Summary:

- On Monday, shares of Super Micro Computer rallied by almost 30% after an internal investigation found “no evidence of misconduct on the part of management or the Board of Directors”.

- The rehiring of former employees, who resigned in conjunction with a past investigation into improper revenue recognition, is difficult to justify and a clear sign of poor corporate governance.

- While the internal investigation discovered no fraud, the company’s Special Committee recommended, among other things, far-reaching management changes and additions.

- Please note that SMCI’s new auditor, BDO, has not been involved in the internal investigation and might very well decide to take a fresh look.

- With the easy money on the rebound trade having already been made and muted expectations for the company’s Q2/FY2025 report in February, I am downgrading my rating from “Hold” to “Sell”.

quantic69

Note:

I have covered Super Micro Computer, Inc. (NASDAQ:SMCI) previously, so investors should view this as an update to my earlier articles on the company.

On Monday, shares of beleaguered high-performance server and storage solutions provider Super Micro Computer, or “Super Micro” rallied by almost 30% after an internal investigation found “no evidence of misconduct on the part of management or the Board of Directors“. In addition, the Audit Committee was found to have acted independently.

Moreover, the “tone at the top” with respect to the rehiring of former employees who resigned in 2018 following an investigation regarding revenue recognition practices, was found to have been appropriate.

Even more important, the company does not expect to restate reported financial results.

The investigation was supported by outside counsel Cooley LLP and forensic accounting firm Secretariat Advisors LLC.

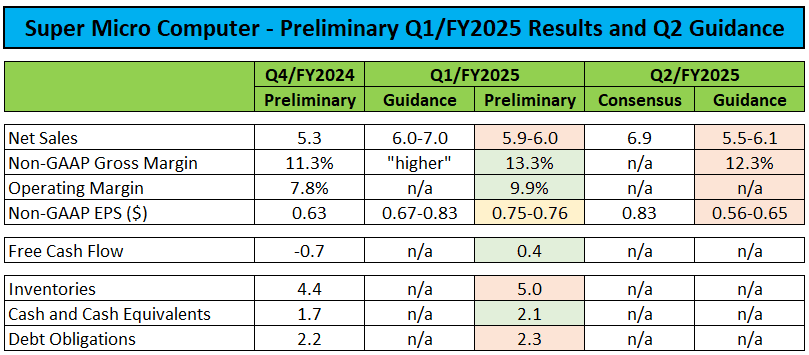

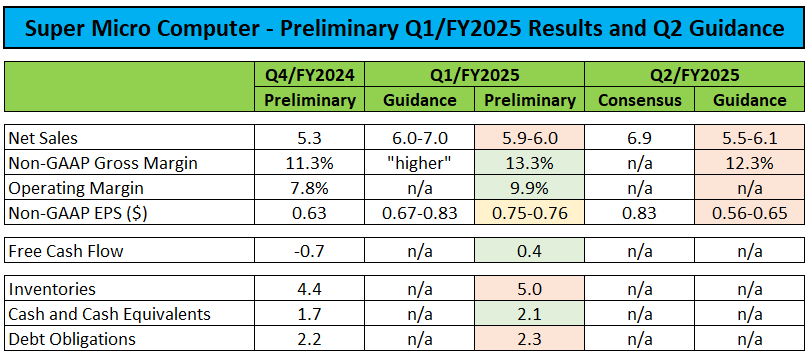

Please note that the company already provided the headline results to investors in a press release four weeks ago:

The Special Committee has completed its investigation based on a set of initial concerns raised by EY. Following a three-month investigation led by Independent Counsel, the Committee’s investigation to date has found that the Audit Committee has acted independently and that there is no evidence of fraud or misconduct on the part of management or the Board of Directors. (…)

With the investigation outcome already well expected, I was somewhat surprised by Monday’s violent rally, particularly after taking a closer look at the scope of the investigation and the Special Committee’s findings.

Internal Investigation Scope

Very much as suspected by me from the very beginning, the investigation centered around key issues raised in a whistleblower complaint and the company’s former auditors earlier this year:

- alleged rehiring of employees who resigned in 2018 after an investigation discovered improper revenue recognition practices

- current revenue recognition practices, particularly at quarter-ends

- alleged circumvention of export controls

- related party disclosures

Having spent several years with top four audit firm PricewaterhouseCoopers (“PwC”) myself, I will provide additional color for readers not familiar with audit reports.

Rehiring Employees

Apparently, the company rehired no less than nine individuals, either as employees or as independent contractors who had previously resigned from the company following an audit committee investigation seven years ago.

While the special committee report states that the decision to rehire these individuals was the product of “reasonable business judgment” and that “appropriate processes” and “proper guardrails” were in place, the report also points to certain “lapses” and inconsistent documentation:

These lapses included instances of not promptly informing the Company’s Audit Committee and/or independent auditor of certain rehires or plans to rehire some of these former employees, including not informing EY prior to entering in June 2024 into a now terminated consulting arrangement with the Company’s former CFO, who had resigned following the 2017 Audit Committee Investigation. (…)

The Special Committee found certain instances where the documentation, tracking, training, and instructions around appropriate guardrails were inconsistent or vague.

Quite frankly, rehiring or entering into consulting agreements with employees who were involved in past accounting deficiencies doesn’t look like “reasonable business judgment” to me.

Remember, it took the company several years and tens of millions of dollars in audit and consulting fees to work through the revenue recognition issues originally discovered in 2017.

Super Micro Computer even entered into a (now terminated) consulting agreement with former CFO Howard Hideshima without informing the company’s audit firm, Ernst & Young LLP or “EY” at that time.

Not for the first time, the company is putting the blame for the “process lapses” on the current CFO:

The Special Committee determined that, because the Company’s Chief Financial Officer/Chief Compliance Officer (CFO/CCO) had primary responsibility for the process of rehiring these employees, he had primary responsibility for process lapses.

Revenue Recognition Practices

The Special Committee reviewed 52 large-scale transactions from April 1, 2023, to June 30, 2024, including two transactions specifically designated by EY:

The sample was focused on sales that included large dollar amounts, involvement of rehires, discussions with now former auditors, customers with high sales concentrations at quarter ends, and/or changes in delivery dates. (…)

Based on its investigation, the Special Committee did not disagree with the Company’s revenue recognition conclusions. Additionally, the Special Committee did not find evidence of a pattern or practice of the Company shipping incomplete products at or near quarter ends to recognize revenue.

The evidence reviewed by the Special Committee did not give rise to any substantial concerns about the integrity of Supermicro’s senior management or Audit Committee, or their commitment to ensuring that the Company’s financial statements are materially accurate.

The Audit Committee demonstrated appropriate independence and generally provided proper oversight over matters relating to financial reporting.

While the Special Committee’s wording included some of the usual limitations (“substantial“, “materially“, “generally“), this is an important acquittal as inappropriate revenue recognition resulted in the requirement to restate years of financial results and the company’s delisting from Nasdaq back in 2018.

Circumvention of Export Controls

According to the press release, the Special Committee reviewed eleven specific export transactions brought up by EY:

The Special Committee did not see any evidence suggesting that anyone at the Company tried to circumvent export control regulations or restrictions, or that anyone at the Company was aware that any of its products might be diverted to a prohibited end user or location. The Special Committee also did not identify products that were sold to Russian customers or shipped to Russia in violation of export controls or sanctions laws that were in place when products were shipped.

Based on its Review, the Special Committee concluded it appears the Company has implemented a reasonable program for compliance with applicable export control regulations.

Once again, the Special Committee’s wording has been chosen carefully (“tried to circumvent“, “was aware“) so it is not entirely clear if there have indeed been no export control violations.

Related Party Disclosures

Again, the Special Committee found no major issues:

The Special Committee concluded that, with respect to the related parties identified in the Short Seller Report, they were (i) previously fully disclosed as required, (ii) not required to be disclosed by applicable disclosure obligations or (iii) in one case, the party became a related party during fiscal year 2024 and will be fully disclosed in the Company’s annual report on Form 10-K when filed.

The question remains, why the company doesn’t take action to become more transparent regarding related party transactions or perhaps even try to change its approach to related party dealings entirely?

Special Committee Recommendations

In sum, the Special Committee’s report raises no major concerns regarding management’s integrity and the company’s approach to employee rehires, revenue recognition, export control compliance and related party disclosures.

Given this issue, some investors might be surprised by the drastic management changes and additions recommended by the Special Committee:

- appointing a new CFO with extensive experience working as a senior finance professional at a large public company

- appointing a Chief Accounting officer to “create an additional layer of accounting standards and oversight“

- appointing a Chief Compliance Officer

- appointing a General Counsel and expanding the legal department

Once again, the current CFO has to take the blame and accordingly, will lose his job in the not-too-distant future. Hopefully, without a consulting agreement being put in place at a later date.

However, given Super Micro Computer’s exponential growth, the suggested management changes and additions make a lot of sense and in fact, should have happened at an earlier date already.

The final recommendation actually provides more evidence that not all is great at Super Micro Computer:

The Company should evaluate its training program regarding sales and revenue recognition policies and practices, including the appropriate role of accounting personnel in the sales transaction process, as well as streamline and revise its current active guardrails to remove unintended ambiguity from monitoring.

Please note also that the company’s newly appointed audit firm, BDO USA, P.C. (“BDO”) has not been involved in the Special Committee’s investigation and might come to different conclusions, particularly following the abrupt resignation of EY in late October. That said, the involvement of outside counsel and forensic accountants adds some much-needed credibility to the Special Committee’s report.

At least in my opinion, the most important takeaway for investors is that the likelihood of restatements has decreased further, thus in turn increasing the odds for the company to become current in its regulatory filings in due time and preserve its Nasdaq listing.

On a different note, last week’s mediocre Q3/FY2025 report and outlook by competitor Dell Technologies (DELL) actually supported Super Micro Computer’s narrative of customers waiting for sufficient availability of Nvidia’s (NVDA) Blackwell GPUs as an explanation for lower-than-anticipated near-term AI server revenue growth.

Two weeks ago, Super Micro Computer also disclosed the repayment and termination of an estimated $400 million in credit facilities with Cathay Bank (CATY) and Bank of America (BAC), likely due to the company’s inability to file its financial statements within the time frames provided by these lenders.

However, with the stock price having doubled over the past couple of weeks despite weak preliminary Q1/FY2025 results and a disappointing outlook for the second fiscal quarter, I am downgrading my rating from “Hold” to “Sell“.

Company Press Release / Conference Call

Going forward, I expect investor focus to shift back to the company’s outlook for the second half of fiscal year 2025 and beyond.

Bottom Line

An internal investigation conducted with the support of outside counsel and forensic accountants largely acquitted Super Micro Computer’s management from a number of key allegations raised in a short seller report three months ago.

That said, the fact that the company quietly rehired or contracted a number of employees, including the former CFO who had resigned in conjunction with a past investigation into improper revenue recognition, is difficult to justify and a clear sign of poor corporate governance.

Clearly, Super Micro Computer needs to learn from past mistakes and adopt a more appropriate management structure going forward, otherwise, the company’s next CFO might very well face the fate of his predecessors.

Please note also that Super Micro Computer is not entirely out of the woods with regard to the above-discussed allegations, as new auditor BDO has not been involved in the internal investigation and might very well decide to take a fresh look.

However, with the company now more likely to catch up on its regulatory filings and preserve its Nasdaq listing, I would expect market participants’ focus to switch back to Super Micro Computer’s operating performance, which has been underwhelming as of late.

With the easy money on the rebound trade having already been made and muted expectations for the company’s Q2/FY2025 report in February, I am downgrading my rating from “Hold” to “Sell“.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.