Summary:

- Super Micro Computer faces significant risks, including auditor Ernst & Young’s resignation, DOJ investigation, and potential Nasdaq delisting due to missed 10K filing deadlines.

- Despite some positive Q1 results, concerns over governance, questionable working capital developments, and decelerating growth make SMCI uncompelling at this time.

- The resignation of Ernst & Young and historical precedents suggest difficulty in finding a new auditor, further jeopardizing SMCI’s Nasdaq listing status.

- Technical analysis indicates a cautious outlook, with critical support at $23; failure to maintain this could signal the market believes delisting risks are valid.

JHVEPhoto

Super Micro Computer (NASDAQ:SMCI) (NEOE:SMCI:CA), a leading liquid-cooled server technology company, has seen its shares fall in recent weeks as uncertainty has arisen over the company’s ability to remain listed on the Nasdaq due to, among other things, missed deadlines for filing its 10-K report.

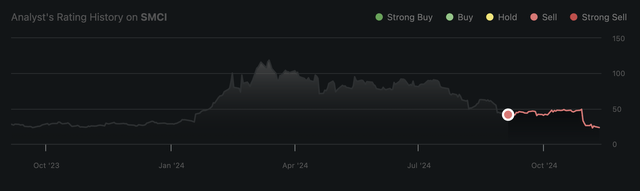

Last time we analyzed Super Micro, we took an unorthodox stance because we were one of the few bears among a fairly bullish crowd of analysts, and we argued that investors should be cautious given some of the red flags we saw with internal control issues, accounting mishaps that occurred prior to 2018 and questionable cash flow numbers. Now, a few months later, the stock is down 44% and, in the meantime, SMCI has been hit by an investigation launched by the DOJ, received a compliance notice from Nasdaq and had its auditor Ernst & Young resign, meaning our expressed concerns may have been quite justified.

So we go into more detail about what we think investors can expect now that SMCI’s auditor has resigned, why we think the risks of delisting is more realistic than currently priced into the stock, and what the recent first-quarter earnings mean for investors.

Auditor Resignation & Delisting Concerns

On Oct. 24, Ernst & Young, one of the Big 4 accounting firms, sent the members of SMCI’s audit committee a letter of resignation after EY raised concerns with the committee about several matters related to “governance, transparency and completeness of communications to EY, and other matters pertaining to the Company’s internal control over financial reporting, and that the timely filing of the Company’s annual report was at significant risk”, according to a statement in late July.

After which, the board appointed a special independent committee to review the issues. Upon receiving additional information through the review process, EY expressed concerns to this special committee about issues raised, including whether the company:

- Demonstrates a commitment to integrity and ethical values consistent with Principle 1 of the COSO Framework, about the ability and willingness of the Audit Committee and overall Board to demonstrate and act as an oversight body that is independent of the CEO and other members of management in accordance with Principle 2 of the COSO Framework.

- And whether EY could rely on representations from certain members of management and from the Audit Committee.

We consider this decision by Ernst & Young to be very important because they imply that, according to the filing, their decision is final and that the information that has come to light has led them to:

No longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management, and after concluding we can no longer provide the Audit Services in accordance with applicable law or professional obligations. (SEC, Form 8-K)

On the other hand, E&Y later added a response letter confirming that they agreed with certain facts contained in this SEC filing submitted by SMCI, and in addition, they agreed with a paragraph we did not mention above that stated:

Other than as described above, during the fiscal years ended June 30, 2024 and 2023, and the subsequent interim period preceding EY’s resignation, (1) there were no “disagreements,” as defined in Item 304(a)(1)(iv) of Regulation S-K, with EY on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which if not resolved to EY’s satisfaction to our knowledge would have caused it to make reference to the subject matter thereof in connection with its report, and (2) there were no “reportable events” as described in Item 304(a)(1)(v) of Regulation S-K.

In other words, the resignation seems to us to be primarily due to recent disagreements over director independence and unwillingness to work with EY to address the concerns of corporate governance and the broader board. Nevertheless, this decision by E&Y has broad implications, some of which range from the ability to remain listed on the Nasdaq to credit implications such as jeopardizing credit agreements due to delayed filings and the ability to obtain low-cost financing, such as from credit lines with suppliers.

We also express concern about SMCI’s ability to attract new auditors, given that the decision by a highly regarded Big 4 auditor to resign is likely to be seen as very significant by other auditors, and also given that SMCI still has an investigation hanging over its head launched by the DOJ in September, which we believe may also have contributed to EY’s decision to resign.

What’s Next?

In terms of what will happen next, we first want to highlight the fact that the special committee appointed according to SMCI has already completed the investigation based on the initial concerns contained in a report:

The Special Committee has completed its investigation based on a set of initial concerns raised by EY. Following a three-month investigation led by an Independent Counsel, the Committee’s investigation to date has found that the Audit Committee has acted independently and that there is no evidence of fraud or misconduct on the part of management or the Board of Directors.

The committee did recommend a number of measures that the company could implement, along with the fact that the full report should come out this week. Our personal view is that while many might consider these initial findings reassuring, we would put more faith in the unresolved issues that EY wanted to be addressed and seemingly did not get resolved by the Special Committee.

The company was notified by Nasdaq on Sept. 17 that it had 60 days to regain compliance by either submitting their 10-K or a plan outlining how they plan to regain compliance, which would allow them a 180-day extension. The deadline should theoretically be this week, on Nov. 16. If Nasdaq rejects this proposal, they can also appeal to Nasdaq’s hearing panel.

The interesting thing about this situation is the fact that SMCI was in almost exactly the same situation in 2017-2018, when it also failed to file multiple quarterly and annual reports, received an extension from Nasdaq, but was eventually delisted anyway in August 2018 after failing to meet listing requirements.

However, when extensions were granted, Deloitte still appeared to be acting as SMCI’s auditor, serving SMCI until the completion of its fiscal year 2023 annual report. The question also remains to what extent the earlier reporting issues will factor into Nasdaq’s current decision to grant SMCI an extension, along with EY’s resignation. We think both factors contribute to a very significant risk that SMCI will either be rejected for an extension or, even if granted an extension, still fail to appoint a new auditor or be unable to submit reports on time as it did in 2018.

In general, the precedents for an auditor like EY resigning are very bad. If we look at some of the most recent examples where EY has resigned, refused to sign off on annual filings or got replaced, including WeWork, Luckin Coffee, and Wirecard, we see that they were eventually delisted and came under tremendous fire. Perhaps the positive outlook for getting an extension from Nasdaq is the fact that the problems at this point are only related to governance and not fraud or misconduct, if investors are to believe the Special Audit Committee findings.

Cash Flow Is King

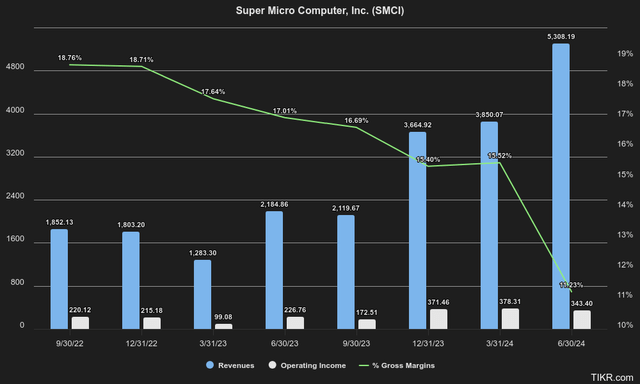

Something we highlighted earlier, and always like to look at when there are concerns about governance or accounting, is the underlying cash flow dynamics, where we saw a significant difference with operating income. While operating income came in at $343.40M last quarter, free cash flow remained very negative at -$524.98M.

Much of this had to do with SMCI seeing some drastic changes in their net working capital, with growing inventories and accounts receivable, which we saw as a risk factor. Free cash flow improved somewhat according to Q1 results in the latest earnings call, where preliminary estimates put free cash flow positive at $365M versus our calculated GAAP operating income at $522.05M. Inventories grew to about $5BN in Q1, up from $4.41BN.

According to management during the earnings call, there was a significant increase in accounts payable, which contributed to the increase in free cash flow. Interestingly, management did give working capital figures such as days of accounts payable outstanding, which increased to 29 days from 25 days last quarter. The cash conversion cycle grew to 97 days, compared with 94 days last quarter. Days of inventory outstanding also increased to 85 days from 82 days last quarter, and days of sales outstanding also increased to 41 days from 37 days last quarter.

So there might be some concern when looking at inventory levels and accounts receivable, given that they continue to grow while seeing SMCI’s top- and bottom-line results slow down on a forward-looking basis, which we will address in a moment. Note that going forward, we will only use GAAP figures and estimates.

But if we first look at preliminary estimates for this quarter (Q1), we see that while SMCI did not meet revenue expectations, revenue still came out to an average of $5.95BN, which is up from $5.31BN last quarter. In addition, gross margins improved to 13.3% from 11.2% last quarter. Estimated GAAP operating income is expected to approach $522.05M, which is an improvement from $343.40M last quarter. In other words, operating margins also saw a significant improvement from 6.5% to 8.77% sequentially. From a balance sheet perspective, we also saw some improvements, with a net cash position of -$0.2BN compared to -$0.5B last quarter.

The disappointment came mainly from the guidance for Q2, which was lower than expected in many aspects. The mid-point for revenue is expected to come in at $5.8 billion, down from $5.95 billion this quarter, with gross margins expected to decline by 100 basis points and operating expenses to increase by $34M. This, according to our calculations, would translate to gross margins of 12.3% and operating income of $410.10M, which would be down from $522.05M this quarter.

This means, in our opinion, that SMCI will either face serious competition from other server manufacturers such as Dell (DELL) and HP (HPE), or that we are close to the peak of this hardware cycle for AI. During the earnings call, management also did not want to give an outlook for annual results, further surprising investors. Regardless, we recognize that SMCI faces both a growth slowdown and continued margin pressures going forward.

And although technically SMCI is only trading at 8.29x its expected $410.10M second-quarter annualized operating income ($1.64BN) with a market capitalization of $13.60BN, we still believe the risks outweigh the fundamentals in this case. As described above, the serious risks of a delisting, questionable operating capital developments and a possible AI hardware overbuild/peak make the company uncompelling for us at this time.

Spooky Technicals

We were surprisingly accurate about the technicals in our last piece we published on SMCI, explaining that the stock was trading in a classic bubble pattern involving a double-top and a return to the baseline. A few months later, it seems that this is exactly what the stock has done at the moment, having found support around the $23 mark.

From a momentum perspective, the 50-day moving average crossed the 200-day moving average at a 2-hour interval, which could signal that more downward pressure may be ahead.

TradingView, Wright’s Research

We would especially keep an eye on this $23 support zone because if it were to fall, we believe it would likely reflect market sentiment or be an important signal of a possible delisting of SMCI.

If we look at similar patterns from the dot-com bubble with the Nasdaq-100 and from the “everything bubble” in 2021 with the Ark Innovation ETF and others, these technical patterns tend to have a very long period where the stock trades near sideways for years, which we would also see as a probability in this case.

TradingView, Wright’s Research

The Bottom Line

Super Micro Computer still has until Nov. 16 to file their 10K or submit a plan to Nasdaq with a roadmap on how they will regain compliance. If this plan is accepted, SMCI could get a 180-day extension and avoid delisting in the short term, but still needs to find a new auditor.

We see the resignation of a highly regarded auditor such as Ernst & Young as a very significant development, as we believe it will be extremely challenging to recruit a new auditor, given that there is currently a DOJ investigation hanging over its head and the precedents of other companies where EY resigned do not exactly set a positive tone. Moreover, it also seems difficult to engage with another auditor on such short notice. Thus, we are concerned about SMCI’s ability to remain traded on the Nasdaq and believe that the company is, in our opinion, uncompelling for the time being. This also means that we believe these regulatory issues trump the cheap valuation at which SMCI is currently trading, as previously assessed.

We agree with Seeking Alpha’s Quant, which currently has SMCI at a “Strong Sell” rating, and would await further developments and more certainty on SMCI’s ability to maintain compliance with Nasdaq.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.