Summary:

- In mid-September 2024, I downgraded Super Micro Computer, Inc. once more, citing concerns about the company’s potentially “shaky situation” despite the hefty dip it experienced since early 2024.

- With the stock down 30% in a single day, SMCI stock now looks relatively cheap. However, I strongly advise against buying this dip.

- In the case of Super Micro, waning confidence in management is likely to lead to a sustained discount in the stock’s valuation.

- SMCI’s likelihood of exceeding current forecasts has, in my opinion, noticeably decreased. Additionally, it’s crucial to receive the company’s 10-K, which we have yet to see.

- I believe that the really difficult times for Super Micro stock could still lie ahead. So for now, I am watching developments from the sidelines and warning against buying into today’s downturn.

D-Keine

Intro & Thesis

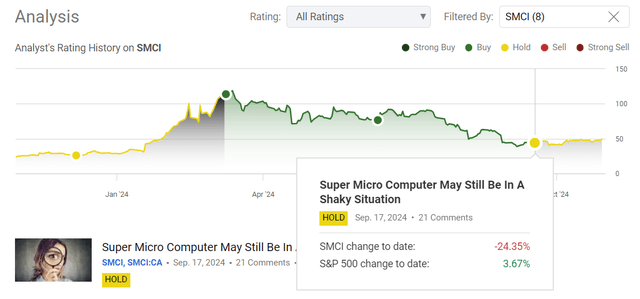

I began covering Super Micro Computer, Inc. (NASDAQ:SMCI) stock here on Seeking Alpha in early December 2022, initially assigning a “Strong Buy” rating. However, by June 2023, I downgraded it to a “Hold.” At one point, I reconsidered my stance and upgraded the rating, but in mid-September 2024, I downgraded it once more, citing concerns about the company’s potentially “shaky situation” despite the hefty dip it experienced since early 2024. Today’s news and the subsequent price action have validated my decision, as the stock has plummeted over 30% in a single trading day.

Seeking Alpha, my coverage of SMCI stock

The stock’s recent decline, coupled with unresolved financial concerns and potential overvaluation, makes it a risky investment despite previous strong performance.

Source: from my September 2024 article.

With the company down 30% in a single day and down almost 60% in the past three months, Super Micro now looks like a relatively cheap investment. This may tempt some investors to buy this dip. However, I strongly recommend against this. There are far more reliable companies on the market with management teams that inspire more confidence. In the case of Super Micro, waning confidence in management is likely to lead to a sustained discount in the stock’s valuation. So without a positive catalyst, I think it is premature to expect a potential turnaround.

Why Do I Think So?

Let’s take a closer look at the recent news I mentioned above: Ernst & Young LLP, the company’s now former auditor, stepped down on 24 October, according to Seeking Alpha:

It’s important to here consider that the auditor’s resignation followed another significant issue that has been frequently discussed by other analysts in their reports (including myself) – these are the allegations made by a famous short seller. Additionally, following the release of that report, SMCI’s management announced that it would delay the release of its 10-K for the SEC.

The timing of the short seller’s report and the subsequent delay of Super Micro Computer’s 10-K filing were quite alarming for me and many other investors. Back in September, I cited Audit Analytics which identified several causes of SEC delays, including misspelled proxy statements, exhibits, financial restatements, and XBRL-related issues. I thought SMCI might get rid of most market concerns because XBRL issues aren’t as bad as one may imagine (though they’re generally raised by smaller or emerging companies rather than multibillion-dollar giants such as Super Micro). But now, having the data on hand, I see a clear disconnect: coupled with the auditor’s resignation, the whole situation makes me feel more than just concerned.

Of course, Seeking Alpha cited the management, who hurried to explain that they won’t require any restatements of its FY2024 and prior years’ financials. CEO Charles Liang has assured customers and partners that the short report and filing delay will not have an impact on them. But the unfolding story and the resignation of one of the largest audit firms hints at something deeper that needs to be scrutinized. I think I don’t have to explain in detail why it’s bad when an auditor leaves: if it happens, particularly without any apparent or innocuous cause, it’s actually a sign that something may be deeply wrong with the company. Auditors often quit when they see the firm performing unqualified accounting activities or disputes over the reporting of financial data, according to Business Time.

I approached the situation from a scientific perspective and decided to investigate articles on how a stock might behave after an auditor leaves a company. The current 30% drop we’re witnessing could be just the beginning of a long-term correction. As suggested by research published in the Journal of Accounting, Auditing, and Finance (dated June 2000), as a rule, big auditors leave larger clients with high crash risk more frequently than smaller auditors. However, auditor size is not critical once there is a crash because the client firms are then the risky customers for big and small auditors. Based on what I’ve read, I suspect that the CEO’s assurance that the financial statements won’t be restated is merely an attempt to put a positive spin on a difficult situation. In reality, the risk that the financials will indeed require a restatement is very high, in my opinion – consequently, trust in the management team is unlikely to be restored anytime soon.

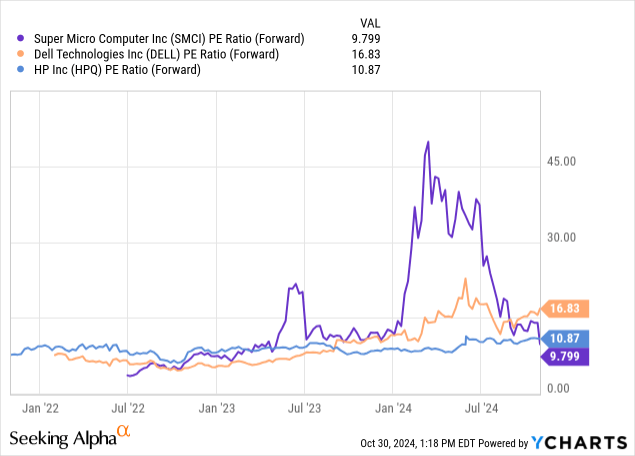

Amid today’s significant stock dip, which has been painful for many investors, I anticipate that many bullish-minded folks will claim that now is the time to buy, while others are fearful. Indeed, the SMCI stock now appears quite cheap when comparing its forwarding P/E to those of its peers, such as HP Inc. (HPQ) or Dell Technologies Inc. (DELL):

In my opinion, however, the current valuation of the company may not yet fully reflect the risks that have emerged for Super Micro. In my last article, I argued that the company’s margins continue to shrink, while those of its competitors have remained relatively stable overall. SMCI’s plans to expand into new niche markets and the fact that they remain one of the biggest suppliers to NVIDIA Corporation (NVDA) fueled excitement around the company’s future growth prospects (at least last year). However, given the obvious problems, I believe current EPS estimates are likely to be revised downward. In addition, there’s a risk that Nvidia will switch to Dell’s products for fear of potential reputational damage. So I wouldn’t take SMCI’s apparent undervaluation too seriously right now.

Another reason for my skeptical (if not negative) attitude toward purchasing Super Micro stock during its current dip is the discrepancy between analysts’ forecasts and the information emerging from the market. After a disappointing report for the last quarter, analysts are divided on what to expect for the upcoming quarter. SMCI is set to report on November 6 for its fiscal Q1 FY2025. Notably, EPS forecasts for this quarter have increased over the past six months but have barely changed in the last month, indicating that optimism still prevails in the market regarding expected EPS and the company’s ability to manage its margins.

I believe this creates a precarious situation for prospective dip-buyers, as SMCI’s likelihood of exceeding current forecasts has, in my opinion, noticeably decreased. Additionally, it’s crucial to receive the company’s 10-K, which we have yet to see.

In my opinion, even if the current EPS forecasts for the next few years are accurate, the company will likely still carry the burden of market mistrust. This should result in a discounted valuation – this is why its current valuation multiple seems, at best, fair in the medium term. In reality, it could be even lower.

The Bottom Line

In conclusion, I would like to say that Super Micro Computer, Inc. (SMCI) deserves the slump we’re seeing right now, in my opinion. A month ago, the valuation alone compared to the forecast growth rates could have argued in favor of buying Super Micro stock. However, as today’s situation shows, this would have been a risky move, so I think we shouldn’t discuss how much undervalued SMCI has become. I believe that the really difficult times for Super Micro stock could still lie ahead. I expect the stock likely fall further as both new and long-term investors exit, which could lead to a further widening or stabilization of the valuation discount.

Therefore, I maintain my “Hold/Neutral” rating as in the current environment, any positive catalyst could boost the stock significantly (even if only temporarily). So for now, I am watching developments from the sidelines and warning against buying into today’s downturn.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!