Summary:

- Super Micro Computer faces potential Nasdaq delisting due to financial disclosure issues, impacting investor confidence, and my stock classification is downgraded to ‘Sell.’

- Preliminary 1Q25 earnings showed disappointing net sales growth and missed forecasts, further eroding confidence in the company’s financial health.

- The loss of Big 4 auditor Ernst & Young and failure to submit timely financial reports highlight potential compliance issues.

- Despite a low valuation multiple, the elevated risks and lack of a clear recovery path make Super Micro Computer currently uninvestable in my opinion.

luza studios

Super Micro Computer Inc. (NASDAQ:SMCI) is looking at a potential delisting from the Nasdaq if the company does not get approval from the stock exchange to keep its listing until it sorts out its financial disclosure mess. According to SMCI, the company filed its compliance plan on Monday.

However, even if the company were not to get delisted, I now have considerable reservations about SMCI. Super Micro Computer’s quarterly earnings, released in the first week of November, were neither particularly good nor bad, and the company’s stock is facing an uncertain future amid a considerable loss of confidence. Reports about a loss of sales could further be damaging to SMCI’s stock price.

In my view, the risk/reward relationship is murky at best and, at worst, the stock is uninvestable until Super Micro Computer fixes its financial disclosures.

My Rating History

In my last piece on Super Micro Computer I modified my stock classification from ‘Buy’ to Hold. The downgrade followed news about Super Micro Computer losing its Big 4 auditor Ernst & Young in light of the company’s accounting woes. Super Micro Computer is anticipated to file a plan with the stock exchange in order to prevent a delisting.

While I don’t think that the stock will be delisted, I think that Super Micro Computer is not investable right now which necessitates a change in my stock classification down to ‘Sell.’

Delisting Concerns Have Pushed Super Micro Computer’s Stock Price To New Lows

When Super Micro Computer presented preliminary 1Q25 earnings on November 6, 2024, the IT solutions provider mentioned in its NT 10-Q filing that it did not know when it will present its quarterly report. This news followed prior disclosures that the company could not provide timely financial information for its 2024 financial year, which was due, in the form of an annual report, in August. On Monday, SMCI said that it appointed BDO as independent auditor.

Super Micro failed to submit its 10-K report in August and received a Non-Compliance letter from the stock exchange. The IT company received a Non-Compliance Letter from Nasdaq on September 17, 2024 which laid out two options for Super Micro Computer: It could file its 10-K report or submit a plan to regain compliance with Nasdaq’s listing rules within 60 days.

On Friday November 15th, Super Micro Computer’s stock skyrocketed more than 18% in extended trading on rumors that the company was anticipated to file a plan for its delayed annual report imminently. Doing so would probably avert a delisting and buy the company a bit more time to work through its accounting mess.

On Monday, Super Micro Computer’s stock skyrocketed 31% after the company confirmed that it presented Nasdaq with its compliance plan. Investors should understand that the submission of the compliance plan to Nasdaq does not mean that the risk of a delisting has been averted.

In my view, Super Micro Computer should be able to get Nasdaq’s approval to maintain its listing in the short-term which would avoid the worst case scenario.

However, with Super Micro Computer’s stock price plunging to just $17.36 last week, a new low, I think the market is sending a very clear message about Super Micro Computer, given its lack of timely financial disclosures.

Net Sales Risks Are Rising

Super Micro Computer presented first quarter earnings, but only on a preliminary basis, on November 6, 2024. According to this update, the IT solutions provider produced net sales of $5.9-6.0 billion in the quarter ending September 30, 2024, reflecting 12% QoQ growth.

In the prior quarter, Super Micro Computer’s QoQ growth was 38%, so the company is not only suffering a substantial drop in its net sales growth, but it also missed its forecast for 1Q25.

Super Micro Computer forecasted net sales between $6.0-7.0 billion for 1Q25, so the IT company missed even the low point of its first quarter guidance. Unfortunately, investors don’t know much more about Super Micro Computer’s first quarter performance other than a preliminary net sales and GAAP profit ranges which is not exactly a vote of confidence.

In terms of profits, Super Micro Computer earned somewhere between $0.68 and $0.70 per share which reconciles to SMCI’s forecast prior to 1Q25 of $0.60 to $0.77 per share.

What made me really uncomfortable was that SMCI missed its forecast substantially which could indicate that some customers are unexpectedly canceling or shifting orders to other suppliers. According to news reports, Elon Musk’s AI startup xAI is allegedly said to be pulling orders from Super Micro Computer, with Dell being a potential beneficiary, which could potentially pose another net sales challenge for the AI company.

Super Micro Computer has doubled down on selling liquid-cooled server racks, which are the kind of systems data centers need in order to deploy tens of thousands of GPUs. Servers make up 95% of sales for Super Micro Computer, so there is definitely a vulnerability here for the company should customers choose to seek out other server suppliers amid SMCI’s accounting issues. Obviously, companies pulling orders here from Super Micro would fundamentally hurt the remaining investment thesis and I would not be surprised to see other companies, like Nvidia contemplate the same action.

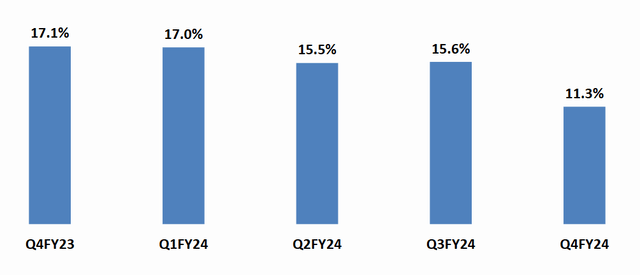

In my last piece on SMCI, I mentioned that I was following with interest SMCI’s margin development. Though Super Micro Computer has enjoyed a sales surge in recent quarters, the company has been unable to substantially improve on its gross and operating margins. In 4Q24, Super Micro Computer even experienced a 4.3 percentage point QoQ margin decrease to 11.3% amid strong competition in the market.

According to the preliminary earnings release, SMCI’s gross margins rose to 13.3% in the first quarter, up 2 percentage points, based on GAAP and non-GAAP. This development would be positive for Super Micro Computer, though I think that the company’s transparency issues are going to hold back the stock from any major re-rating moving forward.

SMCI QoQ Margin Development (Super Micro Computer Inc.)

Improved Net Cash Position

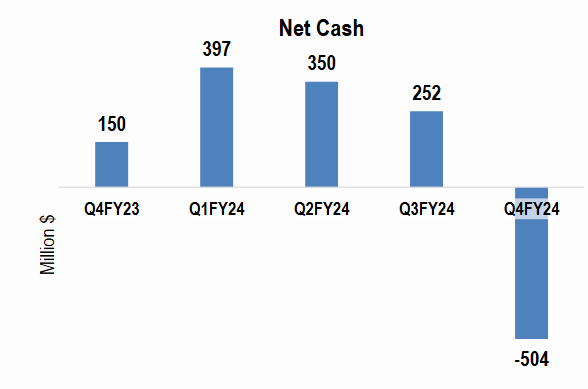

Though Super Micro Computer underperformed its net sales forecast, the company is seeing a positive change in terms of its net cash, which is the difference between cash and cash equivalents on one side of the equation, and the company’s debt on the other.

In 4Q24, Super Micro Computer had a net cash position of -$504 million which has narrowed, according to SMCI’s preliminary financials, to -$200 million. The higher net cash position could be the result of stronger cash collection in the first quarter of 2025, or it could be a negative sign that the company feels it has to boost its cash resources.

Net Cash (Super Micro Computer Inc.)

Long-term AI Tailwinds

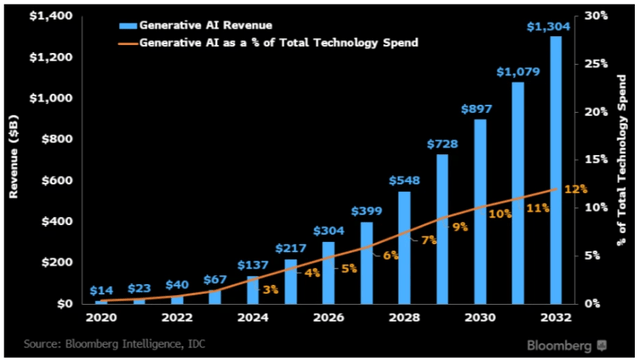

Super Micro Computer is a server company that profits from long-term growth in the generative AI market. Specifically, the growth and diffusion of large-language models that are need to run chatbots are a key growth catalyst for SMCI.

The generative AI market is anticipated to grow to $1.3 trillion by 2032 reflecting potentially annual growth of 33 per annum (between 2024 and 2032). The long-term prospects are therefore in favor of large IT companies specializing on servers, including Super Micro Computer.

While the trends are favorable, I think that the current delisting risk, potential for a net sales contraction and unattractive margin picture presently speak against an investment in SMCI.

Generative AI Revenue Growth (Bloomberg)

Super Micro Computer Is Now Cheap For A Reason

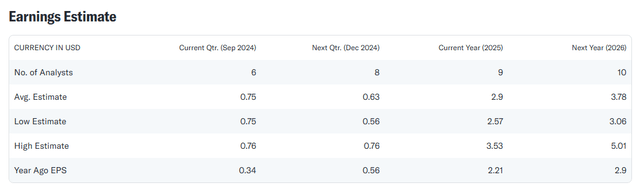

Profit estimates for Super Micro Computer have fallen substantially and may continue to do so. Since my last piece on SMCI at the beginning of November, profit estimates for the IT solutions provider have decreased 12.5%.

As of November 17, 2024, the market models $3.78 per share in profits for Super Micro Computer, reflecting back to us anticipated profit growth of 30% YoY. This year, the market anticipates $2.90 per share in profits, down from $3.34 per share at the end of October. The leading profit multiple for SMCI is thus 7.5x. Under normal conditions, this profit multiple would be highly enticing and probably reflect a margin of safety as well.

With that said, with both the 10-K and the 10-Q outstanding, the auditor replaced and considerable uncertainty about the state of Super Micro Computer’s net sales growth, I think that even at such a low valuation multiple, SMCI’s stock is presently not investible.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Will Remain Challenged

The most obvious near-term challenge to the investment thesis is the listing status of Super Micro Computer. If the IT company fails to secure a positive decision from Nasdaq to keep its listing, Super Micro Computer could be in for real pain. A de-listing would most likely cause severe selling pressure and further taint the Super Micro Computer name.

While I do think that SMCI will be allowed to keep its listing in the short-term in order to gets its financial disclosures up-to-date, I fail to see a clear path forward for Super Micro Computer that would allow the IT company to restore investor confidence.

With that being said, in case SMCI secures an extended listing and submits properly audited financials, there might be a path for a re-rating. The outlook for the AI server market is also quite positive so if Super Micro Computer can gravitate away from its accounting mess and refocus on its actual growth in the industry then investors may slowly regain confidence in SMCI. In addition, higher margins would go a long way in smoothing things over with investors, in my view.

Given the elevated risks that come with an investment in SMCI at this point, however, I don’t see a particularly appealing risk/reward relationship and I am not going to take my chances.

My Conclusion

Super Micro Computer neared its moment of truth this week as the IT company filed its plan with the SEC in order to regain compliance with stock exchange listing requirements. If approved, Super Micro Computer could keep its exchange listing while the company wins more time to sort out its financial disclosures, which, I think, is the much bigger issue.

Should xAI (or other companies) pull orders from Super Micro Computer, the company could see a sales contraction that would create a new headache for the AI company and probably exert more margin pressure. While the long-term demand forecast implies a steady rise in AI-associated revenues (including from servers), I think that the risks widely outweigh the potential reward for SMCI investors.

Taking into account its disappointing 1Q25 preliminary earnings and missing up-to-date disclosures, I believe Super Micro Computer is uninvestable at this time.

Supplier issues could be the next red flag as far as the investment thesis is concerned, and a net sales contraction here would be the worst outcome. Given the increased risk, I am modifying my stock classification for Super Micro Computer to ‘Sell.’

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.