Summary:

- SMCI’s stock surged 65% following my latest “Buy” reiteration, driven by the new auditor’s appointment and after an internal review found no misconduct.

- I believe that this latest news can truly be described as “game-changing” because it fundamentally changes the market’s sentiment towards SMCI.

- Another catalyst needed to fully restore market confidence in SMCI is its SEC reporting and Nasdaq compliance, which I expect to see addressed by late December 2024-January 2025.

- The stock is now one of the cheapest in its sector and industry, trading at discounts of 50-80% to next year’s valuation multiples.

- The current severe undervaluation of the stock and the potential improvement in EPS estimates will open up a bid room for the stock to recover. I keep my “Buy” rating in place after the massive surge from the bottom.

Pornyot Palilai/iStock via Getty Images

Introduction

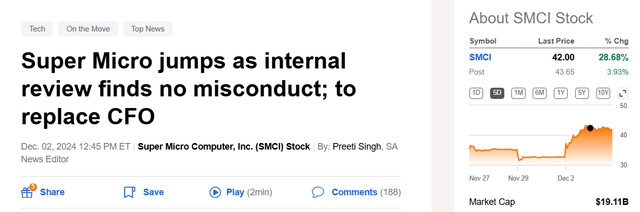

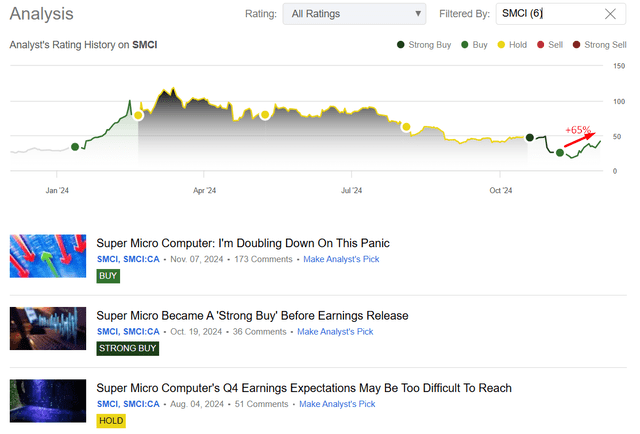

To begin with, let me tell you a bit about my past article on the stock. I initiated my coverage of Super Micro Computer (NASDAQ:SMCI) stock in mid-January 2024 with a “Buy” rating, stating that the stock was undervalued. After the SMCI stock price rose from $34.55/sh. to about $79/sh., I downgraded my rating to “Hold” and advised investors to trim their positions, as I believed the stock had become too expensive. From mid-February to the beginning of August, I remained neutral as I feared that the negative factors that were accumulating around the SMCI would put it under further pressure. The margin contraction indeed continued. The epic delay in the publication of quarterly results also added fuel to the fire, putting further pressure on the stock price. Nevertheless, I raised my rating at the end of October, as I expected a stronger report for the first quarter of fiscal 2025. Unfortunately, my “Strong Buy” didn’t initially pan out, as news broke that SMCI’s former auditor – EY – had decided to resign a few days before the report release. The market reacted with an expected panic. However, I confirmed my bullish stance and stated that I’d buy the dip. I did.

So SMCI stock is now up about 65% since that “Buy” reiteration and the average return of my last 2 bullish calls is now around +20% while the S&P 500 index (SPX) is up only 3.2% since last October.

Seeking Alpha, Oakoff’s coverage of SMCI stock, notes added

What’s Driving SMCI Stock Higher?

Well, first, as I expected, they reported better-than-expected preliminary earnings figures for Q1 fiscal 2025, according to Seeking Alpha. Although the guidance for Q2 came in below consensus, and the stock price reacted negatively initially, the market got a confirmation that the business is actually doing not as bad as was feared. Second, SMCI found a new auditor – BDO USA – which is a reputable firm (even though it’s not a Big 4 representative), so the market participants could finally breathe out with some comfort. The third news broke out a few hours ago – the outside counsel Cooley LLP and forensic accounting firm Secretariat Advisors, LLC, found “no evidence of misconduct on the part of management or the Board of Directors”. As a result, the stock skyrocketed immediately:

That independent review of Super Micro’s financials, which began following the resignation of EY “due to governance and transparency issues”, has found no support for the auditor’s assertions and found no reason to correct financial statements, according to the press release. Although the over-three-month investigation found “a few lapses”, the company is working on correcting them, naming a new CFO, Chief Compliance Officer, and General Counsel, and appointing Kenneth Cheung as its new Chief Accounting Officer.

There were, however, lapses, including in ensuring guardrails were always in place and observed. The Special Committee determined that, because the Company’s Chief Financial Officer/Chief Compliance Officer (CFO/CCO) had primary responsibility for the process of rehiring these employees, he had primary responsibility for process lapses.

- The Special Committee found no evidence indicating that any process lapse resulted from bad faith, improper motives, or lack of regard for accurate financial reporting or compliance, on the part of the CFO/CCO or anyone else.

- These lapses included instances of not promptly informing the Company’s Audit Committee and/or independent auditor of certain rehires or plans to rehire some of these former employees, including not informing EY prior to entering in June 2024 into a now terminated consulting arrangement with the Company’s former CFO, who had resigned following the 2017 Audit Committee Investigation.

Source: From the press release

The committee made a number of recommendations that it believes will improve governance and internal controls and support the “dynamic growth” of the company’s business operations. The company has adopted all of the recommendations.

Source: Morningstar

Super Micro should submit its financial statements during the Nasdaq reporting period and isn’t going to restate any reports from fiscal 2024 or prior years. I believe that this latest news can truly be described as “game-changing” because it fundamentally changes the market’s sentiment towards SMCI.

As far as I understand it from behavioral finance theory (and just the theory of finance), a company’s audited financial statements are taken for granted by the market by default. In other words, market participants assume that every public company reports within the existing rules and fear the auditor’s “negative conclusions and opinions” like fire. We live in such a worldview and recall the actual fragility of this taken-for-granted assumption, when it is clearly violated. EY’s resignation was a clear example of a sharp increase in the risk of this violation occurring. This lowered the SMCI stock price significantly, but it was only a risk, not a confirmed fact. The increase in risk led to a severe undervaluation of the stock and made it extremely cheap. But now that independent professional reviewers have determined that the actual “lapses” were likely minor, and we now see that SMCI is unlikely to need to make any restatements, the market’s confidence has returned. I think the market will now be less skeptical of SMCI’s financials going forward.

What’s Next For SMCI Stock?

I think there’s one more catalyst left before the market’s faith in the company is fully restored – actual SEC reporting and Nasdaq compliance. I expect we’ll see more news on these topics before the end of the year or before the end of January, so the current positive market sentiment around SMCI is just the beginning, in my understanding.

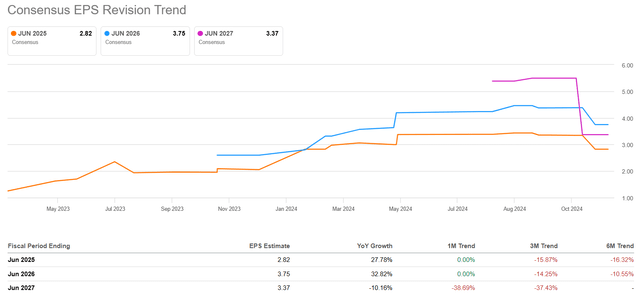

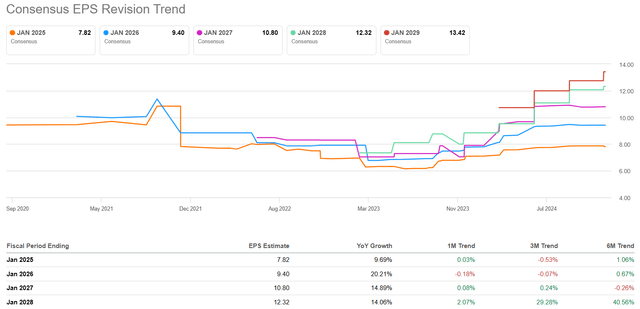

Once those catalysts come in, we’re likely to see a revision of bank estimates, some of which have removed their price targets due to the uncertainties surrounding SMCI’s former auditor (at least Argus Research has done so, as far as I can see). Over the last 3-6 months, SMCI earnings per share expectations have fallen very sharply – so we have fertile ground, a low base of comparison, for a recovery in growth.

The reason why I hope for a positive revision of the forwarding EPS figures is the comparative match with direct peers who share almost the same market niche as SMCI. For example, Dell Technologies (DELL), whose EPS estimates weren’t hit as of late and are actually growing:

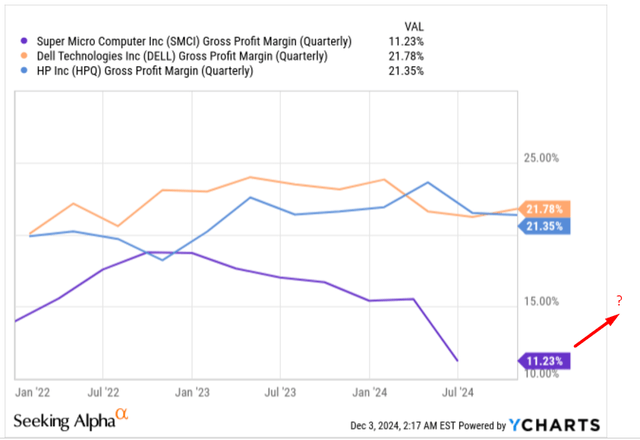

I also hope that the appointment of the new “chiefs” will have a positive impact on operational processes, which will most likely provide the necessary boost to SMCI’s margins. Today, SMCI’s gross margin is far behind that of DELL or HP (HPQ), which was not an acute problem 2-3 years ago. Again, despite the rather weak guidance given in early November, I think SMCI can still make some gains In terms of GP margin (again, the base for comparison is quite low while the market expectations seem to be still lagging).

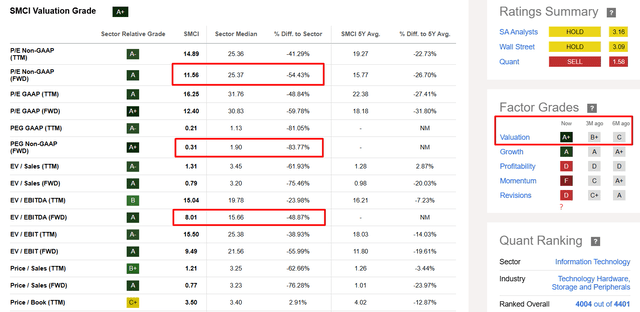

Another point is the persisting undervaluation. Even though the stock closed almost 27% higher yesterday in just one trading day, the valuation of SMCI stock is still very depressing. According to Seeking Alpha’s Quant system, SMCI’s Valuation grade improved “from “B+” 3 months ago to “A+” now. This means the stock is now one of the cheapest in its sector and industry, trading at discounts of 50-80% to next year’s valuation multiples.

Seeking Alpha, SMCI’s Valuation, Oakoff’s notes added

Based on all that, I believe SMCI is still a “Buy” – the recovery isn’t over yet, it seems to be just getting started.

Risks To My Thesis

My thesis about SMCI still holds my hopes, but I know there are dangers that might knock it out of whack. For one, my faith in the company’s future rests on the premise that the independent review and governance reforms that have recently taken place will totally renew market confidence. But if the SEC or Nasdaq discovers new issues in compliance or the company delays its financial filings, the stock may experience more pressure. What’s more, despite the arrival of fresh leadership, it may be a while before any real operational improvements result. If the company is unable to adopt the recommended governance reforms or raise the margins, the market will not trust it for the long term.

Another threat is the market itself and its competitive environment. SMCI is in a fiercely competitive market, and although its valuation sounds attractive, the firm’s gross margins trail those of Dell and HP. If SMCI fails to overcome this gap, its recovery will likely falter.

All these risks may put a ceiling on the stock’s recovery I’m expecting.

Your Takeaway

Despite the risks I outlined above, I expect the recent news that the independent committee found no serious breaches in SMCI’s finances will reduce the level of negative sentiment around the company. I also expect the new management to take a number of measures to build more optimal business processes, which should lead to a stabilization of margins in the medium term. If this happens, the current severe undervaluation of the stock and the potential improvement in EPS estimates will open up a bid room for the stock to recover.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.