Summary:

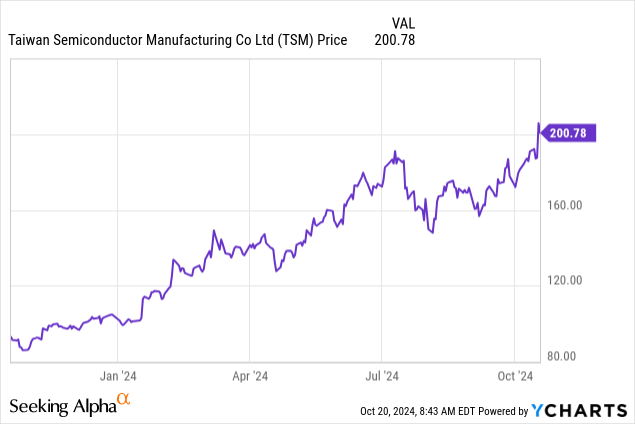

- Taiwan Semiconductor Manufacturing Company Limited’s stock has risen considerably over the past 12 months.

- The company’s strong moat, operational excellence, and robust growth have fueled investor optimism.

- TSMC is one of my stocks to own forever.

PonyWang

Taiwan Semiconductor Manufacturing Company Limited aka TSMC (NYSE:TSM) reported earnings last week to great fanfare, as the stock added a 5+% rally on top of a share price that has already more than doubled over the last 12 months. Even after this run-up, TSM remains one of my favorite picks for the simple reason that it has all the hallmarks of a business to own forever: it has a wide moat, is positioned in an essential and growing sector, and has demonstrated unparalleled operational excellence. Buy TSM and don’t let go.

With AI demand continuing to surge and stock valuations soaring, expectations were fairly high for TSMC’s Q3 results: as the world’s pre-eminent chip manufacturer, servicing almost all the leading semiconductor design companies, TSMC is a bellwether for the health of the tech sector and the economy at large. Even so, the company was able to surpass those lofty expectations and further fuel investor optimism over its ability to maintain its dominant market position. Let’s recap the most recent earnings results.

TSMC reported quarterly revenue of $23.5 billion, up 39% YoY and 12% QoQ, EPS of $1.94, up 54% YoY and 31% QoQ, and gross margin of 57.8%, up 350 bps YoY and 450 bps QoQ. As far as core metrics go, not many companies are achieving this level of growth on a revenue base this high with a margin this lucrative. Contract manufacturing in most industries is a low-margin race to the bottom. However, TSMC is so far ahead of the competition, which is really just Samsung Electronics Co., Ltd. (OTCPK:SSNLF) and Intel Corporation (INTC), that it has been able to consistently achieve an outsized net profit margin, including a record-high 42.8% for Q3 2024.

On the balance sheet side, the company is in great shape as cash & equivalents have ballooned to nearly $60 billion, up 44% YoY, compared to just $28 billion in long-term debt, which is actually slightly down from Q3 2023. And while TSMC’s business is highly capital intensive, the cash flows look pristine as well with $5.7 billion in free cash flow, adding to the stockpile and easily covering the $2.8 billion quarterly dividend payment.

Guidance was equally upbeat with revenue expected between $26.1 billion and $26.9 billion, up 35% YoY and 13% QoQ at the midpoint, and margins expected to be flat or see a slight increase.

When it comes to TSMC, you can usually get a finger on the pulse of management’s expectations by following capital expenditures, which the company ramps up and down based on the demand profile for the coming quarters. In that vein, TSMC boosted CapEx guidance for FY2024 to be slightly above its original $30 billion estimate and projected, without specifying a number, that FY2025 CapEx will likely be higher still.

For those following the semiconductor space, this steady march higher in spending should perhaps come as no surprise. NVIDIA Corporation (NVDA) is in the midst of launching its next-generation Blackwell AI chips, the demand for which CEO Jensen Huang characterized as “insane.” Apple Inc. (AAPL) is placing massive orders for capacity on TSMC’s most cutting-edge node (N3) for its iPhones and Mac laptops. Advanced Micro Devices, Inc. (AMD) is using TSMC for its various CPU and AI accelerator offerings. QUALCOMM Incorporated (QCOM) has booked capacity for its Snapdragon mobile chips, and even Intel contracted out its Arrow Lake processors to TSMC after ditching volume production on its 20A process node.

This who’s who of semiconductor design behemoths demonstrates just how far ahead TSMC is compared to the competition: the world’s largest companies fight over its capacity for their most advanced SoCs and pay top dollar for it. And while TSMC has demonstrated operational excellence, Intel and Samsung have faltered recently. After being the undisputed king of the foundry for decades, Intel flubbed its 10nm process (re-branded Intel 7), eliminating what was viewed as an insurmountable moat. For an article that chronicles this downfall contemporaneously, you can read my piece about Intel’s 10nm debacle from 2019 here.

Intel has shown progress recently with a more aggressive approach to node development timelines, which, I think, has resulted in what could very well be a competitive node in 2025, dubbed 20A. However, TSMC has now established a technological lead, an operational lead, and a customer lead that won’t be easily disrupted.

As for Samsung, though it remains a leader in memory chip manufacturing, logic chips have been a tougher nut to crack. After previously boasting Qualcomm as one of its major customers, Samsung was unable to sufficiently scale its 3nm process to Qualcomm’s satisfaction, prompting the latter to move all major orders to TSMC. It was further reported last week that Samsung had delayed taking shipment of EUV lithography machines, which are used in the manufacturing of advanced chips, from Dutch company ASML Holding N.V. (ASML). These were originally intended for Samsung’s upcoming fab in Texas, which has also seen some on-site staff from the company sent back to South Korea.

At this point, Intel and Samsung are fighting over whatever scraps are left on the table as TSMC continues to massively expand manufacturing capacity to capture as much of the market as possible. And once that market share is captured and customers are locked in, it’s difficult to pry them away. Due to this significant lead, the ever-expanding demand for semiconductor manufacturing, and the operational excellence the company continues to demonstrate, I’m having a hard time thinking of a company that is more set for long-term success than TSMC.

Whether it’s generative AI, smartphones, servers, or whatever the next five or ten secular trends appear to entail, TSMC is positioned to profit from whatever comes down the pipe. Yes, there is the risk that competitors will catch up and margins will fall off slightly. Or, that an economic recession will cripple end-user demand and cause major capacity utilization issues. AI could end up being massively scaled back due to a lack of applications. However, there will always be someone willing to pay a hefty sum for a contract manufacturer that can deliver on the bleeding edge, on time, and within specifications.

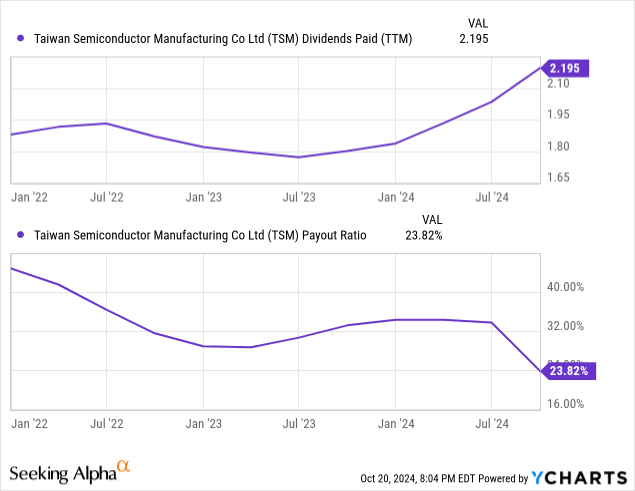

With how much cash TSMC is pulling in, I expect to see a steady increase in the dividend over the foreseeable future:

It has already begun creeping up, but with the payout ratio falling and cash piling up on the balance sheet, I expect the company to begin returning capital to shareholders at a higher rate. In fact, one of my main criticisms would be the current reluctance to spend cash for management, so I’ll be keeping a watchful eye on that in the coming quarters and years.

While the valuation might be considered rich at a forward P/E of around 28, the high revenue base paired with robust growth and best-in-class margins makes the stock attractive. Beyond just next year’s earnings, TSMC’s market position is perhaps one of the best of any company in the market today and I intend to hold my shares for a very long time, if not forever.

Just to cover all bases, also announced last week was a U.S. Commerce Department probe of TSMC over possibly selling or manufacturing chips for Chinese giant Huawei, either directly or through third parties. While this is something investors should note, it’s highly unlikely this will result in a material impact beyond a possible fine if TSMC hardware somehow found its way to Huawei.

Investor Takeaway

TSMC is the undisputed leader in a sector that will be critical for corporate and national security interests for decades to come. The company is generating record revenue, earnings, margins, and cash flow on the back of secular trends like AI and will continue to benefit whatever the next trend may be. Operational excellence and unparalleled execution have made and will continue to make TSMC the go-to foundry of choice for the world’s top tech companies.

While the stock may waffle or drop in the coming years, whether due to a dip in AI demand or the specter of an economic recession or the arrival of an actual economic recession, I will use that as an opportunity to add to my position. I’m rating TSM a Strong Buy, and it’s a stock I intend to own forever.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.