Summary:

- TSMC, the world’s largest chip foundry, has outperformed the S&P 500 and tech sector in 2024, nearly doubling its stock price.

- Strong revenue growth, high margins, and robust demand for advanced technologies like AI and HPC support TSMC’s continued market leadership and EPS growth.

- TSMC’s disciplined CapEx and strategic diversification mitigate geopolitical risks, making it a “Buy” despite competition and operational challenges.

- With projected revenue growth of 30% in 2024 and a promising long-term outlook, TSMC stock remains a compelling investment in the semiconductor sector.

- In 2025, I think TSM is poised to grow significantly due to booming demand across multiple areas such as AI and HPC. At the same time, the current stock price seems quite undervalued.

photoman

Intro & Thesis

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) – aka TSMC – is the world’s largest dedicated chip foundry with a market share of over 60% in its end-market. TSM has a massive scale and cutting-edge technology, providing superior operating margins for the burgeoning foundry market. The transition to fabless has further fueled its development, with high-end clients such as Apple (AAPL), AMD (AMD), and Nvidia (NVDA) taking advantage of its advanced tech.

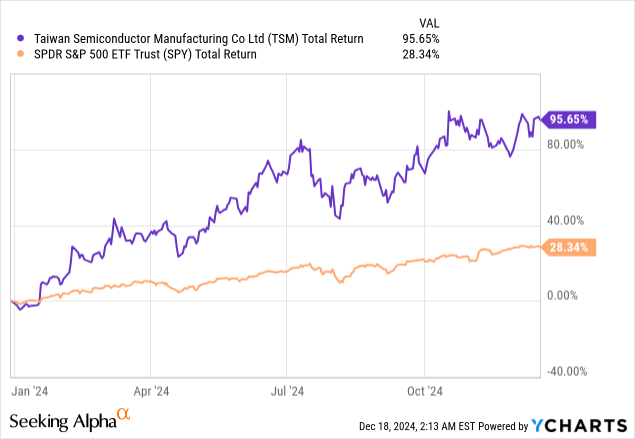

Like most broad-moat tech companies, TSM stock has delivered impressive returns in 2024. While the S&P 500 Index (SPX) and the Technology Select Sector SPDR (XLK) are currently up 28.34% and 24.68% year-to-date, respectively, TSM has nearly doubled (in terms of its total return) for the year, outperforming most of its peers:

I suspect this growth will continue through 2025, as the stock price has doubled, but it’s still very cheap based on my valuation analysis. In addition to that, as I see it, TSM is looking to maintain its position as the market leader in its niche. So as the overall AI/chips market’s underlying TAM rises, these aspirations will likely translate into higher EPS numbers than the market expects today.

Given that, TSM is a “Buy” right now.

Why Do I Think So?

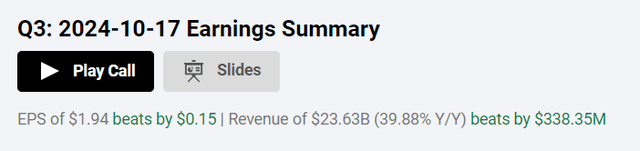

TSM generated ~$23.5 billion in revenue (up 36% YoY), which came well above its internal targets. Earnings per ADS jumped 51% YoY to $1.94, beating the consensus estimates.

These great results were fueled by “strong demand for TSM’s high-end 3-nanometer (N3) and 5-nanometer (N5) technologies”, which are increasingly essential to HPC, AI, and smartphones, the press release noted. The firm’s gross margin rose to 58% (up from 53.4% in Q2), as capacity utilization and cost increases drove the growth. So this drove up the 47% operating margin (from 42% in the prior quarter), underlying TSM’s operational performance and capacity to respond to growing demand for the most advanced semiconductor tech.

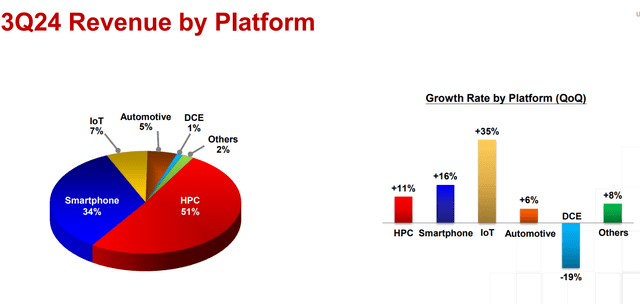

HPC continued to be the largest revenue earner by segment, bringing in ~51% of total revenue, up 65% YoY and 11% QoQ, driven by “a tremendous demand for AI server processors, such as GPUs, AI accelerators, and CPUs for training and inference.” AI server processor revenues will more than triple by 2024, and be in the mid-teens of overall revenue, according to TSM’s commentary. Smartphones, which made up ~34% of all sales, also increased by 19% YoY thanks to “seasonal spikes and the use of powerful nodes in flagship devices such as Apple’s iPhone 16 Pro that runs TSM’s N3 technology”. The IoT and automotive categories also grew robustly, with IoT revenue increasing by 6% and automotive revenue gaining double-digit percentages. However, the DCE (digital consumer electronics) industry was weak, reflecting less demand for older nodes.

North America continued to be TSM’s strongest market in terms of geography, accounting for ~71% of total revenue, increasing by 40% over last year. Such expansions reflect the preponderance of U.S.-based fabless semiconductor manufacturers who owe a significant part of their success to TSM’s foundries. Asia-Pacific and China remained strong performers with annual increases of 70% and 25%, respectively, but China’s revenue dropped 22% QoQ “amid geopolitical uncertainty and export limitations.” Revenue from Europe, Middle East, and Africa (EMEA) fell 18% YoY “due to the ongoing Ukraine war and macroeconomic challenges.” Overall, I like the way management is dealing with global volatility by diversifying appropriately into less risky regions – so I don’t really agree with the need to include a very large discount in the stock’s valuation (I’m writing this for future valuation calculations).

Regarding the balance sheet, everything looks good, actually. TSM holds ~$72.5 billion in cash and marketable securities at the end of Q3, up from $69 billion in Q2. They had generated ~$12.2 billion in operating cash flow during the third quarter and had total capital spending of $6.4 billion, so the capital management discipline seems to be strong.

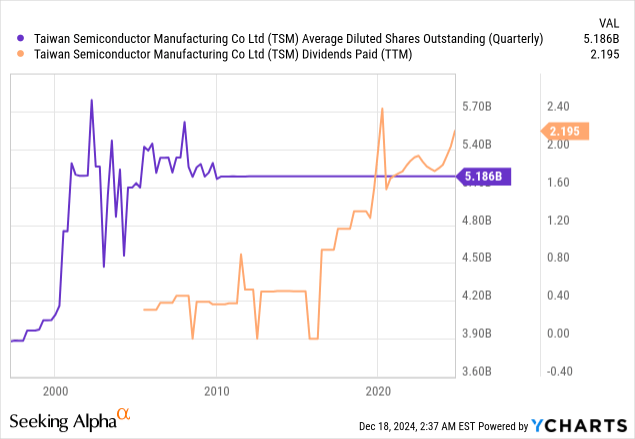

One very important thing to mention – TSM’s CapEx in FY2024 is just over $30 billion, where 70-80% will be devoted to advanced process technologies, 10-20% to specialty technologies, and the rest to advanced packaging, testing, etc. So I think this disciplined investing philosophy keeps TSM on the cutting edge of semiconductor development while providing ample FCF for dividends and potential share buybacks. As of note, during Q3 TSM paid out ~$2.8 billion in dividends and didn’t expand the share count:

Leaning on the strong performance of this year (and the third quarter in particular), TSM’s leadership has offered a positive forecast for Q4 FY2024 and beyond. The Q4 revenue is expected to range from $26.1 billion to $26.9 billion, a 35% YoY gain at the midpoint, while the gross margin is expected to be good at 57-59% with the operating margin ranging from 46.5% to 48.5%. For the full year 2024, TSM extended its revenue growth guidance from high-20% to low-30% based on robust demand for AI and HPC workloads. The management also anticipates that the world semiconductor market will increase by 10% in 2024, and foundry revenue will increase in the mid-to-high teens.

Their Arizona fab, which started 4nm wafer production in April 2024, will launch volume production in early 2025, while the Japan and Germany fabs will specialize in specialty technologies and automotive, respectively.

According to Grand View Research, the global high-performance computing market size is expected to expand at a CAGR of ~7.5% from 2023 to 2030, while the US geo market is going to reach 8.1% in CAGR. So since TSM is targeting mainly the North American market, I expect this projected growth in TAM to translate into higher earnings for the firm going forward.

Some investors are afraid that TSM’s significant dependence on Apple as a customer is a major red flag for long-term ownership of the stock. They explain it by saying TSM is too dependent on AAPL, which may develop its own chip in-house at some point and refuse to work with TSM, hurting the firm’s financials significantly. But I don’t think it’s a real risk – at least for the next few years.

There are no signs (as far as I see it) that Apple is letting go of TSMC chips anytime soon – rather, Apple and TSMC have a longstanding partnership, one that is highly collaborative and profitable. Moreover, it has been speculated recently that Apple plans to keep using TSMC for its next-generation A18 and A20 processors that will be driving future iPhone models. Although rumors swirl about transitions to competitors such as Intel, such claims are largely unsubstantiated given Apple’s longtime dependence on TSMC and its strategic alignment today.

Today’s consensus projects TSM’s revenue to keep expanding with a CAGR of >8.8% over the next 5 years, while TSM’s EPS should grow with an average growth rate of over 26% annually for the next 3 years, according to Seeking Alpha’s Premium data.

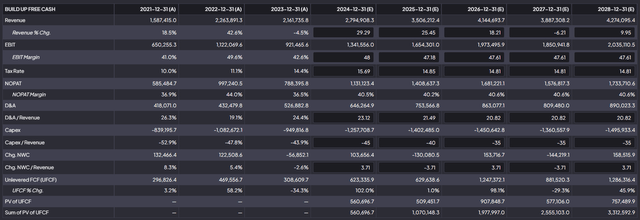

Using the outlined consensus sales growth rates taking into account the latest management forecast for FY2024 and assuming normalization of the key performance indicators up to and including FY2028, I arrive at the following operational model for my DCF calculations:

FinChat, the author’s notes added

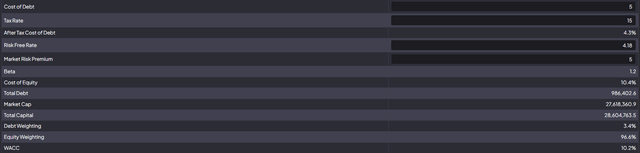

Assuming a cost of debt of just 5% and a market premium of 5%, with a risk-free rate of ~4.2% I get a WACC of 10.2%, which is quite high if we expect a lower interest-rate environment in the next few years. But I’ll leave this WACC as is to account for any potential premium for TSM’s idiosyncratic risk. Here’s what I have:

FinChat, the author’s notes added

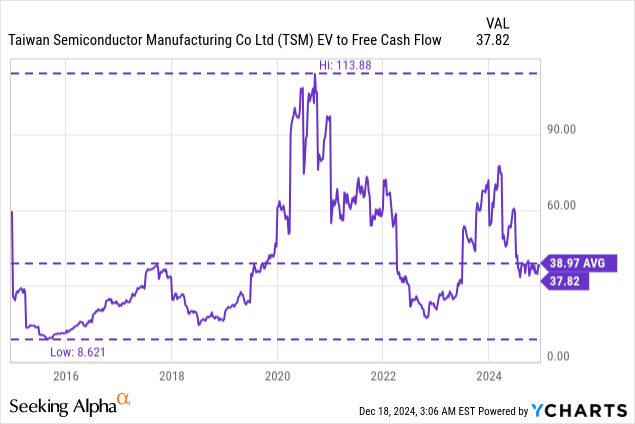

Over the past 10 years, TSM was trading at an average EV/FCF multiple of ~39x (now it’s trading at ~38x):

So 39x is what I’m putting into my DCF model for TSM’s terminal value calculation.

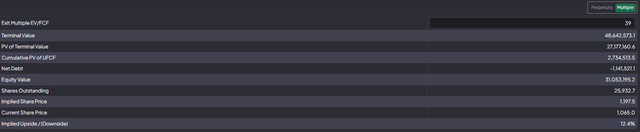

Based on what I have assumed above, the current stock price turns out to be ~12.4% undervalued:

FinChat, the author’s notes added

These calculations do not take into account the possibility of higher growth rates and higher profit margins, which means that the undervaluation could be even higher.

Given the undervaluation and strong growth prospects, I assign a “Buy” rating to TSM stock. Next year is likely to be another strong year for Taiwan Semiconductor stock.

Where Can I Be Wrong?

In spite of the promising estimates, TSMC will face stiff competition and increasing operating costs. As rivals such as Samsung and Intel (INTC) continue to aggressively develop their own technology, particularly in the 2nm domain, market competition will likely increase. Additionally, TSMC will also need to deal with possible supply chain disruptions and the complications associated with large CAPEX.

In addition to that, despite its impressive growth as of late, TSM has struggled to meet the challenges of electricity prices in Taiwan, geopolitical instability, and overpriced overseas fabs. In Taiwan, electricity prices have doubled in the past few years, lowering gross margins by approximately 1%. TSM’s fabs outside the US (Japan, Germany) also cost more to build and operate, leading to a 2-3% annual gross margin reduction, according to Argus Research estimates (proprietary source).

The Bottom Line

Overall, I think TSM will be able to take advantage of the semiconductor industry’s growth structural drivers such as AI, HPC, and mobile smartphone innovations. In 2025 in particular, TSMC is poised to grow significantly due to booming demand across multiple areas such as AI and HPC. Wall Street analysts expect TSMC’s revenues to total above $111 billion, an impressive rise driven by the large-scale mass production of its latest 2nm chips. This technology should solidify TSMC’s position as a semiconductor leader as it continues to service large customers, which are becoming increasingly dependent on the most advanced chips.

Cost increases and geopolitical risks are still present, but TSM’s investments and operational excellence alleviate these threats. With close to 30% growth projected by management in 2024 and an attractive long-term outlook, TSM remains a good bet for anyone who wants to get a foothold in the semiconductor growth story.

Expecting more stock price appreciation from TSM in 2025, I assign a “Buy” rating for the stock.

Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!