Summary:

- Super Micro Computer stock has surged significantly from its November 2024 lows, stunning investors who bailed out and fled then.

- The special committee’s findings indicated no evidence of fraud or misconduct, potentially reducing delisting risks.

- However, corporate governance lapses were still assessed, suggesting internal controls weren’t as robust as what investors expected.

- The BDO audit is critical to helping SMCI recover from its malaise, suggesting the all-clear sign isn’t here yet.

- However, dip-buying sentiments have turned increasingly robust, underscoring the market’s confidence in SMCI’s recovery.

JHVEPhoto

Supermicro: Buyers Returned With Conviction

Investors in Super Micro Computer, Inc. (NASDAQ:SMCI) who bailed and fled as the stock crashed below the $20 level, are now likely regretting their rash decision. Accordingly, SMCI has recovered more than 160% from its November 2024 lows through its highs last week. While there has been a momentary pullback this week, I assessed that dip-buyers have returned with conviction to bolster the stock’s performance. However, fears of the upcoming Nasdaq 100 (NDX) (QQQ) annual reconstitution could have affected recent sentiments on SMCI as investors weigh the risks of the stock being dropped after the reconstitution.

Notably, Supermicro built on the recovery in November 2024 by releasing a detailed report highlighting the work completed by Supermicro’s independent special committee. In addition, the SMCI’s plan to seek an extension to meeting listing rules has also been approved by Nasdaq in another filing last week. Hence, it has further bolstered bullish market sentiments on SMCI. It’s critical for investors to note that Nasdaq’s decision followed closely with the release of the special committee’s report, portending well for Supermicro’s chances to regain compliance with the listing requirements by February 2025. CEO Charles Liang has maintained his confidence that SMCI “will not be delisted” as he attempts to shore up buying sentiments for the embattled AI server supplier.

As a reminder, the committee was formed mainly to further investigate the inquiries raised by its former auditor, Ernst & Young. Hence, investors must note that it doesn’t indicate that Supermicro has gotten the all-clear sign yet. It must complete its external audit expeditiously with new auditor BDO USA and file its delayed 10-K and 10-Q accordingly to regain compliance with Nasdaq listing rules.

Despite that, Supermicro’s progress is notable, leveraging positive market momentum following its recent appointment of BDO USA as its new auditor. Nasdaq’s extension of Supermicro’s deadline has removed the risks of immediate delisting, providing a welcome semblance of calm while giving the company and its auditor more time to help regain compliance.

Hence, the market has likely determined that SMCI bridged the gap toward regaining compliance. However, investors must be cautious when making preemptive assessments of Supermicro’s ability to regain compliance with Nasdaq. Accordingly, investors must not write out the possibility that BDO USA could still discover adverse findings or indicate conflicting/contrasting opinions from that of Supermicro’s independent special committee. Notwithstanding my caution, sufficient weight should also be afforded to SMCI when determining the credibility of Supermicro’s special committee, as it comprised significant hours by Cooley LLP (outside counsel) and Secretariat Advisors (forensic accountants).

Supermicro’s Assessed Delisting Risks Have Likely Been Lowered

In my previous Supermicro article, I upgraded the stock. I was confident that the successful appointment of BDO USA has markedly lowered SMCI’s possible delisting risks. While I noted increased execution risks, as its arch-rivals upped the ante against SMCI, I also highlighted why the stock could bottom out over the critical $20 support level. Accordingly, my bullish thesis has panned out, as buyers returned to defend that level over the past three weeks, a possible sustainable recovery from its recent lows. Hence, I believe it’s justified to assess that the worst is likely over, corroborated by the constructive release of the work completed by Supermicro’s special committee. The key findings from the committee have justified the market’s recent optimism about SMCI. Accordingly, it assessed “no evidence of fraud or misconduct” in its business processes, which has likely assured the market to some extent. Accordingly, the committee carried out wide-ranging investigative work. These include corporate governance, revenue recognition practices, export control framework, and related party transactions. Hence, I believe the detailed scope seems comprehensive and corroborative enough to assure investors that no fraud was committed by Supermicro. Wall Street analysts have also noted the positive impact of the recent developments and even highlighted that the risks of SMCI delisting seem “minimal” for now.

Supermicro’s Corporate Governance Needs Significant Improvements

Despite that, I find it troubling to discover certain corporate governance lapses in Supermicro’s management. Notably, Supermicro acknowledged that “there were, however, lapses, including in ensuring guardrails were always in place and observed.” As a result, CFO David Weigand was recommended to be replaced, given that he was the “primary responsibility for process lapses.” The special committee’s decision to corroborate the CFO’s function with the addition of a chief accounting officer is assessed to be apt and justified, in my opinion. Given the increased complexities of Supermicro’s revenue exposure and expansion, SMCI’s corporate governance must be further tightened expeditiously.

I also find it perplexing that a company of Supermicro’s stature (an S&P 500 company) doesn’t have a separate executive performing the role of a chief compliance officer. The current CFO “doubles up” as the CCO, which doesn’t seem to be the best practice in its industry. Arch-rivals Dell (DELL) and Hewlett Packard Enterprise (HPE) have separate officers performing the role of the CCO, highlighting the distinction. Hence, the recommendation to untether the CCO function from the CFO is justified and necessary, in line with the best practices of its rivals. Aside from that, I believe Supermicro must quickly step up in its implementation of expanding its legal department and hiring a general counsel. Despite that, the special committee determined that it “did not see any evidence suggesting that anyone at the Company tried to circumvent export control regulations or restrictions.”

However, the rapidly evolving export compliance regulations by the Biden administration have caused much flux within the industry. There are reasons to believe that the Trump administration will be equally (if not more) stringent in hampering the access of AI chips to America’s adversaries. Hence, investors must continue to pay close attention to these developments to determine the path forward for the stock.

SMCI Stock: Valuation Bifurcation Assessed

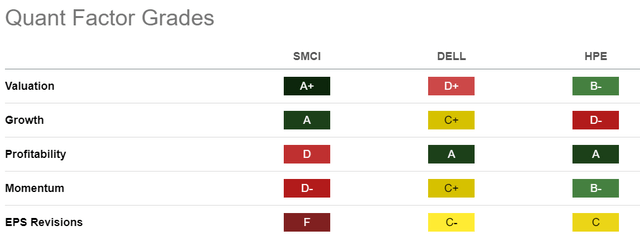

SMCI valuation metrics vs. peers (Seeking Alpha)

Accordingly, SMCI’s “A+” grade is assessed to be too pessimistic, even though it boasts a much faster growth grade than its direct peers. Compared to its arch-rivals, the market seems to have baked in significant pessimism when considering SMCI’s forward-adjusted PEG ratio of 0.39 (almost 80% below its tech sector (XLK) median). Hence, I believe the recent remarkable recovery of SMCI suggests that the market has likely realized its folly, as investors could have overstated Supermicro’s delisting risks previously.

Is SMCI Stock A Buy, Sell, Or Hold?

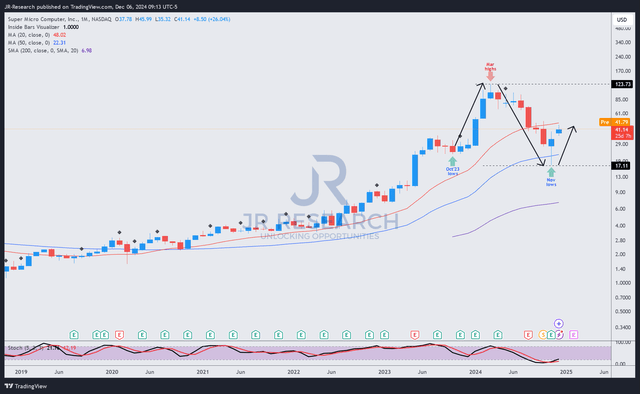

SMCI price chart (weekly, medium-term) (TradingView)

SMCI buyers demonstrated remarkable resilience recently as they returned to help underpin the stock’s $20 critical support zone. In addition, the selling intensity that sent the stock into a tailspin in November has been decisively reversed by buyers above the $20 support zone.

The favorable update by Supermicro’s special committee has strengthened my conviction that the risks of delisting have been lowered, although not completely dissipated. The external audit by BDO USA is critical to helping SMCI regain compliance. Therefore, I expect buying momentum will likely be more cautious in assessing the risk/reward of SMCI in the near term, even as November’s bullish reversal seems decisive.

Given the stock’s stellar surge from its November lows, I assess that a bullish rating remains appropriate, and thus will maintain my Buy rating.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!