Summary:

- TSM is 18% undervalued, driven by its unique strategic positioning, cutting-edge technologies, and strong financials.

- TSM’s focus on high-margin advanced technologies and diversified revenue mix ensures stellar profitability and robust growth, especially with AI tailwinds.

- TSM’s strategic partnerships with leading chip design companies and commitment to evolving technologies position it for future profitability expansion.

BING-JHEN HONG

Introduction

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) is the world’s largest semiconductor foundry and its stock is 18% undervalued, according to my discounted cash flow analysis. Such a discount looks like a gift if we consider TSM’s unique strategic positioning, cutting-edge technologies that ensure stellar profitability, and fortress financial position. Nvidia’s (NVDA) recent stellar earnings release confirmed my opinion that AI tailwinds are still extremely strong, which is greatly beneficial for TSM’s investors. Considering all these positives, I believe that TSM is a ‘Strong buy’.

Fundamental analysis

Taiwan Semiconductor Manufacturing Company has pioneered the pure-play foundry business model. The company serves over 500 semiconductor customers by producing several thousands of distinct products. Revenues are generated through contract manufacturing of chips using cutting-edge process nodes.

TSM FQ3 2024 earnings presentation

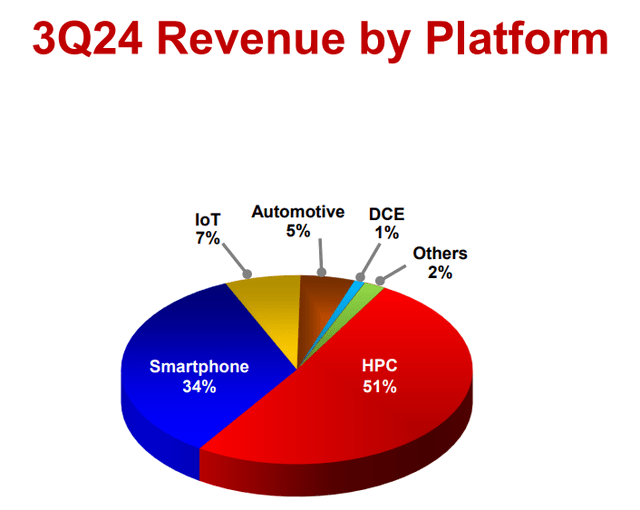

TSM mostly focuses on high-margin advanced technologies as 7nm and below processes account for 69% of wafer revenue during the latest reportable quarter. From the perspective of end markets, TSM’s revenue mix is well-diversified. High-performance computing (‘HPC’) accounts for 51% of the company’s total revenue. Smartphone end-market holds the second spot with a 34% share. TSM also has a presence in other interesting industries like IoT and Automotive.

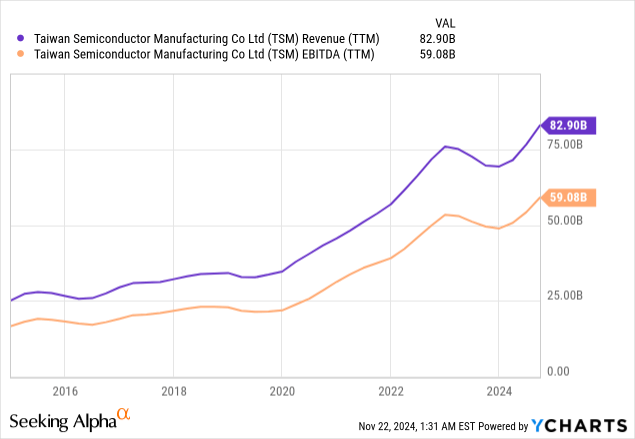

Due to TSM’s large footprint in the HPC end-market, the company benefits from strong secular digitalization trends. The emergence of AI-powered technologies gave the industry another growth catalyst, which enables TSM to set new record revenue and EBITDA levels.

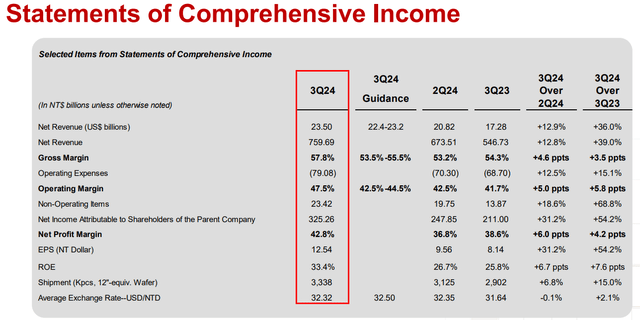

The latest available quarterly earnings release is FQ3 2024. During the quarter, revenue spiked by 36% on a YoY basis, due to strong AI tailwinds. TSM’s operating leverage is strong, which is evident from the five-percentage point growth in operating margin during FQ3 to 47.5%.

TSM FQ3 2024 earnings presentation

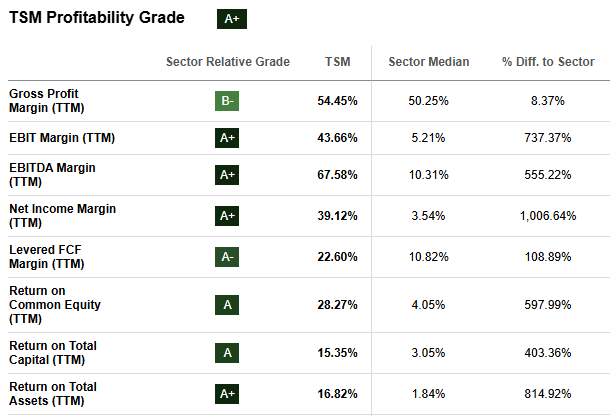

Overall, TSM’s massive scale and focus on cutting-edge high-margin technologies helps the company to generate profitability which is above the sector median. As a result, the company’s balance sheet is strong with low leverage and ample liquidity. Strong profitability and fortress balance sheet enables TSM to successfully balance between reinvesting in growth and innovation while paying dividends to shareholders. The 1.24% forward dividend yield is quite low, but the last decade’s CAGR is very impressive at 15.95%.

SA

TSM’s market positioning is intact. It has long-lasting business relationships with the most advanced chip design companies like Nvidia (NVDA), Broadcom (AVGO), AMD (AMD), and many others. There are only three companies in the world that can produce the most advanced semiconductors: TSM, Samsung (OTCPK:SSNLF), and Intel (INTC). Intel faces multiple fundamental challenges, which I have covered in detail. Moreover, according to Wikipedia, Intel still cannot produce 5nm semiconductors.

TSM is also firmly positioned to compete with Samsung. TSM is a pure-play foundry business that focuses entirely on manufacturing chips for customers. In contrast, Samsung is a very diversified conglomerate with some of its potential foundry customers in areas like smartphones or memory chips. This creates potential conflicts of interest and narrows the potential market for Samsung. Thus, Samsung cannot boast relationships with companies like Apple (AAPL). Furthermore, TSM’s Open Innovation Platform creates a strong ecosystem that locks in customers.

Therefore, TSM is very well positioned both financially and strategically to deliver more value for shareholders. The AI-related demand remains very strong, which we saw from Nvidia’s latest earnings release. Nvidia’s data center revenue continues its exponential growth, and Jensen Huang is very optimistic about future prospects in the AI domain. As Nvidia’s core manufacturing partner, TSM is poised to benefit from strong data center demand.

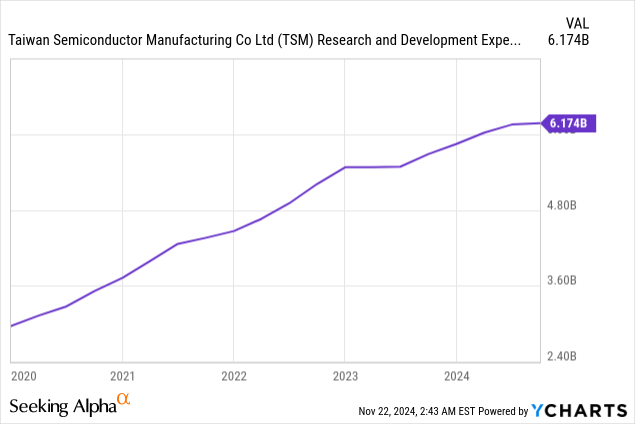

TSM demonstrates a strong commitment to keep up with evolving technologies, which I see from strong growth in R&D spending. The company is working on commercializing the 2nm technology. According to experts, the new offering will cost two times more compared to 4nm and 5nm. Therefore, we can expect more profitability expansion in the future.

Valuation analysis

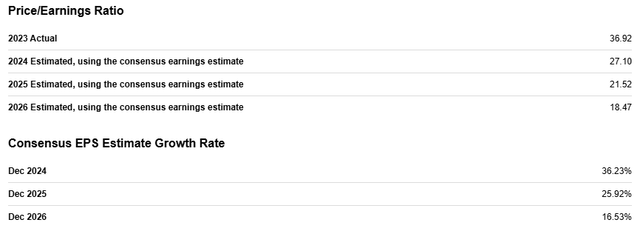

The forward P/E ratio dynamic looks great for the next three fiscal years. The ratio is expected to halve between 2023 actual and 2026 estimated, which is a positive sign. Consensus EPS growth rates look realistic considering TSM’s fundamental strength and AI tailwinds.

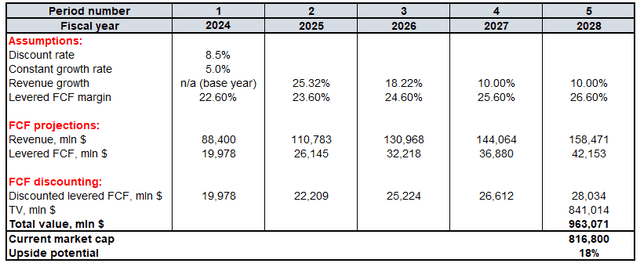

The discounted cash flow (‘DCF’) incorporates FY2024-2026 revenue projections from consensus. For fiscal years 2027-2028, a 10% revenue growth rate is incorporated. The base-year FCF margin is 22.6%. Due to historically strong operating leverage and expected 2nm technology commercialization within the next few years, I assume a 100 basis points FCF margin growth per annum. Due to AI exposure and unique strategic positioning in the industry, I project a 5% constant growth rate. Future cash flows will be discounted using an 8.5% WACC.

The total fair value of the company is $963 billion. After the last close, TSM’s market cap was approximately $817 billion. Therefore, there is an 18% upside potential, which I find compelling.

Mitigating factors

The complex geopolitical situation around Taiwan appears to be the number one risk for TSM’s investors. Tense relationships between Taiwan and China have deep historical roots, and there are even risks of a direct military conflict between these two countries. Potential military conflict will certainly disrupt TSM’s operations and will highly likely lead to adverse financial implications. Since Taiwan and the U.S. have been allies historically, the risk of military conflict between China and Taiwan is not high. On the other hand, the recent Donald Trump presidential election victory adds uncertainty for TSM, as some political experts consider that Donald Trump’s approach is close to isolationism.

Working with hyper-scale customers always means elevated customer concentration risks. Revenues from Apple reportedly constitute 25% of TSM’s top-line. Nvidia is another crucial customer for TSM, and recently, there were reports that the world’s largest company might shift some of its volumes to Samsung.

The semiconductor industry is cyclical and frequently alternates between shortages and oversupply. Despite its strong pricing power, TSM is unable to always raise prices during shortages and must deal with high fixed costs at the same time.

Conclusion

An 18% discount means that TSM is very attractively valued, considering its status as one of the most important companies in the digital era. The strategic positioning is unique, which ensures stellar profitability and ample financial resources to invest in growth and innovation. AI tailwinds are still very strong, and the new 2nm process technology’s commercialization will unlock new profitability growth factor for TSM soon.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.