Summary:

- Super Micro faces renewed concerns over its corporate governance framework as EY resigned as its auditor.

- The auditor highlighted that it was “unwilling to be associated with the financial statements prepared by management.”

- SMCI will report its Q1FY2025 business update on November 5. I expect it to be an intense session.

- Investors and analysts have bailed out, as SMCI crashed more than 30% yesterday. Since its March 2024 peak, the stock is down nearly 75%.

- I highlight why the time and patience for Super Micro is running out, even as it seeks to find a new auditor.

JHVEPhoto

Super Micro’s Auditor Resignation Intensified Investor Risks

Super Micro Computer, Inc. (NASDAQ:SMCI) investors endured a pummeling yesterday (October 30) as the leading AI high-flyer saw its wings clipped, dropping more than 30%. The recent resignation of Super Micro’s auditor, Ernst & Young, spurred the selling intensity, as the market priced in potentially higher risks not anticipated previously.

In my previous bullish SMCI update, given the recent DoJ probe, I had already cautioned about the intense scrutiny facing the company. Therefore, SMCI investors have voted with their feet over the past two months since Hindenburg Research released its bearish short-selling allegations against the Charles Liang-led company.

As a result, the EY resignation has followed these developments worryingly. It was indicated that the auditor had already identified critical concerns in July 2024, preceding the formation of a special committee by SMCI to investigate the issues. Accordingly, the company highlighted that its special committee is “independent,” led by legal advisors Cooley LLP and forensic firm Secretariat Advisors. They are tasked with assessing whether any corrective actions or governance changes are required to address the issues flagged by EY.

Despite that, EY’s resignation underscored the potential deficiencies in the strength of SMCI’s corporate governance framework. Accordingly, the auditor raised concerns over Super Micro’s adherence to the COSO Framework’s Principles 1 (integrity and ethical values) and 2 (independence and oversight). It seems to me that EY has lost confidence in Super Micro’s ability to comply with the framework. Furthermore, the auditor indicated that these issues led them to “no longer be able to rely on management’s and the Audit Committee’s representations.” In addition, the auditor emphasized that it is “unwilling to be associated with the financial statements prepared by management.” Such bold statements could suggest that SMCI is facing severe concerns about its internal controls, potentially affecting EY’s ability to discharge its professional duties as the company’s auditor.

Super Micro’s Nasdaq Listing Could Be Under Threat, While Competitors Up The Ante

I must highlight that these developments mark a significant red flag for me, notwithstanding SMCI’s attractive valuation metrics. Note that the company has a 60-day window from September 17 to submit its delayed 10-K filing or “submit a plan to Nasdaq to regain compliance with Nasdaq’s listing rules.” Therefore, EY’s resignation has occurred at an inopportune moment, as we are inching closer to the November 16 deadline. As a result, I assess that SMCI’s potential delisting risks have been heightened markedly, even as the company seeks to appoint a new auditor.

Besides that, Dell (DELL) and Hewlett Packard Enterprise (HPE) could capitalize on Super Micro’s regulatory and audit fumbles to capture market share in the fast-evolving AI server market. DELL’s outperformance against SMCI since February 2024 corroborates the market’s rotation away from Super Micro stock, as DELL/SMCI has moved into an uptrend bias. I assess that DELL’s relative outperformance could gain more traction if customers are increasingly worried about the stability of SMCI’s listing and regulatory status.

Wall Street also highlighted concerns about SMCI potentially defaulting on a term loan agreement with Bank of America (BAC). Analysts have also turned increasingly concerned, suggesting that Super Micro’s “previous financial model should no longer be relied upon.” In other words, investors must assess whether SMCI’s financials might need to be restated, even as it faces possible liquidity and funding challenges, given the resignation of its auditor and potential delisting consequences. Although the company telegraphed that it doesn’t expect to restate its past financials, EY didn’t “co-sign Super Micro’s statements that the company doesn’t expect changes to previously issued financial results.” Hence, the auditor’s lack of confidence in SMCI’s proclamations is expected to heighten investors’ and regulatory scrutiny, potentially lifting sentiments on its peers.

In a highly competitive market where being first to market is increasingly pivotal, Super Micro customers could become more cautious and potentially turn to DELL and HPE for AI rack server solutions. Moreover, as Super Micro is expected to scale its DLC (liquid-cooled) servers, the recent regulatory and audit challenges have likely dealt a severe blow as it contends with more intense competition from its peers.

SMCI Stock: Momentum Has Worsened Significantly

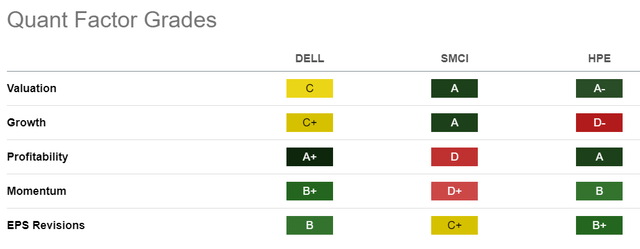

SMCI Quant Grades (Seeking Alpha)

As seen above, DELL and HPE still aren’t valued at a premium relative to their tech sector peers (XLK), justifying the rotation. The market has already astutely moved away from SMCI, as seen with its “D+” momentum grade, downgraded from “A+” over the past six months.

Super Micro will report its Q1FY2025 business update on November 5. I believe the company will seek to assure investors that EY’s resignation hasn’t materially impacted its assessment of the need to restate its financials. However, given EY’s resignation, I assess the market will want more clarity on whether SMCI expects to gain compliance with Nasdaq’s listing requirements before the deadline on November 16. Hence, investors and analysts are expected to demand more proof points to consider buying the dip, as SMCI’s momentum has weakened considerably.

Is SMCI Stock A Buy, Sell, Or Hold?

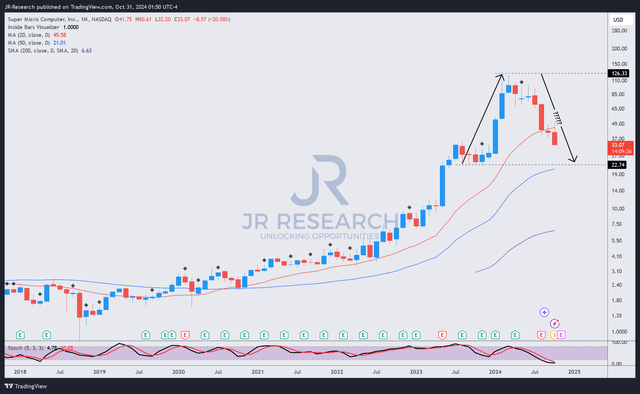

SMCI price chart (monthly, medium-term) (TradingView)

SMCI’s price action suggests its long-term uptrend has remained intact, notwithstanding the battering it received since its March 2024 peak. It has lost nearly 75% through yesterday’s lows, giving back most of its gains since its October 2023 bottom.

Yesterday’s steep selloff has invalidated a near-term support zone above the $37 level, suggesting further volatility should be expected. SMCI could fall further toward the $22 zone, potentially re-testing a more robust support zone before a consolidation is expected.

SMCI’s risk/reward has worsened, given the lack of clarity over its qualitative and corporate governance challenges. Moreover, HPE and DELL could boost their competitiveness by exploiting Super Micro’s malaise to gain more share in the fast-moving AI rack server market.

I have less confidence about SMCI’s bullish reversal at the current levels. However, as the stock’s long-term uptrend has not been decisively breached, I’m reticent about turning bearish at the current levels, but I assess that a downgrade is appropriate.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!