Summary:

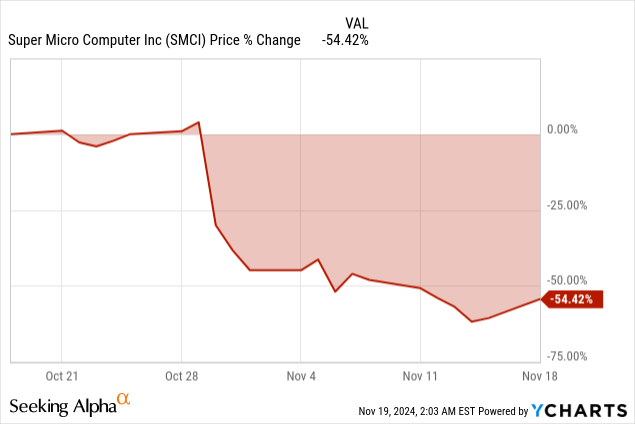

- SMCI’s appointment of BDO as its independent auditor significantly reduces Nasdaq delisting fears and restores investor confidence.

- BDO’s engagement follows detailed due diligence, indicating SMCI’s financials lack material misstatements severe enough for rejection.

- SMCI must file FY2024 and Q1 FY2025 financials by early 2025 to maintain its Nasdaq listing.

- Cases like Marvell Technology demonstrate how a reputable auditor can restore compliance and investor trust during governance crises.

- SMCI’s robust position in the AI infrastructure market positions it for growth once governance issues are fully resolved.

quantic69

Investment Thesis

The recent appointment of BDO USA as Super Micro Computer’s (NASDAQ:SMCI) independent auditor aligns closely with the second forecasted scenario in our earlier analysis. In this scenario, we anticipated the appointment of a reputable mid-tier auditor, which would stabilize the company but might not completely restore investor confidence to pre-crisis levels. The engagement of BDO, a respected global network accounting firm, confirms our expectation that SMCI would prioritize securing a credible auditor while avoiding the reputational challenges of re-engaging a Big Four firm following Ernst & Young’s (“EY”) high-profile resignation.

SMCI’s appointment of BDO as its new auditor marks a critical step forward, reducing delisting risk but not eliminating it. BDO’s engagement, typically preceded by a risk assessment, suggests the financials may be manageable. While the company remains under pressure to meet Nasdaq compliance deadlines and address governance issues, this development changes the risk profile. For risk-tolerant investors, SMCI offers potential upside given its AI market positioning, but uncertainties around filings and regulatory outcomes still warrant caution. A wait-and-see approach remains prudent for most investors.

How BDO Changes SMCI’s Risk Profile

Recently, SMCI announced one important development: appointing BDO as the new independent auditor. This is a critical step in addressing the fallout from the resignation of its auditor, a relationship that was dissolved when the auditing firm noted issues related to governance, internal controls, and management integrity.

In the meantime, SMCI has also submitted a compliance plan to Nasdaq in which it wishes to continue temporary relief of filing financial reports beyond a more extended date and continue its listing status thereafter. BDO, with relevant credibility and technical competence as one of the top five most prominent accounting firm networks worldwide, is appointed. Significantly, the company’s short-term focus is filing the delayed financial reports concerning an Annual Report for FY2024 and a Quarterly Report for Q1 FY2025.

Under the auditing framework, when a new auditor like BDO is engaged, the outgoing auditor, EY in this case, must share all pertinent details about the audit engagement with the incoming firm. This communication often includes information about unresolved issues, governance concerns, material misstatements, and any limitations encountered during the previous audit. For SMCI, EY’s resignation letter highlighted issues related to governance, internal controls, and management integrity.

The appointment of BDO as SMCI’s independent auditor addresses a critical gap in the company’s financial oversight and suggests progress in resolving governance challenges. Before accepting such engagements, auditors perform rigorous due diligence, including a review of financial statements, consultations with the previous auditor, and risk assessments. Hence, BDO’s decision to take on SMCI as a client indicates that the firm has evaluated the financials and determined that, while issues flagged by EY are serious, they may not involve material misstatements severe enough to decline. This development suggests that SMCI’s financials may be on firmer footing than initially feared, which could reduce the immediate risk of Nasdaq delisting.

Historical cases, such as Marvell Technology (MRVL) in 2015, highlight the importance of appointing a reputable auditor during a governance crisis. After its auditor resigned, Marvell engaged Deloitte, which reviewed its financials, identified necessary corrections, and helped restore compliance. Similarly, BDO’s global credibility and technical expertise position it to provide SMCI with the tools needed to regain investor confidence and complete its overdue filings. However, this is just the first step; SMCI must ensure that governance reforms and internal controls address the deeper issues cited by EY, including concerns over management independence and transparency.

Nasdaq Compliance and Possible De-listing

According to Nasdaq’s rules, SMCI must file its overdue financial reports to regain compliance with listing rule 5250(c)(1), which mandates the timely filing of periodic reports with the SEC. SMCI failed to file its Annual Report on Form 10-K for the fiscal year ending June 30, 2024, and its Quarterly Report on Form 10-Q for the fiscal quarter ending September 30, 2024.

Upon receipt of a notice of non-compliance, an issuer is usually granted 60 days to file a compliance plan. If the compliance plan is accepted, Nasdaq may grant an additional extension of up to 180 days from the due date for filing. For SMCI, this could theoretically extend the deadline to February 2025.

If SMCI does not file such reports within the extended period of extension, it would be deemed to violate the listing rules of Nasdaq and thus would be delisted. Delisting would imply a very important consequence: the company’s shares may engage less liquidity. SMCI will also lose investor confidence and face greater challenges while attempting to access capital markets.

Where SMCI engaged the services of BDO and filed a compliance plan with Nasdaq, these steps were hugely positive toward rectifying the financial reporting problems at SMCI. Whether the company can keep up its listing with Nasdaq and restore investor confidence will depend upon the ability of this company to file its Annual and Quarterly Reports within the time extension.

Again, encouraging developments, but a lot of challenges remain. How effective the audit process is by BDO, how internal efforts at SMCI go in making up the deficiencies in governance and control, and whether required filings will be made on time are linked to its success through this period.

Conclusively, recent activities engaged in by SMCI are in line with the active approach to solving its financial-reporting challenges. The future stability and survivability of the company will depend on whether it adheres to principles of transparency, good governance, and regulatory requirements. Investors should follow further efforts by SMCI to comply with its filing obligations and any additional correspondence from Nasdaq on the status of the company’s compliance.

Takeaway

The recent auditor appointment marks a pivotal development. While the move reduces immediate delisting risk, it doesn’t eliminate broader concerns. BDO’s engagement suggests the company’s financials may not contain material misstatements severe enough to deter a top-tier firm, but SMCI still faces significant governance and reporting challenges.

With Nasdaq compliance deadlines looming—potentially stretching to February 2025—SMCI must meet key filing requirements for FY2024 and Q1 FY2025 to avoid delisting. The improved risk profile offers cautious optimism for risk-tolerant investors, but uncertainties still warrant a measured approach.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.