Summary:

- Super Micro Computer’s shares have lost almost 50% of their value following the surprise resignation of its audit firm last week.

- Inability to deliver audited financial statements has resulted in a $400 million liquidity drain as banks have required prepayments and imposed harsh minimum cash balances requirements.

- With Nasdaq’s 60-day grace period expiring in approximately two weeks, the company might end up being delisted in the not-too-distant future.

- Reports of key partner Nvidia redirecting customer orders to Taiwanese competitors and muted demand for the company’s liquid cooling solutions are concerning.

- Risk/reward going into Tuesday’s business update appears unfavorable as outperformance might be scrutinized by investors after recent events while weak results and guidance will likely be viewed as evidence for market share losses.

Erik Isakson

Note:

I have covered Super Micro Computer, Inc. (NASDAQ:SMCI) previously, so investors should view this as an update to my earlier articles on the company.

Following the surprise resignation of its audit firm last week, shares of high-performance server and storage solutions provider Super Micro Computer or “Super Micro” have lost almost 50% of their value as investors are heading for the exits on concerns regarding the company’s internal controls, potential debt and liquidity issues as well as the threat of a near-term delisting of the company’s common stock.

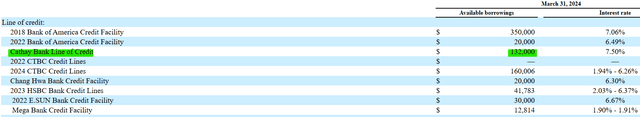

On October 28, the Super Micro amended the terms of its $132 million revolving credit facility with Cathay Bank in order to extend the deadlines for delivering its FY2024 annual report and Q1/FY2025 quarterly report (emphasis added by author).

On October 28, 2024, Super Micro Computer, Inc. (the “Company”) entered into a Third Amendment to Loan Agreement (the “Amendment”), by and among the Company and Cathay Bank, which amends the Loan Agreement, dated as of May 19, 2022 (as amended, the “Loan Agreement”). The Amendment, among other things, (a) extends the date by which the Company is required to deliver its (i) audited financial statements for its fiscal year ending June 30, 2024 under the Loan Agreement from October 28, 2024 to December 31, 2024 and (ii) balance sheet and income statement for its fiscal quarter ending September 30, 2024 under the Loan Agreement from November 29, 2024 to December 31, 2024 and (b) adds a covenant requiring that the Company maintain at least $150 million of unrestricted cash at all times.

Please note that the facility was undrawn at the end of Q3/FY2024:

However, I expect the line to be fully drawn now as otherwise there would have been no need for requiring the company to maintain at least $150 million in unrestricted cash at all times. Cathay Bank could have simply denied access to the facility as a result of Super Micro’s failure to deliver financial statements in due course.

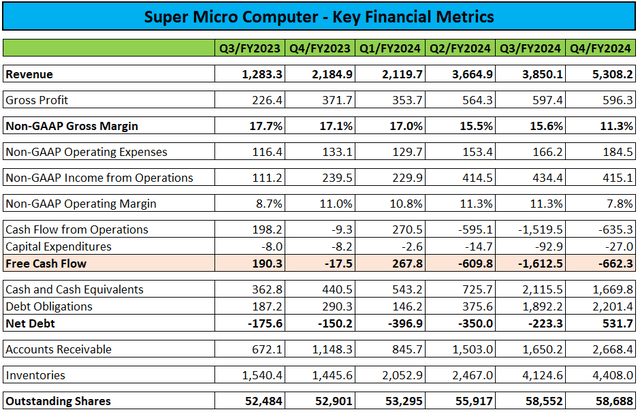

Remember also that the company’s exponential growth has resulted in material cash usage as of late:

Company Press Releases / Regulatory Filings

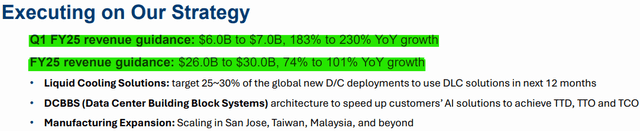

Between October 2023 and June 2024, the company used approximately $2.9 billion of cash but with revenues expected to double again in FY2025, cash usage might accelerate even further:

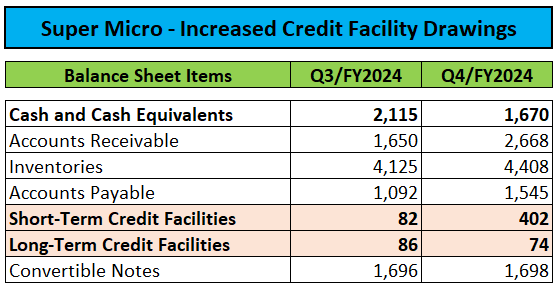

While Super Micro ended FY2024 with $1.7 billion in cash and cash equivalents, the company had started to increase drawings under its available credit facilities in Q4:

Company Press Releases

On July 19, the company entered into a new $500 million term loan agreement with Bank of America (BAC) which is scheduled to mature on January 17, 2025.

However, Super Micro’s inability to deliver audited financial results resulted in the requirement to amend terms. While Bank of America agreed to extend the due date for the company’s FY2024 results by two months to November 27, Super Micro was required to make a $250 million repayment.

Even if the company will be able to appoint a new auditor in the coming weeks, there’s basically no way for Super Micro to deliver audited financial statements by November 27. Consequently, I would expect the lender to demand additional repayments or other painful concessions by the company. But even when assuming Bank of America to be more accommodative, the January 2025 maturity date is likely to remain an issue.

Moreover, last week’s auditor resignation might result in the company’s stock being delisted from Nasdaq later this month. While Nasdaq has provided Super Micro additional time for regaining compliance with continued listing requirements or at least submitting a plan to do so, the grace period will end in approximately two weeks.

Without an auditor and no credible prospects for a near-term filing of the company’s annual report on form 10-K, I would expect Nasdaq to delist Super Micro’s shares, thus repeating its course of action taken in 2018.

In addition, Monday’s reports regarding key partner NVIDIA Corporation or “Nvidia” (NVDA) redirecting client orders to Taiwanese competitors like Gigabyte Technology and ASRock, do not bode well for tomorrow’s business update.

Moreover, according to Wedbush Securities analyst Matt Bryson, the company’s sales of liquid cooled servers in recent months might not have been as strong as previously anticipated.

Pro forma for the $250 million drawn under the new credit facility and the $150 million minimum cash requirement imposed by Cathay Bank, Super Micro’s total liquidity amounted to approximately $1.75 billion at the end of June.

However, with quarterly cash burn having averaged close to $1 billion over the past three quarters, I wouldn’t be surprised to see liquidity becoming an issue going into 2025, particularly given the January 17, 2025 maturity date of the new Bank of America credit facility.

But without audited financials, Super Micro’s options to raise additional capital appear very limited.

Moreover, I would expect suppliers to have taken notice of the company’s woes and resulting challenges to remain in compliance with debt covenants which might result in tighter payment terms going forward.

At least in my opinion, risk/reward looks highly unfavorable going into tomorrow’s conference call as there’s almost no way for Super Micro to win.

- Should the company beat consensus expectations and provide strong guidance, cash usage will likely be a major issue. In addition, I would expect market participants to scrutinize the numbers provided by management after recent events.

- Should Super Micro’s results and outlook fall short of expectations, investors will rightfully assume that the company is losing market share to competition.

Regarding tomorrow’s business update, I would advise investors to closely watch a number of key metrics:

- Free cash flow and remaining liquidity.

- Movements in accounts payable (anything else than a major increase would be an indication for suppliers already having tightened payment terms).

- Changes in gross margin. Remember that margins came under pressure in Q4/FY2024 and are not likely to show material near-term improvement. However, I would expect a further decrease into the single digits to be considered negative.

Bottom Line

In my opinion, even after an almost 50% selloff following last week’s auditor resignation, risk/reward going into Super Micro Computer’s business update call on Tuesday doesn’t look favorable as reported sales outperformance will likely be scrutinized by investors while weak results and guidance might be viewed as an evidence for market share losses.

In addition, the company might be facing liquidity challenges going into next year, particularly with a $250 million debt maturity looming in less than two months.

With limited options to replenish its dwindling cash balances, investors might start to scrutinize Super Micro Computer’s viability.

Consequently, I am reiterating my “Sell” rating going into Tuesday’s business update call.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.