Summary:

- Nvidia fueled more artificial intelligence hysteria at “AI Woodstock” as it unveiled the Blackwell platform, but most large-cap chip stocks lack SA Strong Buy ‘quantamentals’ to match the hype.

- TSMC, up 50% in the past year, has a dominant share in the global foundry market, EBITDA margins of 66%, and P/E FWD at a 12% discount to the sector.

- TSMC has solid quantitative factor grades relative to the sector, including closest in size large-cap peers in the semiconductor industry, such as Nvidia, resulting in an SA quant Strong Buy.

JHVEPhoto

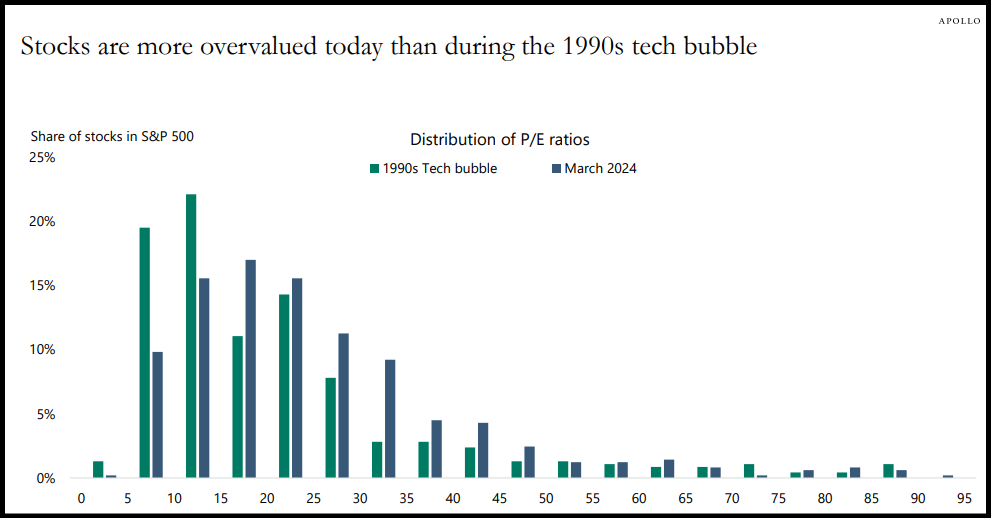

NVIDIA Corporation (NVDA), at the much-hyped AI Woodstock on March 18, unveiled a technology platform it proclaimed would serve as the engine of the “new industrial revolution.” The market reaction was relatively muted in a possible “sell-the-news” moment and amid concerns over an “AI bubble.” In a recent BofA survey, 40% of 226 money managers, collectively with $565 billion in assets under management, said the A.I. market is in a bubble. Moreover, based on the distribution of price-to-earnings ratios (March 2024 vs. March 2000), stocks are more overvalued than in the 1990s dot-com bubble.

Stock Market P/E Ratio Distribution vs. Dot-Com Bubble (Bloomberg, Apollo Chief Economist)

The upside potential of the AI market is undeniable, projected to expand nearly 20-fold by 2030 to an eye-popping $1.8 trillion. Large chip semiconductor stocks have performed well in this environment but many have sky-high valuations based on key quantitative metrics.

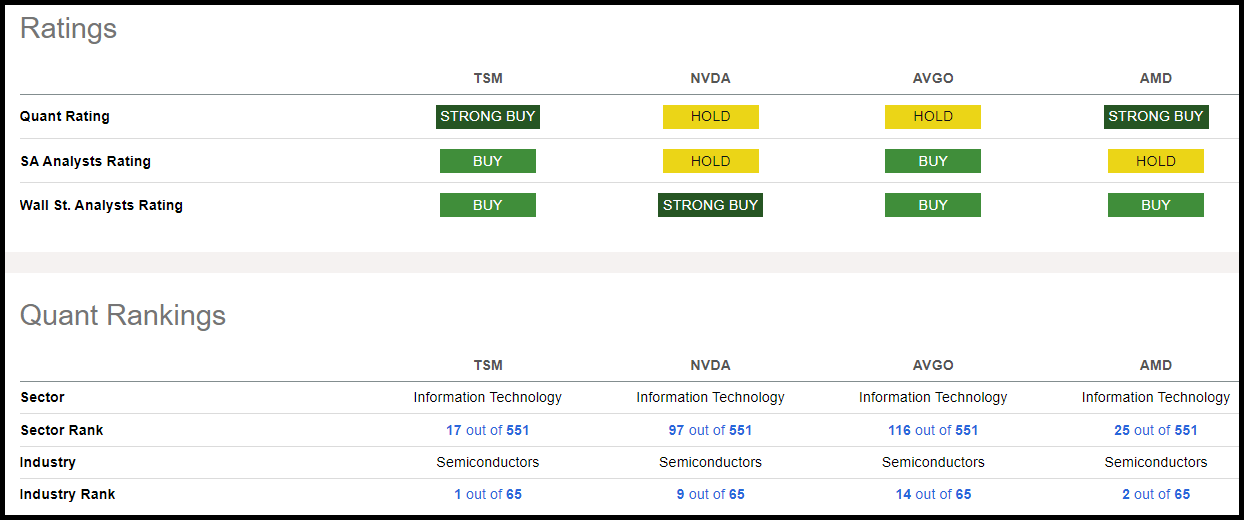

Seeking Alpha’s Quant Ratings takes the hype and emotion out of investing by systematically generating buy/sell recommendations based on a proven data-driven model. The SA quant system automatically gathers over 100 underlying metrics for each stock on a daily basis, which are compared to the sector and graded by five investment factors: Valuation, Growth, Profitability, Momentum, and EPS Revisions. The Quant Rating is not a simple average of factor grades. Some factors and metrics are more heavily weighted based on proven predictive value. However, if a stock performs poorly on any given factor grade, it is disqualified as anything higher than a Hold. The disqualifying grades are a ‘D+’ or worse for Growth, Momentum and EPS Revisions, and a ‘D-’ or worse for Value and Profitability. Size is another important underlying metric that factors into the Quant Rating, not explicitly stated under the five factor grades. The SA Quant Team has identified an AI chip stock with solid fundamentals across the board based on the most critical quantitative metrics relative to the sector and semiconductor peers of similar size.

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM)

-

Market Capitalization: $636.09B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 3/22/24): 17 out of 551

-

Quant Industry Ranking (as of 3/22/24): 1 out of 65

TSMC is one of the ten most valuable companies in the world, a club it joined earlier in March for the first time since 2020 after its stock rose over 50% in the past 12 months. TSMC is #1 among quant-rated stocks in the Semiconductor industry with a Strong Buy rating of 4.87, topping closest industry rivals by market cap, including Nvidia (3.49), Broadcom (3.45), and AMD (4.77).

TSMC Ratings vs. Large-Cap Peers (SA Premium)

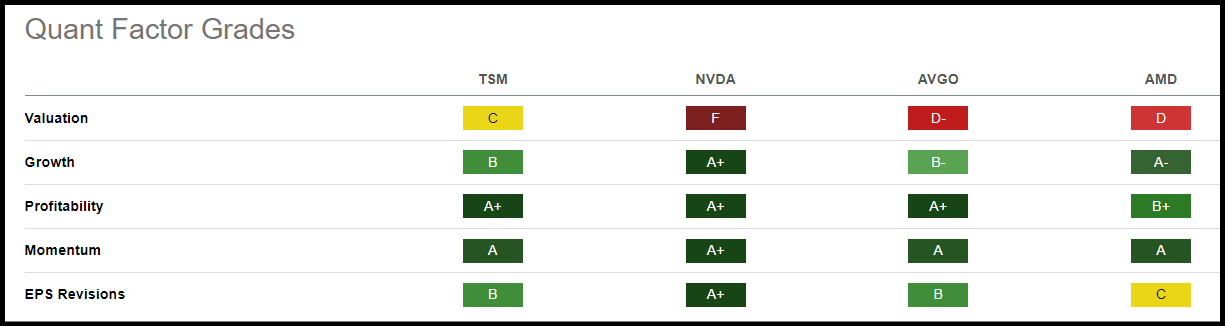

TSMC has A’s in Profitability and Momentum factor grades, B’s in Growth and EPS Revisions, and a C in Valuation. TSMC is soundly outperforming large-cap chip rivals, including Nvidia, largely driven by solid valuation metrics. Nvidia, due to a low valuation factor grade, has had an SA Quant Hold rating for over two years straight. AVGO has been stuck on Hold since its valuation grade slipped to ‘D-’ in January. AMD remains a Strong Buy, although it risks dropping to hold due to a low valuation score.

TSM Quant Factor Grades vs. Industry Peers (SA Premium)

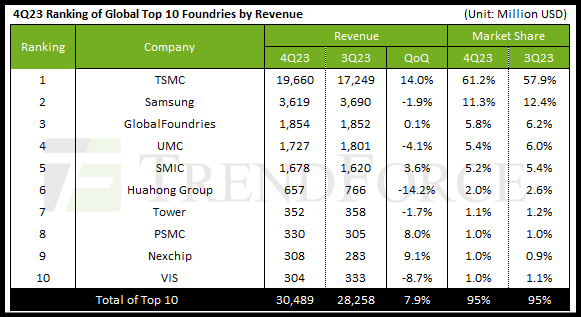

TSMC has over 60% share of the global foundry market as of Q423, a dominant position it expanded by more than 3% from the prior year. In January, TSMC guidance signaled optimism over more revenue growth driven by generative AI. Nvidia announced what it called the world’s “most powerful” chip and noted that the Blackwell-architecture GPUs are manufactured using a custom-built 4NP TSMC process.

Top Microchip Foundries by Revenue (TrendForce)

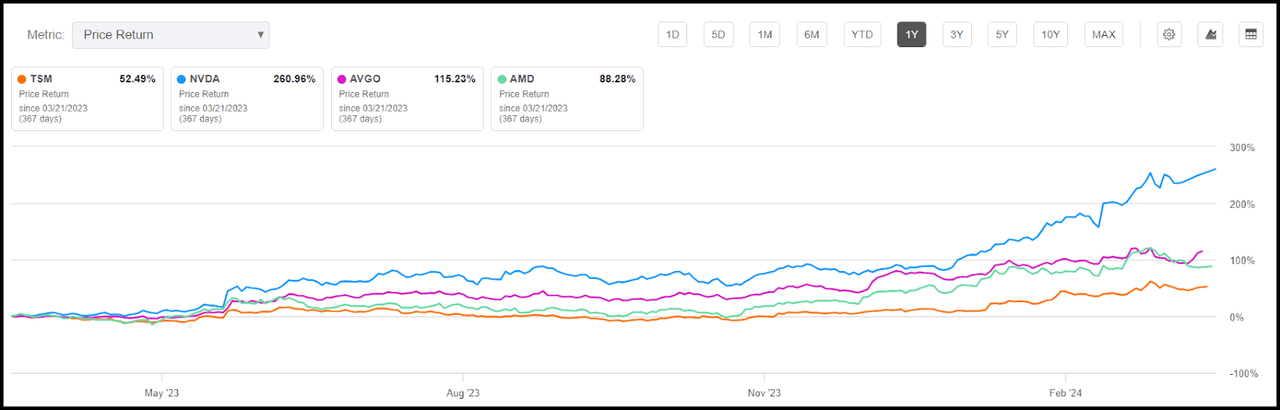

TSMC’s solid momentum over the past year and three months earned it an ‘A’ factor grade, but a few of its rival goliaths have showcased incredible price performance led by Nvidia, up ~260% in the past year, Broadcom +115%, and AMD +88%.

TSMC Price Performance vs. Industry Peers (SA Premium)

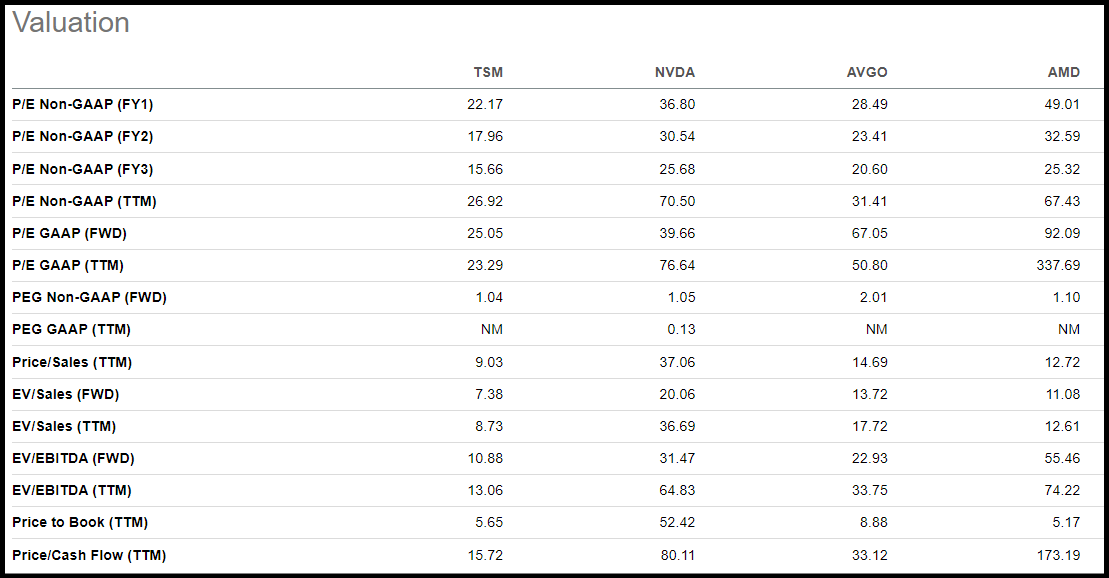

Based on over a dozen key metrics, TSMC looks stronger than the three other stocks on valuation. TSMC P/E Non-GAAP FWD of 22x is almost 12% below the sector median, while NVDA is at 36x, AVGO at 28x, and AMD at almost 50x. TSMC also tops the semiconductor sector median and similarly-sized industry peers in the crucial forward P/E growth (PEG) metric. TSMC’s PEG of 1.04x is close to a 50% discount to the sector’s 1.97x.

TSMC Valuation Grade vs. Nividia, Broadcom, & AMD (SA Premium)

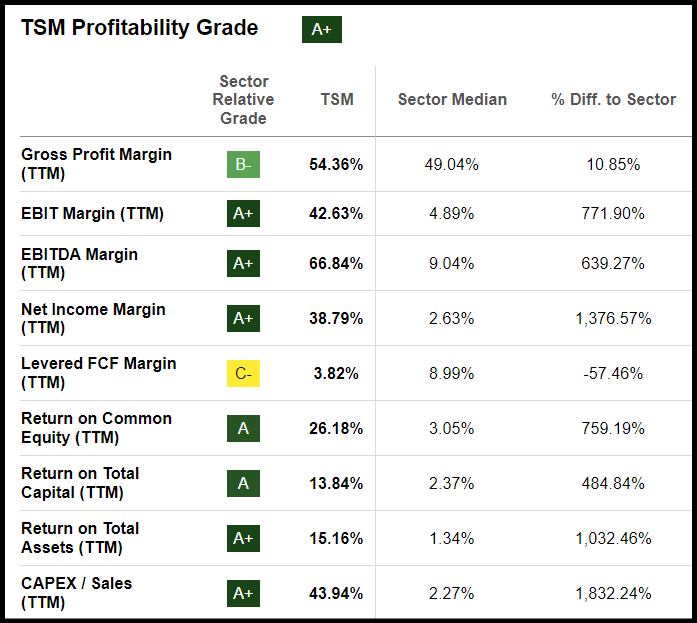

TSMC has an ‘A+’ Profitability Grade highlighted by net income margin of 38%, EBITDA margin of 66%, and EBIT of 42%. TSMC has returned value to investors significantly and effectively managed based on ROE of 26% and ROTC of 13%.

TSMC Profitability Grade (SA Premium)

TSMC beat earnings 11 times in the past 12 quarters, with Q423 EPS of $1.44 beating by $0.07 and revenue of $19.8 billion beating by $279 million. EPS long-term FWD growth of ~20% vs. the sector’s 13% drives a B Growth Grade. EPS is projected to grow over 20% in FY24 and 23% in FY25, according to consensus estimates, and revenue by 22% in FY24 and almost 20% in FY25.

Concluding Summary

Nvidia’s AI Woodstock reveal of a tech platform that would launch a new industrial revolution made for hysteria in the headlines but a muted market reaction amid concerns of a bubble bigger than the dot-com era. Taiwan Semiconductor, with over 60% share of the global foundry market, has Strong Buy ‘quantamentals’ relative to the sector and industry rivals of similar size that match the AI hype. TSMC is up over 50% in the past year with EBITDA margins of 66% and is trading at a discount to the sector and major semiconductor rivals. TSMC is the #1 Strong Buy among SA quant-rated chip stocks. In addition to top microchip stocks, if you’re seeking a limited number of monthly ideas from the hundreds of top quant Strong Buy rated stocks, the Quant Team’s best-of-the-best, consider exploring Alpha Picks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given that any particular security, portfolio, transaction or investment strategy is suitable for any specific person. The author is not advising you personally concerning the nature, potential, value or suitability of any particular security or other matter. You alone are solely responsible for determining whether any investment, security or strategy, or any product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. Steven Cress is the Head of Quantitative Strategy at Seeking Alpha. Any views or opinions expressed herein may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank.

I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.