Summary:

- Super Micro Computer has had an extremely volatile FY2024 stock price performance, indeed, as observed in the meteoric rise in Q1’24 and the subsequent losses through November 2024.

- The short seller report, delayed 10K filing, auditor resignation, and non-compliance with Nasdaq listing have triggered its uncertain prospects and elevated short interests.

- This is on top of the rerouted client orders to other suppliers, with it already contributing to SMCI’s underwhelming FQ2’25 guidance.

- Here is where we believe that its high-growth investment thesis may have been painfully negated, with more near-term volatility likely.

- It may be more prudent to watch out for SMCI’s upcoming FY2024 10K and FQ1’25 10Q filing, along with the onboarding of the new auditor, for more clarity.

DSGpro

SMCI Is Overly Discounted Here – Albeit With Valid Reasons

We previously covered Super Micro Computer, Inc. (NASDAQ:SMCI) in October 2024, discussing its robust prospects attributed to the promising generative AI/ data-center related capex boom, as observed in the management’s rich FQ1’25 earnings guidance.

These tailwinds were then impacted by the potential issues arising from the delayed annual 10-K report worsened by the short seller report – with it triggering near-term uncertainties for those looking to add.

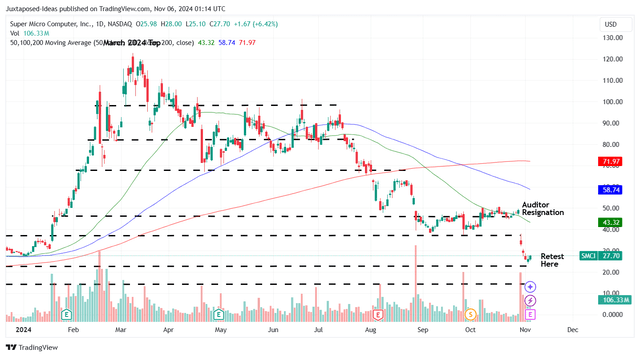

SMCI YTD Stock Price

Since then, SMCI has suffered a painful -40.7% correction after the unexpected resignation of its auditor, Ernst & Young LLP on October 24, 2024 (though released on October 30, 2024):

We are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management, and after concluding we can no longer provide the Audit Services in accordance with applicable law or professional obligations. (Seeking Alpha)

This development is alarming indeed, since we have previously expected to tune in to SMCI’s FQ1’25 earnings call (estimated) on October 30, 2024, one which has been confirmed on November 05, 2024.

While there have been numerous accounting allegations, the auditor’s (very public and painful) resignation may have lent some credibility to the short seller report indeed, with it triggering even more uncertainties in the company’s financial reporting and along with it, long-term prospects.

If anything, readers must note that SMCI had previously paid a $17.5M penalty related to its accounting practices in 2020, including “prematurely recognizing revenue and understating expenses over a period of at least three years.”

At the same time, “more than half of S&P 500 firms have had the same auditor for more than a quarter century,” according to data compiled by Bloomberg – with it signaling the manufacturing company’s “auditor turnover” being generally uncommon.

With SMCI looking “for a successor independent registered public accounting firm,” it is understandable that the management has opted to term the FQ1’25 conference call on November 05, 2024 as a “Business Update” instead of the usual “Earnings Call,” given the lack of auditor endorsement.

Combined with the extended deadline to file FY2024 10K along with the FQ1’25 10Q to December 31, 2024, we can understand why the stock has fallen as it has thus far, worsened by the non compliance with Nasdaq listing rule 5250(c)(1).

Even so, while the previous auditor may have refused to be “associated with the financial statements prepared by management,” SMCI expects to report a relatively promising FQ1’25 revenues of $5.95B (+12% QoQ/ +181.9% YoY) and adj EPS of $0.755 (+20.8% QoQ/ +120.1% YoY).

These numbers do not appear to be overly aggressive indeed, attributed to its strategic partnership with Nvidia (NVDA) as an early mover during the H100 ramp in FY2022/ FY2023, as Jensen Huang also “champion the benefits of direct liquid cooling for artificial intelligence [AI] data centers” during a speech by Supermicro counterpart Charles Liang at Computex in Taipei.

In addition, readers must note that SMCI has reported over 100K GPUs deployed with its proprietary liquid cooling system across numerous “largest AI factories, as well as other cloud service providers” while launching new server platforms – with these developments naturally being top/ bottom-line accretive in FQ1’25.

On the other hand, the delayed filing has triggered uncertainties surrounding SMCI’s capability indeed, perhaps explaining why NVDA has moved the former’s client orders to other companies, with it likely to trigger future headwinds to its top/ bottom-line performance along with high-growth prospects.

This development may have contributed to the relatively underwhelming FQ2’25 guidance, with a relatively notable sequential decline in its revenues to $5.8B (-2.5% QoQ/ +58.4% YoY) and adj EPS to $0.60 (-20.5% QoQ/ +9% YoY).

The departing client base may pose further recovery headwinds indeed, depending on the resolution of its delayed 10K/ 10Q filling issues by December 2024 and the reversal in client/ market sentiments.

The only silver lining in its investment thesis is SMCI’s relatively healthy balance sheet with a cash position of $2.1B (+25.7% QoQ/ +286.7% YoY) in FQ1’25, potentially remaining within its covenant with Cathay Bank of “at least $150M of unrestricted cash at all times.”

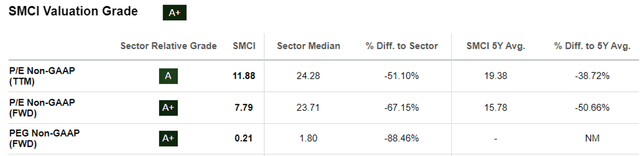

SMCI Valuations

Based on the management’s numbers, it appears that SMCI remains a compelling high-growth investment thesis, based on the overly discounted FWD P/E non-GAAP valuations of 7.79x, compared to the 1Y mean of 22x, 5Y mean of 15.78x, and the sector median of 23.71x.

The same may also be observed in its FWD PEG non-GAAP ratio of 0.21x, compared to the 1Y mean of 0.25x and 5Y mean of 0.23x.

Even if we compare against the sector median of 1.80x and its thermal management/ data center infrastructure peers, including Modine Manufacturing Company (MOD) at FWD PEG non-GAAP ratio of 0.84x, Lennox International Inc. (LII) at 1.72x, AAON, Inc. (AAON) at 2.68x, and Vertiv Holdings (VRT) at 1.15x, it is undeniable that SMCI is extremely cheap at current levels.

So, Is SMCI Stock A Buy, Sell, or Hold?

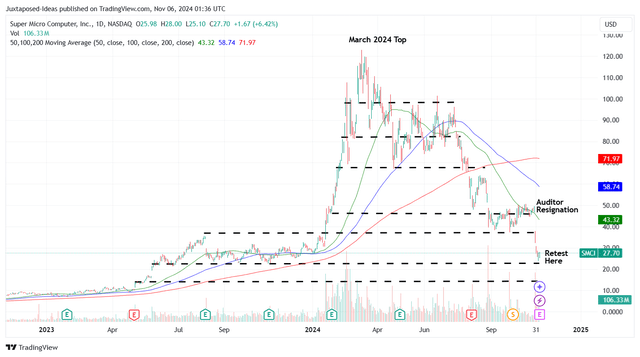

SMCI 2Y Stock Price

For now, SMCI has charted lower lows and lower highs after the recent auditor debacle, with the stock seemingly well-supported at the $25s while bouncing to $27s after the bottom-line beat FQ1’25 Business Update.

For context, we had offered fair value estimates of $48.60 (post-split), based on the FY2024 adj EPS of $2.21 (post-split) and the 1Y P/E mean of 22x. This was on top of the long-term price target of $97.00, based on the consensus FY2026 adj EPS estimates of $4.41 (currently $4.38).

For now, we continue to stand by these numbers, attributed to SMCI’s strategic position as one of the key hyperscaler suppliers and long-term partnership with NVDA – as observed in the management’s still robust guidance and the promising consensus forward estimates.

On the other hand, it goes without saying that SMCI’s short interest remains elevated at 18.03% of its float, with it remaining to be seen when things may normalize.

At the same time, while the management “does not expect any material changes to fiscal 2024,” we must also highlight the auditor’s warning of their inability “to rely on management’s and the Audit Committee’s representations,” with the management also “unable at this time to predict when the Form 10-K will be filed.”

As a result of the two rather conflicting sides of the story, we believe that it may be more prudent to watch out for SMCI’s upcoming FY2024 10K and FQ1’25 10Q filing, along with the onboarding of the new auditor for more clarity on its financial reporting and balance sheet health.

Barring which, the stock may be in danger of being delisted from the Nasdaq exchange – triggering further underperformance in its stock performance.

As a result of the potential volatility, we are downgrading the SMCI stock as a Hold here instead.

Here is where we believe its high-growth investment thesis may have been negatively impacted by the timely short seller report, painful auditor issues, and pessimistic market sentiments.

Patience may be more prudent in the meantime, since there may be more near-term volatility indeed.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.