Summary:

- TSM has proven yet again why it is the clear global foundry winner during the AI boom, as observed in its growing wins, expanding gross margins, and higher market shares.

- Combined with the excellent 2nm demand/yields and raised capex guidance, it is apparent that we remain in the early innings of sustainable growth.

- The recent meltdown has been great indeed, offering the chance for opportunistic investors to add/ dollar cost average with AI-related demand still structurally robust.

asbe/iStock via Getty Images

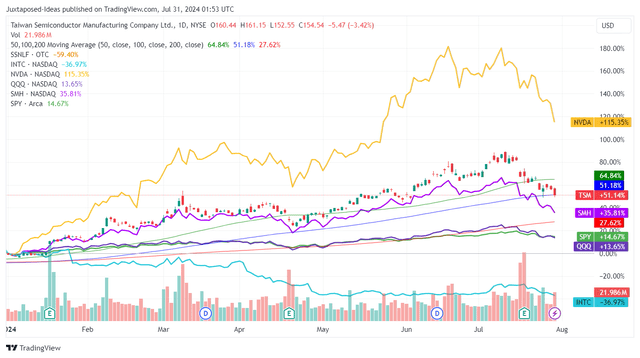

We previously covered Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in June 2024, discussing how NVIDIA Corporation’s (NVDA) FQ1’25 outperformance and promising market trends surrounding generative AI had contributed to the stock’s excellent rally.

This was on top of the improved market sentiments from the foundry’s recent price hikes, fully booked position through 2026, and expanded manufacturing capacity through the end of the decade, warranting our reiterated Buy rating upon a moderate retracement.

Since then, the great correction is finally here, after a YTD generative AI rally that has been overly optimistic, worsened by the uncertain impact of the ongoing US election on the Taiwan semiconductor industry.

Even so, we are reiterating our Buy rating, since TSM is finally moderated from recent highs and is trading nearer to our updated fair value estimates. This is on top of its double beat FQ2’24 earnings call, raised FY2024 guidance, and the accelerated 2nm monetization compared to 3nm and 5nm through 2026.

Combined with the robust long-term market trends surrounding generative AI, we believe that TSM remains a great But at every dip. We shall discuss further.

Generative AI Boom Is Only Moderated – Buy The Pessimism

TSM YTD Stock Price

Unless one had been living under a rock, it went without saying that the generative AI boom had started with the launch of ChatGPT by November 2022, with numerous beneficiary stocks recording massive gains.

The same had been reported by TSM, with the stock more than doubling since then and its financial performance similarly recovering after the semiconductor supply glut eased since mid-2023.

Even so, with the macroeconomic outlook still uncertain and the US election ongoing, it is unsurprising that these stocks have also been moderated by early July 2024, TSM included, attributed to their outsized performance compared to the wider market.

This is despite TSM’s impressive FQ2’24 double beat with revenues of $20.82B (+13.6% QoQ/ +40.1% YoY) and adj EPS of $1.48 (+9.9% QoQ/ +36.3% YoY).

This is on top of the raised FY2024 growth guidance of “slightly above mid-20s percent in US dollar terms,” up from the previous guidance of “low-to-mid 20%” offered in the FQ4’23 earnings call.

At the same time, TSM has offered an extremely telling FY2024 capex guidance of $31B at the midpoint (+1.8% YoY), up from the previous midpoint guidance of $30B (-1.4% YoY).

This development is critical for discerning investors indeed, since “at TSMC, a higher level of capital expenditures is always correlated with the higher growth opportunities in the following years,” implying that AI-related demand remains structurally robust no matter the pessimism observed in the stock market.

At the same time, TSM has highlighted “strong AI-related demand underpinned by the industry megatrend of AI, HPC, and 5G,” as more smartphone designers embrace AI in their next-gen offerings, including the two giants, Apple Inc. (AAPL) and Samsung Electronics Co., Ltd. (OTCPK:SSNLF).

The same has been reported in the PC market, as the top 5 laptop manufacturers launch AI-ready PCs in H2’24 and Microsoft Corporation (MSFT) already projecting up to 50M units of AI PCs sold in 2024.

As a result of the ongoing AI boom beyond the typical data center usage, it goes without saying that TSM stands to benefit, with it already triggering the increased “overall capacity utilization rate for our leading-edge 3-nanometer and 5-nanometer process technologies in the second half of 2024.”

With the management also highlighting 2nm device performance/ yield ahead of plan and higher overall capacity utilization rate, we can understand why they have guided promising gross profits of up to 55.5% in FQ3’24 (+2.3 points QoQ/ +1.2 YoY), compared to the 53.2% reported in FQ2’24 (+0.1 points QoQ/ -0.9 YoY)

At the same time, TSM has guided that “the number of the new tape-outs for 2-nanometer technologies in its first two years to be higher than both 3-nanometer and 5-nanometer in their first two years,” with “almost all the AI innovators are working with it.”

The adoption acceleration and contract wins are unsurprising indeed, as more designers, such as NVIDIA Corporation (NVDA), seek to shorten the replacement cycle for next-gen AI chips.

This may also explain why market rumors are already swirling about the ongoing negotiation between TSM and ASML regarding the next-gen extreme ultraviolet [EUV] lithography equipment for the production of A10 technology, also known as the 1nm process by 2030.

With the 3nm ramp already ongoing and 2nm development on track, we believe that the foundry remains well positioned to commence volume production and sustainable cost performance from 2025 onwards, along with 1nm by the end of the decade.

Lastly, TSM has also highlighted an expanded foundry Total Addressable Market of nearly $250B (up from the previous number of $115B), including advanced packaging, testing, and mask making: termed as Foundry 2.0, thanks to the ongoing AI boom and its strategic partnership with market-leading AI chip designers.

As a result of this promising development and the foundry’s recent price hike discussed in our previous article, we believe that it remains well positioned to achieve robust top/ bottom-line growth during the next cloud super cycle, as observed in the growing global foundry market share at 62% as of Q1’24 (+1 points QoQ/ +3 points YoY).

Impressive indeed.

So, Is TSM Stock A Buy, Sell, or Hold?

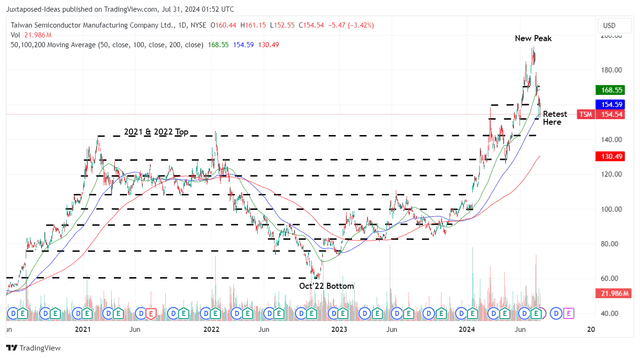

TSM 4Y Stock Price

For now, TSM has charted new heights of $190s by early July 2024, before dramatically pulling back by -20.1% and retesting its previous support levels of $150s and trading nearer to its 100-day moving averages.

For context, we had offered a fair value estimate of $115.50 in our last article, based on the LTM adj EPS of $5.25 ending FQ1’24 and the 5Y P/E mean valuations of 22x.

Based on TSM’s raised FY2024 growth guidance of “slightly above mid-20s percent in US dollar terms” at approximately FY2024 adj EPS of $6.54 (+26.25% YoY) and the same P/E, we are looking at an updated fair value estimate of $143.90.

This number implies that the stock is trading at a much narrower premium of +7.3% at current levels, compared to the previous heights of +34.4%. At the same time, thanks to the recent correction, there appears to be an improved upside potential of +32.9% to our reiterated long-term price target of $205.40, based on the stable consensus FY2026 adj EPS estimates of $9.34.

Does this mean that we are reiterating our Buy rating? Yes indeed, though with a few caveats.

One, while TSM has recovered from the dramatic plunge to $153s on July 25, 2024, the stock has also charted lower lows and lower highs since then, implying further correction in the near term.

With other semiconductor stocks/ ETFs still pulling back and the CBOE Volatility Index still elevated, we believe that it may be better to observe the stock’s movement for a little longer and add nearer to its previous trading ranges of between $140s and $150s for an improved margin of safety.

Two, with NVDA slated to report their FQ2’25 earnings call on August 28, 2024, we believe that there may be more volatility over the next month, depending on their financial performance and forward FQ3’25 guidance.

Assuming another beat and raise, we believe that market sentiments may lift along with the wider semiconductor industry, TSM included, from current levels. Otherwise, there may be more pain indeed, with the stock likely to further pull back to its 2021/ 2022 trading ranges of $128s and $140s.

As a result, interested investors may want to time their entry points depending on their dollar cost averages and risk appetite.

Patience may be more prudent indeed, with TSM’s excellent long-term prospects potentially marred by near-term volatility.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.