Summary:

- TSM exceeded revenue and GAAP EPS expectations in 2Q FY2024, despite a muted stock reaction due to a broad-based pullback in the semiconductor sector.

- Management provided a strong growth outlook driven by increasing AI demand, with continued margin expansion and a long-term goal of approaching 60% in gross margin.

- While the start of production at two overseas fabs next year is expected to impact gross margins by 2-3%, the recent high-NA EUV deal with ASML should improve utilization rates.

- Although stricter chip curbs on China and Trump’s stance on repatriating the chip business pose a tail risk for TSM, I do not think this risk is predictable or likely.

- The stock’s valuation multiple has become more attractive after the recent selloff, with a non-GAAP forward P/E of 25.5x and a non-GAAP forward PEG of 0.96x, both below the sector.

JHVEPhoto

2Q FY2024 Takeaway

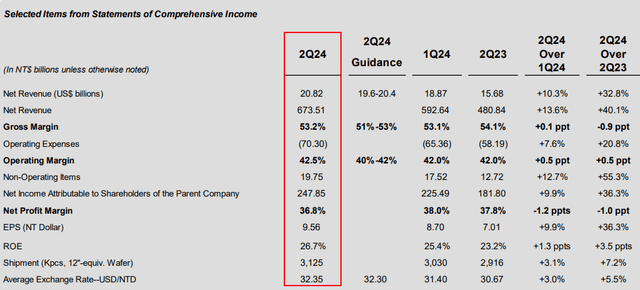

Taiwan Semiconductor (NYSE:TSM) topped both revenue and GAAP EPS in 2Q FY2024. However, the stock reaction was muted as the earnings release was coincided with a broad-based pullback in the semi sector. The company’s growth momentum remains strong, driven by increasing GenAI-related demand. I believe that buy-side has largely priced in a better-than expected revenue number. As in my last coverage (Buy rating), I mentioned that TSM would surpass its high-end revenue guidance for 2Q FY2024 based on the monthly revenue reports from April and May. The total revenue in the last quarter reached $20.82 billion, exceeding the high-end guidance of $20.4 billion.

2Q FY2024 Presentation

The bullish signal lies in its margin expansion while achieving strong growth in revenue. The company reported both gross margin and operating margin that topped the high end of previous guidance and showed improvement on a quarter-over-quarter basis. The management forecasted a continued expansion in margins in the current quarter, due to higher-than-expected overall capacity utilization rate. My view of last quarter was positive, and TSM’s 3Q guidance indicates strong growth momentum with continued margin expansion. Therefore, I reiterate my buy rating on the stock, as the last week’s selloff creates a buying opportunity.

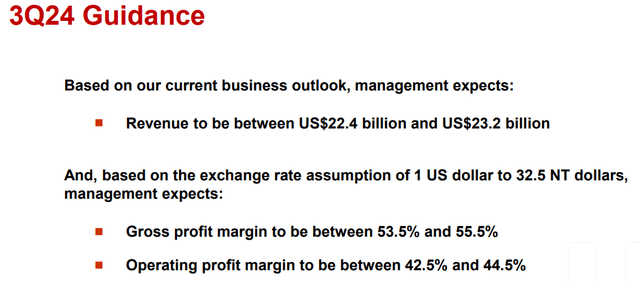

3Q FY2024 Outlook

2Q FY2024 Presentation

For 3Q FY2024, TSM indicated 31.9% YoY growth in revenue, which is ahead of market consensus. In the 2Q FY2024 earnings call, the management guided FY2024 revenue growth to be slightly above mid-20 percent in US dollar terms. If we do some math, we can estimate mid-20 percent revenue growth in 4Q FY2024. In addition, the guided midpoint of 54.5% in gross margin indicates a 130 bps expansion from the previous quarter, and we also expect a 100 bps expansion in operating margin in the current quarter. During the call, an analyst asked whether the company could return to its previous gross margin threshold of 60%, achieved in 2H FY2022. The CFO indicated that continued cost headwinds are expected in the near term, as TSM will begin production at two overseas fabs next year, which will dilute the gross margin by 2-3% going forward. However, a high utilization rate will make the 60% threshold achievable.

Speaking of high utilization rate, I want to address the recent deal with ASML (ASML). In my last coverage on ASML (Hold), I mentioned the company’s high-NA EUV deal with TSM, which is expected to close later this year. This deal will support 2nm production next year. As Intel (INTC) indicated in its recent earnings call, ASML’s high-NA EUV machines can optimize their cost structure to improve gross margin. Therefore, I believe TSM can gradually improve its overall utilization rate in the long run.

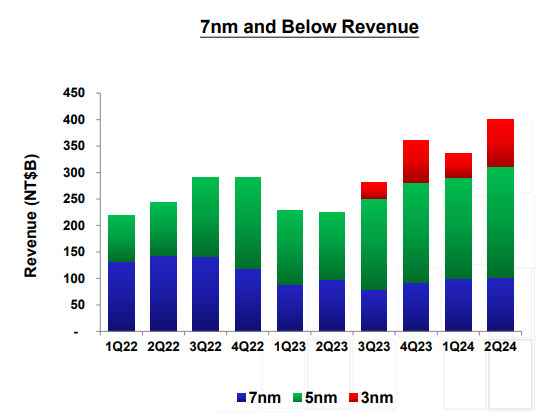

N2P Mass Production in 2H 2026

2Q FY2024 Presentation

The company is building capacity to support upcoming nodes due to increasing demand. As shown in the chart, we saw a strong revenue boost in N3 from the last quarter as TSM’s revenue mix gradually shifts to lower nanometer technologies, driven by the current GenAI boom. During the earnings call, the management indicated that N2 technology is progressing well, with device performance and yield exceeding expectations.

As N2 is expected to start volume production in 2025, the team anticipates it will deliver more efficiency and power benefits, with a 10-15% speed improvement at the same power, a 25-30% power improvement at the same speed, and more than a 15% increase in chip density compared to N3E. Additionally, they also discussed N2P, which can improve efficiency by around 5% at the same power or provide a 5-10% power benefit at the same speed on top of N2, expected to begin volume production in the 2H 2026. Therefore, I believe that TSM will continue to maintain its strong growth trajectory as more powerful chips enter mass production.

Trump’s Recent Comments on Taiwan

Last week, the global semi industry has triggered a deep selloff due to geopolitical news regarding stricter chips curbs on China and Trump’s stance on repatriating chips business. In a Bloomberg interview, Trump said, “They did take about 100% of our chip business. I think, Taiwan should pay us for defense.” and implied that the U.S. under his presidency would not defend Taiwan from a Chinese attack. As Trump gains more popularity before the election, I believe the market is starting to price in a “Trump trade.” While geopolitical tension between the U.S. and China is a tail risk for TSM, I do not think this will materialize in the near term.

Valuation

Seeking Alpha

After a 12% selloff in a week, TSM’s stock valuation multiple has become more attractive. Its GAAP P/E TTM is currently at 27x, which is 13% below its sector average according to Seeking Alpha. Considering its strong growth outlook over the next 12 months, its forward P/E multiple is expected to come down to 25.5x. While this is still 15% above its 5-year average, I believe the stock should trade at a higher multiple given the strong tailwinds from GenAI. Compared to the Nasdaq 100 index’s forward P/E after last week’s selloff, TSM appears to be 11% cheaper.

Most importantly, TSM’s PEG non-GAAP fwd is currently at 0.96x. Given NVIDIA (NVDA)’s over 60% YoY growth outlook in non-GAAP EPS over the next 12 months, its non-GAAP PEG fwd is 1.29x, which is higher than TSM. Therefore, TSM’s current valuation is still attractive compared to other semi peers and the broader technology index. I believe the recent selloff creates a buying opportunity for TSM.

Conclusion

In sum, TSM remains an attractive semi-AI play after the recent selloff. The company’s strong 2Q FY2024 earnings, highlighted by reacceleration in revenue growth and margin expansion, and a strong 3Q FY2024 guidance underscore its robust growth momentum fueled by increasing demand for GenAI chips. However, geopolitical tensions remain a tail risk, as potential policy changes under a Trump presidency could pressure Taiwan’s chip industry, possibly leading to a relatively lower valuation multiple. Despite this, the stock’s forward P/E of 25.5x does not indicate a lofty valuation. The recent selloff has made TSM’s valuation more appealing, presenting a buying opportunity. Given these factors, I believe TSM is poised to maintain its strong growth trajectory and reiterate my buy rating on the stock

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.