Committee on November 5th. While I acknowledge that Super Micro Computer’s stock may face near-term pressure, I believe the stock is undervalued and reiterate a ‘Buy’ rating with a one-year price target of $60 per share.

Key Takeaways from Preliminary Q1

On November 5th, 2024, Super Micro Computer released its Q1 result and provided an update from the independent Special Committee appointed by the Board of Directors. Key takeaways from the quarter can be summarized as follows:

- The company estimates Q1 revenue to be between $5.9 billion and $6 billion, lower than its $6-$7 billion guidance. During the earnings call, the management indicated that the revenue miss was caused by the availability of new GPU chips, as well as their 10-K filing delay. In other words, fewer NVIDIA Corporation (NVDA) high-end chips were more available than the management initially anticipated. In addition, the management couldn’t quantify how much revenue impact was caused by their 10-K filing delay. I believe some customers may have delayed orders with Super Micro Computer as an audited 10-K is often required for supplier due diligence.

- As reported by the media, Nvidia is rerouting orders previously placed with Super Micro Computer to other suppliers. However, during the earnings call, Super Micro Computer disclosed that they had confirmed with Nvidia that there were no changes to the current chip allocation.

- Super Micro Computer’s independent Special Committee has completed its investigation based on initial concerns raised by Ernst & Young, and their investigation to date has found that the Audit Committee has acted independently and that there is “no evidence of fraud or misconduct on the part of management or the Board of Directors,” as noted in their Special Committee’s formal statement. During the earnings call, Super Micro Computer’s management disclosed that the Special Committee expects to deliver the full completed report this week or next.

- Super Micro Computer is in the process of seeking a new auditor, but the timing of their 10-K filing remains uncertain.

- The company anticipates 15%-30% of new data centers will adopt liquid cooling infrastructure in the next 12 months, with market share for liquid cooling expected to grow at least 10x from last year’s level. I believe the strong end-market growth driven by AI computing could support Super Micro Computer’s future growth.

While it remains unknown when Super Micro Computer can secure a new auditor and file its 10-K, I think the company is on the right track to resolve its internal financial issues and conduct its independent investigations. Their Special Committee’s full report could potentially become a near-term catalyst for Super Micro Computer’s stock price, in my opinion.

Outlook and Valuation Adjustment

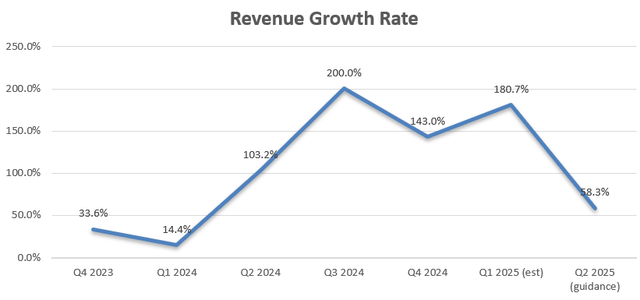

Super Micro Computer is guiding for Q2 revenue of $5.5 billion to $6.1 billion, representing around 58% year-over-year growth at the mid-point.

Super Micro Computer Quarterly Results

According to a recent conference, Nvidia is ramping up its Blackwell GPUs production with shipments expected to begin in Q4 and production scaling throughout FY25, as they are facing strong industry demands due to AI computing. Super Micro Computer has co-developed its Supermicro NVIDIA GB200 NVL72, a liquid-cooled exascale computer in a rack with 72 Blackwell GPUs. During the earnings call, Super Micro Computer indicated that the GB200 NVL72 product is full-production ready, which, I believe, could drive significant revenue growth in the near future.

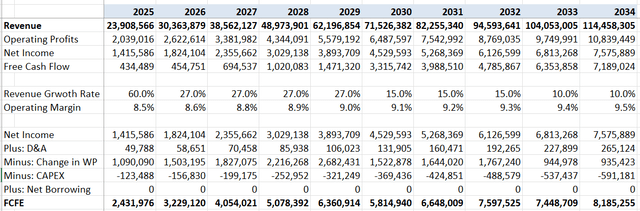

As such, I project the company will deliver around $24 billion in total revenue for FY25, assuming $6 billion in Q2, $6.2 billion in Q3, and $6.35 billion in Q4. The growth assumption is based on a gradual product ramp-up of Blackwell chips.

Global Market Insights predicts the global GPU market will grow at a CAGR of 27% from 2024 to 2032. As other AI server manufacturers like Dell Technologies Inc. (DELL) and Hewlett Packard Enterprise Company (HPE) are catching up with the liquid cooling technologies, I anticipate Super Micro Computer’s revenue growth will align with the market growth, increasing 27% from FY26 to FY29, then decelerating to 15% from FY30 to FY32, then further decelerating to 10% from FY33, as their business scales and AI market matures gradually.

I provision a total of $20 million in legal and litigation costs for FY25 and FY26 due to the business disruptions. I continue to anticipate Super Micro Computer will deliver a 10 bps margin expansion in the future driven by improvements in gross profits. The cost of equity is calculated to be 16.2% assuming: a risk-free rate of 3.6%; a beta of 1.8; and an equity risk premium of 7%. I calculate the free cash flow from equity (FCFE) as follows:

I project the terminal growth to be 4%, as the server market has been growing at low-single-digit through the cycles. I am using a two-stage DCF model to estimate the valuation, by adding the present value (PV) of FCFE over the next 10 years and the terminal DCF value. As I discount all the FCFE to the end of FY25, I am calculating the company’s one-year target price.

Discounting all the future FCFE, the one-year target price is calculated to be $60 per share, as per my estimate.

Key Risk

In the near term, Super Micro Computer’s stock price may remain under pressure and its stock price could significantly deviate from its fundamentals. The stock may stay in a “penalty box” until the company files its 10-K.

In addition, Super Micro Computer exited the quarter with $2.1 billion in cash and $2.3 billion in debts. On October 28th, Super Micro Computer entered into a Third Amendment to Loan Agreement with Cathay Bank, adding a covenant requiring that Super Micro Computer maintain at least $150 million of unrestricted cash at all times. As Super Micro Computer cannot provide its 10K and audited financial statements, I anticipate other lenders will impose additional covenants in the near future. If Super Micro Computer refinances its debt, the company might face much higher interest rates, as its credit rating is likely to be downgraded.

End Note

While Super Micro Computer’s business growth is more likely to be affected by its delayed 10-K filings, the company is well positioned in the rapidly growing liquid cooling data center market. I believe the stock price is undervalued and reiterate a ‘Buy’ rating with a one-year price target of $60 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.