Summary:

- Super Micro Computer’s stock surged 20% pre-market after an independent review found no glaring issues, contrary to former auditor Ernst & Young’s resignation notes.

- Despite the positive review, I recommend holding SMCI due to the ongoing uncertainty with audited financial reports and Nasdaq listing compliance.

- Super Micro’s rapid market leadership with AI hardware boosted its growth, but recent gross margin erosion and competitive pressures have caused sell pressure.

- The company’s history of accounting irregularities and potential delisting risks make it prudent to stay on the sidelines until financial stability is confirmed.

Dilok Klaisataporn

The bulls came rampaging back in pre-market trading on December 2nd, 2024 as Super Micro Computer (NASDAQ:SMCI) issued a press release that the independent review of its internal controls, operations, and accounting practices has concluded. The review found no glaring issues and disagreed with the resignation notes of the company’s former auditor, Ernst and Young. The stock is up nearly 20% in pre-market trading at the time of writing. As the rollercoaster ride continues for SMCI investors, it’s important to take a step back and weigh the risks carefully.

Understanding the current risk and opportunity presented by Super Micro Computer requires a deep understanding of the company’s history. If one analyzes Super Micro’s financials in a vacuum, the company is deeply undervalued. I discuss the valuation in my most recent article, but for now, we can’t invest in SMCI on a valuation basis alone. I recently rated SMCI a Strong Buy based mostly on its valuation, so I will be downgrading the company to a Hold due to the uncertainty over the legitimacy of its financial reports. Despite the press release from today, I still recommend a Hold until the company has published audited financial reports and maintains compliance with the Nasdaq listing requirements once again. There is far too much uncertainty in the short run to recommend that investors buy this stock.

Super Micro’s Path to Mania

Super Micro Computer is an American server OEM that has benefitted greatly from the booming demand for AI hardware. The company has long maintained the belief that being first to market with new technology is the way to win long term. This approach resulted in Super Micro beating larger OEMs like Dell (DELL) and HP, Inc. (HPE) to market with Nvidia (NVDA) H100 servers, which allowed it to gobble up large amounts of market share in a booming market. This brought Super Micro to the forefront of many investors’ attention as the market sought to find other long-term AI winners besides Nvidia. I was one of those investors, having first covered SMCI in May of 2023 with a Strong Buy rating. I followed up this coverage with several other Buy rated articles, discussing supply constraints, market leadership, and the stellar earnings report in January of 2024 that set off a face ripping run.

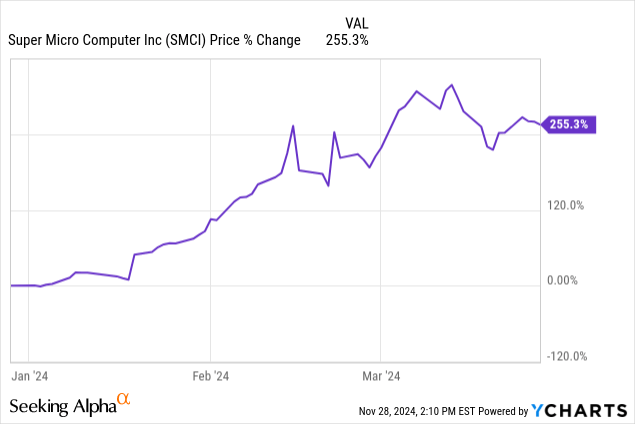

The thesis for Super Micro was quite compelling at the time. The company was growing top line in the triple digits while the market was pricing in only modest growth. There was a huge mismatch in growth rates versus valuation, which the market woke up to in February of this year. The company earned S&P 500 inclusion in March of 2024, which brought the company to +255% YTD as March came to a close.

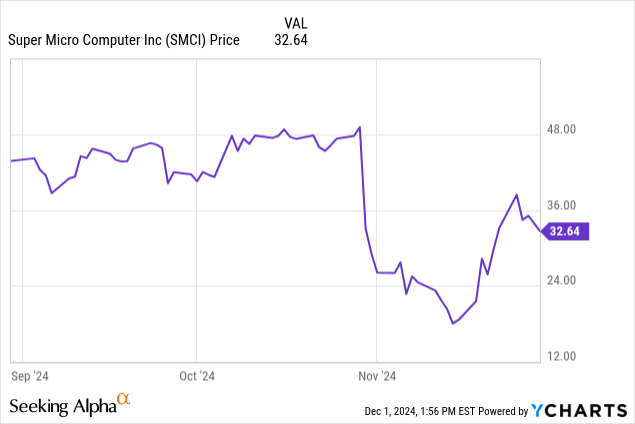

After this, I covered SMCI again saying it was priced for perfection. This proved prescient as the company began experiencing an erosion in gross margin which led to violent selloffs. Super Micro has been and will continue to be a price taker to Nvidia, and it operates in a highly competitive market with very little product differentiation. Server OEMs operate with very thin margins, something Super Micro was shielded from for a while it was the only game in town. Its speed to market gave the company some more pricing power, but once Dell and HPE began shipping AI servers in volume, Super Micro’s gross margin began quickly declining. This came to a head in the FY Q4 ’24 report in August. The market punished the company’s gross margin erosion, which had fallen from around 15% to 10% in 2024. The selloff came despite guidance from management that margins will recover back to the 15% range by the end of fiscal 2025, which led to my recent Strong Buy recommendation. This recommendation was on August 7th, after which the stock had a flurry of bad news create enormous sell pressure.

On August 27th, a short report by Hindenburg Research created some fear of accounting irregularities. I discuss the short report in detail here. The following day, the stock cratered after the company announced it would be late in filing its 10-K for the year. Next, the Justice Department announced a probe into SMCI on September 26th. The drama was reignited in dramatic fashion on October 30th when the company’s auditor, Ernst & Young, resigned suddenly. It wasn’t until November 18th that the company announced a new independent auditor and said that the company expects to have audited financials published by December 31st to maintain compliance with Nasdaq listing standards. All this news was met with very extreme reactions by investors.

Accounting Irregularities: A Familiar Story

The Hindenburg Research short report had an extensive discussion of Super Micro’s prior delisting debacle in 2018. The company was delayed in releasing audited reports and was delisted for two years. The company cleaned up its internal reporting systems and got the SEC sign-off on its reports. Management claimed that they had cleaned up shop. Perry Hayes, then head of Investor Relations (he left the company in 2020) said: “Internal management’s changed. We have a chief of compliance officer. We didn’t have a senior level auditor reporting to the board: now we do. We had a CFO change; new staff within the management and the accounting group. We also changed our head of sales… In addition to that, we hardwired in some of the internal controls and processes around the revenue recognition to prevent some of those things from happening. Our board of directors has also been changed; we now have three CFOs on the board of directors…”

Today, the company is taking many of the same steps it did in 2020 to be re-listed. It’s hiring a new CFO and cleaning up internal controls and systems. A Chief Compliance Officer will be hired (that role was previously handled by outgoing CFO David Weigand). Additionally, the company will hire a Chief Accounting Officer and expand its legal team and hire a General Counsel. I find little reason to believe these changes are addressing the root cause of the issue. Hiring new executives and promising to clean up the house is very similar to what SMCI did the last time around. The ‘root cause’ provided in this was the same as last time. The company had outgrown its internal systems. The size and complexity of its business operations led to issues with internal controls and legal compliance. This was the same exact reason given in 2020. This should give pause to any long-term investor. For shorter term momentum traders there may be opportunity here, but the elevated volatility makes any decision to buy extremely risky.

I believe that it’s best to stay on the sidelines until the company submits updated financial reports and regains compliance with Nasdaq listing standards. I cannot recommend that investors buy a company that is currently at high risk of being delisted.

Investor Takeaway

Existing or potential investors in Super Micro are caught in quite the predicament. On one hand, the company is deeply undervalued on a purely financial basis. On the other hand, there’s an abundance of reason for investors to doubt the legitimacy of the historic financial results and management guidance for fiscal 2025. The company is also currently in violation of Nasdaq listing requirements and has a very elevated risk of being delisted, something that has happened in the past.

The investment case is extremely complex. If the company posts audited financial reports, maintains listing compliance, and quells the doubts of regulators, then the stock will shoot back up to the $50 range quite quickly. However, the risks presented here should not be taken lightly. Considering the uncertainty presented, I am rating Super Micro a Hold at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.