Summary:

- Super Micro Computer released Q1’25 earnings this week, causing shares to plunge 18%.

- The company’s inability to file overdue financials and a high-profile auditor resignation are two major developments that affect my risk rating negatively.

- Despite a slight gross margin improvement in Q1’25, it was a weak earnings pre-release. SMCI’s Q2’25 guidance shows no top-line growth Q/Q.

- Given these developments, I am lowering my rating to hold, as the risk setup has greatly deteriorated.

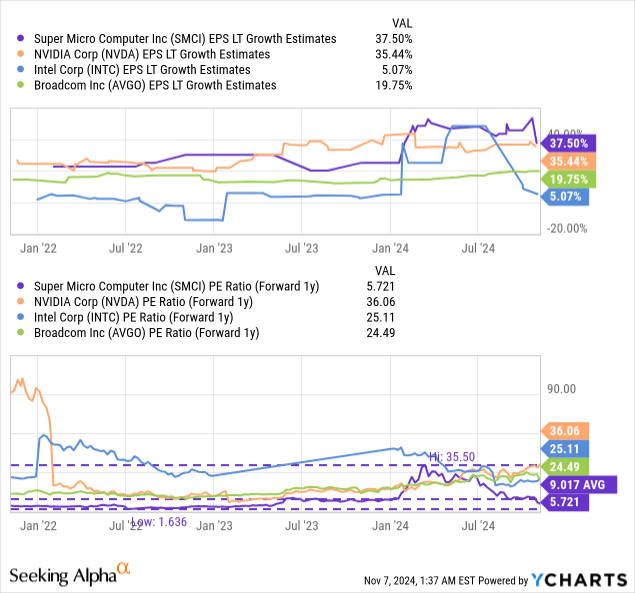

- Shares are currently trading at 5.7X forward earnings, well below the 3-year average. However, shares may have an extraordinary high amount of risk until the company restores trust in its financials.

peshkov

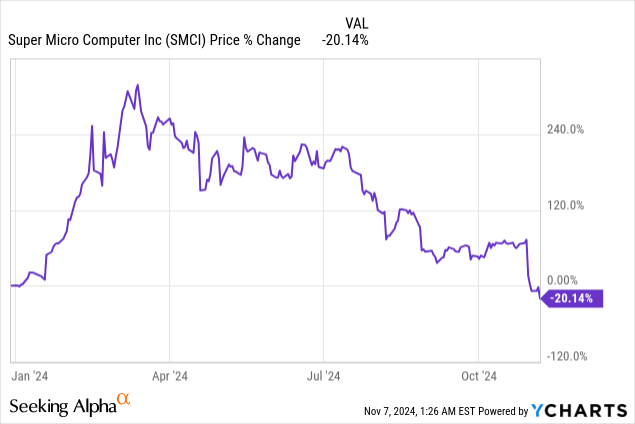

Super Micro Computer (NASDAQ:SMCI) pre-released Q1’25 earnings on Tuesday that caused the company’s shares to drop double-digits the following day. The drop occurred after Super Micro Computer said that its auditor Ernst & Young resigned, causing extreme negative sentiment overhang. Since Super Micro Computer is not yet able to deliver its annual report (which was due in August 2024) the company faces a deteriorating risk landscape that includes a potential delisting from the Nasdaq, unless the AI hardware company regains compliance with Nasdaq’s listing requirements. I believe, in light of the latest developments, that the risk setup has deteriorated greatly here and, correspondingly, I am lowering my rating to hold.

Previous rating

I recommended Super Micro Computer as a strong, speculative buy to long-term growth investors in August — Be Greedy When Others Are Fearful — as I believed the DOJ probe into the company’s accounting practices created too much unwarranted, negative sentiment overhang for the company’s shares at the time. I also indicated that Super Micro Computer was working towards a multi-year revenue growth opportunity in the rapidly expanding server market, which fundamentally supported an investment in SMCI. However, the inability of Super Micro Computer to submit overdue financials and the auditor resignation are clear warning signs that should not be ignored. Additionally, the company’s outlook for Q2’25 does not imply any material revenue growth and with a delisting a potential consequence of the company’s inability to submit a 10-K, I am withdrawing my strong buy rating.

SMCI’s Q1’25 earnings pre-release

Super Micro Computer is facing a multitude of challenges that are fundamentally affecting the risk matrix negatively. According to SMCI’s pre-liminary earnings for Q1’25, the server maker reported adjusted earnings in a range of $0.75 to $0.76 per-share, compared to a previous guidance of $0.67 to $0.83 per-share. Super Micro Computer had net revenue of $5.9-6.0B in Q1’25 which fell short of its guidance of $6.0-7.0B. Therefore, Super Micro Computer’s net revenue fell below the low-end of its Q1’25 guidance, creating selling pressure on the company’s shares on Wednesday.

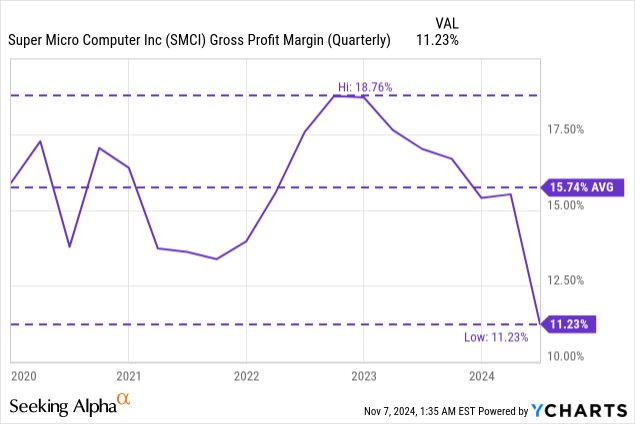

However, Super Micro Computer saw a small increase in its gross margins in the first fiscal quarter. According to the pre-earnings release, Super Micro Computer expects to report a non-GAAP gross margin of approximately 13.3% for the September quarter, which would be an improvement over the weak trend in margins we have seen in previous quarters. In Q4’24 (SMCI’s June quarter), Super Micro Computer’s non-GAAP gross margin amounted to 11.3%, so while the revenue performance disappointed, I believe the margin gain Q/Q was a positive take-away.

The real focus is now on risk

I have not covered Super Micro Computer after it was reported that SMCI was under investigation by the Department of Justice over its alleged accounting irregularities. Since then, another bombshell was dropped by SMCI: the firm’s auditor Ernst & Young resigned from its audit mandate, stating that it was “unwilling to be associated with the financial statements prepared by management.” This is a serious escalation of Super Micro Computer’s current situation and fundamentally changes the risk matrix for Super Micro Computer as well as for investors. Further, the delay in the 10-K filing, which was expected to be submitted to the SEC in August, is now overdue by more than two months, which raises the risk of a Nasdaq delisting.

On September 20, 2024, Super Micro Computer announced that it received a non-compliance letter from the SEC (due to the failure to timely file its financial reports). The company has 60 days from the date of the notification to submit its financial records or risk a delisting. Super Micro Computer confirmed in its earnings pre-release on Tuesday that it still does not know when the 10-K will be filed, creating additional uncertainty that is not going to help the share price in the short term.

Super Micro could regain compliance with Nasdaq listing rules if it convinces the stock exchange that it is diligently working on a plan to regain compliance. If the exchange approves of the company’s plan, Nasdaq could extend the grace period for the filing of the 10-K report from 60 days to 180 days. It goes without saying that Super Micro Computer is now in a very tough spot, and the share price reflects this development. After earnings, SMCI’s share price dropped 18% and the year-to-date performance is now negative 20%.

Weak outlook for Q2’25

Super Micro submitted its guidance for the second fiscal quarter, which calls for $5.5-6.1B. This guidance implies practically no growth for the AI hardware company quarter-over-quarter. The reason for this is that companies like Nvidia (NVDA) are said to route their AI GPU supplies to other companies. If this turns out to be true, this would deal the AI hardware company another blow just at a time when the company grapples with the risk of losing its Nasdaq listing. On the earnings call, however, Super Micro’s CEO Charles Liang clarified that he does not see a major impairment of the relationship between Nvidia and SMCI and that he does not expect any allocation/supply problems as far as the new Blackwell GPU is concerned.

SMCI’s valuation

I recommended Super Micro Computer for two reasons: 1) The server market represented a multi-layered growth opportunity for SMCI, and 2) A delayed 10-K filing as well as a DOJ investigation into the company that followed from this delay resulted in a depressed valuation that I predicted investors could exploit to their favor. This turned out not to be the case, as the auditor resignation made things worse for SMCI.

Shares of the AI hardware maker are now valued at a forward price-to-earnings ratio of 5.7X, which is 37% below the 3-year average P/E ratio of 9.0X. Compared to other AI-focused hardware companies, Super Micro Computer is very cheap: companies like Nvidia, AMD (AMD) and Broadcom (AVGO) are trading at significantly higher price-to-earnings ratios of 24X or more, but these companies also don’t have SEC filing issues and don’t battle the fallout from a high-profile auditor resignation.

With this, much negative sentiment overhang affecting SMCI and the 10-K report still being late, SMCI may have a very hard time re-pricing to its valuation average… which I previously thought was possible. In the longer term, considering that Super Micro Computer can regain the confidence of investors by restoring trust in its financials, I do see a path for the AI hardware company to revalue to 9-10X forward earnings… which is not an especially rich valuation factor. This valuation range implies a fair value in the neighborhood of $36-40 per-share, implying up to 75% revaluation potential. Given the multitude of problems that SMCI now faces, however, there is considerable uncertainty about whether the shares will remain listed on the Nasdaq. This uncertainty as well as the fact that SMCI submitted a disappointing revenue guidance for Q2’25 are reasons for my down-grade to hold.

Risks with SMCI

Super Micro Computer is still dealing with a considerable amount of issues: the company does have a transparency and trust problem relating to its financials, is battling a DOJ investigation and now a delisting is potentially on the table. What would change my mind about Super Micro Computer is if the company were to see a revenue slowdown in its core server business, which would likely be accompanied by a simultaneous gross margin contraction (in which case I would rate SMCI a sell). On the other hand, a resolution of SMCI’s accounting woes and the avoidance of a Nasdaq delisting would likely be reasons for me to upgrade Super Micro Computer to buy/strong buy.

Final thoughts

Super Micro Computer submitted its pre-release earnings for its first fiscal quarter on Tuesday, which resulted in an 18% stock price crash the following day. In my opinion, SMCI is facing a serious negative sentiment overhang that makes it almost impossible to value the company right now: Super Micro Computer’s shares trade at a material discount to other AI hardware plays in the market, as well as below SMCI’s valuation average in the last three years. Super Micro Computer is facing a deteriorating risk matrix after its auditor resigned, and the company said on Tuesday that it still doesn’t know exactly when it will submit its annual financial report to the SEC. Therefore, I am forced to down-grade my rating for Super Micro Computer from strong buy to hold until investors get more clarity of the actual state of SMCI’s business.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI, NVDA, AMD, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.