Summary:

- Super Micro Computer is significantly undervalued due to highly likely exaggerated fears of accounting manipulations and the reported DOJ investigation, presenting a strong buying opportunity.

- Despite reputational challenges, SMCI’s partnerships with NVIDIA and AMD affirm its credibility and operational integrity, bolstering confidence in its financial reports.

- Preliminary FQ1 2025 results show robust revenue growth and improved margins, driven by strong AI GPU platform demand, indicating solid business fundamentals.

- Valuation analysis suggests a fair share price of $90, highlighting substantial upside potential from current levels, making SMCI a compelling opportunity.

JHVEPhoto

Introduction

Super Micro Computer (NASDAQ:SMCI) is still dropping, and is five times cheaper than its March 2024 peak. The company is still generating exponential revenue growth and increasing EPS. However, the stock price suggests that concerns about SMCI’s accounting inaccuracy overshadow robust business expansion.

I am not happy that the stock plunged by 63% since my August bullish call, as I have skin in the game. I have been buying aggressively since the stock started tanking in late August, meaning that I have a substantial SMCI position. I also worry about the recent auditor resignation and there is a lot of uncertainty in the FY2024 10-K report release timing. Yet, the stock is so cheap that it provides an excellent opportunity to double down. The preliminary earnings for the latest quarter were released a week ago. It is very hard to imagine that the management would risk presenting an unfair view of SMCI’s financial performance, given the panic around the stock and the reported DOJ investigation.

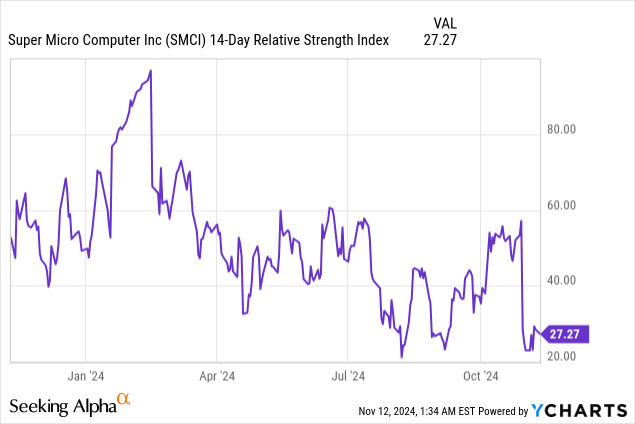

The deeply low 14-day RSI reading shows how very spooked the market is over SMCI. This makes me greedy. I tend to believe that allegations of accounting manipulations are exaggerated. Therefore, I still consider SMCI a ‘Strong Buy’.

Fundamental analysis

SMCI has recently encountered several significant reputational challenges. This began with a late-August opinions from some analysts that questioned the trustworthiness of SMCI’s financial statements and the management’s integrity. The company then failed to file its 10-K report on time, and there are reports of a DOJ investigation regarding allegations around accounting manipulations. As a result of all these adverse events, the stock price decreased by more than 60% since late August.

The company has recently released its FQ1 2025 preliminary results and FQ2 2025 guidance, with robust revenue and EPS growth. I tend to trust in the accuracy of this release, despite the aforementioned allegations. There are two big reasons for such confidence.

The first is that it is hard to imagine that a company under public pressure and scrutiny would manipulate its financials. Second, no major semiconductor companies have separated from SMCI and continue to call SMCI their partner. It has been rumored that Nvidia is taking orders away from SMCI, but I tend to go with what the companies say on their website.

On October 15, Nvidia announced a new partnership with SMCI. The expanded collaboration highlights the integration of Nvidia’s BlueField data processing unit (‘DPU’) into SMCI’s storage solutions. This factor highlights Nvidia’s confidence in SMCI’s trustworthiness. Furthermore, a presentation endorsing SMCI is still available on AMD’s official website. I might be missing something, but Nvidia and AMD appear to be companies with flawless reputations. Thus, it is highly unlikely that Jensen Huang or Lisa Su would risk their reputations by supporting collaboration with a company with questionable integrity or operational practices. There is also a separate page on Intel’s website dedicated to endorse SMCI’s offerings.

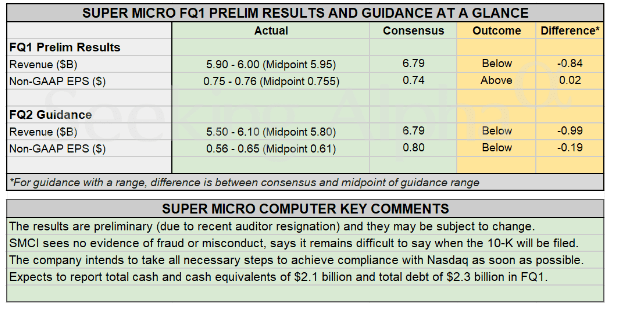

SA

Therefore, I consider the preliminary earnings announcement as trustworthy. According to preliminary results, revenue for FQ1 ranged from $5.9 billion to $6 billion, representing an 181% year-over-year increase. The growth was primarily driven by strong demand for AI GPU platforms. SMCI’s non-GAAP gross margin has improved quarter-over-quarter from 11.3% to 13.3%. The profitability expansion was powered by favorable shifts in the product and customer mix.

The FQ2 guidance also looks robust, with the projected range from $5.5 billion to $6.1 billion. The $5.8 billion midpoint level is 58% higher compared to the same quarter of FY2024. The guidance fell short of Wall Street expectations, but this looks explainable, as the management cites low Blackwell GPU availability due to high demand. So, the problem looks temporary.

Secular trends are still strong as cloud giants look unwilling to cool down their data center spending spree. Amazon plans to invest another billion+ in Italian data centers and has recently bought 350 acres for data center in Becker. Google’s plans to invest much more in data centers over the long term are apparent after the company announced that it is buying nuclear reactors to meet the energy demand of its current and future data centers. Microsoft also recognizes the potential for data center expansion and is already incorporating sustainable solutions to minimize its environmental footprint. Thus, the industry is thriving and evolving rapidly, providing a strong tailwind for SMCI.

The stock is significantly oversold, with its 14-day RSI indicator at a historically low level of 27. While the market seems extremely fearful about SMCI, I prefer to set emotions aside. The world’s largest semiconductor companies, which undoubtedly value their reputations, continue to work closely with SMCI, suggesting that the allegations are likely overestimated. Furthermore, the company is already under significant public pressure and scrutiny, making accounting manipulations around the latest preliminary quarterly earnings release extremely unlikely.

Valuation analysis

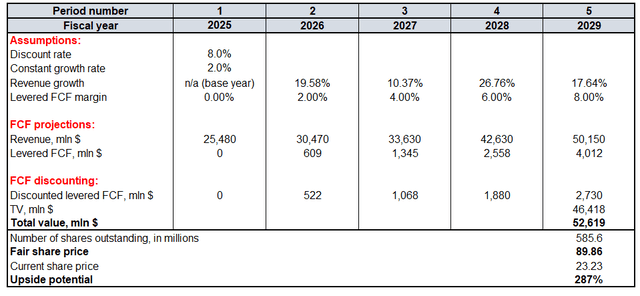

As I mentioned, the stock is now significantly cheaper than it was in late August, and such a plunge is explained by fears of the market regarding accounting manipulation allegations. However, since I outlined why I believe that these fears are highly likely exaggerated, I plan to rely on long-term consensus revenue projections to build my DCF model. The zero FCF margin for the base year reflects the company’s aggressive CapEx spending to address soaring demand. For the years after FY2025, I reiterate the same trajectory of the metric expanding by 200 basis points yearly. To balance out an aggressive FCF margin assumption, I use a very conservative 2% constant growth rate to calculate terminal value (‘TV’). I use an 8% WACC to discount future cash flows.

The first simulation indicates a fair share price of approximately $90, which is almost four times higher compared to the current share price. Thus, fears around the stock made it extremely cheap.

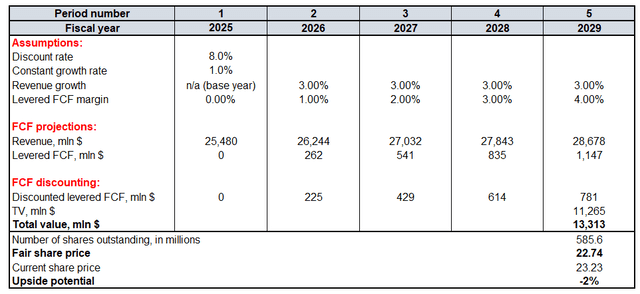

The fair value estimation approaches the current share price only if unrealistically pessimistic assumptions are incorporated. The fair share price is around $23 when I apply a 1% constant growth rate and a very low 3% revenue CAGR for the next five years, with the FCF margin expanding by only 100 basis points annually.

With that said, I believe SMCI is very attractively valued. My target price is $90 per share, which is close to mid-summer 2024 levels, making such upside potential realistic.

Mitigating factors

Official communication is crucial in emergency cases threatening the image of a business, such as those experienced by SMCI over the last few months. In my opinion, the management could have handled the situation in a smoother way. As a result, it seems that the stock crash would not have been as bad. There is still no indication of when the company’s FY2024 10-K report will be published, which creates room for possible new bad-looking headlines. This might just set off another bearish market wave if the communication approach between the management and investors remains the same.

Additionally, the past precedent of delisting in 2019 due to accounting issues remains a concern. According to the official information from SMCI, the management is still unable to share the expected date of the 10-K filing, which increases risks of failing to comply with Nasdaq listing rules. However, I believe that the company’s efforts to engage a new auditor will mitigate the risk. The completion of the Special Committee’s investigation, which found no evidence of fraud or misconduct, is a positive step towards resolving this adverse situation.

Conclusion

As an investor, I prefer to set emotions aside and focus on the facts. A company that has faces intense public scrutiny is almost certainly not going to play along with its accounting books. This factor makes the recent preliminary FQ1 2025 earnings release is a reliable informational tool. I am also extremely skeptical that Nvidia, AMD, or Intel would continue supporting SMCI as a crucial technological partner if there was really something wrong with it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.