Summary:

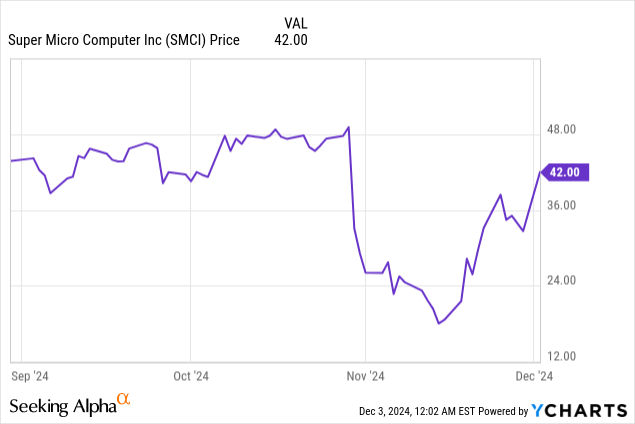

- Supermicro’s stock dropped 64% from my sell call on October 17, 2024, due to DoJ investigation and accounting concerns, hitting a low of $17.25 on November 15, 2024.

- The stock rebounded 143% from its low to $42 by December 2, 2024, as the company addressed initial accounting issues.

- Investors should remain cautious until an audited report is filed, despite recent positive developments like appointing BDO USA as an independent auditor.

- Supermicro is a buy for risk-tolerant, aggressive growth investors, but the company’s risks still warrant careful consideration.

JHVEPhoto

The last time I wrote about Super Micro Computer (NASDAQ:SMCI), also called Supermicro, was on October 17, 2024; I issued a sell call because of a potential DoJ investigation and accounting concerns brought up by a whistle-blower lawsuit. I learned long ago that it is often best to sell the stock of companies accused of having accounting issues or that may be under investigation. A decent percentage of the time, the uncertainty surrounding such situations leads to a downdraft in the stock price, precisely what happened On October 30, 2024, when Supermicro dropped around 33%. The stock hit rock bottom on November 15 at an intraday price of $17.25, a 64% decline from my sell call price of $48.08.

Recently, the stock has been on the rise due to management taking steps to clear up the initial accounting concerns. The stock ended December 2 at $42, up 143% from its November 15 bottom. This article will discuss the news that catalyzed Supermicro’s stock to drop on October 30 and the good news that sparked the stock’s recent rise. It will also examine why investors should remain cautious about fully believing the company’s first quarter fiscal year (“FY”) 2025 preliminary financial report, review a few risks, the valuation, and why the stock is a buy for risk-tolerant aggressive growth investors.

The bad news

The news that sparked Supermicro’s stock price decline on October 30 was the resignation of Ernst & Young LLP, one of the Big 4 accounting firms, along with Deloitte, PricewaterhouseCoopers, and Klynveld Peat Marwick Goerdeler (KPMG). The sudden resignation of an auditor of Ernst & Young’s stature has many negative implications. The company’s difficulties in finding a new auditor and getting them up to speed may have disrupted its operations, potentially hurting Supermicro’s competitive standing. This situation might also bring increased scrutiny from the Securities and Exchange Commission (SEC). When the company eventually files its FY 2024 annual and its first quarter FY 2025, there is a risk that the SEC may require further changes. One of the worst repercussions of an auditor resigning is that investors could lose confidence in management and trust in the company’s financial reports.

The good news

The company held a conference call for its first quarter FY 2025 preliminary results on November 5, 2024. Chief Executive Officer (“CEO”) Charles Liang said on the call:

We are working with urgency to become current again with our financial reporting. I am pleased to report that the Special Committee has today provided the following statement to Super Micro, which is also included in our press release. I quote, “The Special Committee has completed its investigation based on a set of initial concerns raised by Ernst & Young. Following a three-month investigation led by an Independent Counsel, the Committee’s investigation to date has found that the Audit Committee has acted independently and that there is no evidence of fraud or misconduct on the part of management or the Board of Directors. The Committee is recommending a series of remedial measurement for the company to strengthen its internal governance and oversight functions, and the Committee expects to deliver the full report on the completed work this week or next. The Special Committee has other work that is ongoing but expects it to be completed soon.” End of quote.

If you believe the company’s preliminary numbers, Supermicro’s first quarter FY 2025 revenue grew 181% over the previous year’s first quarter to the midpoint of $5.9 billion to $6 billion. Previous guidance called for $6.0 to $7.0 billion in revenue. CEO Liang said on the earnings call:

[Growth was] driven by strong AI demand from our old and new customers. It was one of our strongest first quarters in history, despite many customers are waiting for the coming soon new generation GPU chips.

The company’s first-quarter preliminary non-GAAP gross margin is around 13.3%, an expansion of two points from the 11.3% produced in the fourth quarter of FY 2024, and its non-GAAP operating margin is approximately 9.9%, up from the 7.8% operating margin last quarter. CEO Liang said, “Both [gross and operating margin] were higher than the previous quarter as customer mix improved, and supply chain costs and expedited shipment eased for DLC (Direct Liquid Cooling) components.”

Supermicro’s first quarter FY 2025 non-GAAP earnings grew 122% over the previous year’s first quarter to the midpoint of $0.75 to $0.76 per share (“EPS”). Be aware that the company issued these unaudited preliminary numbers before it found a new accounting firm. Chief Financial Officer David Weigand said on the first quarter preliminary conference call, “The final financial results reported for this period may differ from the results reported here based on the review by the new independent registered public accounting firm to be appointed.“

The stock bottomed ten days after the first quarter preliminary earnings release and conference call. On November 18, Supermicro appointed BDO USA as an independent auditor and filed a compliance plan with Nasdaq (NDAQ). BDO USA is the fifth-largest accounting firm in the U.S. market, which boosted investors’ confidence. Additionally, if Nasdaq accepts the company’s compliance plan, Supermicro may avoid delisting and reestablish some investor confidence in management.

The stock rose 28.68% on December 2 after the company announced that the Independent Special Committee had completed its review. The press release stated:

Special Committee, supported by outside counsel Cooley LLP and forensic accounting firm Secretariat Advisors, LLC, finds no evidence of misconduct on the part of management or the Board of Directors and that the Audit Committee acted independently

No restatement of reported financials expected

Board adopts recommendations of the Special Committee and appoints new Chief Accounting Officer, approves the transition to a new CFO and authorizes additional executive hires, along with other measures to strengthen the Company

The Special Committee finding no evidence of wrongdoing by management or the Board of Directors reduces the likelihood of the SEC banning key management from serving. It also increases confidence in company leaders’ integrity and ethical practices. Investors also welcomed news that restatements of reported financials are unlikely, increasing confidence that the company’s financial statements are accurate and reliable.

The Special Committee report suggests that Supermicro may have outgrown its management’s governance and compliance capabilities. As a result, the Committee recommended that the company find an experienced Chief Financial Officer (“CFO”) and a new Chief Accounting Officer to strengthen its financial reporting and governance practices. It also believes the company needs to hire a Chief Compliance Officer and a General Counsel and expand its in-house attorneys.

Supermicro investors hope that by implementing the Special Committee’s recommendations, the company can avoid delisting and stave off a potentially overly intrusive SEC investigation.

Risks

Although a new auditor and the Special Committee report are positive steps in the right direction, investing in Supermicro is still a high-risk proposition. Investors should remain cautious about believing the company’s numbers until management can file an audited report with the SEC. Until the company files and the SEC accepts the report without making changes, the possibility that management might have to restate numbers remains on the table. Other risks could make some avoid the stock.

While management gave guidance for FY 2025 annual revenue of $26 billion to $30 billion on the fourth quarter FY 2024 earnings call, they didn’t want to discuss annual guidance on the first quarter preliminary conference call—a sign of uncertainty about what the FY 2025 year will bring.

Seeking Alpha published an article on December 3 that stated:

In our view, the next key watch points for investors to monitor include: whether the new independent auditors, BDO, accept the findings of the Special Committee or decide to undertake their own independent review; and whether Nasdaq supports Super Micro’s request for an extension of time to regain compliance with the Nasdaq continued listing requirements, where the company has already outlined its intention to complete its 10-K and 10-Q filings and become current within the discretionary period available,” analyst Samik Chatterjee wrote in a note to clients. Chatterjee kept his Underweight rating on Super Micro.

There is a chance that BDO will undertake an independent review and develop stricter measures. It could also decide that Supermicro needs to restate prior earnings. Additionally, Nasdaq could decide that Supermicro doesn’t fit its listing requirements and delist the stock. If the above scenarios manifest, investors could lose confidence, and the stock could head back down.

These accounting issues could negatively impact the company’s market share and revenue growth in future quarters. In response to a question on the first quarter conference call about why preliminary revenue results were less than fourth-quarter guidance, CEO Liang said (emphasis added):

So I believe the major impact is new chip availability. Because Blackwell chip for sure is much higher performance, much better performance per dollars, right? And the good thing is that it will be available gradually. And Q1 hopefully, Q1 2025 volume become much better. And so that’s the major factor, I believe. As to our 10-K delay may impact a little bit, how much I don’t know yet, but a certain impact for sure, but hopefully not too big. As to the whole year, yes, today, we do not provide annual guidance basically with our detailed edge, right. In the last few months, we delivered more than 2,000 rack DLC. That, I believe, is a very high percentage for the whole deep cooling market. So, for the future growth, is still very optimistic.

So, the company is not out of the woods yet. It is in fierce competition with Dell Technologies (DELL) and Hewlett Packard Enterprise (HPE), which both could use Supermicro’s troubles to gain market share by presenting themselves as more stable and trusted providers.

Valuation

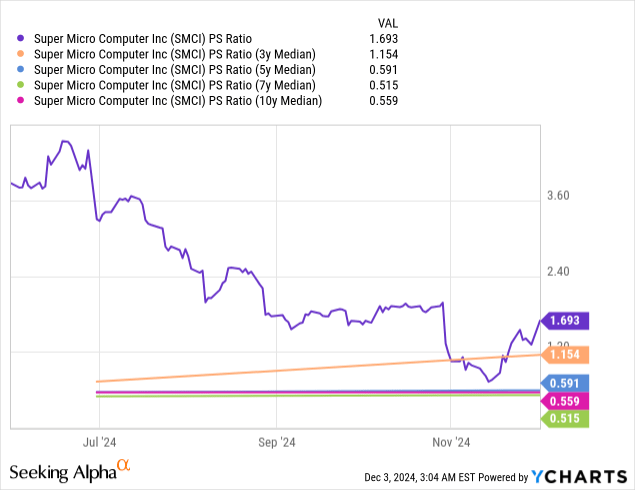

Supermicro’s price-to-sales (P/S) ratio is 1.693, above its three-, five-, seven-, and ten-year medians. Some investors may consider the stock overvalued because of this comparison to its median.

Supermicro’s one-year forward price/earnings-to-growth (“PEG”) is 0.34 (One-year forward price/earnings of 11.20 divided by analysts’ June 2026 estimated EPS growth of 32.82%). Suppose the stock sold at a one-year forward PEG ratio of 1.0; the price would be $123.08, a 193% rise from the December 2 closing price of $42.

The weakness of forward-looking forecasts is that they rely on analysts to assess the future accurately. Considering all the turmoil surrounding the company’s numbers, analysts have even more difficulty making accurate forecasts one year out, especially when the company is reluctant to make annual forecasts. So, take the above valuation exercise with a grain of salt. Considering the company’s recent accounting issues, the market may apply a heavy discount to its valuation. There is a risk that the stock may not reach a price of $123 over the next year.

Supermicro is a buy

This buy recommendation comes with the qualification that only risk-tolerant investors should consider buying the stock. Conservative investors should avoid it. The company is still in a high-risk situation. Despite recent optimism, events could still play out badly for Supermicro, and the stock could sink. If you fully understand those risks, the stock’s decline this year may represent a buying opportunity. The exact reasons for buying the stock that existed when I first recommended it on November 15, 2023, for $29.50 remain valid. I upgrade Supermicro to a buy for aggressive growth investors who understand the risks of investing in this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.